Latest Oil Market News And Analysis: April 24, 2024

Table of Contents

Global Crude Oil Price Movements

Benchmark Prices (Brent, WTI)

Today, April 24th, 2024, witnessed significant shifts in benchmark crude oil prices. Brent crude opened at $85 per barrel, reaching a high of $88 before settling at $87.50, a 2.5% increase compared to yesterday's close. Similarly, WTI crude experienced a strong upward trend, opening at $82, peaking at $85.20, and closing at $84.80, representing a 3% daily gain. This represents a considerable weekly increase of 5% for Brent and 6% for WTI, signaling a potentially bullish trend.

- Specific price fluctuations: Throughout the day, prices saw several spikes and dips, reflecting the market's reaction to incoming news and trading activity. A notable surge occurred around midday, likely triggered by unexpected geopolitical developments (discussed below).

- Significant price changes and causes: The sharp price increase can be attributed to a combination of factors, including reduced OPEC+ production (detailed in the next section), ongoing geopolitical uncertainty, and stronger-than-expected global demand.

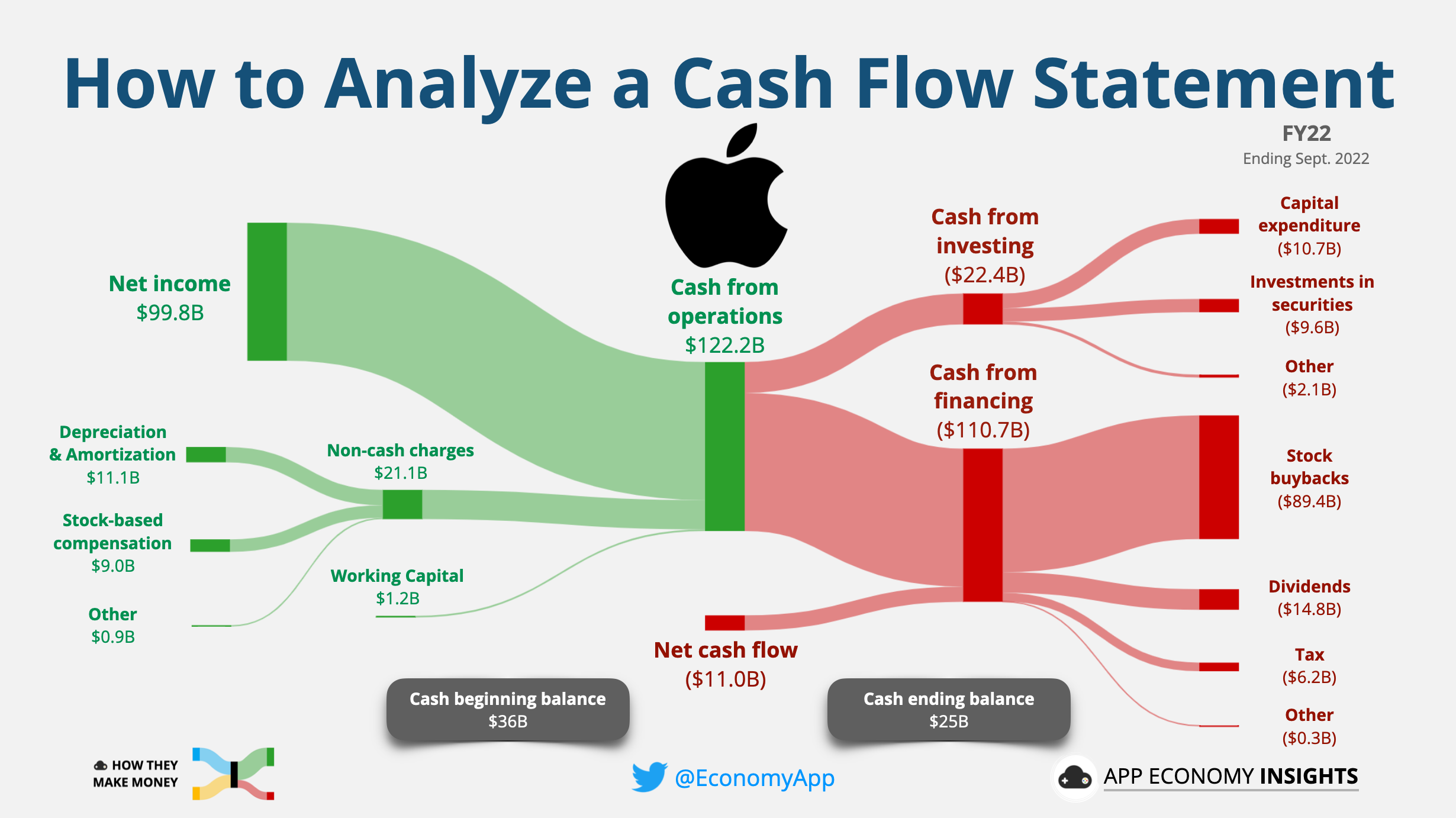

- (Insert Chart/Graph here visually representing Brent and WTI price movements throughout the day and week). This chart clearly illustrates the volatility and upward trend in crude oil prices. Using keywords like "crude oil price chart," "Brent crude price graph," and "WTI crude oil price analysis" in the chart's alt text will enhance SEO.

OPEC+ Production Decisions and Impact

Meeting Summary

While no formal OPEC+ meeting occurred today, market sentiment was significantly impacted by reports suggesting a potential future reduction in oil production by key members. These rumors, coupled with ongoing geopolitical risks, contributed to the price surge.

- Rationale behind potential production changes: The perceived need to support prices, especially considering the recent economic slowdown in some key consuming nations, is believed to be driving the considerations of production cuts.

- Impact on global oil supply and prices: Any reduction in OPEC+ production would tighten global oil supply, thereby exerting upward pressure on prices. This is especially relevant given the already-constrained supply chain and the increased global demand.

- Disagreements or tensions within OPEC+: While there are reports suggesting a united front within the cartel on the matter of production, underlying tensions between member states always exist and remain a significant factor in price volatility. The use of keywords like "OPEC+ production cut," "OPEC+ strategy," and "oil market manipulation" helps SEO.

Geopolitical Factors and Their Influence

Geopolitical Events

Ongoing geopolitical tensions in Eastern Europe continue to play a significant role in shaping the oil market. Concerns over potential disruptions to oil supplies from the region, coupled with sanctions against certain oil-producing nations, contribute to price uncertainty.

- Effect on oil supply chains, transportation, and demand: The ongoing conflict raises concerns about the security of crucial oil shipping routes. Any disruption to these routes could lead to supply shortages and price spikes.

- Specific countries or regions affected: Eastern European countries and their neighboring regions are particularly vulnerable to disruptions in oil supplies. This geopolitical risk extends to global markets as well.

- Potential long-term implications: The protracted nature of the conflict suggests that geopolitical uncertainty will likely persist, continuing to influence oil prices in the foreseeable future. Using "geopolitical instability oil price," "oil supply chain disruption," and "sanctions impact on oil" will enhance the article's SEO score.

US Shale Oil Production and its Role

US shale oil production remains a crucial factor in the global oil market. While output has shown some signs of growth, it has not kept pace with the increasing global demand.

- Current state of US shale oil production: Recent data indicates a modest increase in US shale oil production. However, this increase has been insufficient to offset the impact of reduced OPEC+ production and geopolitical risks.

- Impact on global supply and prices: The US remains a major oil producer, and its production levels significantly affect global supply and price dynamics. Increased US production could help alleviate price pressures; conversely, any decline could exacerbate them.

- Changes in drilling activity or investment: Investment in the US shale sector has been fluctuating, reflecting both the opportunities and uncertainties associated with the sector. This volatility affects overall production capacity. Use of keywords such as "US shale oil production forecast," "American oil production," and "shale gas" will help with SEO.

Conclusion: Wrapping Up the Latest Oil Market News and Analysis

Today's oil market was characterized by significant price increases driven by a confluence of factors. Reduced expectations of OPEC+ production, ongoing geopolitical uncertainties, and the relatively constrained US shale production all contributed to the surge in Brent and WTI crude oil prices. The resulting market volatility highlights the complex interplay of global events and their impact on energy markets. The key takeaway is the continuing uncertainty in the oil market, driven by both supply-side and geopolitical factors. Investors and consumers alike should closely monitor these developments.

Stay updated on the ever-changing oil market by subscribing to our daily newsletter. Check back tomorrow for the latest oil market news and analysis!

Featured Posts

-

Jack O Connell A Modern Icon And His Classic Jlc Reverso

Apr 25, 2025

Jack O Connell A Modern Icon And His Classic Jlc Reverso

Apr 25, 2025 -

Aussie Veterans Warning Anzac Day Ignored National Identity At Risk

Apr 25, 2025

Aussie Veterans Warning Anzac Day Ignored National Identity At Risk

Apr 25, 2025 -

Enis Reduced Cash Flow Impact On Share Buyback And Future Outlook

Apr 25, 2025

Enis Reduced Cash Flow Impact On Share Buyback And Future Outlook

Apr 25, 2025 -

Dwnld Trmp Ka Ywkryn Pr Rwsy Hmle Ke Bare Myn Skht Rdeml

Apr 25, 2025

Dwnld Trmp Ka Ywkryn Pr Rwsy Hmle Ke Bare Myn Skht Rdeml

Apr 25, 2025 -

Montana Senate Power Struggle Coalition Of Democrats And Republicans

Apr 25, 2025

Montana Senate Power Struggle Coalition Of Democrats And Republicans

Apr 25, 2025

Latest Posts

-

King Announces Advance Birthday Party Plans

Apr 26, 2025

King Announces Advance Birthday Party Plans

Apr 26, 2025 -

Early Birthday Celebrations Announced By The King

Apr 26, 2025

Early Birthday Celebrations Announced By The King

Apr 26, 2025 -

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025

A Kings Birthday Party Plans Unveiled Ahead Of Schedule

Apr 26, 2025 -

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025

Royal Birthday Bash King Starts Festivities Early

Apr 26, 2025 -

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025