Is XRP A Commodity? The SEC's Classification And Ongoing Debate

Table of Contents

The SEC's Case Against Ripple and its Classification of XRP

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security, arguing that Ripple’s sale of XRP constituted the sale of investment contracts. This classification hinges heavily on the Howey Test, a four-pronged legal standard used to determine whether an investment is a security.

H3: The SEC's Argument:

The SEC's case rests on the assertion that Ripple's actions met all four prongs of the Howey Test:

- Investment of money: Individuals invested money in XRP.

- Common enterprise: The investors were part of a common enterprise with Ripple and other XRP holders.

- Expectation of profits: Investors anticipated profits based on Ripple's efforts.

- Solely from the efforts of others: Investors relied on Ripple's efforts to develop and promote XRP to generate profits.

H3: Ripple's Counterarguments:

Ripple vigorously contests the SEC's classification, arguing that XRP is a decentralized digital asset and not a security. Their key arguments include:

- Decentralization of XRP Ledger: Ripple emphasizes the XRP Ledger's decentralized nature, arguing that it operates independently of Ripple's control.

- Lack of centralized control: They claim they don't control the price or distribution of XRP.

- Programmatic sale of XRP: Ripple highlights that much of their XRP sales were programmatic and not direct sales to individual investors.

- Focus on utility and functionality: Ripple stresses XRP's utility as a payment currency within the XRP Ledger.

H3: Key Legal Precedents:

Both sides have cited various legal precedents and case laws to support their arguments. The SEC relies on cases that emphasize the investment contract aspect, while Ripple points to cases highlighting the functionality and decentralized nature of digital assets. The interpretation and application of these precedents remain central to the ongoing debate.

The Commodity Futures Trading Commission (CFTC) and its Perspective

While the SEC focuses on securities regulation, the Commodity Futures Trading Commission (CFTC) regulates commodities and derivatives. Its perspective on digital assets, particularly XRP, could offer a contrasting viewpoint.

H3: CFTC's stance on digital assets: The CFTC has shown a willingness to regulate certain digital assets as commodities, focusing on their use as instruments for speculation and trading. Their approach often differs from the SEC's, emphasizing market manipulation and price volatility rather than the investment contract aspects.

H3: Implications of a CFTC classification: If the CFTC were to classify XRP as a commodity, this could lead to:

- Regulatory oversight: The CFTC would regulate XRP trading and market practices.

- Trading regulations: Trading platforms would face specific regulations for handling XRP.

- Impact on XRP's market: The regulatory framework could significantly impact XRP's market liquidity and trading volumes.

H3: The ongoing debate between SEC and CFTC approaches: The potential for conflicting regulatory interpretations between the SEC and CFTC highlights the complexities of regulating the rapidly evolving cryptocurrency market. A unified regulatory framework remains a crucial need for the entire industry.

The Ongoing Debate and Future Implications

The question of whether XRP is a commodity or a security continues to be fiercely debated, with compelling arguments on both sides.

H3: Arguments for XRP as a Commodity:

- Its use as a medium of exchange: XRP facilitates fast and low-cost cross-border payments.

- Its decentralized nature: The XRP Ledger operates independently of any single entity.

- Its price fluctuations based on market forces: XRP's price is subject to supply and demand, like other commodities.

H3: Arguments Against XRP as a Commodity:

- Ripple's initial distribution model: The initial distribution of XRP involved pre-sales that could be construed as investment offerings.

- Potential for future development impacting value: Future developments by Ripple could still influence XRP's value.

- The ongoing centralized aspects of its ecosystem: Despite the ledger's decentralization, aspects of Ripple's operations remain centralized.

H3: The Impact on the Cryptocurrency Market: The outcome of the Ripple case will undoubtedly have a significant impact on the broader cryptocurrency market, affecting investor confidence, regulatory clarity, and the development of new digital assets. The legal precedent set will influence how other cryptocurrencies are classified.

Conclusion

The SEC's classification of XRP as a security and Ripple's counterarguments have created a complex legal battle with significant implications for the entire cryptocurrency market. The central question – Is XRP a commodity? – remains unresolved. The arguments presented by both sides, focusing on the Howey Test, decentralization, and the potential for future development, highlight the challenges of applying traditional securities laws to innovative digital assets. The outcome will shape the future regulatory landscape and influence how investors perceive and interact with digital assets. Stay informed about the ongoing developments in this landmark case and conduct thorough research to form your own opinion on whether you believe XRP is a commodity.

Featured Posts

-

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025

Dundee Man Jailed For Sexual Assault Graeme Sounes Sentenced

May 02, 2025 -

Sf Actor Workshop Co Founder Priscilla Pointer Dies At 100

May 02, 2025

Sf Actor Workshop Co Founder Priscilla Pointer Dies At 100

May 02, 2025 -

Targets Dei Rollback Boycott Traffic Drop And The Fallout

May 02, 2025

Targets Dei Rollback Boycott Traffic Drop And The Fallout

May 02, 2025 -

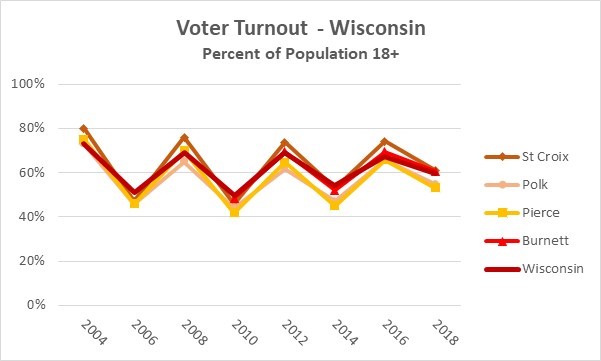

The Significance Of Voter Turnout In Florida And Wisconsin A Political Analysis

May 02, 2025

The Significance Of Voter Turnout In Florida And Wisconsin A Political Analysis

May 02, 2025 -

Fortnite Item Shop Update Skins Returning After A 1000 Day Absence

May 02, 2025

Fortnite Item Shop Update Skins Returning After A 1000 Day Absence

May 02, 2025

Latest Posts

-

Voter Confidence In Sc Elections 93 Positive Survey Results

May 03, 2025

Voter Confidence In Sc Elections 93 Positive Survey Results

May 03, 2025 -

Examining Maines Novel Post Election Audit Pilot Program

May 03, 2025

Examining Maines Novel Post Election Audit Pilot Program

May 03, 2025 -

South Carolina Elections Survey Data Shows 93 Public Trust

May 03, 2025

South Carolina Elections Survey Data Shows 93 Public Trust

May 03, 2025 -

Survey Shows 93 Trust In South Carolinas Election Process

May 03, 2025

Survey Shows 93 Trust In South Carolinas Election Process

May 03, 2025 -

Maines Groundbreaking Post Election Audit A Detailed Look

May 03, 2025

Maines Groundbreaking Post Election Audit A Detailed Look

May 03, 2025