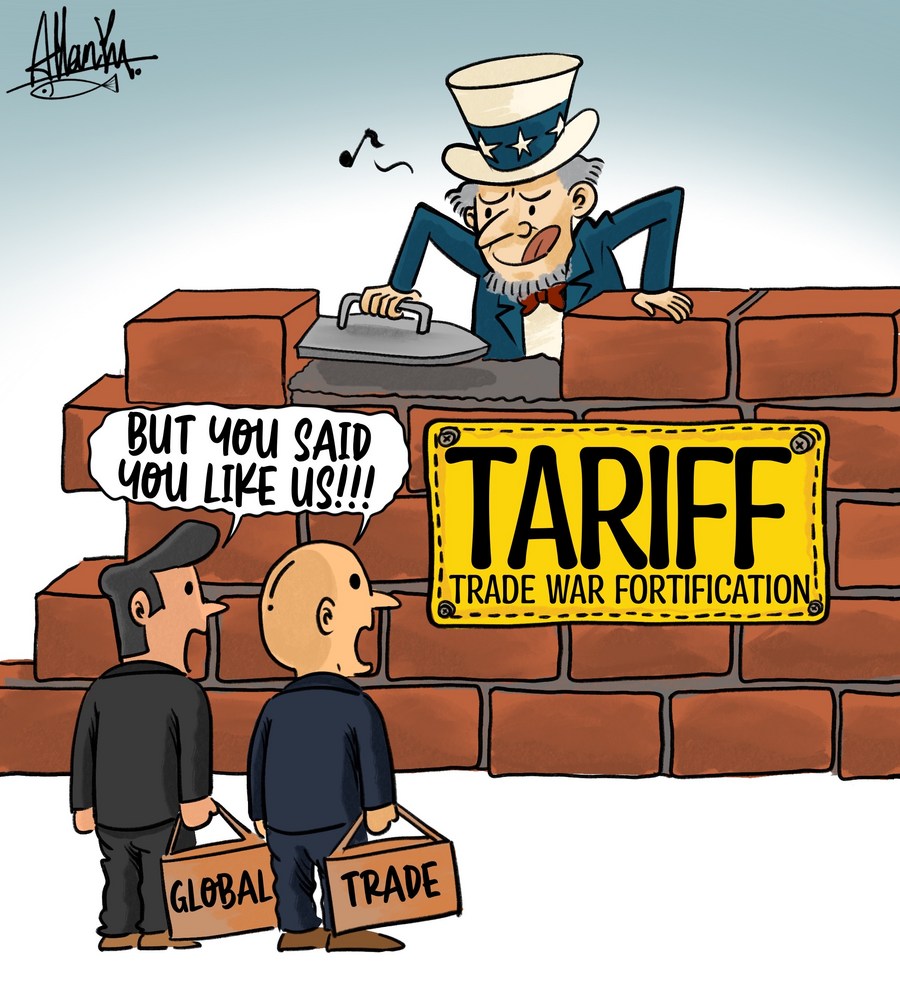

Liberation Day And Beyond: Assessing The Financial Impact Of Trump's Trade Policies On Billionaires

Table of Contents

Winners: Billionaires Benefiting from Protectionist Measures

The Rise of Domestic Industries and Related Billionaires:

Trump's protectionist trade policies, particularly the imposition of tariffs on steel and aluminum, aimed to bolster domestic industries. This had a noticeable impact on certain billionaires.

- Steel Industry: Tariffs led to increased demand for domestically produced steel, benefiting steel magnates and related businesses. While specific billionaire names are difficult to isolate without extensive proprietary financial data, the impact on publicly traded steel companies is demonstrably positive. This is reflected in stock market performance and increased profitability for major players in the sector.

- Agriculture: While some agricultural sectors suffered from retaliatory tariffs, others saw increased domestic consumption, benefiting certain agricultural billionaires who focused on the domestic market and profited from reduced competition.

- Stock Market Fluctuations: The volatility caused by trade wars created opportunities for skilled investors. Some billionaires likely profited by strategically buying low and selling high amidst the fluctuating stock market.

However, this protectionism came at a cost. Increased tariffs led to higher prices for consumers, potentially squeezing household budgets.

Strategic Investments and Acquisitions Fueled by Trade Uncertainty:

The uncertainty created by Trump's trade policies spurred strategic investment and acquisition activity among some billionaires.

- Market Volatility: Trade disputes created market volatility, opening opportunities for astute investors to acquire undervalued assets or make strategic investments in sectors poised for growth despite the uncertainty.

- Hedging Strategies: Many billionaires employ sophisticated hedging strategies to mitigate risks. During this period, these strategies likely played a significant role in preserving and even enhancing their wealth.

- Consolidation: Some billionaires may have capitalized on market downturns to consolidate their holdings or expand their business empires through acquisitions of struggling competitors weakened by the trade conflicts.

Losers: Billionaires Hurt by Trade Wars and Retaliation

Impact on Global Businesses and Supply Chains:

Many businesses rely on global supply chains. Trump's trade policies disrupted these chains, negatively impacting some billionaires.

- Disrupted Supply Chains: Companies reliant on global sourcing faced delays, increased costs, and disruptions to their operations due to tariffs and trade restrictions. This directly impacted the bottom line for some billionaires whose wealth was tied to these international supply chains.

- International Trade Restrictions: Reduced access to foreign markets due to retaliatory tariffs and trade conflicts significantly impacted the profitability of certain multinational corporations and, consequently, the wealth of their owners.

- Increased Production Costs: Tariffs on imported goods led to increased production costs for companies relying on foreign inputs, ultimately eating into profits.

The Decline of Specific Sectors Due to Tariffs and Retaliation:

Several sectors experienced significant declines due to tariffs and retaliatory measures.

- Technology: The technology sector, heavily reliant on global trade and supply chains, experienced substantial challenges. Retaliatory tariffs imposed by China particularly impacted some tech giants, affecting the wealth of their founders and major shareholders.

- Retail: Retailers faced increased costs due to tariffs on imported goods and also suffered from reduced consumer spending due to the overall economic uncertainty. This resulted in financial losses for some billionaire retail owners.

- Retaliatory Tariffs: Retaliatory tariffs imposed by other countries on US goods had a significant negative impact on various sectors and the billionaires associated with them. This created a ripple effect throughout the global economy.

Analyzing the Overall Economic Impact and its Effect on Inequality

Macroeconomic Effects of Trump's Trade Policies:

Trump's trade policies had complex and far-reaching macroeconomic effects.

- GDP Growth: The impact on GDP growth is debated, with some arguing it was negatively affected, while others claim the effects were minimal or even positive in certain sectors.

- Inflation: Tariffs contributed to inflation, impacting consumers and eroding purchasing power.

- Job Creation/Destruction: While some sectors saw job creation due to increased domestic demand, others experienced job losses due to factory closures and reduced exports.

The Widening Gap: Did Trump's Policies Exacerbate Wealth Inequality?

The impact of Trump's trade policies on wealth inequality is a complex issue.

- Wealth Concentration: Analyzing the changes in wealth concentration among the ultra-rich during this period requires a nuanced approach, accounting for various factors beyond trade policies.

- Long-Term Implications: The long-term implications of these trade policies on economic inequality are still unfolding and require further research.

- Alternative Perspectives: Measuring wealth inequality itself is subject to debate and different methodologies may yield contrasting results.

Conclusion: Understanding the Long-Term Effects of Trump's Trade Policies on Billionaire Wealth

Trump's trade policies had a multifaceted impact on billionaire wealth, creating both winners and losers. While some billionaires benefited from protectionist measures and strategic investment opportunities, others suffered from disruptions to global supply chains and retaliatory tariffs. The overall macroeconomic effects and the impact on wealth inequality remain subjects of ongoing debate and require further research. To fully understand the long-term consequences of "Liberation Day and Beyond: Assessing the Financial Impact of Trump's Trade Policies on Billionaires," we need to continue analyzing economic data, considering various perspectives, and examining the evolving global economic landscape. Further research into specific economic indicators and financial reporting from affected companies is crucial for a comprehensive understanding of this complex issue.

Featured Posts

-

The Significance Of Trumps Choice Of Casey Means For Surgeon General

May 10, 2025

The Significance Of Trumps Choice Of Casey Means For Surgeon General

May 10, 2025 -

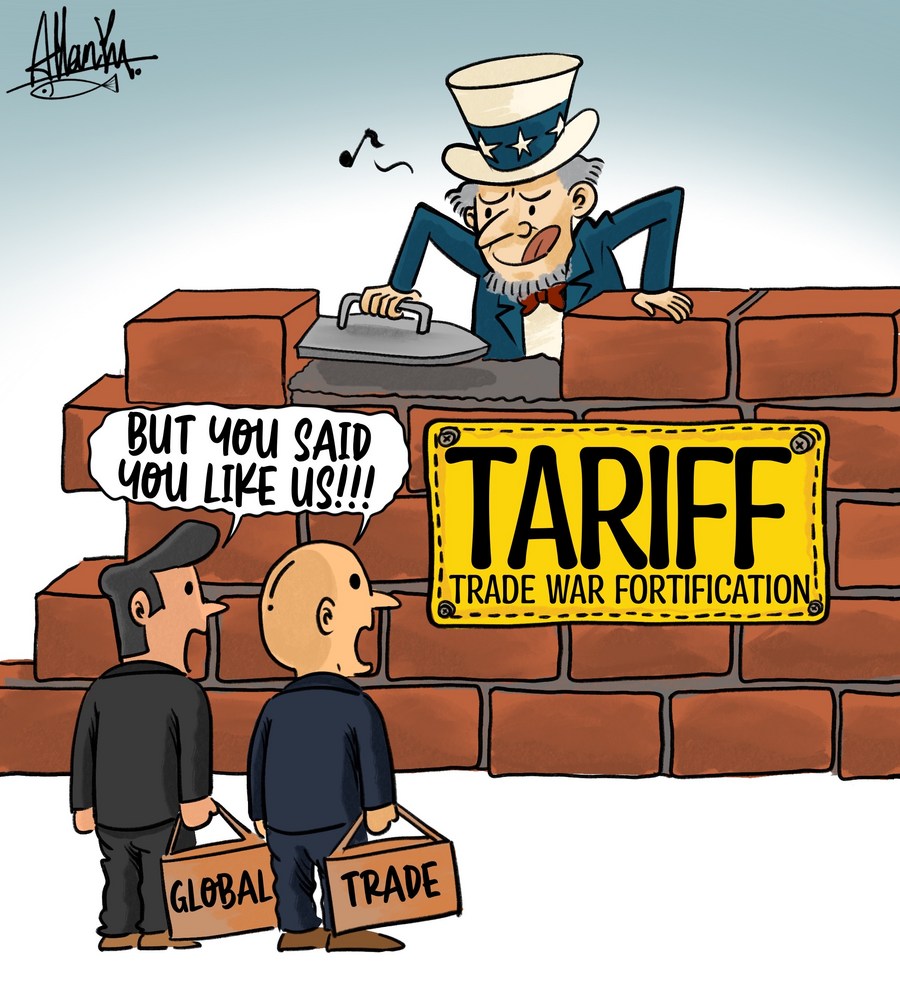

A Data Driven Look At Emerging Business Hotspots In Country Name

May 10, 2025

A Data Driven Look At Emerging Business Hotspots In Country Name

May 10, 2025 -

Former Becker Sentencing Judge To Head Nottingham Inquiry

May 10, 2025

Former Becker Sentencing Judge To Head Nottingham Inquiry

May 10, 2025 -

Analyzing Brobbeys Impact Strength And Tactics Ahead Of Europa League Clash

May 10, 2025

Analyzing Brobbeys Impact Strength And Tactics Ahead Of Europa League Clash

May 10, 2025 -

How Palantirs Nato Partnership Will Reshape Public Sector Ai

May 10, 2025

How Palantirs Nato Partnership Will Reshape Public Sector Ai

May 10, 2025