Kerrisdale Capital's Report Triggers D-Wave Quantum (QBTS) Stock Decline

Table of Contents

D-Wave Quantum (QBTS) stock experienced a significant drop following the release of a damning short-selling report by Kerrisdale Capital. This article delves into the impact of this report on D-Wave Quantum's stock price, examining the key allegations, market reaction, and the company's response. We'll explore the implications for investors interested in the burgeoning quantum computing stock market.

<h2>Kerrisdale Capital's Report: Key Allegations Against D-Wave Quantum (QBTS)</h2>

Kerrisdale Capital, a well-known short-selling firm, published a scathing report targeting D-Wave Quantum, a leading player in the quantum computing sector. The report leveled serious accusations against QBTS, significantly impacting investor confidence and leading to the D-Wave Quantum stock plunge. The core arguments presented in the Kerrisdale Capital report focused on several key areas:

-

Overstated Technological Capabilities: The report alleged that D-Wave Quantum had overstated the capabilities and practical applications of its quantum annealing technology, suggesting a significant gap between marketing claims and actual performance. This directly challenged the perceived value proposition of D-Wave's quantum computers.

-

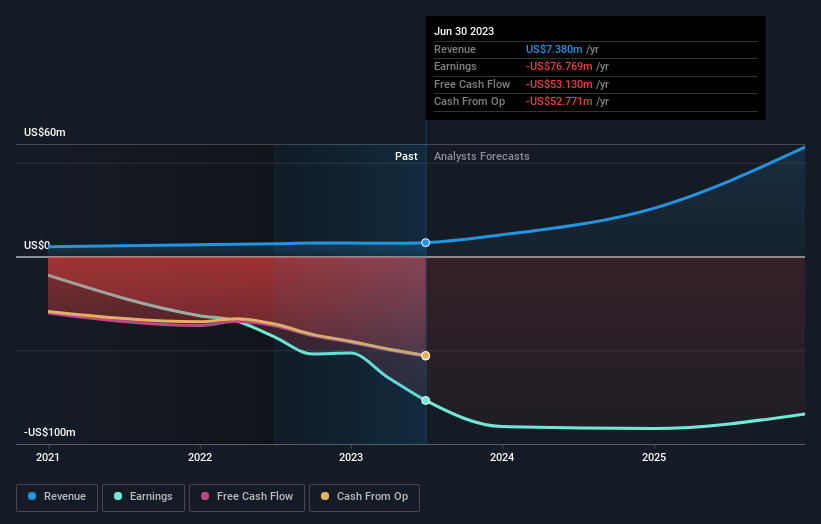

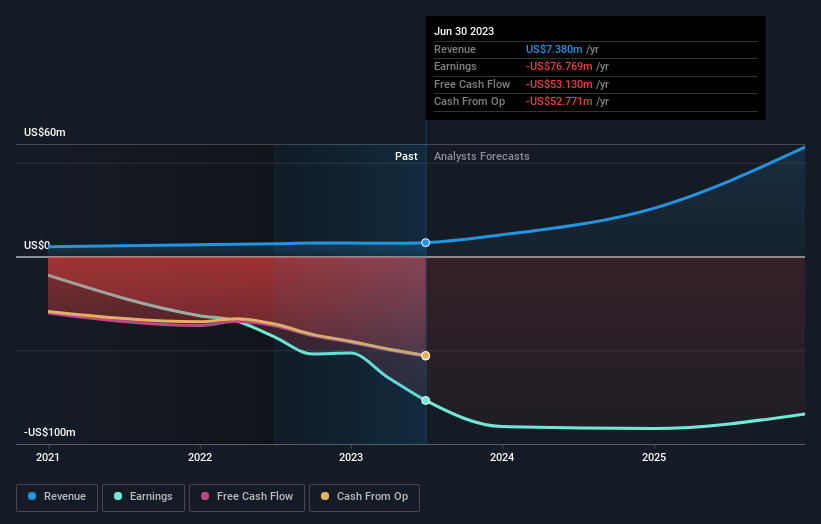

Inflated Revenue Projections and Questionable Business Model: Kerrisdale questioned the sustainability of D-Wave's revenue projections, highlighting concerns about the company's long-term financial viability and the reliance on a potentially unsustainable business model. This raised red flags regarding the D-Wave Quantum valuation.

-

Concerns about Company Valuation: The report argued that D-Wave Quantum was significantly overvalued, citing discrepancies between its market capitalization and the perceived value of its technology and future prospects within the quantum computing market.

-

Potential Accounting Irregularities: While not explicitly stated as definitive, the report hinted at potential accounting irregularities that warrant further investigation. This added another layer of concern for potential investors.

You can find the original Kerrisdale Capital report (if publicly available) [insert link here]. The report's detailed analysis of D-Wave Quantum's financial statements and technological claims fueled significant debate within the quantum computing investment community. The "Kerrisdale Capital allegations" significantly impacted the sentiment surrounding D-Wave Quantum stock.

<h2>Market Reaction to the Kerrisdale Capital Report: QBTS Stock Plunge</h2>

The immediate impact of Kerrisdale Capital's report on QBTS stock was dramatic. The D-Wave Quantum stock price experienced a sharp decline, with a [insert percentage]% drop within [insert timeframe, e.g., the first 24 hours]. Trading volume surged significantly, indicating heightened investor activity and concern. The market reaction underscored a widespread loss of confidence in D-Wave Quantum's future prospects. Investor sentiment shifted dramatically, with many questioning the long-term viability of the company as a quantum computing investment. This volatility highlighted the risks inherent in investing in the still-developing quantum computing sector. The "QBTS stock price" became a key indicator of the market's response to the allegations.

<h3>Analysis of the D-Wave Quantum (QBTS) Business Model and Future Prospects</h3>

Kerrisdale Capital's report raised critical questions about the long-term viability of D-Wave Quantum's business model. The validity of their claims regarding overstated technology and inflated revenue projections is crucial for understanding the company's future. The long-term prospects of D-Wave and the broader quantum computing sector are intertwined with technological advancements and market adoption. However, significant competition exists in the quantum computing market, which adds another layer of complexity to the analysis. Counterarguments from D-Wave's management or independent analysts could offer alternative perspectives, helping investors to navigate the conflicting information and make informed decisions. The "D-Wave Quantum business model" and its future within the competitive "quantum computing future" are subject to ongoing evaluation.

<h2>D-Wave Quantum (QBTS) Response to Kerrisdale Capital's Report</h2>

D-Wave Quantum issued a [insert description of response, e.g., formal rebuttal] to Kerrisdale Capital's report, aiming to address the allegations and mitigate the negative impact on its stock price and investor confidence. [Insert details of the response and its impact, including quotes if available]. The effectiveness of their response in addressing investor concerns remains a subject of debate. The "D-Wave Quantum response" and their "investor relations" strategy will be crucial for regaining lost trust and stabilizing the "QBTS stock price."

<h2>Conclusion</h2>

Kerrisdale Capital's report significantly impacted D-Wave Quantum (QBTS) stock price, triggering a sharp decline due to serious allegations regarding its business model, technology capabilities, and valuation. The report highlighted the considerable risks associated with investing in emerging technologies, especially within the still-evolving quantum computing sector. Thorough due diligence is paramount before investing in any company, and this case underscores the importance of critically evaluating information from various sources. Before investing in "Kerrisdale Capital QBTS" related stocks or other companies in the quantum computing sector, conduct extensive research, staying informed about ongoing developments and the performance of "D-Wave Quantum stock." For further insights into market analysis, consult a reputable financial news source [insert link to a reputable financial news source].

Featured Posts

-

Big Bear Ai Stock Current Market Outlook And Investment Potential

May 20, 2025

Big Bear Ai Stock Current Market Outlook And Investment Potential

May 20, 2025 -

Agatha Christie And Sir David Suchet A Travel Documentary Review

May 20, 2025

Agatha Christie And Sir David Suchet A Travel Documentary Review

May 20, 2025 -

Man Utds Strategic Forward Signing Under Amorim

May 20, 2025

Man Utds Strategic Forward Signing Under Amorim

May 20, 2025 -

Bribery Conviction For Navys Burke Details Of The Job Exchange Scheme

May 20, 2025

Bribery Conviction For Navys Burke Details Of The Job Exchange Scheme

May 20, 2025 -

Ex Munster Player James Cronin Takes The Reins At Highfield

May 20, 2025

Ex Munster Player James Cronin Takes The Reins At Highfield

May 20, 2025