Japanese Bond Market Volatility: The Steep Yield Curve's Economic Effects

Table of Contents

Understanding the Steepening Yield Curve in Japan

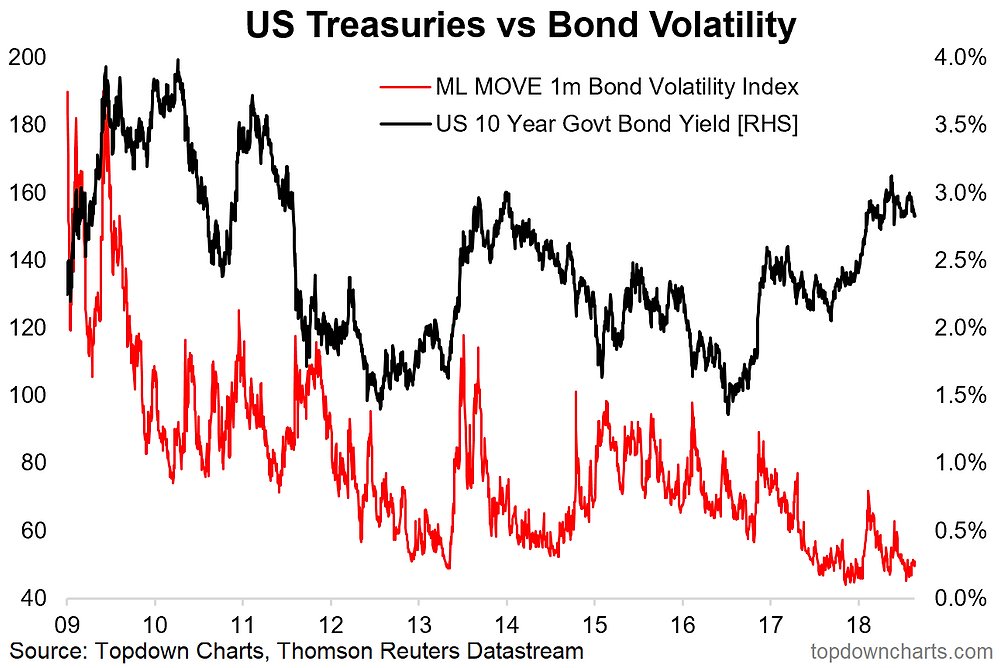

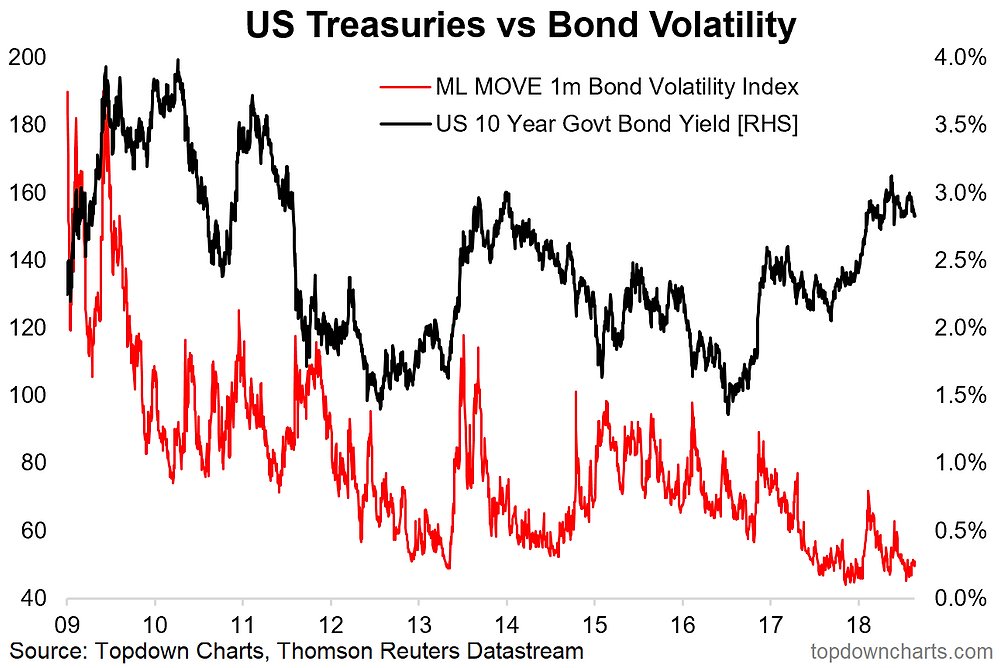

The yield curve represents the relationship between the interest rates (yields) offered on government bonds of different maturities. A normal yield curve slopes upward, meaning longer-term bonds offer higher yields than short-term bonds, reflecting the greater risk associated with longer-term investments. A steepening yield curve indicates a widening gap between short-term and long-term yields. In Japan, this steepening signifies growing expectations of future interest rate hikes.

Recent trends in the Japanese government bond (JGB) yield curve show a marked increase in the difference between short-term and long-term yields. This is largely a departure from the historically low and often flat yield curve maintained by the Bank of Japan (BOJ) through its quantitative easing (QE) policies.

-

Comparison of current JGB yields with historical data: Analyzing current JGB yields against historical data reveals a significant upward shift, particularly in longer-term bonds. This signifies a shift in market sentiment and expectations.

-

Factors contributing to the steepening curve: Several factors contribute to the steepening curve, including:

- Rising inflation expectations: Increased inflation expectations lead investors to demand higher yields on longer-term bonds to compensate for the erosion of purchasing power.

- Bank of Japan (BOJ) policy shifts: The BOJ's recent adjustments to its yield curve control (YCC) policy, allowing for greater flexibility in long-term JGB yields, have contributed to the steepening.

- Global interest rate hikes: Rising interest rates in other major economies also exert upward pressure on JGB yields.

-

Differing yields between short-term and long-term JGBs: The widening gap between short-term and long-term JGB yields reflects differing market expectations about future interest rates and inflation. Investors are demanding higher premiums for holding longer-term bonds, anticipating higher future yields.

Economic Consequences of Japanese Bond Market Volatility

The increased volatility in the Japanese bond market has significant economic consequences, impacting various sectors of the economy.

Impact on Inflation

-

Relationship between rising bond yields and inflationary pressures: Higher bond yields often reflect increased inflationary pressures. As investors anticipate higher inflation, they demand higher returns on their investments to offset the erosion of purchasing power.

-

Potential for increased consumer prices: The steepening yield curve could contribute to increased consumer prices as businesses pass on higher borrowing costs to consumers.

-

BOJ's inflation targets and the challenges posed by a steep yield curve: The BOJ's struggle to achieve its inflation targets is exacerbated by the steepening yield curve, which suggests that inflationary pressures are stronger than previously anticipated.

Effects on the Japanese Yen

-

Correlation between JGB yields and the value of the Japanese yen: Rising JGB yields can attract foreign investment into Japan, increasing demand for the Japanese yen and strengthening its value. Conversely, decreased yields could lead to a weakening of the yen.

-

Impact on currency exchange rates and international trade: Fluctuations in the yen's value due to JGB yield changes affect the competitiveness of Japanese exports and imports, impacting international trade.

-

Potential for increased volatility in the foreign exchange market: The increased volatility in the JGB market can translate into increased volatility in the foreign exchange market, creating uncertainty for businesses engaged in international trade.

Influence on Corporate Investment

-

Effect of higher borrowing costs on business investment decisions: Higher borrowing costs associated with rising JGB yields can discourage corporate investment, leading to reduced capital expenditures.

-

Potential for slower economic growth: Decreased corporate investment due to higher borrowing costs can contribute to slower economic growth.

-

Impact on corporate profitability and job creation: Reduced investment can negatively impact corporate profitability and potentially lead to reduced job creation.

The Bank of Japan's Response and Future Outlook

The Bank of Japan has responded to the steepening yield curve with adjustments to its monetary policy, primarily through modifications to its yield curve control (YCC) policy.

-

Review of the BOJ's monetary policy adjustments: The BOJ has gradually increased the acceptable range for 10-year JGB yields, allowing for greater flexibility in the market.

-

Analysis of the effectiveness of the BOJ's interventions: The effectiveness of the BOJ's interventions remains a subject of debate, with some arguing that the adjustments are insufficient to counter the upward pressure on yields.

-

Potential future policy changes and their implications: Future policy changes could include further adjustments to YCC, potentially leading to more volatility in the JGB market.

-

Predictions and forecasts for the future trajectory of JGB yields: Forecasting the future trajectory of JGB yields is challenging due to the interplay of various factors, including global economic conditions, inflation expectations, and BOJ policy decisions.

Conclusion

The increasing volatility in the Japanese bond market, largely driven by a steepening yield curve, presents significant challenges and opportunities. Understanding the interplay between inflation expectations, BOJ policy, and JGB yields is crucial for navigating this dynamic environment. The implications extend beyond Japan, affecting global currency markets and investor confidence. Continued monitoring of the Japanese bond market volatility and the BOJ’s responses is essential for investors and policymakers alike. Stay informed on developments in the Japanese bond market volatility to make informed decisions.

Featured Posts

-

New York Knicks Thibodeau Calls For More Fight After Heavy Loss

May 17, 2025

New York Knicks Thibodeau Calls For More Fight After Heavy Loss

May 17, 2025 -

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 17, 2025

Ryujinx Emulator Project Ends After Reported Nintendo Intervention

May 17, 2025 -

Josh Hart Injury Latest News And Potential Return Date For Knicks Celtics Game

May 17, 2025

Josh Hart Injury Latest News And Potential Return Date For Knicks Celtics Game

May 17, 2025 -

Canadian Stock Market Soars Tsx Composite Index Sets New Intraday High

May 17, 2025

Canadian Stock Market Soars Tsx Composite Index Sets New Intraday High

May 17, 2025 -

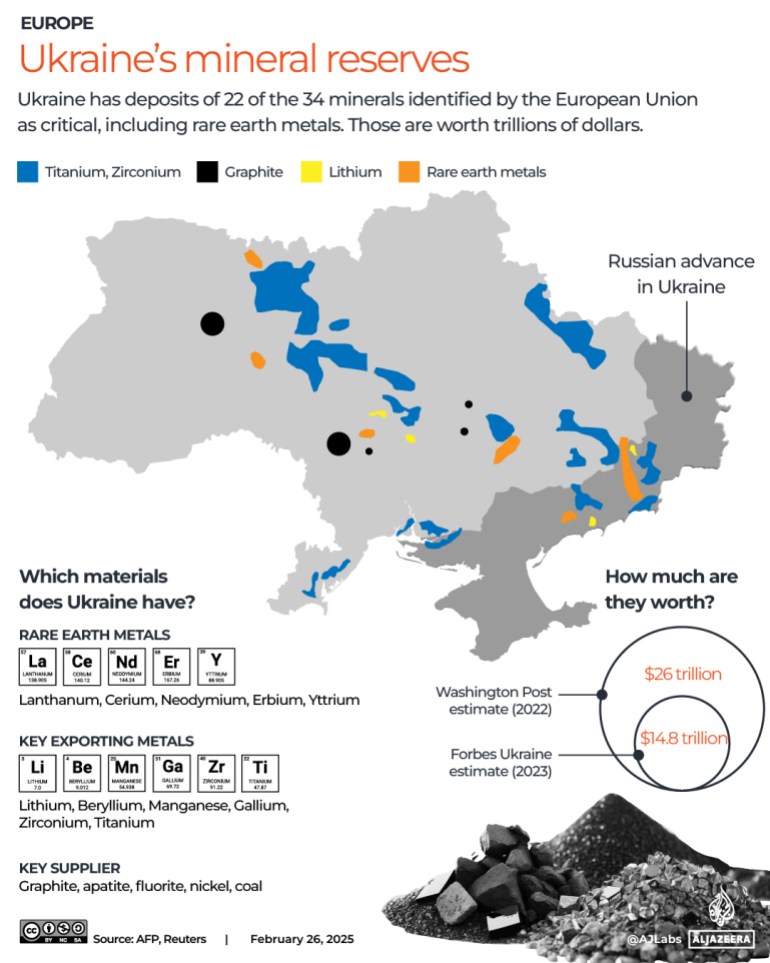

Rare Earth Minerals Fueling A New Cold War

May 17, 2025

Rare Earth Minerals Fueling A New Cold War

May 17, 2025

Latest Posts

-

David Del Valle Uribe Su Participacion En La Olimpiada Nacional Representando A Reynosa

May 17, 2025

David Del Valle Uribe Su Participacion En La Olimpiada Nacional Representando A Reynosa

May 17, 2025 -

Reynosa En La Olimpiada Nacional El Destacado Desempeno De David Del Valle Uribe

May 17, 2025

Reynosa En La Olimpiada Nacional El Destacado Desempeno De David Del Valle Uribe

May 17, 2025 -

David Del Valle Uribe El Orgullo De Reynosa En La Olimpiada Nacional

May 17, 2025

David Del Valle Uribe El Orgullo De Reynosa En La Olimpiada Nacional

May 17, 2025 -

David Del Valle Uribe Representante De Reynosa En La Olimpiada Nacional

May 17, 2025

David Del Valle Uribe Representante De Reynosa En La Olimpiada Nacional

May 17, 2025 -

Acidente Com Onibus Universitario Detalhes Sobre O Ocorrido E Vitimas

May 17, 2025

Acidente Com Onibus Universitario Detalhes Sobre O Ocorrido E Vitimas

May 17, 2025