Land Your Dream Job: 5 Do's And Don'ts In The Private Credit Industry

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression – make it count! Generic applications are a surefire way to get overlooked. Instead, tailor each application to the specific firm and role.

- Highlight relevant skills and experience: Focus on keywords that resonate with private credit employers. These include: credit analysis, portfolio management, underwriting, due diligence, financial modeling, leveraged finance, distressed debt, private equity, asset-based lending, mezzanine financing. Use these terms naturally within the context of your accomplishments.

- Quantify your achievements: Use numbers to demonstrate the impact you've made. For example, instead of "Improved portfolio performance," write "Increased portfolio returns by 15% through proactive credit risk management."

- Customize each application: Research each firm's investment strategy, recent deals, and company culture. Show that you understand their business and how your skills align with their needs.

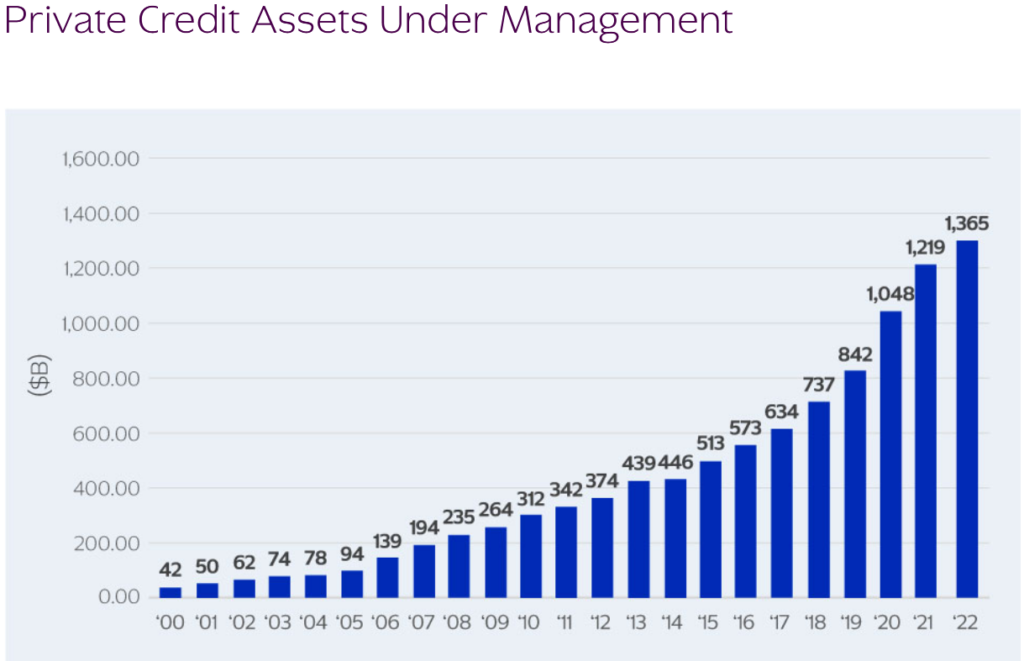

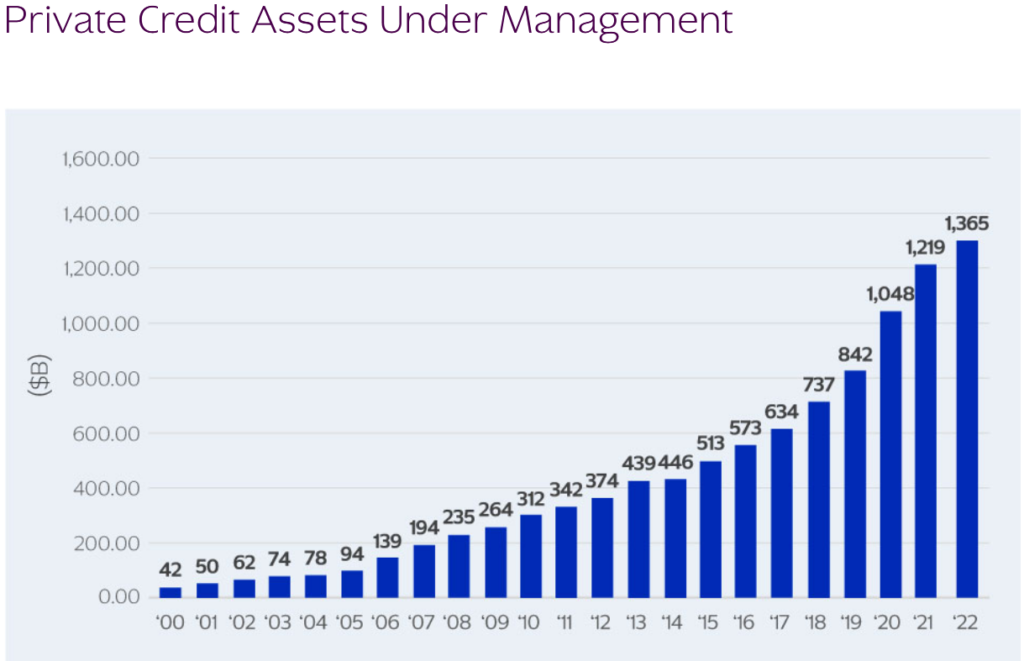

- Showcase your understanding of the private credit market: Demonstrate knowledge of current market trends, regulations (like the Dodd-Frank Act), and the competitive landscape. Mention specific market events or recent news that demonstrate your awareness.

Do 2: Network Strategically within the Private Credit Community

Networking is paramount in the private credit industry. Building relationships can open doors to unadvertised opportunities and provide valuable insights.

- Attend industry conferences and events: These events provide excellent networking opportunities to meet potential employers and learn about current trends.

- Utilize LinkedIn effectively: Create a professional profile, connect with professionals in the private credit industry, and engage in relevant discussions. Join private credit-focused groups.

- Informational interviews: Reach out to professionals working in roles you aspire to. These conversations offer valuable insights into the day-to-day work and company culture.

- Leverage your existing network: Tap into your personal and professional network for potential leads and referrals.

Do 3: Master the Art of the Private Credit Interview

The interview process is your chance to showcase your personality, skills, and understanding of the private credit world.

- Practice behavioral interview questions: Prepare answers using the STAR method (Situation, Task, Action, Result) to illustrate your skills and experience. Focus on examples relevant to private credit.

- Research the firm thoroughly: Understand their investment strategy, portfolio composition (types of assets they invest in), recent transactions, and company culture.

- Ask insightful questions: This shows your genuine interest and understanding of the role and the firm. Prepare thoughtful questions beforehand, demonstrating your research.

- Prepare financial modeling questions: Private credit roles often involve financial modeling. Be ready to discuss your experience building and interpreting models, and be prepared for case studies.

Do 4: Showcase Your Financial Acumen and Technical Skills

Strong financial modeling skills and a deep understanding of finance are essential in private credit.

- Strong understanding of financial statements: Demonstrate proficiency in analyzing balance sheets, income statements, and cash flow statements. Be prepared to discuss key ratios and their implications.

- Proficiency in financial modeling: Be comfortable building and interpreting financial models, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and other relevant valuation techniques.

- Knowledge of valuation methodologies: Understand DCF, precedent transactions, comparable company analysis, and other valuation techniques. Be prepared to discuss their strengths and weaknesses.

- Data analysis and interpretation skills: Demonstrate your ability to analyze large datasets, extract meaningful insights, and present findings clearly.

Do 5: Follow Up After Each Interview and Application

Following up demonstrates your initiative and keen interest in the position.

- Send a thank-you note: Express your gratitude for the interviewer's time and reiterate your interest in the position. Personalize each note.

- Follow up on the application status: Politely inquire about the timeline and next steps after a reasonable time has passed.

- Maintain contact with recruiters and hiring managers: Stay in touch and update them on your progress (e.g., completion of other interviews).

5 Don'ts in Your Private Credit Job Search

Don't 1: Neglect to Research the Firm and the Role

Thorough research is crucial. Failing to do your homework demonstrates a lack of interest and preparation.

- Avoid generic applications. Show you understand the specific firm, its investment mandate, and the nuances of the role.

Don't 2: Overlook the Importance of Networking

Don't solely rely on online job boards. Networking is essential for uncovering hidden opportunities.

- Building relationships can lead to unadvertised opportunities and valuable mentorship.

Don't 3: Underestimate the Importance of Technical Skills

Technical skills are crucial. Lack of proficiency in financial modeling or data analysis can be a deal-breaker.

- Brush up on your technical skills before applying – practice your modeling and data analysis skills.

Don't 4: Fail to Prepare for Behavioral and Technical Interviews

Poor preparation reflects poorly on your candidacy.

- Practice your answers to common interview questions and prepare for technical case studies.

Don't 5: Neglect to Follow Up After the Interview

Following up shows initiative and continued interest.

- A simple, personalized thank-you note can make a positive difference.

Conclusion

Landing your dream job in the private credit industry requires dedication, preparation, and a strategic approach. By diligently following these five do's and don'ts, you can significantly improve your chances of success. Remember to tailor your materials, network effectively, master the interview process, showcase your technical prowess, and follow up persistently. Don't delay – start your journey to landing your dream private credit job today!

Featured Posts

-

I Enjoyed The Monkey But Kings Other 2024 Films Are More Exciting

May 10, 2025

I Enjoyed The Monkey But Kings Other 2024 Films Are More Exciting

May 10, 2025 -

Interest Rate Decision Fed Weighs Inflation And Unemployment Risks

May 10, 2025

Interest Rate Decision Fed Weighs Inflation And Unemployment Risks

May 10, 2025 -

Overcoming Adversity A Footballers Rise From Wolves Rejection To European Success

May 10, 2025

Overcoming Adversity A Footballers Rise From Wolves Rejection To European Success

May 10, 2025 -

U S Federal Reserve Economic Outlook And Implications For Interest Rates

May 10, 2025

U S Federal Reserve Economic Outlook And Implications For Interest Rates

May 10, 2025 -

Edmonton Oilers Force Game 3 After Overtime Win Against Kings

May 10, 2025

Edmonton Oilers Force Game 3 After Overtime Win Against Kings

May 10, 2025