Is XRP's 400% Gain Sustainable? Analyzing Future Price Potential

Table of Contents

Factors Contributing to XRP's Recent Surge

Several factors have contributed to XRP's recent impressive price surge. Understanding these is crucial for predicting its future trajectory.

Positive RippleNet Developments

RippleNet's expansion and increasing adoption have significantly boosted XRP's value. The growing number of financial institutions using RippleNet for cross-border payments directly correlates with increased XRP transaction volume.

- Strategic Partnerships: Ripple has forged partnerships with major banks and financial institutions globally, expanding RippleNet's reach and solidifying its position in the cross-border payments market. Recent partnerships include [insert specific examples of recent partnerships and collaborations].

- Increased Transaction Volume: The volume of transactions processed through RippleNet has seen a substantial increase, reflecting growing confidence and adoption among financial institutions. This increased usage directly impacts XRP demand.

- Successful Implementations: Numerous successful implementations of RippleNet showcase its effectiveness and reliability, attracting new clients and fostering confidence in the system, which in turn boosts XRP's value. [Insert examples of successful RippleNet implementations]. This positive feedback loop drives RippleNet growth and consequently, XRP adoption.

Growing Institutional Interest

Institutional investors are increasingly showing interest in the cryptocurrency market, and XRP is no exception. Large-scale XRP holders and institutional investment are becoming more prevalent, contributing to its price appreciation.

- Grayscale Investments: [Mention any involvement of Grayscale or other significant institutional investors in XRP]. The entry of established players signals growing legitimacy and confidence in the cryptocurrency.

- Increased Trading Volume on Institutional Exchanges: [Cite data or sources showing increase in trading volume on major exchanges]. This suggests growing institutional participation and liquidity.

- Positive Regulatory Developments (if any): While the SEC lawsuit is a major factor, any positive regulatory developments in specific jurisdictions could significantly influence institutional interest and investment in XRP.

Overall Market Sentiment

The broader cryptocurrency market significantly influences XRP's price. Positive market sentiment generally translates to increased demand for XRP and other altcoins.

- Bitcoin's Price Movements: Bitcoin’s price often acts as a benchmark for the entire cryptocurrency market. Positive Bitcoin price trends often result in a ripple effect across the altcoin market, including XRP.

- Overall Market Trends: Positive news and developments within the wider cryptocurrency space, such as new regulations or technological advancements, can impact investor sentiment and drive XRP's price upwards.

- Altcoin Market Performance: The performance of other cryptocurrencies in the altcoin market also influences investor sentiment towards XRP.

Potential Challenges and Risks Affecting XRP's Future

Despite its recent surge, XRP faces significant challenges that could impact its future price.

Ongoing Legal Battle with the SEC

The ongoing SEC lawsuit against Ripple presents a considerable risk to XRP's price and future prospects. The outcome of this legal battle will significantly impact the regulatory landscape surrounding XRP and investor confidence.

- Potential Outcomes: The possible outcomes range from a complete victory for Ripple, leading to a surge in XRP price, to an unfavorable ruling that could severely dampen investor sentiment and lead to a price correction.

- Regulatory Uncertainty: The legal uncertainty surrounding XRP creates volatility and makes it a riskier investment for many. This uncertainty can deter institutional investors and suppress price appreciation.

- Delisting Risk: Depending on the outcome, some exchanges might delist XRP, impacting liquidity and accessibility.

Market Volatility and Correction Risks

The cryptocurrency market is inherently volatile, and XRP is no exception. Significant price corrections are possible, even after such a substantial price increase.

- Market Downturns: Broader market downturns, often triggered by macroeconomic factors or negative news in the crypto space, can lead to sharp drops in XRP's price.

- Negative News: Negative news related to Ripple, XRP, or the cryptocurrency market in general can trigger sell-offs and price corrections.

- Risk Management Strategies: Investors should implement appropriate risk management strategies, such as diversification and stop-loss orders, to mitigate potential losses.

Competition from Other Cryptocurrencies

XRP faces stiff competition from other cryptocurrencies offering similar functionalities, particularly in the cross-border payment space.

- Key Competitors: [List key competitors and briefly describe their strengths and weaknesses relative to XRP]. The competitive landscape is constantly evolving.

- Technological Advancements: New technologies and improvements in existing payment systems could pose a significant challenge to XRP's market share.

- Differentiation: Ripple needs to continually differentiate XRP and RippleNet to maintain its competitive edge.

Analyzing XRP's Future Price Potential

Predicting XRP's future price with certainty is impossible, but analyzing technical and fundamental aspects can provide some insights.

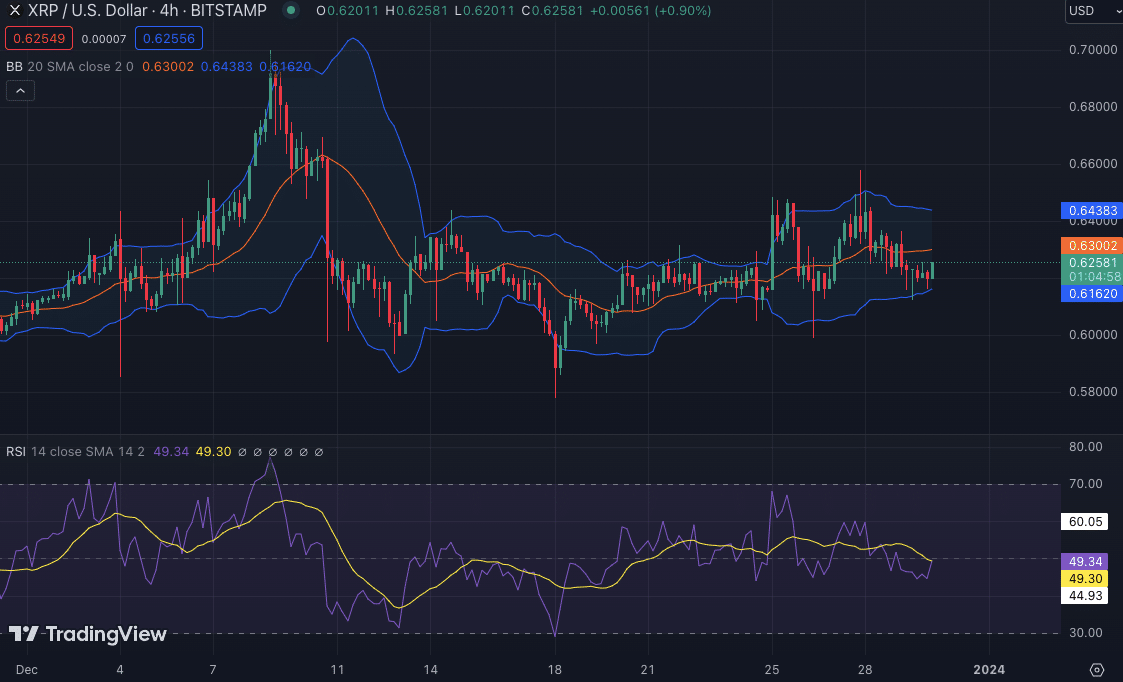

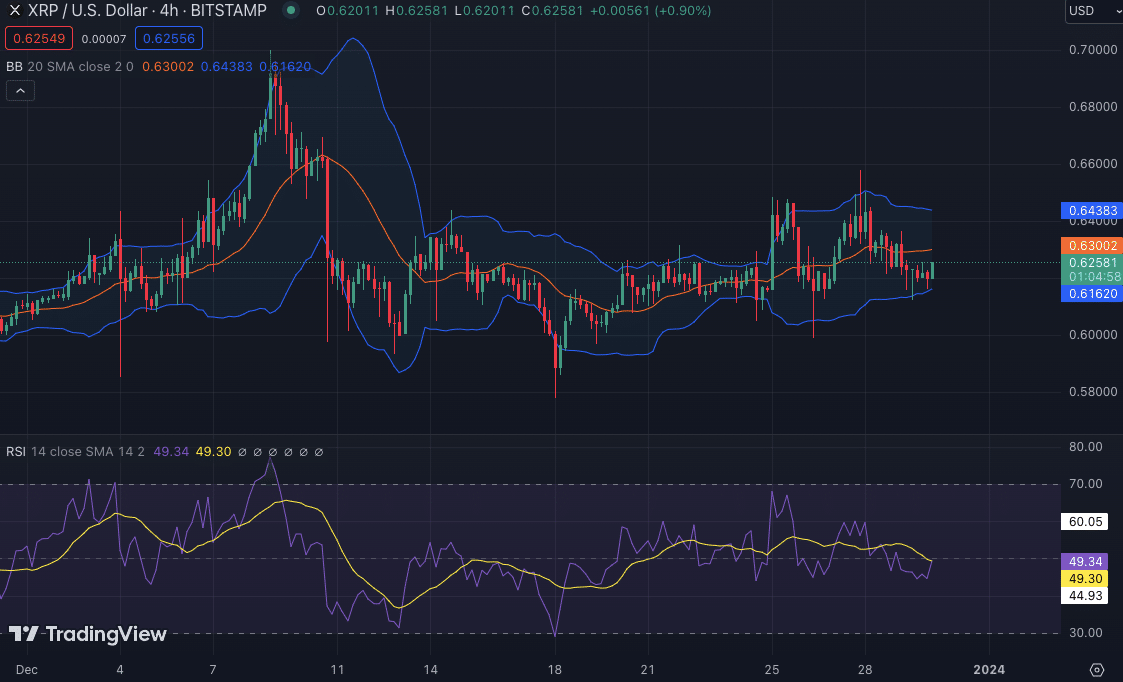

Technical Analysis

Technical analysis of XRP price charts, trading volume, and other indicators can offer a short-term perspective on potential price movements. [Include a brief and non-speculative mention of relevant technical indicators like moving averages or RSI, but avoid making specific price predictions].

Fundamental Analysis

Fundamental analysis focuses on the long-term potential of XRP, considering factors such as the adoption rate of RippleNet, its technological advancements, and its position within the broader cryptocurrency market. The long-term XRP price prediction depends on the continued success and expansion of RippleNet.

Realistic Expectations

While XRP's recent performance is impressive, maintaining this growth rate is unlikely. A balanced perspective is crucial. Instead of focusing on unrealistic price targets, investors should consider various scenarios and adjust their investment strategies accordingly.

Conclusion: Is XRP's 400% Gain Sustainable? A Final Verdict

XRP's 400% gain is impressive, fueled by positive RippleNet developments, growing institutional interest, and favorable market sentiment. However, the ongoing SEC lawsuit, inherent market volatility, and competition from other cryptocurrencies pose significant challenges. While the future of XRP remains uncertain, a balanced view acknowledging both opportunities and risks is essential. Before investing in XRP or any other cryptocurrency, conduct thorough research and understand the inherent risks involved. While XRP's future price potential is significant, it's crucial to approach investment decisions cautiously. Subscribe to our newsletter for further updates on XRP and other cryptocurrency market trends.

Featured Posts

-

How To Break Bread With Scholars Tips For Engaging Academic Conversations

May 08, 2025

How To Break Bread With Scholars Tips For Engaging Academic Conversations

May 08, 2025 -

El Gigante De Arroyito Fortaleza De Central En Cordoba

May 08, 2025

El Gigante De Arroyito Fortaleza De Central En Cordoba

May 08, 2025 -

Hargreaves Predicts Arsenal Psg Champions League Showdown

May 08, 2025

Hargreaves Predicts Arsenal Psg Champions League Showdown

May 08, 2025 -

Blue Origins Launch Failure Details On The Subsystem Issue

May 08, 2025

Blue Origins Launch Failure Details On The Subsystem Issue

May 08, 2025 -

Efficient Data Transfer Optimizing Your Data Migration Strategy

May 08, 2025

Efficient Data Transfer Optimizing Your Data Migration Strategy

May 08, 2025