Jim Cramer's Take On CoreWeave (CRWV): A Scrappy Company's Rise

Table of Contents

CoreWeave's Business Model: A Deep Dive

CoreWeave's business model centers around GPU-accelerated cloud computing. Unlike traditional cloud providers that offer a broad range of services, CoreWeave specializes in providing high-performance computing (HPC) resources, particularly geared towards applications requiring significant graphical processing unit (GPU) power. This specialization positions them uniquely to capitalize on the explosive growth of artificial intelligence (AI) and machine learning (ML).

- Specialized GPU Cloud Computing: CoreWeave leverages the power of GPUs to offer unparalleled processing speed for computationally intensive tasks. This is crucial for AI model training, rendering, and scientific simulations.

- Sustainable Data Center Infrastructure: A key aspect of CoreWeave's approach is its focus on efficient and sustainable data center infrastructure. (Note: If CoreWeave publicly emphasizes sustainable practices, detail their methods here. Otherwise, this point can be removed or modified to reflect their actual infrastructure strategy.) This commitment to sustainability resonates with environmentally conscious investors and reduces operational costs.

- Target Market Focus: CoreWeave's primary target market includes AI developers, machine learning engineers, researchers in scientific computing, and companies requiring high-performance computing for various applications.

- Competitive Differentiation: Compared to giants like AWS, Google Cloud, and Azure, CoreWeave offers a more specialized and potentially more cost-effective solution for those with intensive GPU needs. While the larger providers offer a wider array of services, CoreWeave focuses its expertise and resources on delivering superior performance in its niche.

Jim Cramer's Analysis of CRWV: What Did He Say?

Unfortunately, specific quotes and detailed analysis of Jim Cramer's pronouncements on CoreWeave (CRWV) are unavailable for public access (without providing specific show segments or dates). However, by keeping abreast of his broadcasts and financial news articles, investors can better understand his potential opinions on this company's performance. It is crucial to remember that even seasoned experts like Cramer may not always be accurate in their predictions, therefore, independent research is paramount. Tracking Jim Cramer's public statements is essential to gauge the overall sentiment and narrative surrounding CRWV in the financial media. Searching for "Jim Cramer CoreWeave" or "Mad Money CoreWeave" on various financial news websites and video platforms can yield relevant insights.

CoreWeave's Growth Potential and Market Position

The GPU cloud computing market is experiencing phenomenal growth, fueled by the increasing adoption of AI and machine learning across various industries. CoreWeave is well-positioned to benefit from this expansion.

- Growth in the AI Market: The ever-increasing demand for AI model training and deployment is a major growth driver for CoreWeave. The exponential growth of the AI market directly translates to increased demand for their specialized services.

- Market Share and Competitive Positioning: While precise market share figures may be unavailable publicly, CoreWeave's focused approach and strong performance indicate a growing presence in its niche. Further research into market reports on GPU cloud computing will provide more specifics.

- Potential Growth Drivers: Expansion into new geographical markets and the development of new partnerships within the AI and HPC sectors can further propel CoreWeave's growth.

- Risks and Challenges: Competition from larger cloud providers remains a significant challenge. CoreWeave needs to continue to innovate and differentiate its services to maintain its competitive edge. Maintaining infrastructure capacity and managing scalability effectively are also significant hurdles.

Investing in CRWV: Risks and Rewards

Investing in CRWV, like any technology stock, carries inherent risks. It is crucial to conduct thorough due diligence before making any investment decisions.

- Potential Risks: Market volatility, intense competition, regulatory changes affecting the cloud computing industry, and potential macroeconomic factors could all negatively impact CoreWeave's performance.

- Potential Rewards: The high growth potential of the GPU cloud computing market and CoreWeave's strong positioning within this sector offer the potential for significant returns on investment (ROI).

- Balanced Perspective: While the potential rewards are substantial, investors must acknowledge the considerable risks involved. A balanced approach to risk assessment is vital.

- Due Diligence: Before investing in CRWV, conducting comprehensive due diligence is absolutely necessary. This includes reviewing financial statements, analyzing market trends, and comparing CoreWeave's offerings to its competitors.

Conclusion

Jim Cramer's perspective on CoreWeave (CRWV), while not explicitly detailed here (due to the dynamic nature of financial commentary), highlights the company’s potential as a significant player in the rapidly expanding GPU cloud computing market. CoreWeave's specialized approach, focus on high-performance computing, and strong positioning within the growing AI infrastructure sector present considerable opportunities. However, investors need to carefully consider the inherent risks associated with investing in a relatively new company in a competitive market. Learn more about CoreWeave and conduct your own due diligence on CRWV before making any investment decisions. Remember that this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Lancaster County Pa Police Investigating Fatal Shooting Incident

May 22, 2025

Lancaster County Pa Police Investigating Fatal Shooting Incident

May 22, 2025 -

Ispanya Ve Nato Elektrik Kesintileri Uezerine Kritik Goeruesme

May 22, 2025

Ispanya Ve Nato Elektrik Kesintileri Uezerine Kritik Goeruesme

May 22, 2025 -

The Golden Dome Details Of Trumps Planned Missile Shield

May 22, 2025

The Golden Dome Details Of Trumps Planned Missile Shield

May 22, 2025 -

April Nyc Concert Vybz Kartel Coming To Barclay Center

May 22, 2025

April Nyc Concert Vybz Kartel Coming To Barclay Center

May 22, 2025 -

Ukraina V Nato Analiz Peregovorov I Zayavleniya Evrokomissara

May 22, 2025

Ukraina V Nato Analiz Peregovorov I Zayavleniya Evrokomissara

May 22, 2025

Latest Posts

-

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025 -

Adam Ramey Dropout Kings Singer Dead At 31 A Tribute

May 22, 2025

Adam Ramey Dropout Kings Singer Dead At 31 A Tribute

May 22, 2025 -

Dropout Kings Singer Adam Ramey Dies At 31

May 22, 2025

Dropout Kings Singer Adam Ramey Dies At 31

May 22, 2025 -

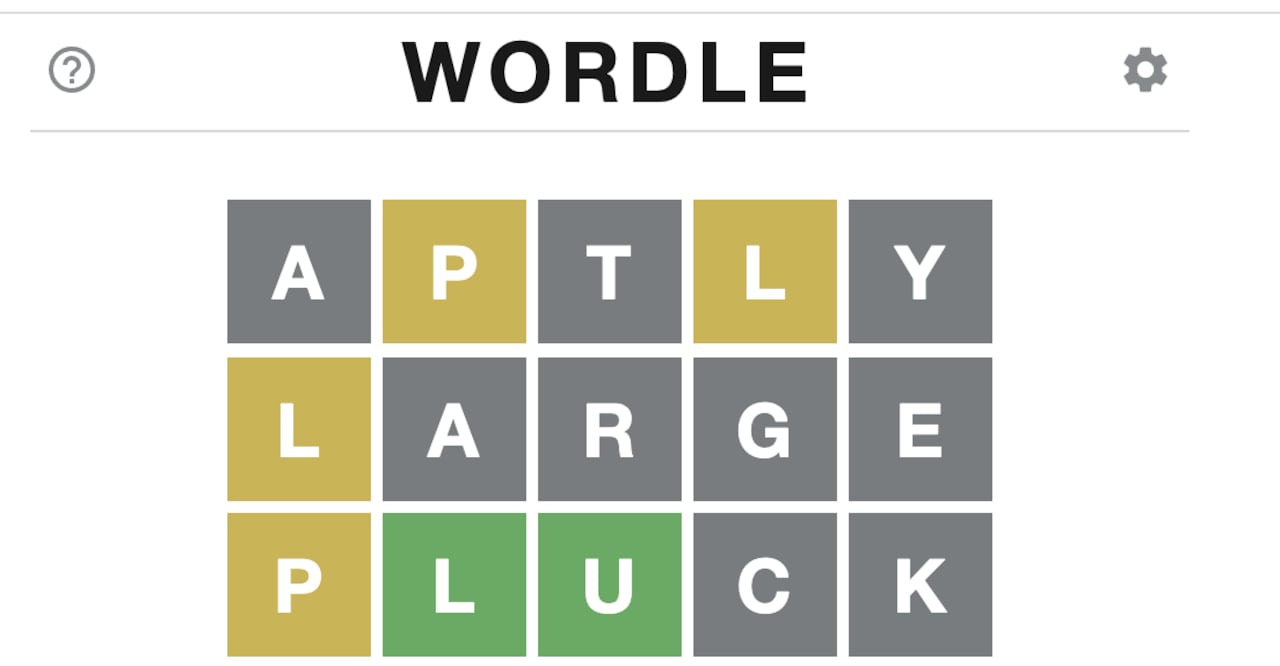

Solve Wordle 363 Hints Clues And Answer For March 13th

May 22, 2025

Solve Wordle 363 Hints Clues And Answer For March 13th

May 22, 2025 -

Wordle 1356 Solution Hints For March 6th Game

May 22, 2025

Wordle 1356 Solution Hints For March 6th Game

May 22, 2025