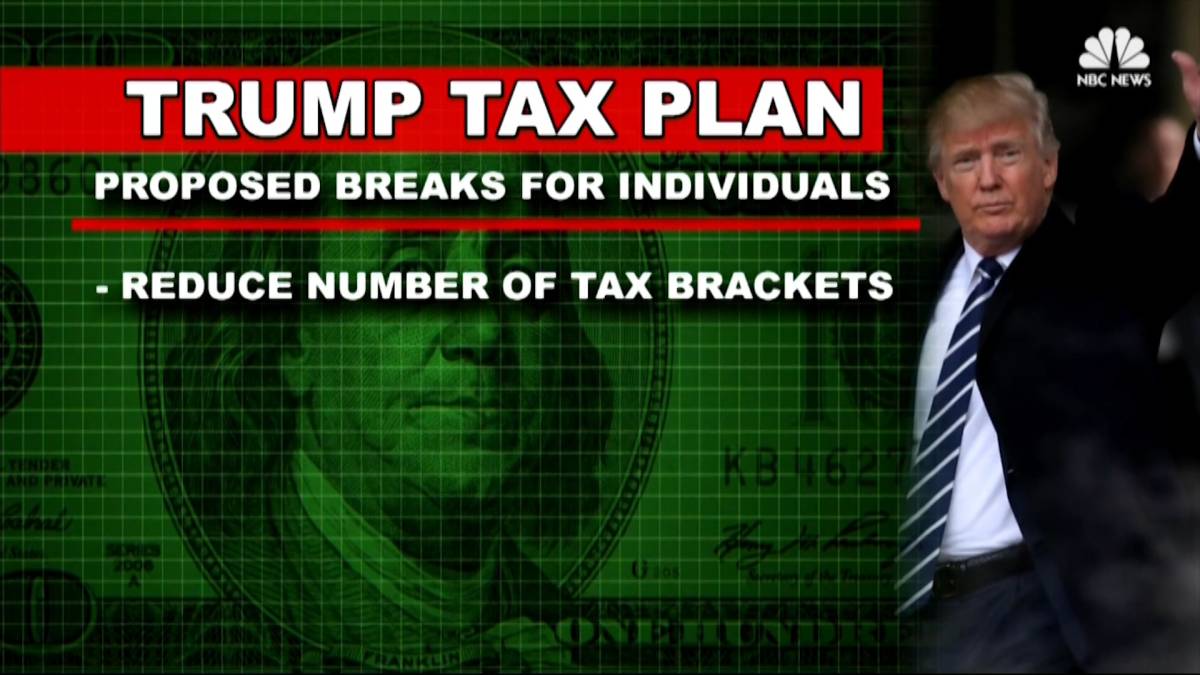

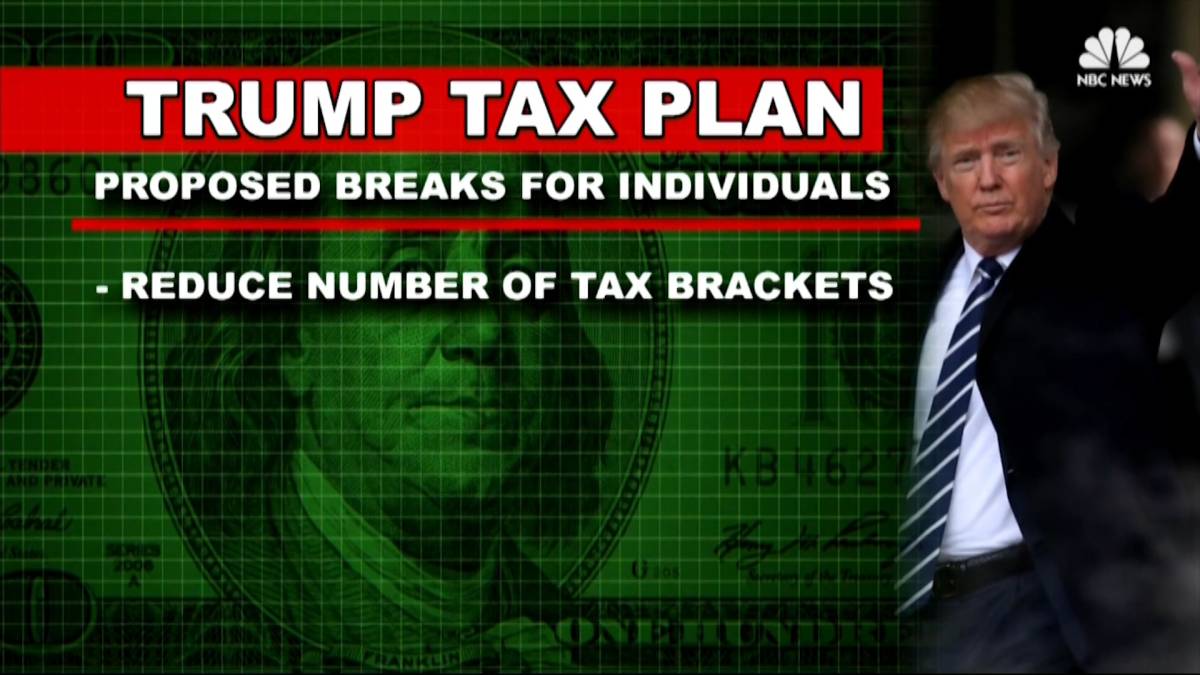

Key Features Of The Trump Tax Cut Plan Released By House Republicans

Table of Contents

Individual Income Tax Rate Reductions

The Trump Tax Cut Plan proposed significant changes to individual income tax brackets, aiming to simplify the system and reduce the tax burden for many Americans.

Lower Tax Brackets

The plan aimed to reduce the number of individual income tax brackets and lower the rates within those brackets. This was a cornerstone of the proposed tax reform.

- Specific Percentage Reductions: While exact percentages varied depending on the specific iteration of the plan, the general aim was to significantly reduce rates across all brackets. For example, some proposals suggested dropping the top rate from 39.6% to 35%.

- Impact on Different Income Levels: Lower tax brackets were designed to provide tax relief for lower- and middle-income taxpayers. However, the impact varied depending on individual circumstances and the specific details of the plan.

- Examples of Tax Savings: Simulations showed varying levels of tax savings for different income earners. A family earning $75,000 annually, for example, might see a several hundred dollar reduction, while higher earners could see savings in the thousands.

Standard Deduction Increase

The plan also suggested a substantial increase in the standard deduction. This had a significant impact on the number of taxpayers who itemized their deductions.

- New Standard Deduction Amounts: The proposed increases were substantial, significantly raising the amounts for single filers, married couples filing jointly, and heads of households. This made itemizing less beneficial for many taxpayers.

- Impact on Itemizers: The increased standard deduction resulted in a decrease in the number of taxpayers who chose to itemize their deductions, simplifying tax preparation for many.

- Implications for Charitable Deductions: While the standard deduction increased, the implications for charitable deductions were complex and depended on the specific details of the plan. Some analyses suggested that the overall benefit of charitable giving could be reduced for some taxpayers.

Child Tax Credit Expansion

The Trump Tax Cut Plan proposed expanding the Child Tax Credit, benefiting families with children.

- Increased Credit Amount: The proposed plan aimed to increase the amount of the child tax credit per child.

- Potential Expansion of Eligibility: Some versions of the plan suggested expanding eligibility to include more families, possibly increasing the number of beneficiaries.

- Impact on Families with Multiple Children: Families with several children would see a greater benefit from the increased and potentially expanded credit.

Corporate Tax Rate Reduction

A major component of the Trump Tax Cut Plan was a substantial reduction in the corporate tax rate.

Lower Corporate Tax Rate

The plan's goal was to significantly reduce the corporate tax rate, making the US more competitive globally.

- Specific Percentage Reduction: The proposed reduction was substantial, aiming to lower the rate from the existing rate to a significantly lower percentage, generally in the mid-20% range.

- Effects on Corporate Profits and Investment: Proponents argued that the lower rate would stimulate economic growth by increasing corporate profits and encouraging investment.

- Comparison to International Corporate Tax Rates: The reduced rate aimed to bring US corporate taxes more in line with rates in other developed countries.

Pass-Through Business Deduction

The plan also included provisions for a deduction for pass-through businesses.

- Deduction Percentage: The proposed deduction offered a percentage deduction for income from pass-through entities, such as S corporations and partnerships.

- Eligibility: The eligibility criteria for this deduction were carefully defined to target small business owners.

- Impact on Small Business Owners: The deduction was intended to provide significant tax relief for small business owners, allowing them to keep more of their earnings.

Elimination or Modification of Tax Deductions and Credits

The Trump Tax Cut Plan also proposed changes to several existing deductions and credits.

State and Local Tax Deduction (SALT)

One of the most controversial aspects of the plan was the proposed limitation or elimination of the State and Local Tax (SALT) deduction.

- Impact on High-Tax States: The elimination or limitation of the SALT deduction disproportionately affected taxpayers in high-tax states, potentially increasing their tax burden.

- Potential Effects on Homeownership: The change could also impact homeownership in high-tax states, affecting property values and affordability.

Other Deduction Changes

Beyond SALT, the plan considered changes to other deductions, such as those for mortgage interest and charitable contributions.

- Specific Deductions Affected: Depending on the specific version of the plan, several deductions were modified or potentially eliminated.

- Proposed Changes: The changes varied, some potentially reducing the benefit of the deduction, while others might have remained largely unchanged.

- Overall Impact on Taxpayers: The cumulative impact of these changes varied greatly depending on individual circumstances.

Conclusion

The Trump Tax Cut Plan, as proposed by House Republicans, represented a significant overhaul of the US tax code. Key features included substantial reductions in individual and corporate income tax rates, an expansion of the child tax credit, and modifications to several deductions, notably the SALT deduction. Understanding the specific changes—from lower tax brackets to potential limitations on deductions—is vital for taxpayers to assess their potential tax liability. To further research the implications of this proposed legislation and plan for potential tax changes, continue your research using keywords such as "Trump tax reform," "House Republican tax plan," or "individual income tax rates 2017" (replace 2017 with the relevant year). Staying informed about the Trump Tax Cut Plan is crucial for effective financial planning.

Featured Posts

-

Toronto Raptors Nba Draft Lottery Odds And Cooper Flaggs Potential Impact

May 13, 2025

Toronto Raptors Nba Draft Lottery Odds And Cooper Flaggs Potential Impact

May 13, 2025 -

Trumps Qatari Jet Gift Justification And Controversy

May 13, 2025

Trumps Qatari Jet Gift Justification And Controversy

May 13, 2025 -

Nba Draft Lottery Winners Since 2000 A Challenging Quiz

May 13, 2025

Nba Draft Lottery Winners Since 2000 A Challenging Quiz

May 13, 2025 -

Is Devon Sawa Coming Back For The Final Destination 25th Anniversary

May 13, 2025

Is Devon Sawa Coming Back For The Final Destination 25th Anniversary

May 13, 2025 -

Islanders Claim Top Pick In Nhl Draft Lottery Sharks Pick Second

May 13, 2025

Islanders Claim Top Pick In Nhl Draft Lottery Sharks Pick Second

May 13, 2025