JBS And Banco Master: Acquisition Negotiations Terminated

Table of Contents

Reasons for Termination of JBS and Banco Master Negotiations

The termination of the JBS and Banco Master acquisition signifies a significant setback for both entities. Several factors likely contributed to the deal's collapse. While neither company has provided exhaustive details, press releases and industry analysts point towards several key reasons:

-

Regulatory Hurdles: Antitrust concerns are a common obstacle in large-scale mergers and acquisitions. The Brazilian competition authority, Conselho Administrativo de Defesa Econômica (CADE), may have raised concerns about the potential for reduced competition within the financial and agricultural sectors if the acquisition proceeded. Further investigation into specific regulatory challenges is warranted. [Insert Link to relevant news article or official statement, if available].

-

Disagreements on Valuation and Deal Terms: Negotiations often falter due to discrepancies in valuation. JBS and Banco Master may have disagreed on the appropriate price, payment terms, or other crucial aspects of the deal structure. This is a frequent reason for M&A failures.

-

Changes in Market Conditions: The global economic landscape is constantly shifting. Factors such as interest rate hikes, economic uncertainty, or a downturn in specific markets could have made the acquisition less appealing to one or both parties. These macroeconomic factors significantly impact deal feasibility.

-

Strategic Shifts: Strategic priorities can change rapidly. Either JBS or Banco Master may have experienced a shift in their long-term business plans that made the acquisition less desirable, perhaps identifying more attractive investment opportunities elsewhere. [Insert Link to relevant news article or official statement, if available].

Impact on JBS's Growth Strategy

The failed JBS and Banco Master acquisition significantly impacts JBS's growth strategy. The company will likely need to reassess its expansion plans and explore alternative avenues for achieving its objectives. Possible strategies include:

-

Focus on Organic Growth: JBS may prioritize internal growth by improving operational efficiency, expanding existing operations, and optimizing its supply chain. This "organic growth" approach can be less risky than large acquisitions.

-

Exploration of Other Acquisitions: The failure doesn't necessarily halt JBS's M&A activity. The company might now explore acquisitions in other sectors or target different companies within the financial or agricultural industries. Their M&A strategy will likely require a review and refinement.

-

Increased Investment in Research and Development: JBS might increase investment in research and development to develop innovative products and technologies, thereby fostering organic growth and strengthening its competitive edge.

Implications for Banco Master and the Brazilian Financial Market

For Banco Master, the terminated acquisition has important implications. While the immediate impact on its stock price will need to be observed, [Insert Link to financial news source if available] it also presents the bank with opportunities.

-

Seeking Other Strategic Partnerships: Banco Master may now actively seek other strategic partnerships or collaborations to achieve its business goals.

-

Impact on Banco Master Stock: The termination of the JBS and Banco Master acquisition may influence Banco Master's stock price and market capitalization in both the short and long term. Investor confidence will be crucial.

-

Broader Implications for the M&A landscape in Brazil: This event could have ramifications for the broader Brazilian banking sector's M&A activity, potentially influencing other potential deals.

Future Outlook: JBS and Banco Master Post-Termination

Following the failed JBS and Banco Master acquisition, both companies will likely focus on their individual strategies. The possibility of future collaborations remains uncertain.

-

JBS's Future Acquisition Targets: JBS will undoubtedly explore new acquisition opportunities, seeking targets that better align with their revised strategic priorities.

-

Banco Master's Future Strategy: Banco Master will likely revise its strategic plan, potentially focusing on organic growth, exploring new partnerships, or revisiting M&A opportunities with different partners.

-

Long-Term Implications: The long-term implications of this failed deal on the relationship between JBS and Banco Master remain to be seen. A future collaboration remains a possibility, but it's far from guaranteed.

Conclusion: Analyzing the End of JBS and Banco Master Acquisition Talks

The termination of the JBS and Banco Master acquisition negotiations marks a significant development with potential ramifications for both companies and the broader financial and agricultural landscapes. Several factors, including regulatory hurdles, valuation discrepancies, and shifting market conditions, likely contributed to the deal's failure. This event underscores the complexity and inherent risks associated with large-scale mergers and acquisitions. Both JBS and Banco Master must now adapt their strategies to navigate this new environment. To stay updated on the latest developments regarding the JBS and Banco Master acquisition and other significant business news, subscribe to our newsletter [Link to newsletter signup], follow us on social media [Links to social media], or check back regularly for updates on our website. The future trajectory of both JBS and Banco Master following this significant event will be closely watched by investors and industry experts alike.

Featured Posts

-

Super Bowl Controversy Kanye West And Taylor Swifts Public Rift

May 18, 2025

Super Bowl Controversy Kanye West And Taylor Swifts Public Rift

May 18, 2025 -

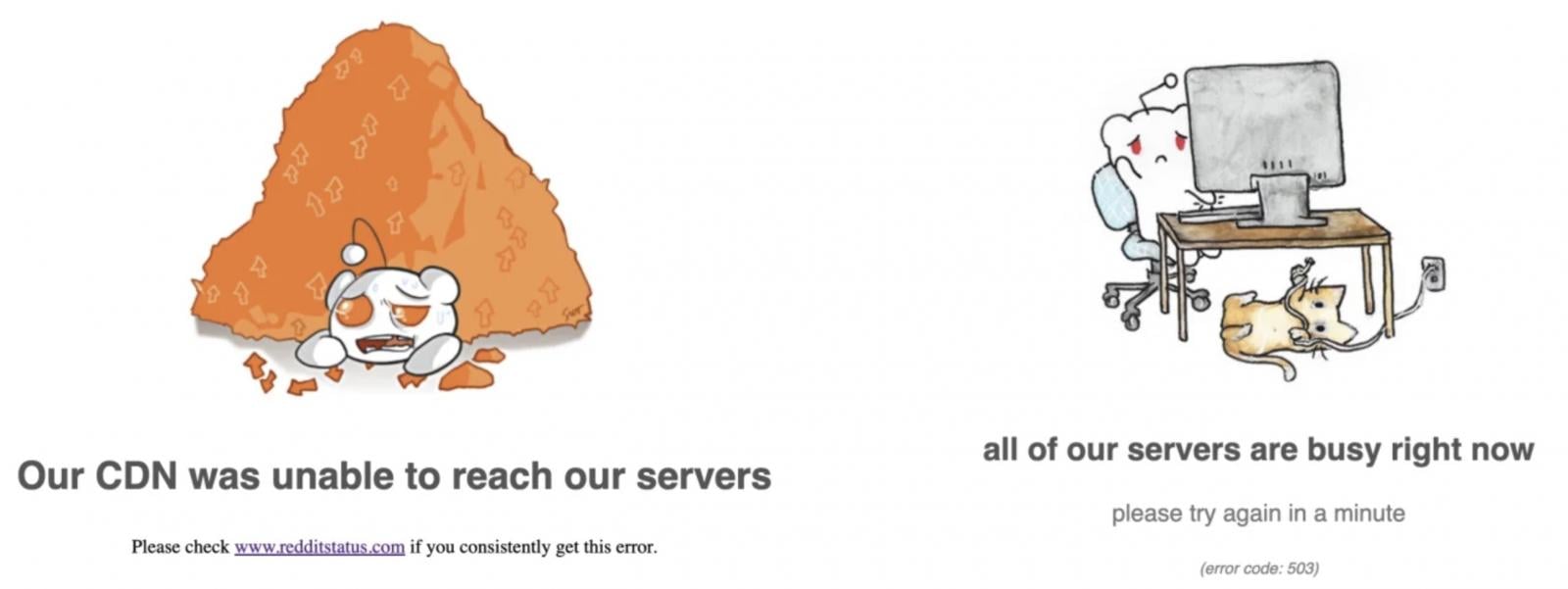

Thousands Report Reddit Downtime Globally

May 18, 2025

Thousands Report Reddit Downtime Globally

May 18, 2025 -

Is Taylor Swift Finally Releasing Reputation Taylors Version New Clues Emerge

May 18, 2025

Is Taylor Swift Finally Releasing Reputation Taylors Version New Clues Emerge

May 18, 2025 -

Kanye Westas Ir Bianca Censori Nauja Sokiruojanti Nuotrauka

May 18, 2025

Kanye Westas Ir Bianca Censori Nauja Sokiruojanti Nuotrauka

May 18, 2025 -

Five Wounded In Amsterdam Hotel Knife Attack Police Conduct Raid

May 18, 2025

Five Wounded In Amsterdam Hotel Knife Attack Police Conduct Raid

May 18, 2025

Latest Posts

-

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025

Post Only Fans Launch Amanda Bynes Spotted Out And About

May 18, 2025 -

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025

Amanda Bynes Seen With Friend After Only Fans Launch

May 18, 2025 -

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025

Amanda Bynes Steps Out New Only Fans Content Revealed

May 18, 2025 -

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025

Amanda Bynes Post Only Fans Public Appearance

May 18, 2025 -

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025

Amanda Bynes Only Fans A Look At Her Recent Public Appearance

May 18, 2025