Landmark Saudi Rule Change To Transform Its ABS Market

Table of Contents

Key Aspects of the New Saudi ABS Regulations

The new regulations represent a significant departure from previous restrictions, creating a more attractive and efficient environment for ABS issuance and trading. The key changes can be summarized in three crucial areas: relaxation of restrictions on eligible assets, a streamlined approval process, and enhanced investor protection measures.

Relaxation of Restrictions on Eligible Assets

Previously, the range of assets eligible for securitization in Saudi Arabia was limited. The new rules significantly broaden this scope.

- Mortgage-backed securities: The inclusion of mortgages as eligible assets opens a vast new market segment, providing a crucial funding source for the Saudi real estate sector.

- Auto loan ABS: Securitization of auto loans will inject liquidity into the automotive finance industry, stimulating sales and economic activity.

- Receivables securitization: Businesses will now have a more efficient way to convert their receivables into immediate cash flow, improving their financial flexibility.

- Other asset classes: The regulations also expand to encompass other asset classes previously excluded, contributing to a more diversified and robust ABS market.

This broadened scope dramatically increases the size and diversity of the Saudi ABS market, potentially leading to a substantial increase in overall transaction volume. This is particularly beneficial to sectors like real estate and consumer finance, which can now access a much wider range of funding options.

Streamlined Approval Process

The new regulations drastically simplify the process for obtaining approval for ABS issuances.

- Reduced processing time: The application review and approval process has been significantly expedited, reducing bureaucratic hurdles.

- Simplified documentation requirements: The need for extensive documentation has been reduced, leading to lower costs and faster time-to-market for issuers.

These changes are intended to encourage greater participation in the ABS market, especially among Small and Medium Enterprises (SMEs). By reducing costs and administrative burdens, the regulations make it easier for smaller businesses to access much-needed capital for expansion and growth. The enhanced regulatory efficiency promises a more agile and responsive ABS market.

Enhanced Investor Protection Measures

The new regulations prioritize investor protection to foster confidence and attract a wider pool of investors.

- Increased transparency: The rules mandate greater transparency in the disclosure of information related to ABS issuances, enabling investors to make better-informed decisions.

- Robust risk mitigation frameworks: The regulations include measures aimed at mitigating risks for investors, further enhancing market stability.

- Credit rating requirements: The involvement of reputable credit rating agencies will add an extra layer of validation and assurance for investors.

These measures are critical in boosting investor confidence, which is essential for the growth and stability of the ABS market. Higher investor participation will lead to increased liquidity and greater depth in the market, further attracting both domestic and international investors.

Impact on the Saudi Economy and Financial Sector

The changes to the ABS market are expected to have a profound impact on Saudi Arabia's economy and financial sector.

Increased Capital Availability for Businesses

Easier access to ABS financing will stimulate economic activity across various sectors.

- SME financing: SMEs, often facing challenges accessing traditional funding, will benefit significantly from this expanded access to capital.

- Corporate finance: Larger corporations can use ABS to refinance existing debt or fund new projects, fostering further growth and investment.

- Infrastructure development: The increased capital availability can greatly benefit large-scale infrastructure projects, accelerating national development plans.

By facilitating easier access to debt financing, the new regulations promise to be a catalyst for significant economic growth, impacting job creation and overall prosperity.

Attracting Foreign Investment

The improved regulatory environment and increased market depth are set to attract substantial foreign investment.

- International investor interest: The changes signal a commitment to market modernization and transparency, making Saudi Arabia more attractive to international investors.

- Capital inflow: Increased foreign investment will boost economic activity, create jobs, and introduce new expertise and technologies into the Saudi market.

This inflow of capital contributes significantly to the Kingdom's diversification efforts and strengthens its financial sector.

Development of the Islamic Finance Sector

The new regulations explicitly support the growth of the Islamic finance sector.

- Sukuk issuance: The broadened scope of eligible assets is expected to lead to a significant increase in Sukuk issuance, furthering Saudi Arabia’s leadership in Islamic finance.

- Sharia-compliant ABS: The regulations provide a framework for the issuance of Sharia-compliant ABS, furthering the development of the Islamic financial ecosystem.

The increased focus on Islamic finance enhances Saudi Arabia's position as a global hub for Islamic financial instruments and services.

Conclusion

The landmark rule change in Saudi Arabia's ABS market represents a pivotal moment for the Kingdom’s financial sector. By creating a more transparent, efficient, and investor-friendly environment, this regulatory reform is poised to unlock significant economic growth and attract substantial foreign investment. The impact on SMEs, corporations, and the Islamic finance sector is expected to be transformative. The opportunities in the evolving Saudi Asset-Backed Securities (ABS) market are substantial, presenting a compelling investment proposition for both domestic and international players. Learn more and explore how you can capitalize on this exciting development.

Featured Posts

-

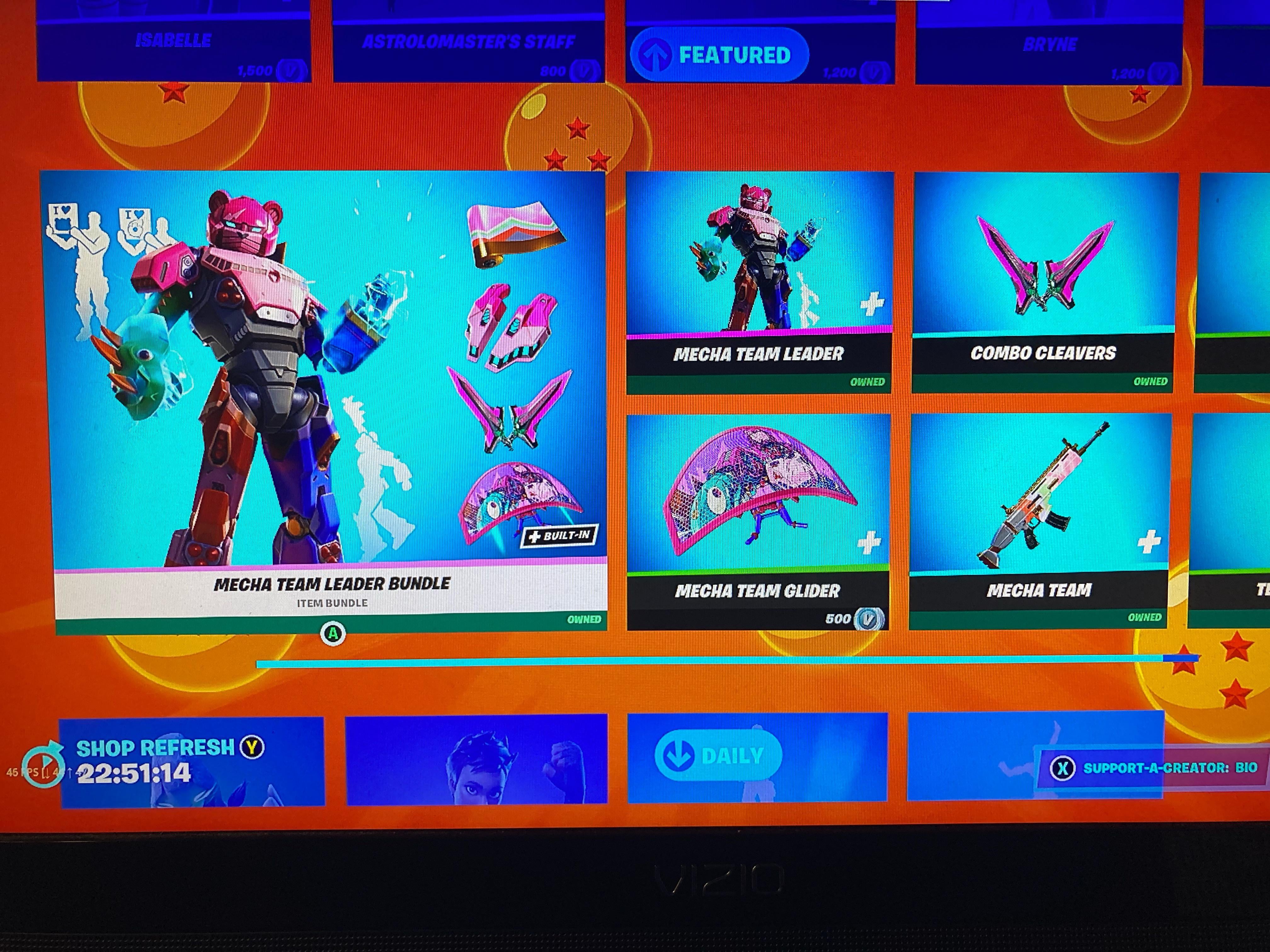

Fortnite V34 30 Update Sabrina Carpenter Skin New Features And Patch Notes

May 02, 2025

Fortnite V34 30 Update Sabrina Carpenter Skin New Features And Patch Notes

May 02, 2025 -

Duurzaam Schoolgebouw Kampen Rechtszaak Tegen Enexis Over Stroom

May 02, 2025

Duurzaam Schoolgebouw Kampen Rechtszaak Tegen Enexis Over Stroom

May 02, 2025 -

England Vs Spain Tv Channel Kick Off Time And How To Watch The Lionesses

May 02, 2025

England Vs Spain Tv Channel Kick Off Time And How To Watch The Lionesses

May 02, 2025 -

Fortnite Community Upset Over Recent Item Shop Changes

May 02, 2025

Fortnite Community Upset Over Recent Item Shop Changes

May 02, 2025 -

Lotto Plus 1 And Lotto Plus 2 View The Latest Draw Results And Winning Numbers

May 02, 2025

Lotto Plus 1 And Lotto Plus 2 View The Latest Draw Results And Winning Numbers

May 02, 2025

Latest Posts

-

Poppys Family A Touching Tribute To A Beloved Manchester United Supporter

May 02, 2025

Poppys Family A Touching Tribute To A Beloved Manchester United Supporter

May 02, 2025 -

Family Mourns Loss Of Devoted Manchester United Fan Poppy

May 02, 2025

Family Mourns Loss Of Devoted Manchester United Fan Poppy

May 02, 2025 -

New Loyle Carner Album Incoming Details Revealed

May 02, 2025

New Loyle Carner Album Incoming Details Revealed

May 02, 2025 -

Family Mourns The Loss Of Devoted Manchester United Fan Poppy

May 02, 2025

Family Mourns The Loss Of Devoted Manchester United Fan Poppy

May 02, 2025 -

Manchester United Fan Poppy Family Shares Emotional Tribute Following Her Passing

May 02, 2025

Manchester United Fan Poppy Family Shares Emotional Tribute Following Her Passing

May 02, 2025