Land Your Dream Private Credit Job: 5 Essential Tips

Table of Contents

Craft a Compelling Resume & Cover Letter Tailored to Private Credit

Your resume and cover letter are your first impression – make them count. To land your dream private credit job, these documents need to showcase your skills and experience in a way that resonates with hiring managers.

Highlight Relevant Skills and Experience:

Your resume should be a targeted marketing document highlighting your suitability for private credit roles. Use keywords that recruiters and hiring managers actively search for. Include terms such as:

- Credit analysis: Demonstrate your ability to assess credit risk and financial health.

- Financial modeling: Showcase expertise in building and interpreting financial models for valuation and forecasting.

- Deal sourcing: Highlight experience in identifying and evaluating potential investment opportunities.

- Due diligence: Emphasize your thoroughness in conducting investigations and assessments.

- Portfolio management: Show your ability to manage and monitor a portfolio of investments.

- Underwriting: Showcase your expertise in assessing risk and making lending decisions.

- Private equity: Mention any experience working with private equity firms or on private equity-related transactions.

- Debt financing: Demonstrate your understanding of various debt financing structures and instruments.

Quantify your accomplishments whenever possible. Instead of simply stating "Managed a portfolio," say "Managed a $50 million portfolio, achieving a 15% annualized return." Also, mention any relevant software proficiency: Bloomberg Terminal, Argus, and of course, advanced Excel skills are highly valued.

Target Your Resume and Cover Letter:

Generic applications rarely succeed. Research the specific firm and role you’re applying for meticulously.

- Tailor your resume and cover letter: Align your skills and experience with the specific requirements listed in the job description. Use keywords from the job posting.

- Demonstrate understanding: Show you understand the firm's investment strategy, target market, and recent transactions. Mention specific deals they've completed or their investment philosophy in your cover letter. This demonstrates genuine interest and research.

- Example: "I was particularly impressed by your recent investment in [Company X], and believe my experience in [relevant area] aligns perfectly with your firm’s focus on [investment strategy]."

Network Strategically Within the Private Credit Industry

Networking is crucial in the private credit industry. Building relationships can significantly increase your chances of landing your dream private credit job.

Attend Industry Events:

- Private credit conferences: These events offer excellent networking opportunities with professionals from various firms.

- Industry-specific workshops and seminars: Attending these events demonstrates your commitment to professional development and provides opportunities to meet experts.

Leverage LinkedIn:

LinkedIn is an invaluable tool.

- Connect with professionals: Reach out to individuals working in private credit, particularly those at firms you admire.

- Join relevant groups: Participate in discussions and share insights. This helps you build your professional network and stay updated on industry trends.

- Follow key players and firms: Stay informed about their activities and opportunities.

Informational Interviews:

- Reach out to professionals: Schedule informational interviews with individuals working in your target roles.

- Gain valuable insights: Learn about their career paths, the industry's nuances, and potential job openings. These conversations can lead to unexpected opportunities.

Master the Private Credit Interview Process

The private credit interview process is rigorous. Thorough preparation is essential.

Prepare for Technical Questions:

Expect in-depth technical questions.

- Practice financial modeling and valuation: Be prepared to build and interpret models, perform discounted cash flow analyses, and discuss various valuation methodologies.

- Understand credit metrics and financial statements: Demonstrate a solid grasp of key financial ratios, credit analysis techniques, and the ability to analyze financial statements critically.

- Research common questions: Prepare thoughtful and concise answers to common private credit interview questions. Practice your delivery.

Showcase Your Soft Skills:

Technical skills are essential, but soft skills are equally important.

- Communication: Articulate your ideas clearly and concisely.

- Teamwork: Highlight your ability to collaborate effectively in a team environment.

- Problem-solving: Demonstrate your analytical skills and ability to solve complex problems.

- Pressure & Deadlines: Showcase your ability to work effectively under pressure and meet tight deadlines.

- Enthusiasm: Express genuine enthusiasm for the private credit industry and the specific role.

Understand the Different Private Credit Roles and Specializations

The private credit industry offers diverse roles and specializations. Understanding these nuances is crucial for targeting your job search effectively.

Research Various Roles:

Familiarize yourself with the typical career progression:

- Analyst

- Associate

- VP

- Director

- Principal

- Managing Director

Target Your Application:

- Identify your preferred specialization: Focus on areas like direct lending, mezzanine financing, distressed debt, real estate debt, or infrastructure debt.

- Tailor your materials: Highlight relevant skills and experience for your chosen specialization.

Continuously Upskill and Stay Current

The private credit industry is dynamic. Continuous learning is crucial for maintaining a competitive edge.

Professional Development:

- Certifications: Consider pursuing relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

- Training programs and webinars: Stay updated on the latest industry trends and techniques.

- Industry publications and news: Read publications like Private Debt Investor, and follow industry news closely.

Expand Your Knowledge:

- Develop sector expertise: Focus on specific sectors like healthcare, technology, or energy. This specialized knowledge makes you a more valuable candidate.

- Credit risk management and regulatory compliance: Develop a strong understanding of these crucial aspects of the industry.

Conclusion

Landing your dream private credit job requires a strategic and focused approach. By crafting a compelling resume, networking effectively, mastering the interview process, understanding the various roles and specializations, and continuously upskilling, you significantly increase your chances of success. Remember to tailor your application materials to each specific opportunity and leverage your network to gain valuable insights. Don't delay – start implementing these five essential tips today and begin your journey towards landing your dream private credit job!

Featured Posts

-

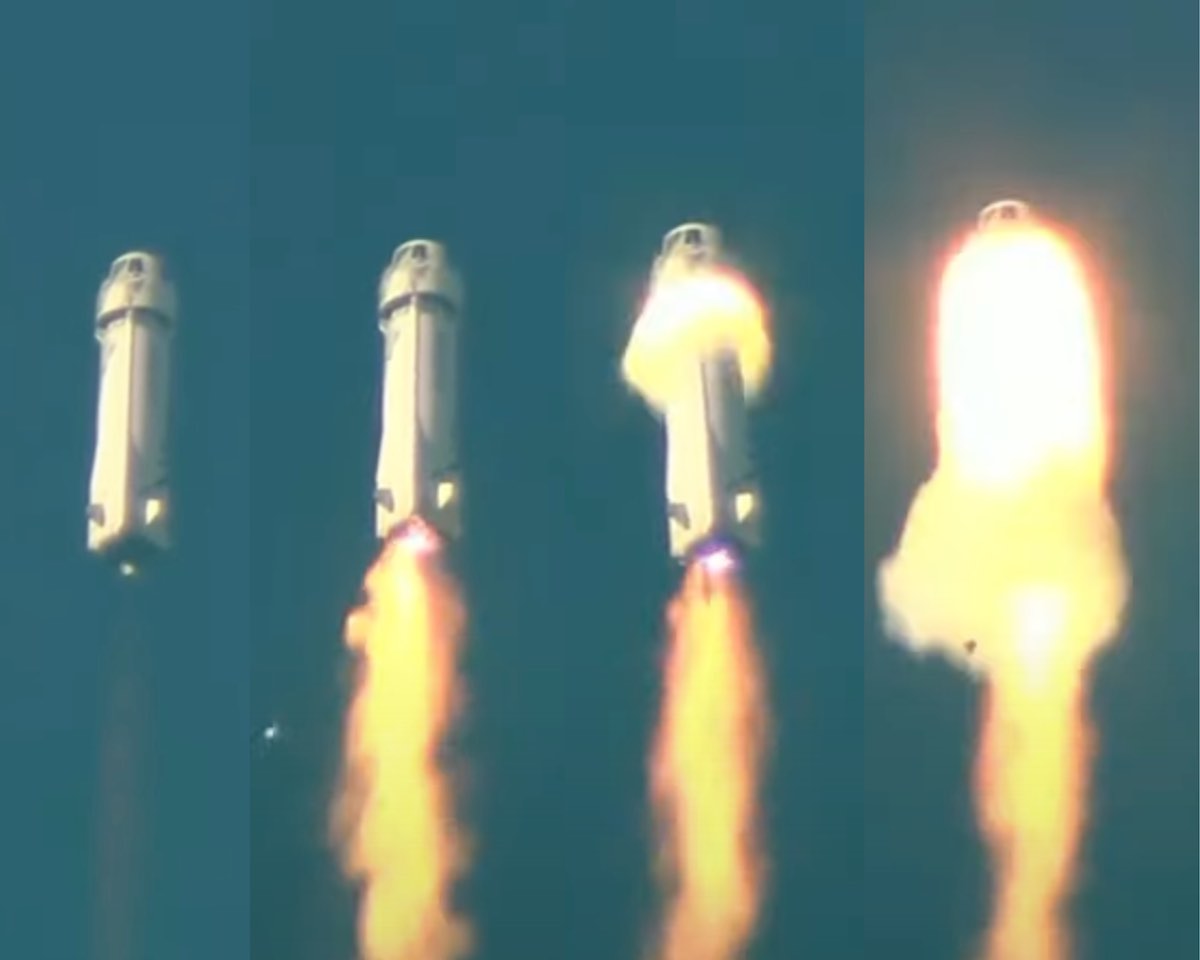

Blue Origin Scraps Launch Due To Vehicle Subsystem Problem

Apr 29, 2025

Blue Origin Scraps Launch Due To Vehicle Subsystem Problem

Apr 29, 2025 -

Understanding Tylor Megills Recent Success Key Factors In His Mets Performance

Apr 29, 2025

Understanding Tylor Megills Recent Success Key Factors In His Mets Performance

Apr 29, 2025 -

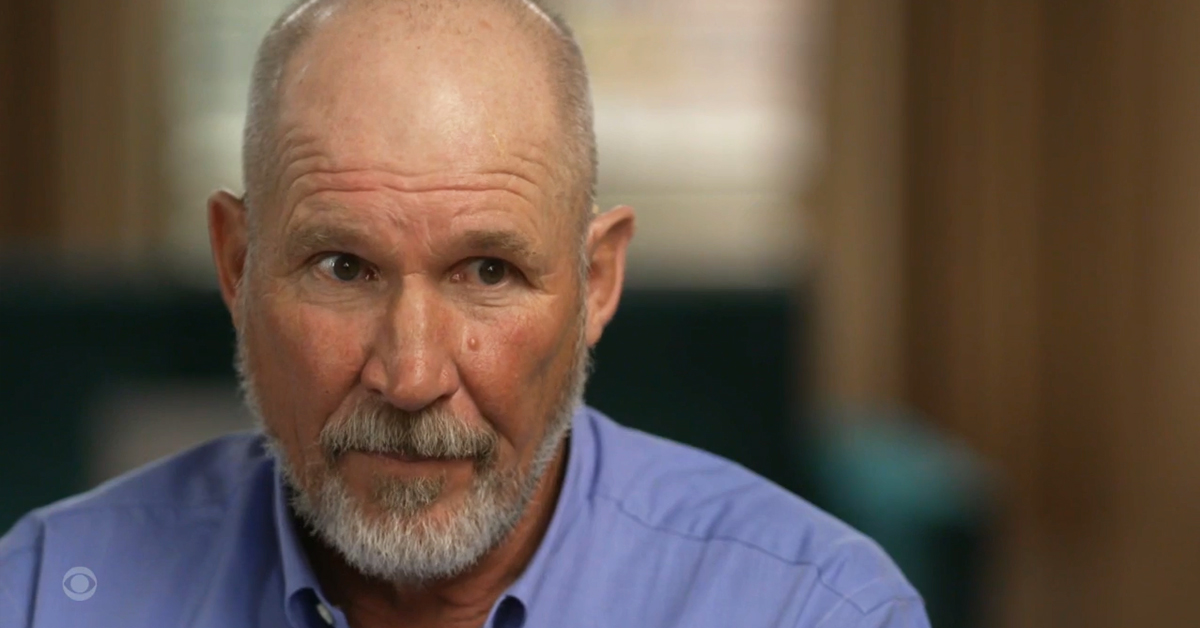

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods Allegations

Apr 29, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods Allegations

Apr 29, 2025 -

Legal Showdown Looms Us Attorney General Challenges Minnesota On Transgender Athlete Rule

Apr 29, 2025

Legal Showdown Looms Us Attorney General Challenges Minnesota On Transgender Athlete Rule

Apr 29, 2025 -

Russias Military Buildup Why Europe Is Concerned

Apr 29, 2025

Russias Military Buildup Why Europe Is Concerned

Apr 29, 2025

Latest Posts

-

Wrexham Afcs Rise Ryan Reynolds Cheers On The Teams Promotion

Apr 29, 2025

Wrexham Afcs Rise Ryan Reynolds Cheers On The Teams Promotion

Apr 29, 2025 -

Historic Promotion Ryan Reynolds Reaction To Wrexhams Success

Apr 29, 2025

Historic Promotion Ryan Reynolds Reaction To Wrexhams Success

Apr 29, 2025 -

Ryan Reynolds And Wrexham Afc A Historic Promotion Party

Apr 29, 2025

Ryan Reynolds And Wrexham Afc A Historic Promotion Party

Apr 29, 2025 -

Wrexhams Promotion Ryan Reynolds Joins The Celebration

Apr 29, 2025

Wrexhams Promotion Ryan Reynolds Joins The Celebration

Apr 29, 2025 -

Ryan Reynolds Celebrates Wrexham Afcs Promotion A Historic Moment

Apr 29, 2025

Ryan Reynolds Celebrates Wrexham Afcs Promotion A Historic Moment

Apr 29, 2025