Jim Cramer On CoreWeave (CRWV): A Contrarian View On AI Infrastructure Leadership

Table of Contents

Jim Cramer's Stance on CoreWeave (CRWV): A Deep Dive

Unfortunately, readily available, specific public statements from Jim Cramer directly addressing CoreWeave (CRWV) are currently limited. However, by analyzing his commentary on similar companies within the cloud computing and AI infrastructure sectors, we can infer a potential perspective. Cramer frequently emphasizes the importance of strong fundamentals, sustainable growth, and competitive advantages. His opinions often reflect a focus on near-term market performance alongside long-term potential.

- Potential Inference: Given Cramer's general preference for companies demonstrating strong technological innovation and robust growth potential, it's plausible that he would view CoreWeave's position in the rapidly expanding AI infrastructure market favorably. However, his cautionary approach might lead him to stress the importance of evaluating CRWV's valuation carefully against its competitors.

- Related Stocks: We can speculate that Cramer's views on CRWV might be compared to his commentary on other companies in the AI infrastructure space like NVIDIA (NVDA), whose GPUs are central to CoreWeave's business model.

- Conflict of Interest Disclaimer: It’s crucial to remember that this analysis is based on publicly available information and inferences. Any investment decisions should be made independently, with a full understanding of potential risks and without relying solely on the opinions of any single commentator.

CoreWeave's (CRWV) Strengths in the AI Infrastructure Race

CoreWeave has rapidly established itself as a significant player in the AI infrastructure market. Its business model centers around providing high-performance cloud computing solutions tailored to the specific needs of AI applications. This focus, combined with its technological strengths, provides a compelling proposition.

- High-Performance Computing: CoreWeave leverages a massive scale of NVIDIA GPUs, offering unparalleled processing power for demanding AI workloads.

- Scalability and Flexibility: Its cloud-based infrastructure allows for rapid scaling, adapting to fluctuating demands and enabling clients to optimize resource allocation.

- Strategic Partnerships: CoreWeave's collaborations with key players in the AI ecosystem enhance its market reach and provide access to cutting-edge technologies.

- Growing Customer Base: The company's client list includes a diverse range of businesses, highlighting its ability to cater to various AI development needs.

Challenges and Risks Facing CoreWeave (CRWV)

Despite its strengths, CoreWeave faces several challenges inherent to the competitive AI infrastructure market.

- Intense Competition: Established giants like Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure pose significant competition, leveraging their extensive resources and existing customer bases.

- Technological Disruption: Rapid advancements in AI technology could render CoreWeave's current infrastructure less competitive, requiring constant adaptation and investment.

- Economic Volatility: Economic downturns could reduce investment in AI development, impacting demand for CoreWeave's services.

- Dependence on NVIDIA: CoreWeave's reliance on NVIDIA GPUs creates potential vulnerability to supply chain disruptions or changes in NVIDIA's pricing strategies.

Valuation and Investment Implications of CRWV

CoreWeave's valuation is a crucial consideration for potential investors. Analyzing its current market capitalization against its growth trajectory and comparing it to competitors is essential.

- Valuation Comparison: Comparing CoreWeave's price-to-sales ratio (P/S) or other relevant metrics to similar companies in the AI infrastructure sector provides a benchmark for assessing its current valuation.

- Future Price Targets: Based on various growth scenarios (optimistic, conservative, pessimistic), potential future price targets can be projected. These projections should take into account factors such as revenue growth, market share gains, and competitive pressures.

- Investment Strategy: The ideal investment approach will depend on individual risk tolerance and investment horizon. A long-term investor might be more willing to weather potential short-term market fluctuations. Short-term investors might seek more immediate returns and a lower risk profile.

Conclusion: Weighing the Contrarian View on CoreWeave (CRWV) and AI Infrastructure

CoreWeave (CRWV) occupies a promising position within the rapidly expanding AI infrastructure market. However, its success depends on navigating a competitive landscape and managing inherent risks. While Jim Cramer's (inferred) perspective on CoreWeave remains elusive, understanding his general investment philosophy – focused on strong fundamentals and sustainable growth – provides a valuable framework for assessing the company's potential. Ultimately, understanding Jim Cramer's views on CoreWeave (CRWV) should inform, but not dictate, your own investment strategy in the burgeoning AI infrastructure market. Thorough due diligence, including independent research and a clear understanding of your risk tolerance, is crucial before making any investment decisions in CRWV or any other AI infrastructure stock.

Featured Posts

-

Javier Baez Y Su Lucha Por La Salud Y La Productividad En El Beisbol

May 22, 2025

Javier Baez Y Su Lucha Por La Salud Y La Productividad En El Beisbol

May 22, 2025 -

Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025

Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025 -

Occasionverkopen Abn Amro Een Analyse Van De Recente Groei

May 22, 2025

Occasionverkopen Abn Amro Een Analyse Van De Recente Groei

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025 -

Blake Lively Film Controversy Lawsuit Subpoenas And All The Details

May 22, 2025

Blake Lively Film Controversy Lawsuit Subpoenas And All The Details

May 22, 2025

Latest Posts

-

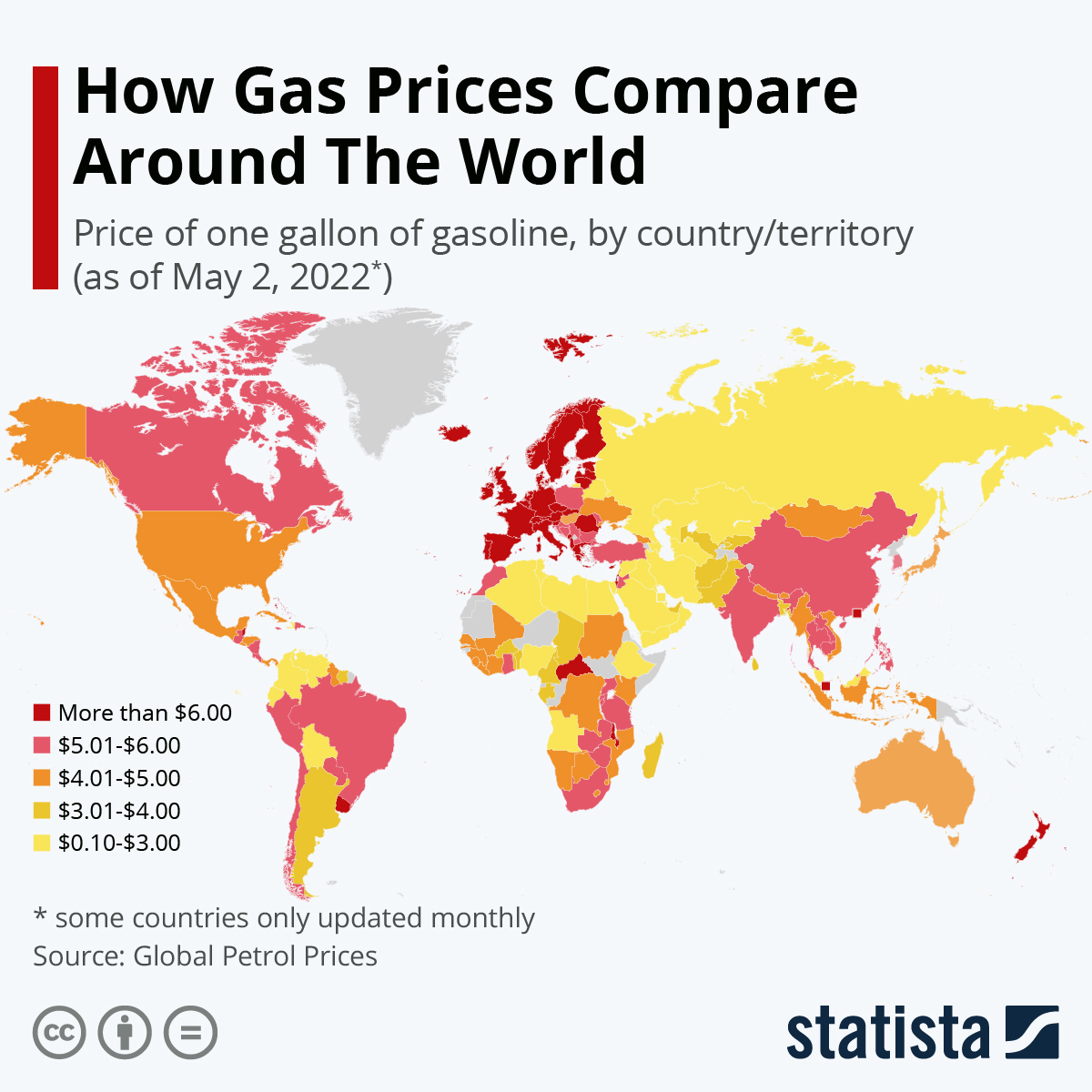

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025