Is Uber Technologies (UBER) A Smart Investment?

Table of Contents

H2: Uber's Business Model and Market Position

Uber's success stems from its innovative business model and dominant position in the ride-sharing market. Understanding its market share and diversification strategy is key to assessing its investment potential.

H3: Dominant Player in Ride-Sharing

Uber holds a significant market share globally, although its dominance varies by region. Its network effects—the more users, the more attractive the platform becomes—provide a strong competitive advantage.

- Key Competitors: Lyft in the US, Didi in China, and other regional players pose significant competition.

- Market Dominance: Uber boasts significant market share in many major cities worldwide, leveraging its extensive network of drivers and riders.

- Network Effects: The larger Uber's network, the more convenient it is for both riders and drivers, creating a self-reinforcing cycle of growth. This extends to Uber Eats, further solidifying its market position.

H3: Diversification Beyond Rides

Uber's expansion beyond ride-sharing, primarily through Uber Eats, significantly reduces its reliance on a single revenue stream. This diversification strategy mitigates risk and presents exciting growth opportunities.

- Uber Eats Growth: Uber Eats has experienced substantial growth, competing with established players like DoorDash and Grubhub in the food delivery market.

- Uber Freight: Uber Freight expands into the logistics sector, tapping into a large and growing market. This segment offers potential for revenue synergy with the existing ride-sharing platform.

- Future Diversification: Further expansion into other related sectors could further enhance its resilience and increase its overall value proposition.

H3: Technological Innovation and Future Growth

Uber's substantial investment in autonomous vehicle technology represents a long-term strategic move with potentially massive implications for profitability.

- Cost Savings: Successful implementation of autonomous vehicles could significantly reduce operational costs, improving profitability margins.

- Challenges: The development and regulation of autonomous vehicles pose significant challenges, impacting the timeline for widespread adoption.

- Future Growth Prospects: The potential for autonomous vehicles to transform the transportation industry represents a key driver of Uber's long-term growth potential.

H2: Financial Performance and Valuation of UBER Stock

Analyzing UBER's financial performance and valuation is crucial for determining its investment attractiveness. Careful consideration of both positive and negative aspects is vital.

H3: Revenue Growth and Profitability

Examining Uber's financial statements reveals trends in revenue growth, profitability margins, and key financial ratios. Sustained revenue growth is a positive indicator, but profitability needs closer scrutiny.

- Year-over-Year Revenue Growth: Track Uber's year-over-year revenue growth to gauge its performance and expansion rate.

- Profitability Trends: Analyze Uber's profitability margins (gross profit, operating profit, net profit) to assess its efficiency and financial health.

- Debt Levels and Cash Flow: Assess Uber's debt levels and cash flow to understand its financial stability and its ability to fund future growth initiatives.

H3: Risk Factors and Challenges

Uber faces several challenges that could impact its future performance. Understanding these risks is essential for informed investment decisions.

- Regulatory Hurdles: Ride-sharing regulations vary significantly across different jurisdictions, creating potential regulatory risks and operational challenges.

- Driver Relations: Maintaining positive relationships with drivers is crucial for Uber's operations and reputation. Driver compensation and benefits are important factors.

- Intense Competition: The ride-sharing market is intensely competitive, with existing rivals and potential new entrants constantly vying for market share.

- Economic Downturn: Economic downturns can negatively impact demand for ride-sharing and food delivery services, potentially affecting Uber's revenue.

H3: Stock Price Analysis and Valuation Metrics

Utilizing various valuation metrics allows for a more comprehensive assessment of UBER stock's intrinsic value.

- P/E Ratio and PEG Ratio: Compare Uber's P/E and PEG ratios to industry peers to determine if it's overvalued or undervalued relative to its growth prospects.

- Historical Stock Price Performance: Analyze the historical stock price performance to understand its volatility and identify any trends.

- Future Growth Projections: Consider future growth projections, based on market forecasts and Uber's own strategic plans, to estimate potential future returns.

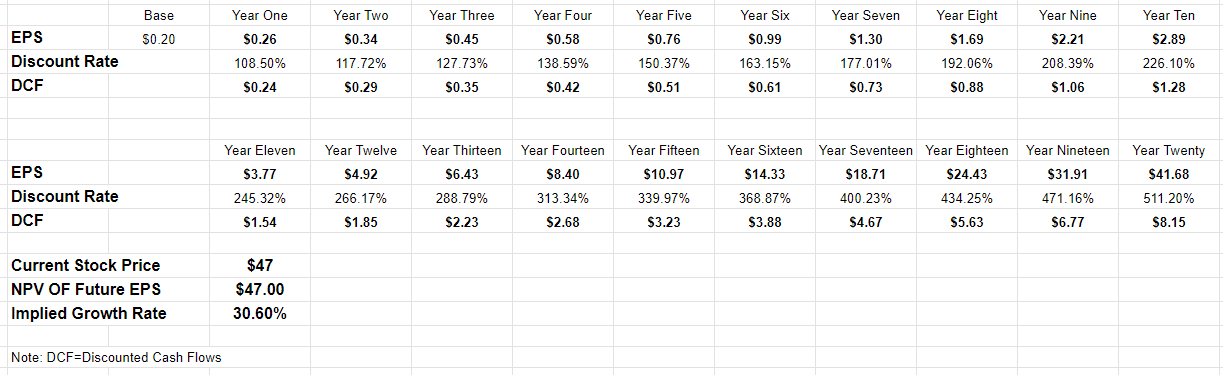

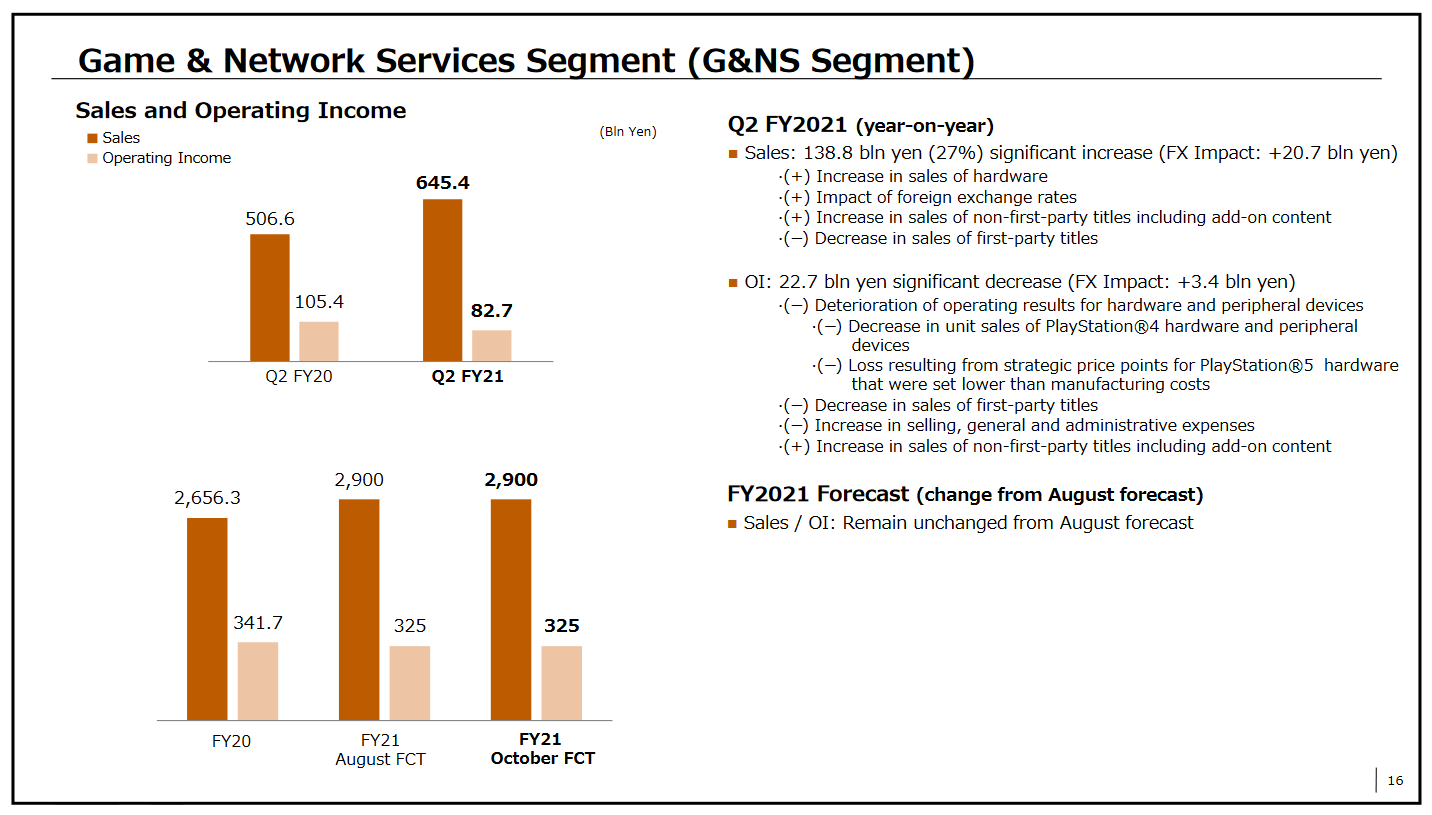

- Discounted Cash Flow Analysis: A discounted cash flow (DCF) analysis can provide a more in-depth valuation, projecting future cash flows and discounting them back to their present value.

H2: Investment Considerations and Strategies

Making informed investment decisions requires considering your personal risk tolerance and investment timeline.

H3: Long-Term vs. Short-Term Investment

UBER stock is generally considered a growth stock, better suited for long-term investors with a higher risk tolerance.

- Long-Term Benefits: Investing in UBER for the long term allows you to potentially benefit from its future growth and expansion into new markets.

- Short-Term Risks: Short-term trading of UBER stock carries higher risks due to its inherent volatility.

- Diversification Strategies: Diversifying your portfolio across different asset classes and industries is crucial to mitigate risk.

H3: Alternative Investment Options

Comparing UBER to other investments in the technology sector helps put its investment potential in perspective.

- Competitor Analysis: Assess the performance and potential of Uber's competitors to identify potentially better or more stable investment alternatives.

- Other Transportation Companies: Consider investments in other companies in the transportation sector, to diversify your holdings within this industry.

- Tech Stocks with Similar Growth Potential: Explore other technology stocks offering similar growth prospects but potentially with lower risk profiles.

3. Conclusion: Is Investing in UBER Stock Right for You?

Uber Technologies presents a compelling investment opportunity due to its market dominance, diversification efforts, and technological innovation. However, significant risks remain, including intense competition, regulatory hurdles, and the challenges associated with autonomous vehicle technology. Whether or not UBER stock is a smart investment depends on your individual risk tolerance, investment timeframe, and overall portfolio strategy. This article provides information for your consideration, but remember to conduct thorough independent research, including consulting with a qualified financial advisor, before investing in UBER stock or any other security. This analysis does not constitute financial advice. To further enhance your understanding of UBER stock, consider exploring additional resources on UBER stock outlook and Uber investment strategy. Is UBER a good investment? Ultimately, the answer depends on your individual circumstances and investment goals.

Featured Posts

-

9 4 360

May 08, 2025

9 4 360

May 08, 2025 -

How Much Do You Know About Nba Playoffs Triple Doubles Take The Quiz

May 08, 2025

How Much Do You Know About Nba Playoffs Triple Doubles Take The Quiz

May 08, 2025 -

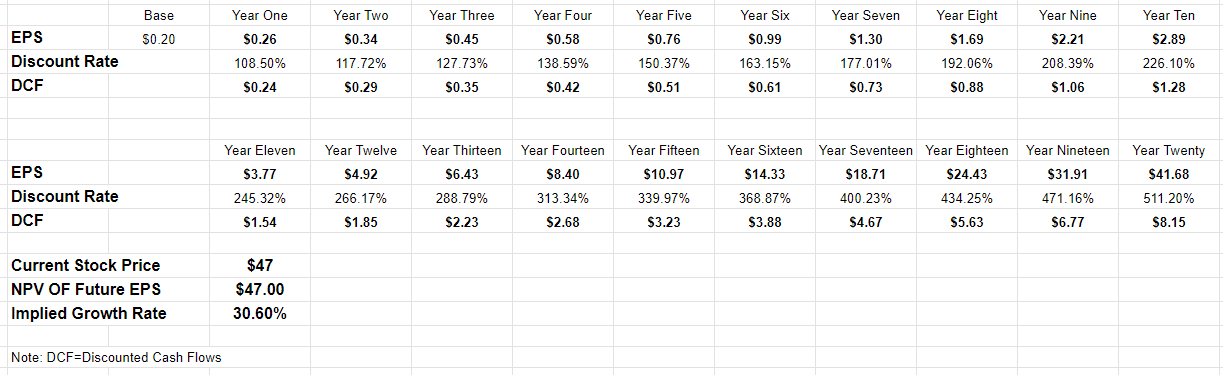

Disappointing Ps 5 Pro Sales Figures Raise Concerns

May 08, 2025

Disappointing Ps 5 Pro Sales Figures Raise Concerns

May 08, 2025 -

Arsenal News Collymores Pressure Mounts On Arteta

May 08, 2025

Arsenal News Collymores Pressure Mounts On Arteta

May 08, 2025 -

Jury Rules Against Soulja Boy In Sexual Assault Case Awarding 6 Million

May 08, 2025

Jury Rules Against Soulja Boy In Sexual Assault Case Awarding 6 Million

May 08, 2025