Japan's Economy Contracts In Q1 2023: Pre-Tariff Impact Analysis

Table of Contents

GDP Decline and its Contributing Factors

The contraction in Japan's GDP during Q1 2023 was multifaceted, stemming from a confluence of domestic and global factors. A significant decrease in private consumption and weakening business investment played dominant roles in this economic slowdown.

Sharp Decrease in Private Consumption

Private consumption, a key driver of Japan's economy, experienced a sharp decline in Q1 2023. This drop can be attributed to several factors:

-

Rising Inflation: Soaring energy prices and the weakening Yen significantly increased the cost of living, squeezing household budgets and dampening consumer confidence. The inflation rate reached [Insert specific data for Q1 2023 inflation rate in Japan], impacting purchasing power.

-

Weakening Yen: The depreciation of the Japanese Yen against major currencies increased import costs, making imported goods more expensive for Japanese consumers. This further fueled inflation and reduced disposable income.

-

Reduced Consumer Confidence: Uncertainty about the future economic outlook, coupled with persistent inflation, led to a decrease in consumer confidence. Consumers became more cautious with their spending, opting to save rather than spend.

The percentage change in consumer spending during Q1 2023 was [Insert specific data – e.g., -2.5%]. This substantial drop underscores the severity of the impact on domestic demand.

Weakening Business Investment

Business investment also witnessed a significant decline during the first quarter of 2023. This weakening can be largely attributed to:

-

Global Economic Uncertainty: Concerns about a potential global recession and geopolitical instability created uncertainty among businesses, leading them to postpone or cancel investment projects.

-

Rising Interest Rates: The Bank of Japan's monetary policy adjustments, while aimed at curbing inflation, also increased borrowing costs, making investment more expensive for businesses.

-

Cautious Business Sentiment: The combination of global uncertainty and rising costs resulted in a cautious business sentiment, further contributing to the decrease in investment.

The percentage change in business investment during Q1 2023 was [Insert specific data – e.g., -3%]. This downturn signifies a loss of confidence in future growth prospects.

Impact of the Weakening Yen

The depreciation of the Japanese Yen played a significant role in the Q1 2023 contraction. The weakening Yen, while initially boosting exports in some sectors, ultimately had a negative impact due to:

-

Increased Cost of Imported Goods: The weakening Yen made imported goods, including energy and raw materials, significantly more expensive, fueling inflation and impacting businesses reliant on imports.

-

Impact on Inflation Rates: The increase in import costs directly contributed to a rise in inflation, eroding consumer purchasing power and dampening economic activity.

-

Effect on Purchasing Power: The decline in the Yen's value reduced the purchasing power of Japanese consumers, limiting their ability to buy goods and services, both domestic and imported.

The Yen's fluctuation during this period, reaching [Insert specific data – e.g., a low of 140 Yen per US dollar], exacerbated the negative economic impact.

Pre-Tariff Impacts and Anticipated Effects

While the Q1 2023 contraction was driven by a combination of factors, concerns about potential future tariffs added to the prevailing economic uncertainty.

Potential Impact of Future Tariffs

The possibility of increased tariffs on Japanese goods, particularly in key export markets like the US and EU, presents a significant threat to the Japanese economy.

-

Specific Sectors Most Vulnerable: Sectors such as automobiles, electronics, and machinery are particularly vulnerable to increased tariffs, as these industries are heavily reliant on exports.

-

Potential for Retaliatory Tariffs: The imposition of tariffs by Japan's trading partners could trigger retaliatory measures, further disrupting international trade and harming the Japanese economy.

-

Impact on Trade Balance: Increased tariffs would negatively impact Japan's trade balance, potentially leading to a further widening of the current account deficit.

The timing and scale of future tariffs remain uncertain, but the mere anticipation of them has already contributed to the cautious business sentiment observed in Q1 2023.

Government Response and Mitigation Strategies

In response to the economic contraction, the Japanese government has implemented several mitigation strategies:

-

Fiscal Stimulus Measures: The government has announced fiscal stimulus packages aimed at boosting domestic demand and supporting businesses. [Insert specific details about the stimulus package, if available].

-

Monetary Policy Adjustments: The Bank of Japan has maintained its ultra-loose monetary policy, aiming to keep interest rates low and encourage borrowing and investment. However, the effectiveness of this approach in the face of rising global inflation remains to be seen.

-

Support for Specific Industries: The government has implemented targeted support measures for industries particularly hard-hit by the economic slowdown, such as tourism and manufacturing.

The effectiveness of these interventions will be crucial in determining the speed and strength of Japan's economic recovery.

Global Economic Context and its Influence

The contraction in Japan's economy cannot be analyzed in isolation; it is intrinsically linked to the broader global economic environment.

Impact of Global Inflation and Recessionary Fears

Global inflation and recessionary fears significantly impacted the Japanese economy during Q1 2023.

-

Impact of Global Inflation: Rising global inflation increased input costs for Japanese businesses, reducing profit margins and dampening investment.

-

Reduced Demand for Exports: Weakening global demand reduced exports from Japan, further impacting economic growth.

-

Spillover Effects from Global Recessionary Fears: Concerns about a global recession led to a decrease in business confidence, reducing investment and impacting economic activity.

The interconnected nature of the global economy makes Japan vulnerable to external shocks.

Supply Chain Disruptions and their Ongoing Effects

Persistent supply chain disruptions continued to exert significant pressure on the Japanese economy in Q1 2023.

-

Impact on Production: Supply chain bottlenecks hampered production in several key industries, leading to delays and increased costs.

-

Cost Increases: Disruptions led to increased costs for raw materials and intermediate goods, impacting businesses' profitability.

-

Delays in Delivery: Delayed deliveries further disrupted production schedules and added to the economic uncertainty.

These disruptions exacerbated the challenges faced by Japanese businesses and contributed to the overall economic slowdown.

Conclusion

The unexpected contraction of Japan's economy in Q1 2023 is a complex issue stemming from a combination of factors, including a sharp decrease in private consumption and business investment, the weakening Yen, rising global inflation, and persistent supply chain disruptions. The potential impact of future tariffs further added to the economic uncertainty. While the government has implemented mitigation strategies, their effectiveness remains to be seen. The interplay of domestic and global factors highlights the interconnectedness of the world economy and the challenges Japan faces in navigating a period of considerable uncertainty.

The unexpected contraction of Japan's economy in Q1 2023 necessitates close monitoring of the situation. Further analysis of pre-tariff impacts and the effectiveness of government interventions is crucial. Stay informed about developments in the Japanese economy by regularly checking for updates and in-depth analysis of Japan's economy and its future trajectory.

Featured Posts

-

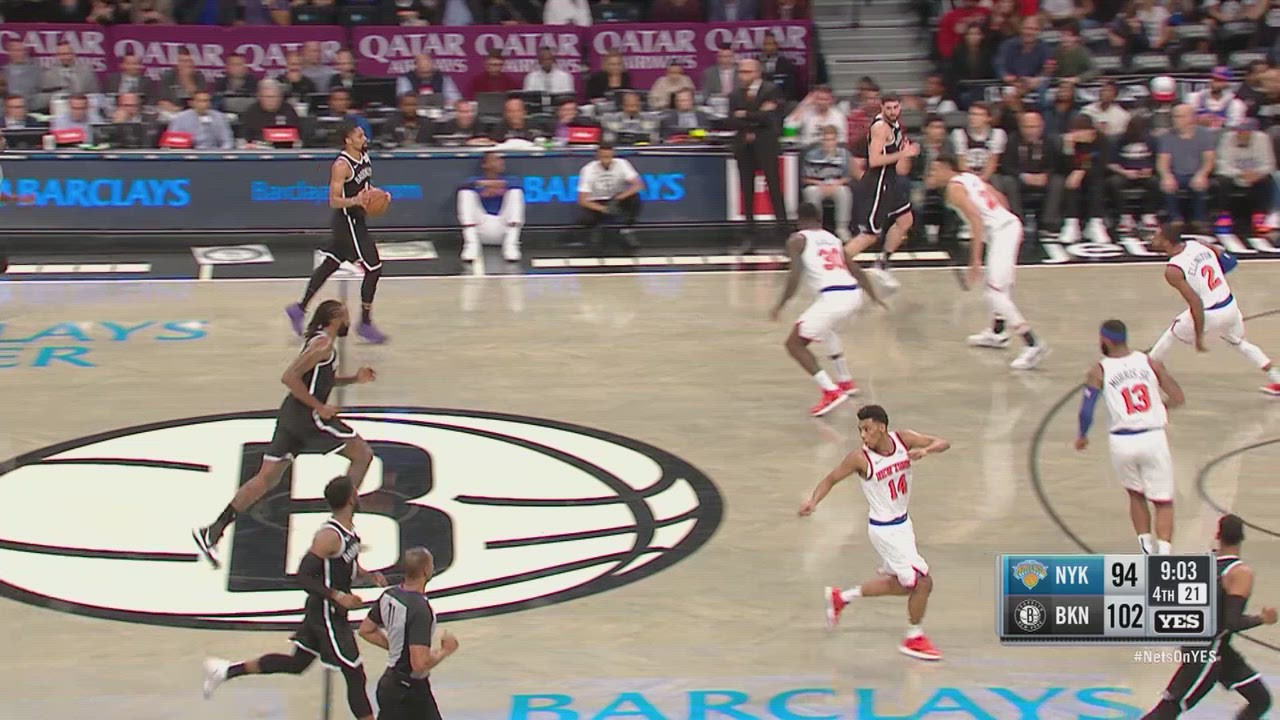

Josh Harts Historic Triple Double Season A New Knicks Record

May 17, 2025

Josh Harts Historic Triple Double Season A New Knicks Record

May 17, 2025 -

New York Knicks The Landry Shamet Conundrum

May 17, 2025

New York Knicks The Landry Shamet Conundrum

May 17, 2025 -

Why Do Guests Disregard Red Carpet Rules A Cnn Perspective

May 17, 2025

Why Do Guests Disregard Red Carpet Rules A Cnn Perspective

May 17, 2025 -

Will Tom Cruise Ever Pay Tom Hanks His 1 The Enduring Hollywood Anecdote

May 17, 2025

Will Tom Cruise Ever Pay Tom Hanks His 1 The Enduring Hollywood Anecdote

May 17, 2025 -

Week 26 Update 2024 25 High School Confidential

May 17, 2025

Week 26 Update 2024 25 High School Confidential

May 17, 2025

Latest Posts

-

Crucial Foul Call Missed Nba Refs Admit Error In Knicks Pistons Game

May 17, 2025

Crucial Foul Call Missed Nba Refs Admit Error In Knicks Pistons Game

May 17, 2025 -

Nba Officials Acknowledge Crucial Missed Call In Knicks Vs Pistons Game

May 17, 2025

Nba Officials Acknowledge Crucial Missed Call In Knicks Vs Pistons Game

May 17, 2025 -

Knicks Win Over Pistons Nba Officials Admit To Crucial Missed Call

May 17, 2025

Knicks Win Over Pistons Nba Officials Admit To Crucial Missed Call

May 17, 2025 -

Officials Admit Missed Call In Knicks Pistons Game

May 17, 2025

Officials Admit Missed Call In Knicks Pistons Game

May 17, 2025 -

Nba Referees Acknowledge Missed Foul Call In Knicks Victory Over Pistons

May 17, 2025

Nba Referees Acknowledge Missed Foul Call In Knicks Victory Over Pistons

May 17, 2025