Late To The Game? Assessing Palantir Stock's Potential For 40% Growth By 2025

Table of Contents

Palantir's Current Market Position and Competitive Advantages

Palantir occupies a unique space in the big data and AI landscape. Its success hinges on its ability to deliver sophisticated data analytics platforms to both government and commercial clients. This dual approach provides a diversified revenue stream and mitigates the risks associated with relying solely on a single sector.

Dominating Niche Markets

Palantir has successfully established itself in several niche markets, leveraging its proprietary technology and strong client relationships.

- Government Contracts: Palantir's platforms are utilized by numerous intelligence agencies and government departments globally, providing crucial data analysis capabilities for national security and public safety. This includes assisting in counter-terrorism efforts, fraud detection, and crime prevention, solidifying its presence in the "Palantir government contracts" market.

- Commercial Clients: Across various sectors, including finance, healthcare, and manufacturing, Palantir's "data analytics platform" helps organizations improve operational efficiency, make better decisions, and gain a competitive edge. Key examples of Palantir commercial clients include large financial institutions using its platforms for risk management and fraud detection. This showcases the versatility of Palantir's "AI-powered solutions" and its growth potential within the broader "Palantir commercial clients" segment.

Technological Innovation and Future Growth Drivers

Palantir's continued success hinges on its relentless pursuit of technological innovation. Significant investments in artificial intelligence, machine learning, and cloud computing are key growth drivers.

- Palantir AI & Machine Learning: The company is actively developing and deploying advanced AI and machine learning algorithms to enhance the capabilities of its platforms. This includes advancements in predictive analytics, automation, and natural language processing.

- Palantir Cloud Platform: The migration to a cloud-based architecture offers scalability, cost-efficiency, and accessibility, making its "software-as-a-service (SaaS)" offerings more attractive to a wider range of clients.

- Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions further strengthen Palantir's technological capabilities and market reach, contributing to its long-term growth prospects.

Financial Performance and Growth Projections

Analyzing Palantir's financial statements is crucial for evaluating the feasibility of the 40% growth target.

Analyzing Palantir's Financial Statements

A thorough examination of "Palantir revenue," "Palantir profitability," and cash flow is essential. While year-over-year revenue growth has been impressive, consistent profitability and robust cash flow are equally critical for sustained growth. (Note: Insert charts and graphs illustrating key financial indicators here. Data should be sourced from reputable financial reports.)

Factors Affecting Growth Potential

Several factors could impact Palantir's growth trajectory. A realistic assessment must account for these potential headwinds.

- Palantir Competition: Increased competition from established players and new entrants in the data analytics and AI market could impact Palantir's market share.

- Market Risks: Economic downturns could reduce demand for Palantir's services, particularly in the commercial sector.

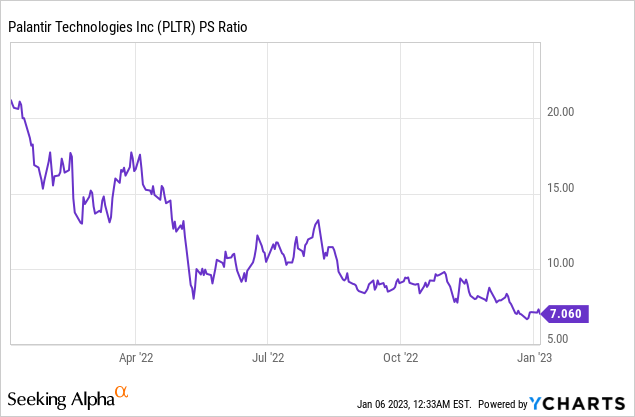

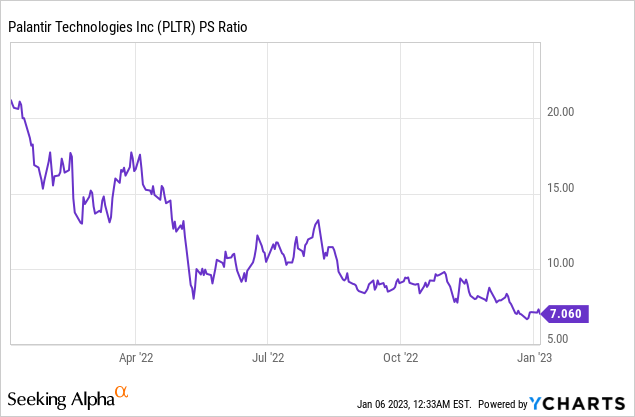

- Investment Risks: Fluctuations in the "Palantir stock price" reflect the inherent volatility of the tech sector and overall market sentiment. "Palantir valuation" remains a topic of ongoing discussion among analysts.

- Geopolitical Instability: Geopolitical events and regulatory changes could disrupt operations and impact contracts, especially within the government sector.

Investment Considerations and Risk Assessment

Determining the viability of the 40% growth target requires a careful consideration of the preceding analyses.

Assessing the 40% Growth Target's Feasibility

The 40% growth projection is ambitious. While Palantir possesses significant strengths, several factors could hinder its achievement.

- Arguments for 40% Growth: Strong existing client relationships, technological innovation, and expansion into new markets support the optimistic projection.

- Arguments against 40% Growth: Intense competition, economic uncertainty, and potential regulatory hurdles pose significant challenges. Alternative growth scenarios should be considered. A thorough analysis of "Palantir investment strategy" and "return on investment (ROI)" is necessary.

Comparison with Competitors

A comparison with major competitors like [Competitor A] and [Competitor B] is essential for a comprehensive assessment. (Note: Insert a comparison table highlighting key differences in technology, market position, and financial performance.) Analyzing "[Competitor A] vs Palantir" and "[Competitor B] vs Palantir" reveals Palantir's competitive advantages and disadvantages within the broader "market share" landscape.

Conclusion: Is Palantir Stock Right for You?

Investing in Palantir Stock presents both significant opportunities and considerable risks. The potential for 40% growth by 2025 is alluring, but it's crucial to acknowledge the challenges. Thorough due diligence is paramount. Carefully weigh the arguments for and against investing in "Palantir Stock," considering the potential rewards against the risks involved. Before making any investment decisions, conduct your own research using reputable financial resources and seek advice from qualified financial professionals. Remember, a careful assessment of "Palantir Stock" and its inherent volatility is essential for informed decision-making.

Featured Posts

-

Millions Stolen After Hacker Targets Executive Office365 Accounts Fbi Investigation

May 09, 2025

Millions Stolen After Hacker Targets Executive Office365 Accounts Fbi Investigation

May 09, 2025 -

Bitcoins Price Surge A Deeper Dive Into The Market Rebound

May 09, 2025

Bitcoins Price Surge A Deeper Dive Into The Market Rebound

May 09, 2025 -

Red Wings Playoff Hopes Dim After 6 3 Loss In Vegas

May 09, 2025

Red Wings Playoff Hopes Dim After 6 3 Loss In Vegas

May 09, 2025 -

Reaktsiya Na Slova Stivena Kinga O Trampe I Maske

May 09, 2025

Reaktsiya Na Slova Stivena Kinga O Trampe I Maske

May 09, 2025 -

Snegopady V Yaroslavskoy Oblasti Kogda Zhdat Sleduyuschego

May 09, 2025

Snegopady V Yaroslavskoy Oblasti Kogda Zhdat Sleduyuschego

May 09, 2025