JM Financial's Baazar Style Retail Investment: Buy At Rs 400

Table of Contents

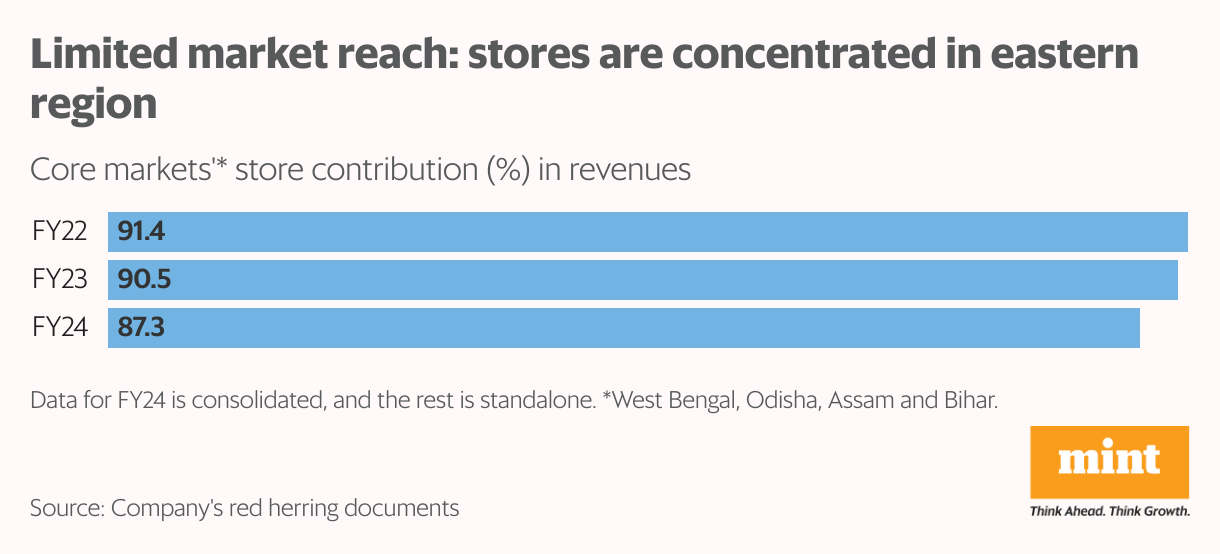

Understanding JM Financial's Baazar-Style Retail Investment Strategy

JM Financial, a well-established financial services company, is venturing into the vibrant Baazar-style retail sector with this investment opportunity. Their strategy centers on acquiring and managing smaller, high-street retail spaces in high-foot traffic locations. This "Baazar-style" model differs from large-scale malls; it targets diverse consumer segments by focusing on the dynamism and accessibility of traditional, bustling marketplaces.

- Focus on smaller, high-street retail spaces: This minimizes upfront investment costs and allows for greater flexibility in tenant selection.

- Targeting diverse consumer segments: The Baazar model caters to a broad customer base, reducing reliance on single tenant performance and increasing resilience to market fluctuations.

- Emphasis on high foot traffic locations: Prime locations ensure consistent customer flow, maximizing rental income potential.

- Potential for high rental yields: The strategic selection of high-traffic locations and diverse tenant mix aims to generate substantial rental income.

Analyzing the Rs 400 Price Point

The Rs 400 price point for this JM Financial Baazar-style retail investment presents a crucial aspect for evaluation. Determining its valuation requires considering several factors:

- Potential for capital appreciation: The retail sector's growth, especially in high-demand locations, can lead to significant capital appreciation over time.

- Expected rental income: The potential rental yield from the property directly impacts the overall return on investment (ROI). Careful analysis of tenant lease agreements and market rental rates is crucial.

- Risks associated with the retail sector: Economic downturns, changes in consumer behavior, and competition from online retail can significantly impact rental income and property value.

- Market volatility considerations: The real estate market is inherently volatile. External factors like interest rate changes and inflation can influence the investment's performance. Thorough market research is imperative.

Due Diligence and Risk Assessment for JM Financial's Baazar-Style Retail Investment

Before investing in any opportunity, especially in the volatile retail sector, meticulous due diligence is paramount. For this JM Financial investment opportunity at Rs 400:

- Thorough market research is crucial: Analyze the specific location, local demographics, and competition. Understanding the current market trends and future growth potential is key.

- Analyze the location and its potential for growth: Is the location experiencing population growth? Are there ongoing infrastructure developments? These are critical indicators of future value.

- Assess the financial stability of tenants: Evaluate the creditworthiness and business viability of prospective tenants to mitigate the risk of rental defaults.

- Consider diversification to mitigate risk: Diversifying your investment portfolio across different asset classes reduces the overall risk associated with any single investment.

Alternative Investment Options and Comparison with JM Financial's Offering

The retail sector offers various investment avenues. Comparing JM Financial's Baazar-style investment at Rs 400 against alternatives is crucial. Other choices might include REITs (Real Estate Investment Trusts), investment in larger retail spaces, or other asset classes.

- Compare return on investment (ROI) potential: Carefully compare the projected ROI of JM Financial's offering with alternative investments, considering factors like capital appreciation and rental income.

- Compare risk levels: Assess the inherent risks associated with each option, considering factors like market volatility and tenant defaults.

- Discuss liquidity differences: Real estate investments generally offer lower liquidity compared to other asset classes. Understanding the ease of converting this investment back to cash is critical.

- Highlight any unique advantages of JM Financial's offering: JM Financial’s experience and expertise in the financial market could provide a unique advantage in managing and optimizing the investment.

Should You Invest in JM Financial's Baazar-Style Retail Investment at Rs 400?

JM Financial's Baazar-style retail investment at Rs 400 presents a potentially lucrative opportunity but involves inherent risks. The high rental yield potential is offset by the volatility of the retail sector and the importance of careful due diligence. Thorough research, including analysis of location, tenant stability, and market trends, is essential. Remember, no investment is without risk. Weigh the potential rewards against the potential downsides before committing your capital.

Learn more about JM Financial's Baazar-style retail investment at Rs 400 and determine if this Rs 400 Baazar-style retail investment from JM Financial is the right fit for your investment strategy. Conduct your own thorough research before making any investment decisions.

Featured Posts

-

Improving Transgender Mental Health The Promise Of A Gender Euphoria Scale On Transgender Day Of Visibility

May 15, 2025

Improving Transgender Mental Health The Promise Of A Gender Euphoria Scale On Transgender Day Of Visibility

May 15, 2025 -

Analyzing Jimmy Butlers Miami Heat Play Was More Help Needed

May 15, 2025

Analyzing Jimmy Butlers Miami Heat Play Was More Help Needed

May 15, 2025 -

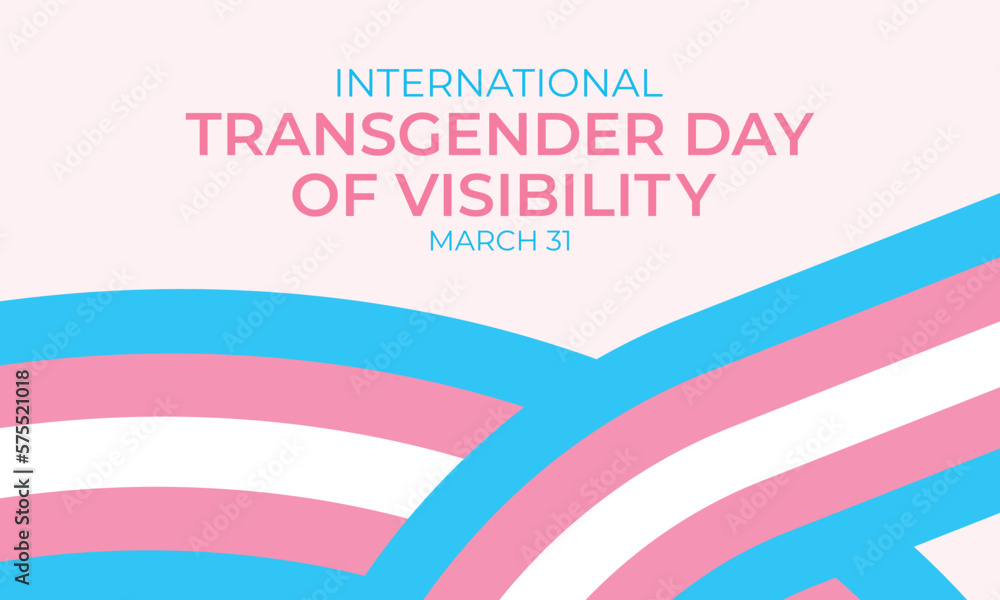

Svedsko Na Ms S 18 Nhl Hraci Vyhoda Proti Nemecku

May 15, 2025

Svedsko Na Ms S 18 Nhl Hraci Vyhoda Proti Nemecku

May 15, 2025 -

Almeria Eldense Partido En Directo Y Online La Liga Hyper Motion

May 15, 2025

Almeria Eldense Partido En Directo Y Online La Liga Hyper Motion

May 15, 2025 -

Jm Financials Baazar Style Retail Stock Should You Buy At Rs 400

May 15, 2025

Jm Financials Baazar Style Retail Stock Should You Buy At Rs 400

May 15, 2025