Jim Cramer On CoreWeave (CRWV): Evaluating The Cloud Infrastructure Provider

Table of Contents

Jim Cramer's Perspective on CoreWeave (CRWV)

Unfortunately, at the time of writing, publicly available information on Jim Cramer's specific commentary regarding CoreWeave (CRWV) is limited. His opinions, frequently expressed on his show and through other media, often focus on established players in the tech sector. However, given CoreWeave's recent entrance into the public market and its focus on a high-growth sector (GPU cloud computing), it's likely a matter of time before he weighs in. As soon as any official statements are released, this section will be updated to reflect his analysis.

This section will be updated to reflect any future comments made by Jim Cramer about CRWV. We will analyze whether he expresses a bullish, bearish, or neutral sentiment and the rationale behind his assessment.

- Specific comments made by Cramer about CoreWeave's technology: (To be added upon availability)

- Cramer's assessment of the company's competitive landscape: (To be added upon availability)

- Any predictions or recommendations made by Cramer regarding CRWV stock: (To be added upon availability)

CoreWeave's Business Model and Competitive Advantage

CoreWeave differentiates itself in the crowded cloud infrastructure market by focusing heavily on GPU-accelerated computing. This specialization caters to the burgeoning needs of artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) applications. Unlike general-purpose cloud providers like AWS, Azure, and Google Cloud, CoreWeave offers a more specialized and optimized infrastructure for businesses heavily reliant on GPU power.

- Key features and benefits of CoreWeave's cloud infrastructure: Scalable GPU clusters, high-speed networking, specialized software tools for AI/ML workloads, and potentially cost-effective pricing models compared to competitors for specific use cases.

- Comparison with major cloud providers: While AWS, Azure, and Google Cloud offer GPU instances, CoreWeave's focus allows for potential advantages in performance, pricing, and specialized support for demanding AI/ML tasks. A direct price comparison would require detailed specifications for specific workloads.

- Discussion of CoreWeave's technological innovation and patents: This section would need further research into CoreWeave's proprietary technologies and intellectual property portfolio, if any.

Financial Performance and Growth Prospects of CRWV

Analyzing CoreWeave's financial performance requires access to its publicly filed financial statements (10-K, 10-Q). Key metrics like revenue growth, EBITDA, net income, and debt levels will provide a clearer picture of the company's financial health. Furthermore, understanding the growth trajectory of the AI and machine learning markets is crucial in assessing CRWV's future potential. The overall market valuation of CRWV in relation to its competitors and future projections needs consideration.

- Key financial metrics (revenue, EBITDA, net income, etc.): (Requires access to financial statements)

- Analysis of growth rates and trends: (Requires access to financial statements and market data)

- Comparison with competitors' financial performance: (Requires access to financial statements of competitors)

- Discussion of potential risks and challenges: Competition from established cloud providers, maintaining technological leadership, and the inherent volatility of the technology sector are key risks to be considered.

Investment Risks and Considerations for CRWV

Investing in CoreWeave (CRWV) carries inherent risks, as with any technology stock. The highly competitive cloud computing market presents challenges. Market volatility, technological disruption, and economic downturns could significantly impact the company's performance. Therefore, a high risk tolerance is needed for an investment in CRWV. Remember, diversification is crucial for any investment portfolio.

- Specific risks associated with the cloud computing market: Intense competition, pricing pressures, and the need for continuous innovation are key risks.

- Risks related to the company's financial performance: The company's relatively recent IPO means there's a limited historical track record to analyze. Its financial health and growth trajectory will require ongoing monitoring.

- Geopolitical and regulatory risks: International trade relations, data privacy regulations, and geopolitical instability can all influence the cloud computing market.

- Alternative investment options: Investors should research other companies in the cloud computing sector to diversify their investments.

Conclusion

While definitive statements on Jim Cramer's views on CoreWeave (CRWV) are unavailable at this time, analysis of the company itself reveals significant potential. CoreWeave's focus on GPU-accelerated computing positions it well within the rapidly expanding AI and ML markets. However, investors must weigh this potential against the considerable risks inherent in the technology sector and the competitive cloud infrastructure market. Conduct thorough due diligence, review CoreWeave's financial statements, and compare its performance and projections against competitors before making any investment decisions. Remember, this analysis does not constitute financial advice. Always seek independent financial counsel before investing in any stock, including CoreWeave (CRWV), and carefully consider your own risk tolerance and financial goals when evaluating cloud infrastructure providers. Don't rely solely on the opinions of any single commentator, however influential; thorough independent research is crucial.

Featured Posts

-

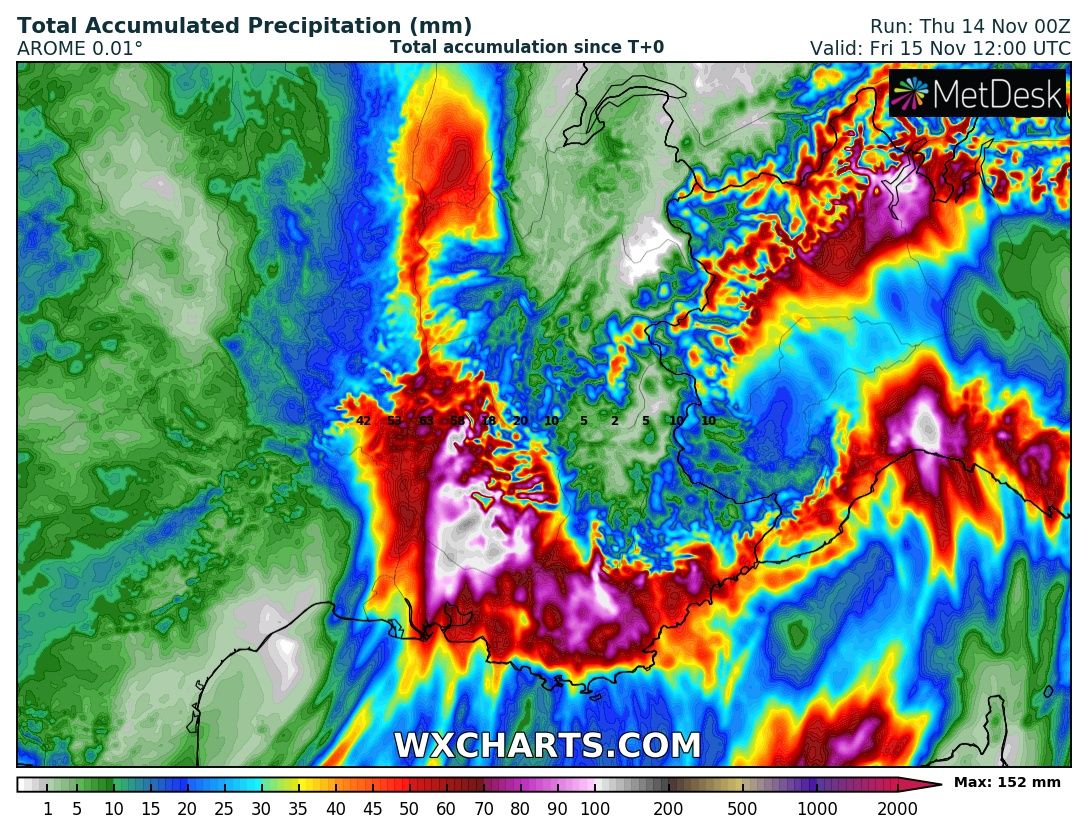

Stormy Weather And Late Snow Hit Southern French Alps

May 22, 2025

Stormy Weather And Late Snow Hit Southern French Alps

May 22, 2025 -

Viral Video Cubs Fans Lady And The Tramp Hot Dog Moment

May 22, 2025

Viral Video Cubs Fans Lady And The Tramp Hot Dog Moment

May 22, 2025 -

Switzerlands Response To Increased Chinese Military Activity

May 22, 2025

Switzerlands Response To Increased Chinese Military Activity

May 22, 2025 -

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025 -

Nato Da Tuerkiye Nin Artan Etkisi Gueclue Bir Ortak Belirleyici Bir Rol

May 22, 2025

Nato Da Tuerkiye Nin Artan Etkisi Gueclue Bir Ortak Belirleyici Bir Rol

May 22, 2025

Latest Posts

-

Sunday Wordle 1352 Hints Clues And The Solution

May 22, 2025

Sunday Wordle 1352 Hints Clues And The Solution

May 22, 2025 -

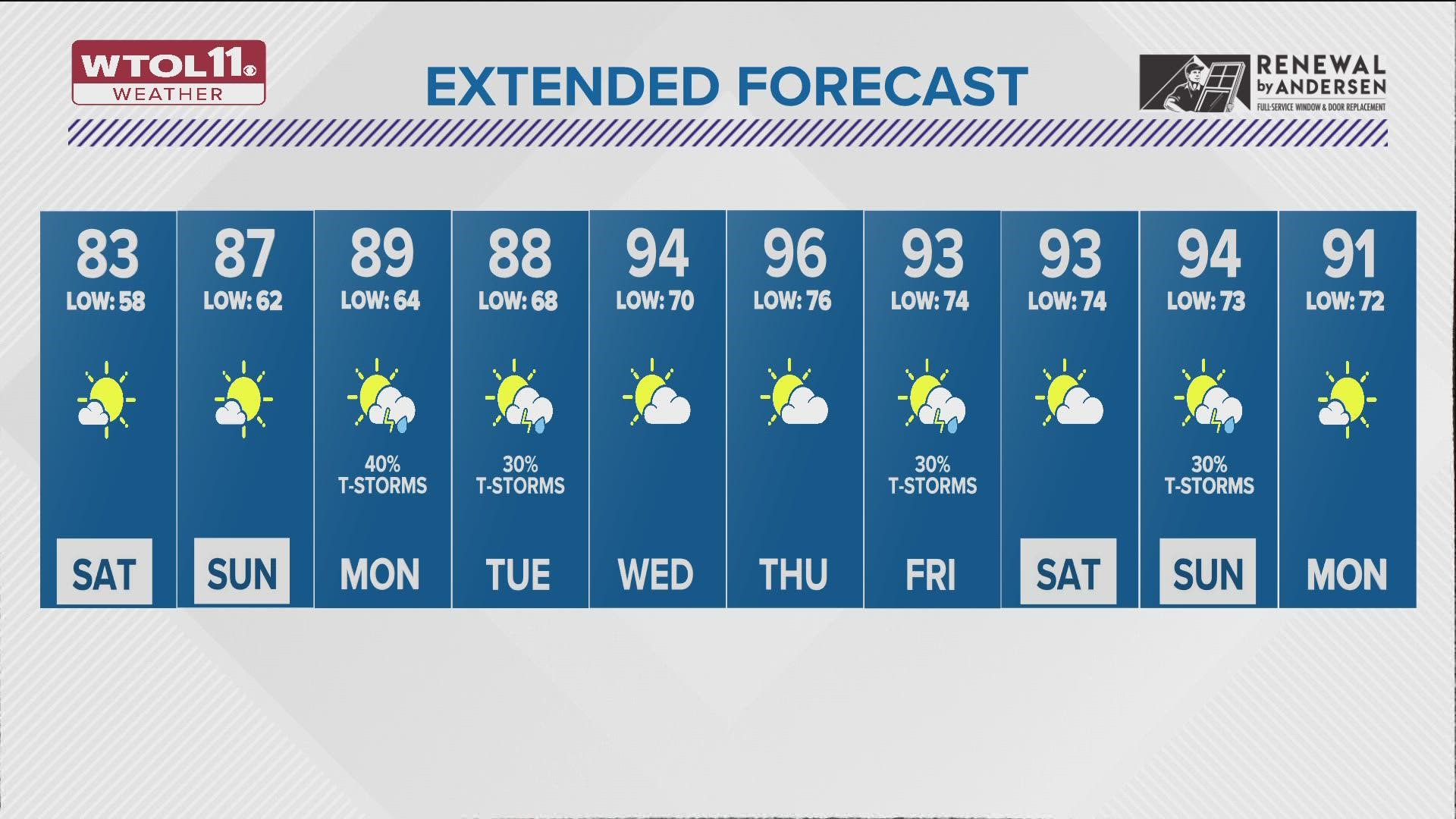

Tracking Toledo Gas Prices A Recent Decline

May 22, 2025

Tracking Toledo Gas Prices A Recent Decline

May 22, 2025 -

Gas Price Relief Toledo Sees Decrease In Fuel Costs

May 22, 2025

Gas Price Relief Toledo Sees Decrease In Fuel Costs

May 22, 2025 -

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025 -

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025