Japan's Yield Curve: Foreign Investors And The Extended Rebound Predicted By Swaps

Table of Contents

The Japanese yield curve has been a subject of intense scrutiny lately, with significant implications for foreign investors. Recent movements, particularly the extended rebound predicted by interest rate swaps, suggest a shift in market sentiment. This article will delve into the factors influencing Japan's yield curve, focusing on the role of foreign investment and the accuracy of swap-based predictions. Understanding Japan's yield curve is crucial for navigating the complexities of the Japanese bond market and making informed investment decisions.

H2: Understanding Japan's Yield Curve and its Recent Behavior

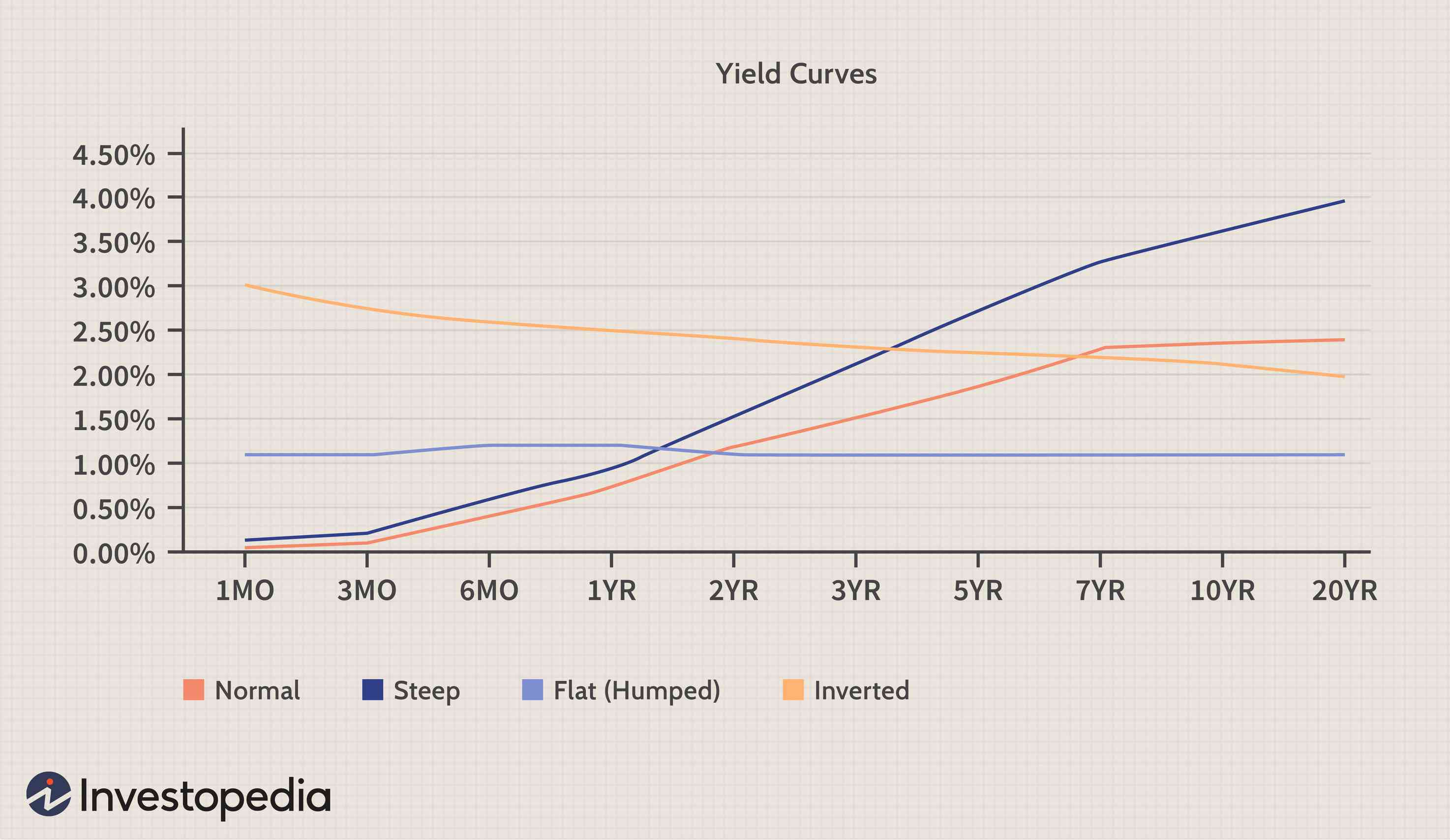

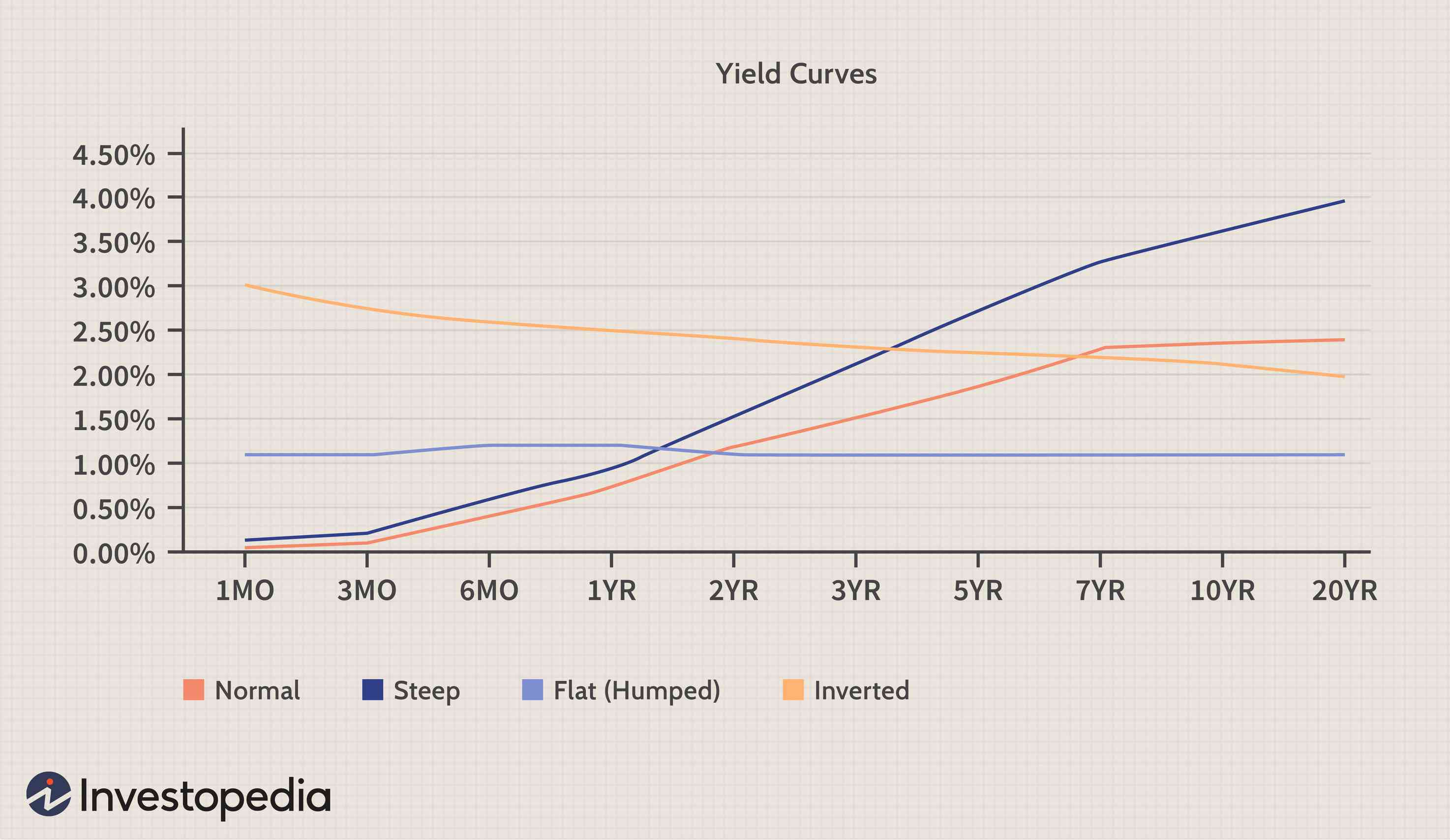

Japan's yield curve, like those of other developed nations, plots the relationship between the interest rates (yields) of government bonds with different maturities. The short end of the curve represents yields on short-term bonds (e.g., 1-year), while the long end reflects yields on longer-term bonds (e.g., 10-year, 30-year). The difference between these yields is known as the yield spread.

Recent trends show significant fluctuations in Japan's yield curve. Historically characterized by a flat or even inverted shape due to the Bank of Japan's (BOJ) aggressive monetary easing policies, the curve has shown signs of steepening, particularly since the BOJ's recent adjustments to its yield curve control (YCC) policy. This suggests a potential shift towards higher long-term interest rates. (Insert relevant chart/graph visualizing recent yield curve movements here).

- Historical context of Japan's yield curve: For years, Japan maintained exceptionally low interest rates, leading to a flattened yield curve.

- Impact of the Bank of Japan's monetary policy: The BOJ's YCC policy directly influenced the shape and levels of the yield curve. Recent modifications to this policy have had a noticeable effect.

- Analysis of recent yield curve inversions or steepening: Periods of inversion (short-term rates higher than long-term rates) have been less frequent in recent years as the curve steepens.

- Comparison to yield curves of other developed economies: Comparing Japan's yield curve to those of the US, UK, or Eurozone provides valuable context for understanding global economic trends and investor sentiment.

H2: The Role of Foreign Investors in Shaping Japan's Yield Curve

Foreign investors play a substantial role in the Japanese bond market, holding a significant portion of Japanese Government Bonds (JGBs). Their investment decisions heavily influence JGB yields and consequently, the shape of Japan's yield curve. Capital inflows push yields down, while outflows exert upward pressure.

Foreign investors' strategies vary, ranging from long-term buy-and-hold approaches to short-term trading based on interest rate differentials and global economic forecasts. The search for yield in a low-rate global environment has made JGBs an attractive asset, but changing global conditions can impact this investment appetite.

- Impact of global economic conditions on foreign investment in JGBs: Global economic slowdowns or uncertainties often lead to increased demand for safe-haven assets like JGBs, driving down yields.

- Risk appetite of foreign investors and its effect on yield curve dynamics: Increased risk aversion typically leads to capital flows into JGBs, flattening the yield curve.

- Diversification strategies of foreign investors and their implications for JGB yields: JGBs are often part of broader global diversification strategies, influencing demand and consequently, yields.

- Potential for future foreign investment in JGBs: The future trajectory of foreign investment in JGBs will be influenced by global economic growth, interest rate differentials, and geopolitical events.

H3: Interest Rate Swaps and the Predicted Rebound

Interest rate swaps are derivative contracts that allow parties to exchange interest rate payments. By analyzing the prices of these swaps, market participants can infer expectations for future interest rates and, by extension, predict future yield curve movements. Recently, interest rate swap data has pointed towards an extended rebound in Japan's yield curve.

- Mechanism of interest rate swaps and their relevance to yield curve forecasting: Swap prices reflect market participants' collective view of future interest rates.

- Interpretation of swap data and its implications for investors: Rising swap rates often indicate expectations of rising bond yields.

- Comparison of swap predictions with actual yield curve movements: The accuracy of these predictions should be assessed by comparing them against the actual yield curve evolution.

- Limitations of using swaps as the sole predictor of yield curve movements: Swaps provide valuable insight, but other factors must also be considered when making yield curve predictions.

H2: Implications for Investors and Future Outlook

The predicted rebound in Japan's yield curve presents both opportunities and risks for investors. For instance, a steepening curve can benefit investors holding short-term bonds while potentially impacting those with longer-term positions.

- Strategies for investors based on the predicted rebound: Investors might adjust their portfolio allocations depending on their risk tolerance and the predicted yield curve dynamics.

- Potential risks and downside scenarios: Unforeseen economic events or changes in BOJ policy could alter the predicted trajectory.

- Factors that could affect the accuracy of the predicted rebound: Geopolitical risks, inflation pressures, and global economic growth all influence the accuracy of the predictions.

- Long-term outlook for Japan's yield curve: The long-term outlook for Japan's yield curve is subject to considerable uncertainty and hinges on domestic and global factors.

Conclusion:

Foreign investors significantly influence Japan's yield curve, and interest rate swaps offer valuable insights into potential future movements. However, the accuracy of these predictions remains subject to various economic and political factors. Understanding Japan's yield curve is crucial for investors to make informed decisions. Staying informed about ongoing developments in Japan's yield curve, monitoring interest rate swaps and other relevant indicators, and conducting further research are crucial for successful investment strategies. Keep a close eye on the dynamics of Japan's yield curve for optimal investment performance.

Featured Posts

-

The Tough Times Test Analyzing The Responses Of Political Parties

Apr 25, 2025

The Tough Times Test Analyzing The Responses Of Political Parties

Apr 25, 2025 -

Makeup And Skin Health Understanding The Risks And Benefits

Apr 25, 2025

Makeup And Skin Health Understanding The Risks And Benefits

Apr 25, 2025 -

The Harrogate Spring Flower Show Is Back April 24th

Apr 25, 2025

The Harrogate Spring Flower Show Is Back April 24th

Apr 25, 2025 -

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 25, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 25, 2025 -

Against All Odds Bochums Incredible Comeback Against Bayern Munich

Apr 25, 2025

Against All Odds Bochums Incredible Comeback Against Bayern Munich

Apr 25, 2025

Latest Posts

-

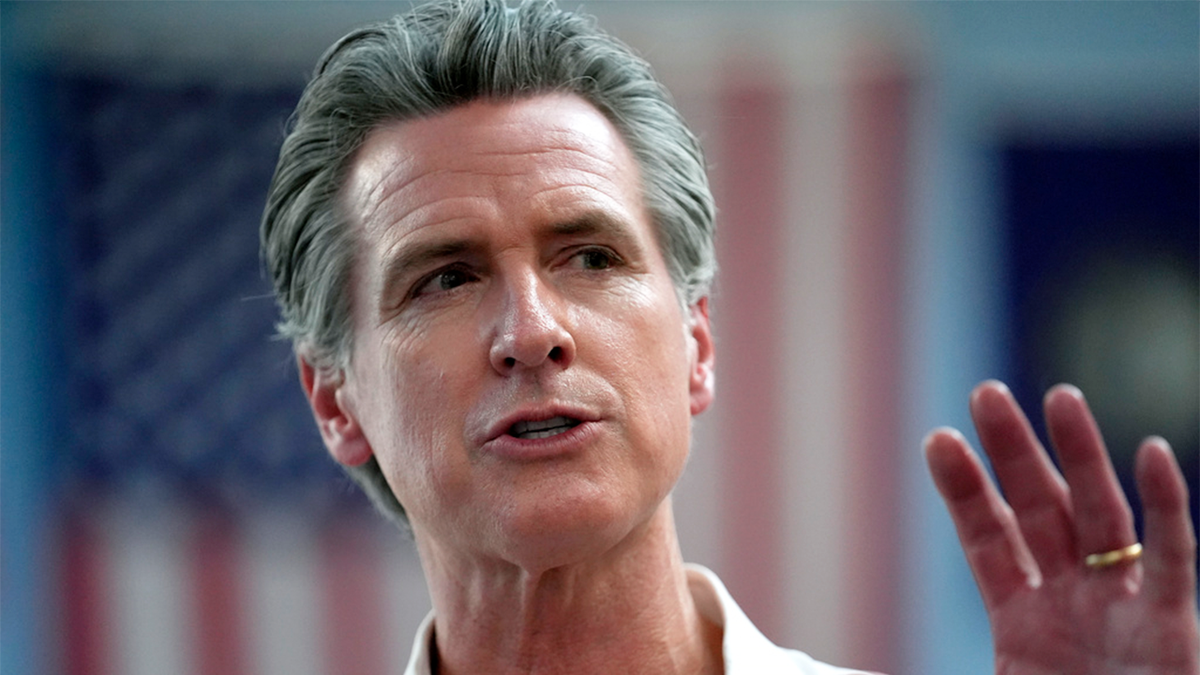

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025 -

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025

Gavin Newsoms Toxic Democrat Remark A Political Backlash

Apr 26, 2025