Jerome Powell: Tariffs And The Fed's Tightrope Walk

Table of Contents

The Impact of Tariffs on Inflation

Tariffs, essentially taxes on imported goods, significantly impact inflation and the overall economic landscape. Their influence is multifaceted, affecting both consumer prices and the intricate web of global supply chains.

Increased Prices for Consumers

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This reduces purchasing power and can fuel inflationary pressures throughout the economy. The impact isn't evenly distributed; some sectors feel the pinch more acutely than others.

-

Examples of tariff-affected goods: Consumer electronics (e.g., smartphones, televisions), clothing and textiles, automobiles and auto parts, and various agricultural products. The impact is often felt disproportionately by lower-income households who spend a larger portion of their income on these essential goods.

-

Data points on inflation increases linked to specific tariffs: (Further research is needed to include specific data points here, correlating specific tariffs with measurable increases in the Consumer Price Index (CPI) or other relevant inflation metrics. This section would benefit from citing reputable economic data sources such as the Bureau of Labor Statistics or the Federal Reserve itself.) For example, a study could show the correlation between the imposition of tariffs on steel and aluminum and subsequent price increases in construction and manufacturing.

Supply Chain Disruptions

Beyond direct price increases, tariffs disrupt global supply chains. Businesses face challenges in sourcing materials and goods, leading to shortages and further price increases. This disruption can cascade through the economy, impacting various sectors.

-

Discussion of specific supply chain bottlenecks caused by tariffs: (This section requires research to cite specific examples of supply chain disruptions caused by particular tariffs. Examples could include delays in the delivery of goods due to increased customs processing times, or shortages of specific materials due to restricted imports.)

-

Impact on business investment and job creation: The uncertainty and increased costs associated with tariffs can negatively impact business investment and job creation. Businesses may postpone expansion plans or even reduce their workforce in response to higher input costs and reduced demand.

The Fed's Response to Tariff-Induced Inflation

Faced with tariff-induced inflation, the Federal Reserve employs various monetary policy tools to stabilize the economy. These tools aim to curb inflation while minimizing negative impacts on economic growth and employment.

Interest Rate Hikes

A primary tool in the Fed's arsenal is raising interest rates. Higher interest rates increase borrowing costs for businesses and consumers, reducing spending and investment, thereby cooling down inflationary pressures.

-

Explanation of the mechanism of interest rate hikes and their impact on borrowing costs: By raising the federal funds rate (the target rate for overnight lending between banks), the Fed influences other interest rates throughout the economy, making loans more expensive. This dampens demand and can help to control inflation.

-

Potential negative consequences of aggressive interest rate hikes (e.g., recession): However, aggressively raising interest rates risks slowing economic growth too much, potentially triggering a recession. The Fed must carefully balance its efforts to control inflation with the need to maintain economic expansion.

Quantitative Tightening

Another tool the Fed can use is quantitative tightening (QT), which involves reducing its balance sheet. This is the opposite of quantitative easing (QE), where the Fed buys assets to increase the money supply. In QT, the Fed sells assets, reducing the money supply and thus putting downward pressure on inflation.

-

Explanation of quantitative tightening and its effects on the economy: QT reduces the amount of money circulating in the economy, which can help to curb inflation but also potentially reduce economic activity.

-

Comparison with quantitative easing and its opposite effects: QE increases the money supply, stimulating economic growth but potentially leading to inflation if not managed carefully. QT aims to counteract these inflationary effects.

The Political Tightrope: Balancing Economic Stability and Trade Policy

The Federal Reserve operates with a mandate for price stability and full employment, but its actions are intertwined with the broader political and economic landscape. The impact of tariffs introduces a significant layer of complexity.

Independent Central Bank vs. Political Pressure

The Fed strives for independence from political influence, but it can't entirely ignore the economic consequences of the administration's trade policies. This creates a delicate balancing act.

-

Discussion of the tension between the Fed's mandate and political considerations: While the Fed's independence is crucial for its credibility, it must acknowledge the significant economic effects of trade policies, even if it doesn't directly control them.

-

Historical examples of the Fed's response to political pressures: (Further research is needed here to provide examples of how the Fed has navigated political pressures in the past. Examining past periods of trade disputes or economic crises could be informative.)

Uncertainty and Market Volatility

Uncertainty surrounding trade policy creates market volatility, making it challenging for the Fed to make accurate predictions and implement effective policies. This unpredictability impacts investor confidence and economic decision-making.

-

Impact of tariff uncertainty on investor confidence and market behavior: Uncertainty leads to risk aversion, potentially causing investors to pull back from investments, slowing economic growth.

-

Strategies the Fed can employ to mitigate market volatility: Clear communication, transparency about the Fed's policy goals and rationale, and flexibility in its approach can help to reduce market volatility.

Conclusion

Jerome Powell's leadership of the Federal Reserve during a period of significant trade tension presents a considerable challenge. Balancing the inflationary pressures caused by tariffs with the need to maintain economic stability requires a nuanced and adaptable approach. The Fed's response, whether through interest rate hikes, quantitative tightening, or other measures, will have far-reaching consequences for the US economy. Understanding the interplay between tariffs and the Fed's monetary policy under Powell is crucial for investors, businesses, and policymakers alike. Stay informed about Jerome Powell’s decisions regarding tariffs and the Fed's tightrope walk to make sound financial decisions in this dynamic environment. Continue to monitor the interplay between tariffs, inflation, and the Federal Reserve's actions to navigate the economic complexities effectively.

Featured Posts

-

Nvidias Rtx 5060 What Went Wrong And What It Means For The Future Of Gpu Reviews

May 25, 2025

Nvidias Rtx 5060 What Went Wrong And What It Means For The Future Of Gpu Reviews

May 25, 2025 -

New York Times Connections Hints And Answers For Puzzle 646 March 18 2025

May 25, 2025

New York Times Connections Hints And Answers For Puzzle 646 March 18 2025

May 25, 2025 -

Explore Jensons Fw 22 Extended Line New Styles And Details

May 25, 2025

Explore Jensons Fw 22 Extended Line New Styles And Details

May 25, 2025 -

Amsterdam Exchange 11 Loss Extends Negative Trend To Three Days

May 25, 2025

Amsterdam Exchange 11 Loss Extends Negative Trend To Three Days

May 25, 2025 -

Hsv Aufstieg Perfekt Der Weg Zurueck In Die Bundesliga

May 25, 2025

Hsv Aufstieg Perfekt Der Weg Zurueck In Die Bundesliga

May 25, 2025

Latest Posts

-

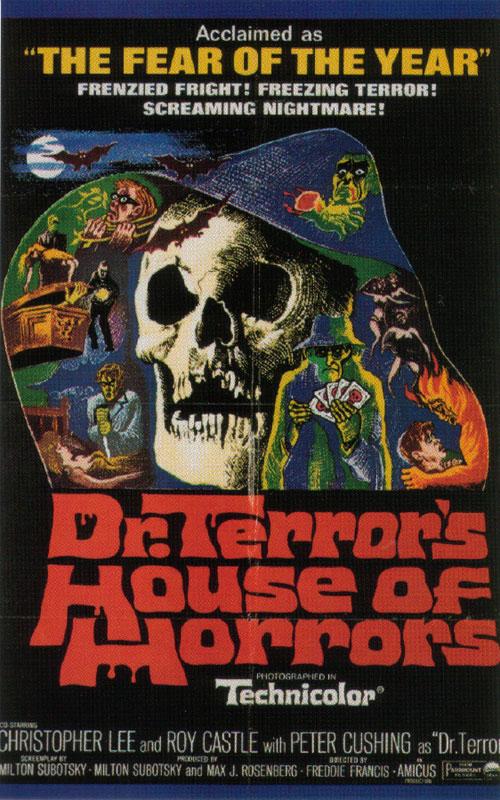

A Thrill Seekers Guide To Dr Terrors House Of Horrors

May 25, 2025

A Thrill Seekers Guide To Dr Terrors House Of Horrors

May 25, 2025 -

The Jenson Fw 22 Extended A Deep Dive

May 25, 2025

The Jenson Fw 22 Extended A Deep Dive

May 25, 2025 -

Is Dr Terrors House Of Horrors Right For You A Comprehensive Review

May 25, 2025

Is Dr Terrors House Of Horrors Right For You A Comprehensive Review

May 25, 2025 -

Planning Your Visit To Dr Terrors House Of Horrors

May 25, 2025

Planning Your Visit To Dr Terrors House Of Horrors

May 25, 2025 -

Jenson Buttons 2009 Brawn A Historic Formula 1 Moment

May 25, 2025

Jenson Buttons 2009 Brawn A Historic Formula 1 Moment

May 25, 2025