Japan Trading House Shares Surge: Berkshire Hathaway's Long-Term Investment

Table of Contents

Berkshire Hathaway's Investment Strategy and its Impact

Berkshire Hathaway's investment philosophy centers on identifying undervalued, fundamentally strong companies with durable competitive advantages – a strategy that has yielded remarkable returns over decades. Their preference for long-term holdings, often characterized by a "buy and hold" approach, minimizes the impact of short-term market fluctuations. This long-term perspective is perfectly exemplified by their recent foray into the Japanese market.

Berkshire Hathaway made significant investments in five major Japanese trading houses: Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, Sumitomo Corporation, and Marubeni Corporation. The announcement immediately sent ripples through the market, causing a sharp increase in the share prices of these companies.

- Significant increase in share prices of target companies: The immediate market reaction was overwhelmingly positive, with share prices of the invested companies experiencing double-digit percentage increases in the days following the announcement.

- Increased investor confidence in Japanese trading houses: Berkshire Hathaway's endorsement lent considerable credibility to these often-overlooked companies, attracting renewed interest from both domestic and international investors.

- Potential for further growth and acquisitions: The influx of capital and the enhanced market perception could facilitate further growth and potential acquisitions within the Japanese trading house sector.

The Appeal of Japanese Trading Houses as Long-Term Investments

Japanese sogo shosha, or general trading companies, possess unique characteristics that make them attractive to long-term investors. Their highly diversified business models, spanning numerous sectors from energy and resources to infrastructure and consumer goods, provide resilience against economic downturns. Their global reach, established through decades of international operations, provides access to diverse markets and opportunities. Finally, their typically strong financial positions, marked by substantial cash reserves and low debt levels, contribute to their stability and long-term viability.

- Resilience during economic downturns: Their diversified portfolios allow them to weather economic storms more effectively than companies focused on single sectors.

- Diversification across various sectors: This broad diversification mitigates risk and provides consistent revenue streams across economic cycles.

- Strong balance sheets and cash reserves: Solid financial foundations provide a buffer against market volatility and enable strategic investments during periods of uncertainty.

- Potential for future growth in emerging markets: These companies are well-positioned to capitalize on growth opportunities in developing economies.

Analyzing the Surge in Japan Trading House Shares: Factors Contributing to the Increase

While Berkshire Hathaway's investment played a pivotal role, other factors contributed to the surge in Japan Trading House shares. A generally positive global economic outlook, coupled with increased demand for raw materials and commodities, has boosted the performance of these companies. Furthermore, strong performance in key sectors like energy and infrastructure, supported by favorable government policies in Japan, has further enhanced investor sentiment.

- Improved global economic outlook: A more optimistic global economic forecast has increased investor appetite for riskier assets, including Japan Trading House shares.

- Increased demand for raw materials and commodities: The global recovery and increasing industrial activity have fueled demand for resources, benefiting trading houses involved in these markets.

- Strong performance in key sectors like energy and infrastructure: Growth in these essential sectors directly translates into increased revenue and profitability for the trading houses.

- Government policies supporting economic growth: Government initiatives aimed at stimulating economic activity have created a positive environment for businesses in Japan, including trading houses.

Risks and Considerations for Investors

While the prospects for Japan Trading House shares appear bright, potential risks should be considered. Geopolitical uncertainties in Asia, fluctuations in the Yen against other major currencies, and competition from other global trading companies could impact performance. A comprehensive understanding of these factors is crucial for informed investment decisions.

- Geopolitical uncertainties in Asia: Regional conflicts or economic instability could negatively impact trading activities and investor confidence.

- Yen fluctuations against other major currencies: Currency fluctuations can affect profitability and returns for international investors.

- Competition from other global trading companies: Competition from other large international trading firms could pressure margins and limit growth.

Conclusion

Berkshire Hathaway's investment in Japanese trading houses has undeniably ignited a significant surge in Japan Trading House shares. This reflects not only the unwavering confidence of a legendary investor but also the inherent strength and long-term growth potential of these diversified global enterprises. Although certain risks exist, the long-term outlook for these companies remains promising, presenting a compelling investment opportunity. Consider exploring the potential of Japan Trading House shares and their role in diversifying your investment portfolio. However, remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Japan Trading House shares or similar assets.

Featured Posts

-

Secure Your Psl 10 Tickets Sale Starts Today

May 08, 2025

Secure Your Psl 10 Tickets Sale Starts Today

May 08, 2025 -

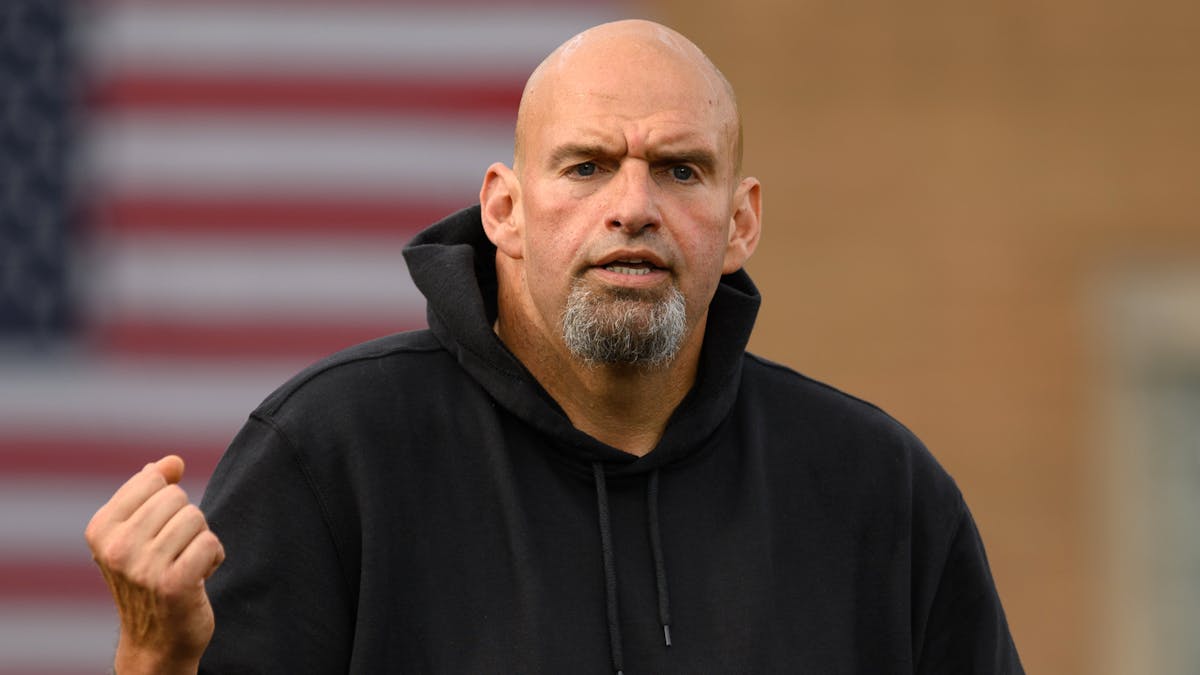

John Fetterman Pushback Against Ny Magazines Fitness Concerns

May 08, 2025

John Fetterman Pushback Against Ny Magazines Fitness Concerns

May 08, 2025 -

Aym Aym Ealm Ky 12 Wyn Brsy Yadgar Tqaryb Ka Ahtmam

May 08, 2025

Aym Aym Ealm Ky 12 Wyn Brsy Yadgar Tqaryb Ka Ahtmam

May 08, 2025 -

Jayson Tatum And Ella Mai Sons Birth Confirmed In New Commercial

May 08, 2025

Jayson Tatum And Ella Mai Sons Birth Confirmed In New Commercial

May 08, 2025 -

Oklahoma City Thunder Vs Houston Rockets Complete Guide To Watching And Betting

May 08, 2025

Oklahoma City Thunder Vs Houston Rockets Complete Guide To Watching And Betting

May 08, 2025