Key Information In VusionGroup's AMF CP Document 2025E1029754

Table of Contents

Executive Summary and Key Highlights of VusionGroup's AMF CP Filing

VusionGroup's AMF CP document 2025E1029754 presents a comprehensive overview of the company's financial performance for the reporting period. The executive summary provides a high-level assessment, highlighting significant achievements and challenges. The overall financial performance reflects [insert overall positive or negative assessment, e.g., "strong growth across key sectors"].

Key metrics revealed in this CP document analysis include:

- Revenue growth percentage: [Insert percentage and context, e.g., "a 15% increase year-over-year, driven by strong demand in the North American market."]

- Net income figures: [Insert figures and context, e.g., "a net income of €[amount], demonstrating improved profitability."]

- Key strategic initiatives mentioned: [Mention key initiatives and their impact, e.g., "The successful launch of their new product line contributed significantly to revenue growth."]

- Significant investments or acquisitions: [Mention any significant investments or acquisitions and their expected impact, e.g., "The acquisition of [Company Name] expanded VusionGroup's market reach into the European Union."]

Analysis of VusionGroup's Financial Position (2025E1029754): A Deep Dive

A detailed analysis of VusionGroup's financial position, as presented in document 2025E1029754, reveals [Insert overall assessment, e.g., "a robust financial foundation"]. The examination of the balance sheet, income statement, and cash flow statement provides a comprehensive view of their liquidity and solvency.

Key aspects of their financial health include:

- Key ratios: The current ratio of [insert ratio] indicates [insert interpretation, e.g., "strong short-term liquidity"]. The debt-to-equity ratio of [insert ratio] suggests [insert interpretation, e.g., "a manageable level of debt"].

- Analysis of assets and liabilities: [Discuss the composition of assets and liabilities and any significant changes].

- Cash flow from operations, investing, and financing activities: [Analyze cash flow from each activity and its implications].

- Discussion of potential risks and opportunities: [Identify and discuss potential financial risks and opportunities based on the data presented].

VusionGroup's Operational Performance and Strategic Outlook (Document 2025E1029754)

VusionGroup's operational performance, as detailed in document 2025E1029754, showcases [Insert overall assessment, e.g., "efficiency gains and market leadership"]. The report provides insights into their market position, competitive landscape, and future strategic plans.

Key observations regarding their operational performance and strategic outlook include:

- Market share analysis: VusionGroup holds [insert percentage] of the market share in [insert market segment], indicating [insert interpretation].

- Key operational metrics: Efficiency ratios such as [insert example ratio and value] demonstrate [insert interpretation, e.g., "improvements in operational efficiency"].

- Discussion of future growth strategies: The document highlights strategic priorities such as [list key strategies, e.g., product innovation, market expansion, strategic partnerships].

- Expansion plans and new market entry: VusionGroup plans to expand into [insert markets] and potentially launch [insert new products/services].

Risk Factors and Uncertainties Disclosed in VusionGroup's AMF CP Document

The AMF CP document 2025E1029754 transparently discloses various risk factors and uncertainties that could impact VusionGroup's future performance. Understanding these risks is essential for a complete assessment.

Key risk factors identified include:

- List of significant risk factors: [List key risks identified in the document, e.g., competition, regulatory changes, economic downturns].

- Potential impact of each risk factor: [Discuss the potential impact of each risk factor on the company's financial performance].

- Company's risk management plans: [Outline VusionGroup's strategies for mitigating these identified risks].

Conclusion: Understanding the Implications of VusionGroup's AMF CP Document 2025E1029754

This analysis of VusionGroup's AMF CP Document 2025E1029754 provides a comprehensive overview of their financial performance, operational efficiency, and strategic outlook. Understanding this document is vital for informed decision-making regarding investments, partnerships, or other business dealings with VusionGroup. The document reveals a [insert summary of overall performance, e.g., "company with strong fundamentals and a promising future," or "company facing challenges that need to be addressed"].

For a comprehensive understanding of VusionGroup's financial performance and strategic direction, download the full AMF CP Document 2025E1029754 or contact VusionGroup directly. Remember that this article is for informational purposes only and does not constitute financial advice. Always conduct thorough due diligence before making any investment decisions related to VusionGroup or any other company.

Featured Posts

-

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025 -

How To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free Without Cable

Apr 30, 2025

How To Watch Ru Pauls Drag Race Season 17 Episode 8 For Free Without Cable

Apr 30, 2025 -

2025 Nfl Draft Washington Commanders Big Board And Potential Draft Picks

Apr 30, 2025

2025 Nfl Draft Washington Commanders Big Board And Potential Draft Picks

Apr 30, 2025 -

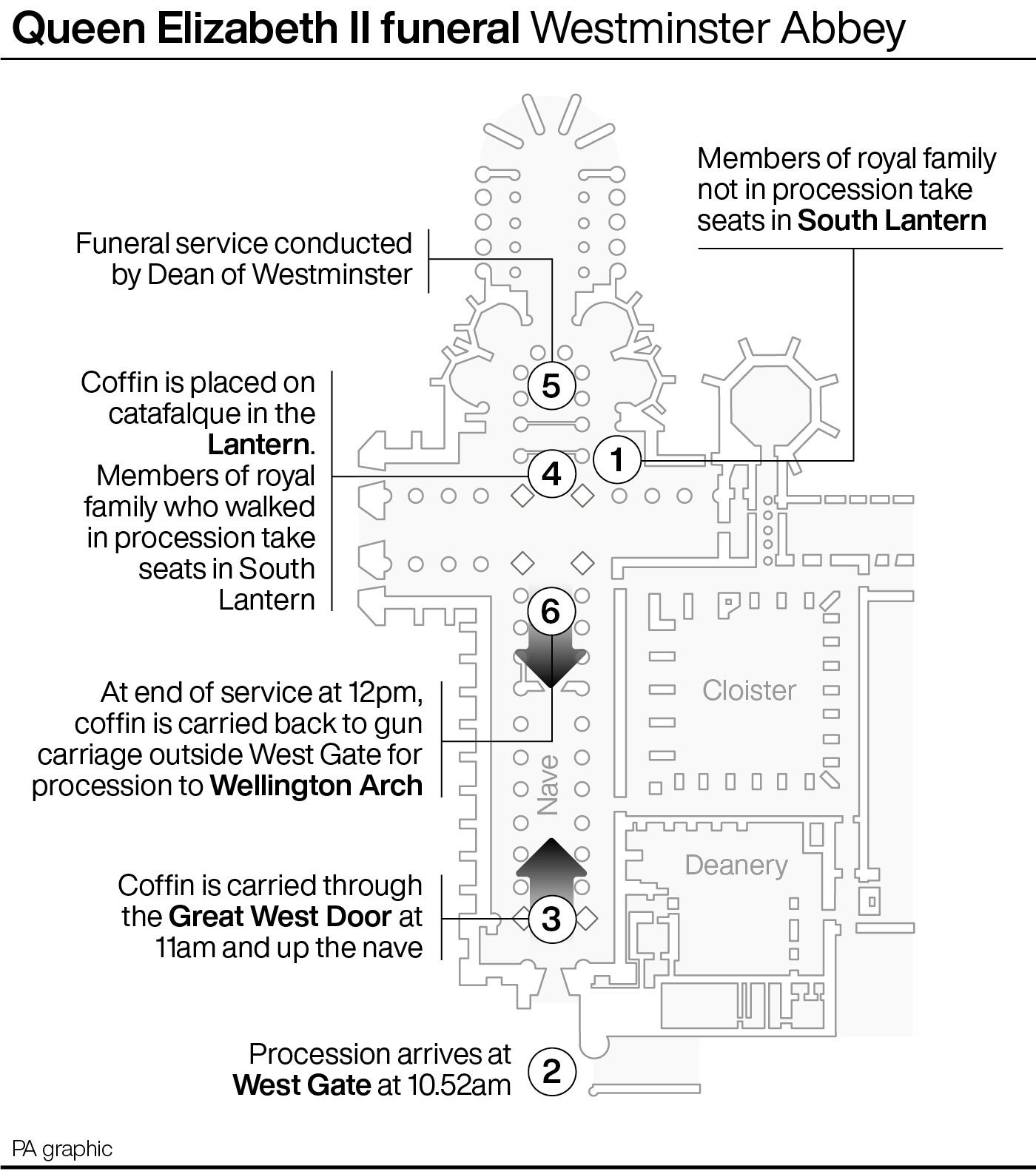

Papal Funeral Seating Plan Challenges And Solutions

Apr 30, 2025

Papal Funeral Seating Plan Challenges And Solutions

Apr 30, 2025 -

Sluchayat Iva Sofiyanska Plnata Istoriya

Apr 30, 2025

Sluchayat Iva Sofiyanska Plnata Istoriya

Apr 30, 2025

Latest Posts

-

The Trump Presidency A Look At His First Congressional Speech

Apr 30, 2025

The Trump Presidency A Look At His First Congressional Speech

Apr 30, 2025 -

Canadian Election Looms Trumps Assessment Of Us Canada Ties

Apr 30, 2025

Canadian Election Looms Trumps Assessment Of Us Canada Ties

Apr 30, 2025 -

Trumps Pre Election Statement On Canada Analysis And Reaction

Apr 30, 2025

Trumps Pre Election Statement On Canada Analysis And Reaction

Apr 30, 2025 -

Zlobniy Samovlyublenniy Sliznyak Kanadskiy Politik O Trampe I Posledstviya Ego Slov

Apr 30, 2025

Zlobniy Samovlyublenniy Sliznyak Kanadskiy Politik O Trampe I Posledstviya Ego Slov

Apr 30, 2025 -

Congress Awaits Trumps Speech Key Issues And Expected Outcomes

Apr 30, 2025

Congress Awaits Trumps Speech Key Issues And Expected Outcomes

Apr 30, 2025