Leveraged Semiconductor ETFs: A Case Study Of Pre-Surge Investor Behavior

Table of Contents

Identifying Pre-Surge Indicators in the Semiconductor Market

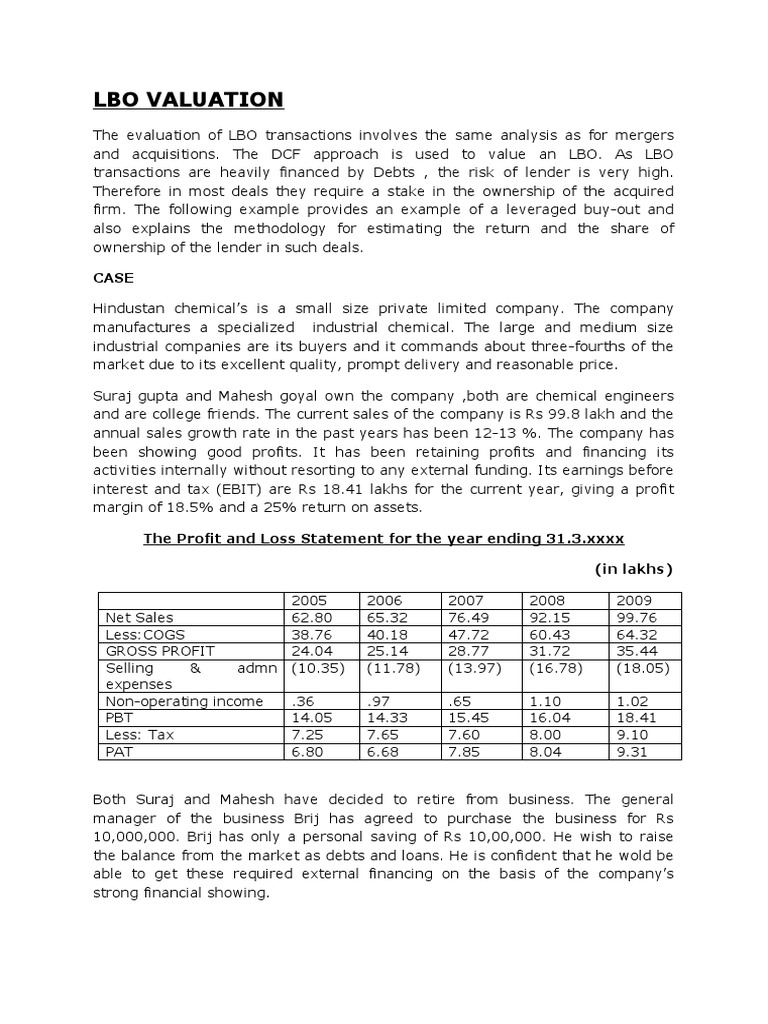

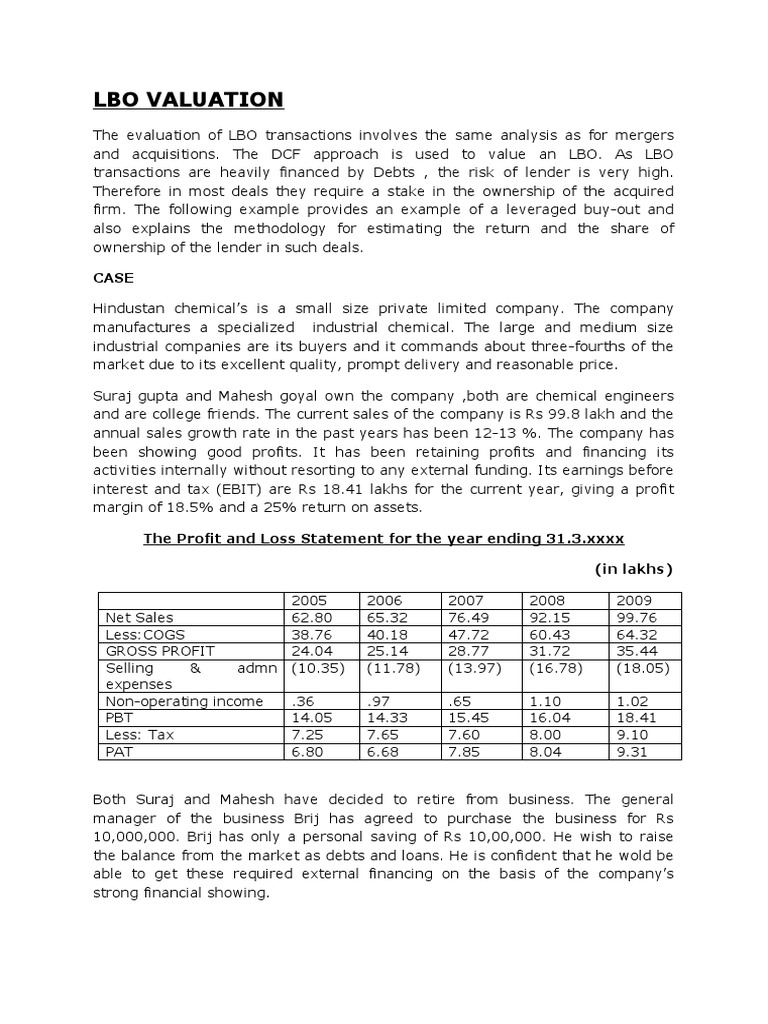

Predicting surges in the semiconductor market, and consequently, in leveraged semiconductor ETFs, requires a multi-faceted approach. Analyzing macroeconomic indicators provides a crucial foundation for anticipating industry performance. These indicators offer valuable insights into the underlying demand driving the semiconductor sector.

-

Analyzing historical correlation between macroeconomic indicators and semiconductor ETF performance: By studying past data, we can identify correlations between global GDP growth, consumer spending on electronics, and the performance of semiconductor ETFs. This historical analysis helps establish predictive models. For instance, a surge in global smartphone sales often precedes increased demand for semiconductor components, impacting ETF prices.

-

Identifying specific economic events (e.g., new product launches, geopolitical tensions) that triggered increased investor interest in leveraged semiconductor ETFs: Major events like the launch of new gaming consoles, the rollout of 5G technology, or geopolitical instability affecting chip manufacturing can significantly influence investor sentiment and drive demand for leveraged semiconductor ETFs. These events often act as catalysts for price increases.

-

Examining sentiment analysis of news articles and social media related to the semiconductor sector: Analyzing the tone and frequency of news articles and social media posts related to the semiconductor industry can provide valuable insights into investor sentiment. Positive sentiment, fueled by positive news and strong earnings reports, often precedes a price surge in semiconductor ETFs. Tools that analyze sentiment from various online sources can be particularly useful for this purpose.

Investor Behavior and Sentiment Analysis

Understanding investor psychology is vital for navigating the volatile world of leveraged semiconductor ETFs. Investor behavior is often influenced by a combination of rational analysis and emotional factors.

-

Examining trading volume and price volatility as indicators of investor excitement and potential overvaluation: Increased trading volume and heightened price volatility can be indicative of growing investor excitement and potential overvaluation. These indicators suggest a potential peak in the market cycle, warranting caution.

-

Analyzing the role of social media and online forums in shaping investor sentiment and potentially contributing to bubbles: Social media platforms and online investment forums can significantly influence investor sentiment, potentially contributing to speculative bubbles. The rapid spread of information, often without proper context or verification, can lead to herd behavior and amplified price swings.

-

Exploring the impact of analyst ratings and reports on investor confidence: Analyst ratings and research reports play a significant role in shaping investor confidence. Positive ratings and bullish forecasts can fuel further investment, potentially driving prices upward. However, it’s crucial to remember that these opinions are not guarantees of future performance.

Risk Assessment and Portfolio Management Strategies

Leveraged ETFs, particularly those focused on volatile sectors like semiconductors, amplify both gains and losses. Understanding and managing risk is paramount.

-

Discussion of the magnifying effect of leverage during market downturns and the potential for significant losses: Leverage magnifies returns during uptrends but equally amplifies losses during downturns. Investors should be fully aware of the potential for substantial losses in a declining market.

-

Strategies for mitigating risk, such as diversification, stop-loss orders, and position sizing: Diversification across asset classes, the use of stop-loss orders to limit potential losses, and careful position sizing are crucial risk management strategies for leveraged semiconductor ETFs. These strategies help protect against significant losses during market corrections.

-

Examination of alternative investment strategies, such as unleveraged semiconductor ETFs or individual stock selection: Investors might consider alternative strategies, such as investing in unleveraged semiconductor ETFs or carefully selecting individual semiconductor stocks, to reduce risk while still participating in the sector's growth.

Case Study Examples

Several leveraged semiconductor ETFs, such as (hypothetical examples - replace with real ETF tickers for accuracy): SOXX3X (3x leveraged Semiconductor ETF) and SMH2X (2x leveraged Semiconductor ETF), have exhibited significant price swings leading up to major market surges. Analyzing their performance in specific periods – for example, the period leading up to the 2021 semiconductor shortage – provides valuable real-world examples to illustrate the concepts discussed earlier. Examining trading volumes and price action during these periods helps identify potential pre-surge indicators.

Lessons Learned and Future Implications

This case study highlights the critical role of pre-surge indicators and investor sentiment in the performance of leveraged semiconductor ETFs.

-

Key takeaways regarding pre-surge indicators and investor behavior: Careful monitoring of macroeconomic indicators, investor sentiment, and trading volume is crucial for anticipating potential price surges and managing risk effectively.

-

Practical recommendations for risk management and portfolio construction: Implementing sound risk management practices, including diversification, stop-loss orders, and position sizing, is essential for mitigating the inherent risks associated with leveraged investing.

-

Potential future research directions in this area: Further research could focus on developing more sophisticated predictive models incorporating machine learning and alternative data sources to improve the accuracy of pre-surge predictions.

Conclusion:

This case study highlighted the complexities of investing in leveraged semiconductor ETFs, particularly during periods of market exuberance. By carefully analyzing pre-surge indicators, understanding investor sentiment, and implementing robust risk management strategies, investors can improve their chances of success. However, remember that even with careful planning, leveraged investing in volatile sectors such as semiconductors inherently carries a high degree of risk. Further research and a thorough understanding of leveraged semiconductor ETFs are essential before making any investment decisions. Remember to always conduct your own thorough due diligence before investing in any leveraged semiconductor ETFs.

Featured Posts

-

Miami Open Sabalenka Triumphs Over Pegula

May 13, 2025

Miami Open Sabalenka Triumphs Over Pegula

May 13, 2025 -

Oregon Womens Basketball Triumphs Over Vanderbilt In Ncaa Tournament Thriller

May 13, 2025

Oregon Womens Basketball Triumphs Over Vanderbilt In Ncaa Tournament Thriller

May 13, 2025 -

Dzherard Btlr 8 Godini S Osinovenoto Mu Blgarsko Kuche

May 13, 2025

Dzherard Btlr 8 Godini S Osinovenoto Mu Blgarsko Kuche

May 13, 2025 -

Atalanta Vs Lazio En Vivo Hora Canal Y Fecha Serie A 2025

May 13, 2025

Atalanta Vs Lazio En Vivo Hora Canal Y Fecha Serie A 2025

May 13, 2025 -

Ali Larter On Her Relationship With Billy Bob Thornton Theres Not A Lot Of Judgment

May 13, 2025

Ali Larter On Her Relationship With Billy Bob Thornton Theres Not A Lot Of Judgment

May 13, 2025