Live Music Stock Market Update: Pre-Market Gains After Recent Volatility

Table of Contents

Pre-Market Performance of Key Live Music Stocks

The pre-market trading session paints a generally positive picture for major live music stocks. While the market remains dynamic, several key players are experiencing notable increases. This suggests a potential shift in investor sentiment after a period of uncertainty.

Let's look at some specific examples:

- Live Nation (LYV): +3% pre-market gain. This increase can be attributed to a combination of factors, including strong summer concert attendance figures and the announcement of several new partnerships with international artists. The company's robust ticketing platform and diverse portfolio of venues continue to drive revenue.

- AEG Presents: +2% pre-market gain. This smaller, but significant player in the live music industry, benefited from a successful festival season and increased corporate event bookings. Their focus on niche markets and emerging artists appears to be paying off.

- Superfly: +1.5% pre-market gain. This promoter, known for its large-scale festivals, experienced a boost likely driven by the successful conclusion of their flagship event and strong advance ticket sales for next year’s lineup.

These gains suggest a renewed confidence in the live music sector's ability to overcome recent challenges and capitalize on pent-up demand.

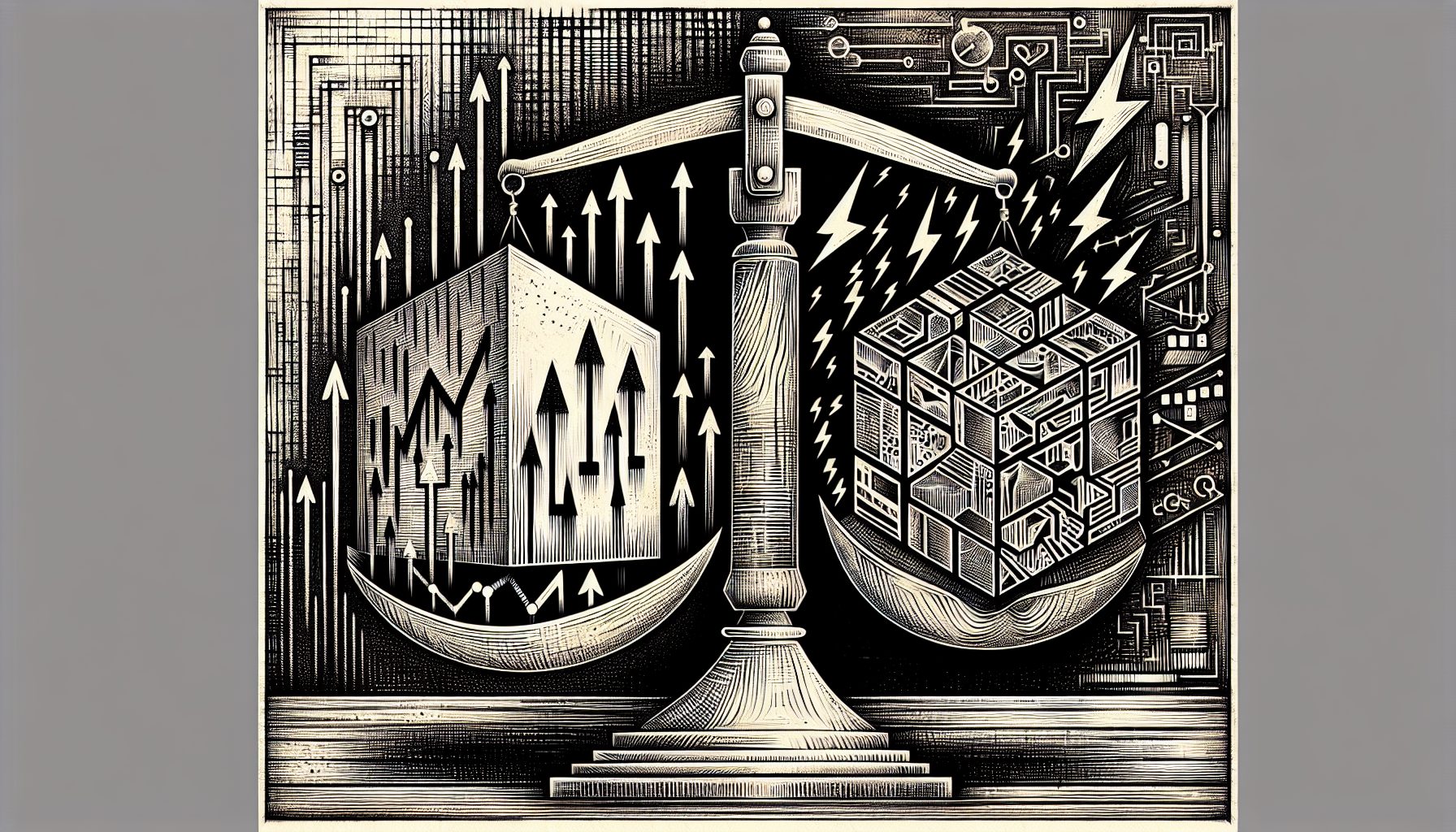

Factors Influencing Recent Volatility in Live Music Stocks

The recent volatility in live music stocks stems from a confluence of factors impacting the broader economy and the entertainment industry specifically.

- Inflationary pressures: Rising costs for everything from venue rentals to artist fees have squeezed profit margins. This has led to some ticket price increases, potentially affecting consumer spending. However, strong demand suggests consumers are still willing to pay for live experiences.

- Economic uncertainty: Global economic uncertainty and concerns about a potential recession have made investors hesitant, leading to fluctuations across various market sectors, including entertainment.

- Post-pandemic recovery: The recovery from the pandemic has been uneven across different geographic markets and segments of the live music industry. Some regions have bounced back strongly, while others are still lagging.

- Supply chain disruptions: Supply chain issues continue to impact event production, leading to increased costs and logistical challenges for promoters. Securing necessary equipment and personnel remains a concern.

- Artist cancellations: Unexpected artist cancellations due to illness or other reasons can significantly impact event revenue and investor confidence, creating short-term volatility.

Understanding these factors is crucial for assessing the risks and opportunities in the live music stock market.

Analyzing the Long-Term Outlook for Live Music Stocks

Despite recent volatility, the long-term outlook for live music stocks remains relatively positive. Several key factors support this view:

- Technological innovation's impact: The integration of technology, including livestreaming and virtual concert experiences, offers new revenue streams and opportunities for reaching wider audiences. This diversification mitigates risks associated with solely relying on in-person events.

- Shifting consumer preferences: While digital entertainment remains popular, there's a strong and persistent demand for in-person live music experiences, which are considered irreplaceable by many fans.

- The competitive landscape and its effects: While competition exists, the industry is also characterized by consolidation, with larger players acquiring smaller promoters. This leads to greater market share and stability for the top companies.

However, investors should remain aware of potential risks associated with external economic conditions, unforeseen events, and competitive pressures.

Investment Strategies for Live Music Stocks

Investing in live music stocks requires a considered approach that aligns with individual risk tolerance and investment goals.

- Diversification strategies for reducing risk: Don't put all your eggs in one basket. Diversify your portfolio across different live music companies and other asset classes to reduce overall risk.

- Long-term investment strategies for growth: The live music industry is cyclical but shows resilience over the long term. A long-term investment strategy can help you weather short-term market fluctuations and benefit from the sector's growth potential.

- Risk assessment and tolerance levels: Understand your comfort level with risk before investing. Live music stocks can be volatile, so only invest what you can afford to lose.

- Considering sector-specific ETFs focused on entertainment: Exchange-traded funds (ETFs) focused on entertainment or media can offer a diversified way to gain exposure to the live music sector without concentrating your investment in individual companies.

Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Conclusion

The pre-market gains in live music stocks suggest a potential rebound after a period of volatility. While various factors continue to influence the market, the positive indicators suggest a cautiously optimistic outlook for the sector. However, it is crucial to consider the long-term trends and conduct thorough research before investing in live music stocks, or any stock for that matter. Stay informed about the latest developments in the live music stocks market and make informed investment decisions based on thorough research and analysis of live music stocks and related market data. Regularly check for updates on market performance and news related to the live music industry.

Featured Posts

-

Krizis V Mongolii Massovoe Zarazhenie Koryu

May 30, 2025

Krizis V Mongolii Massovoe Zarazhenie Koryu

May 30, 2025 -

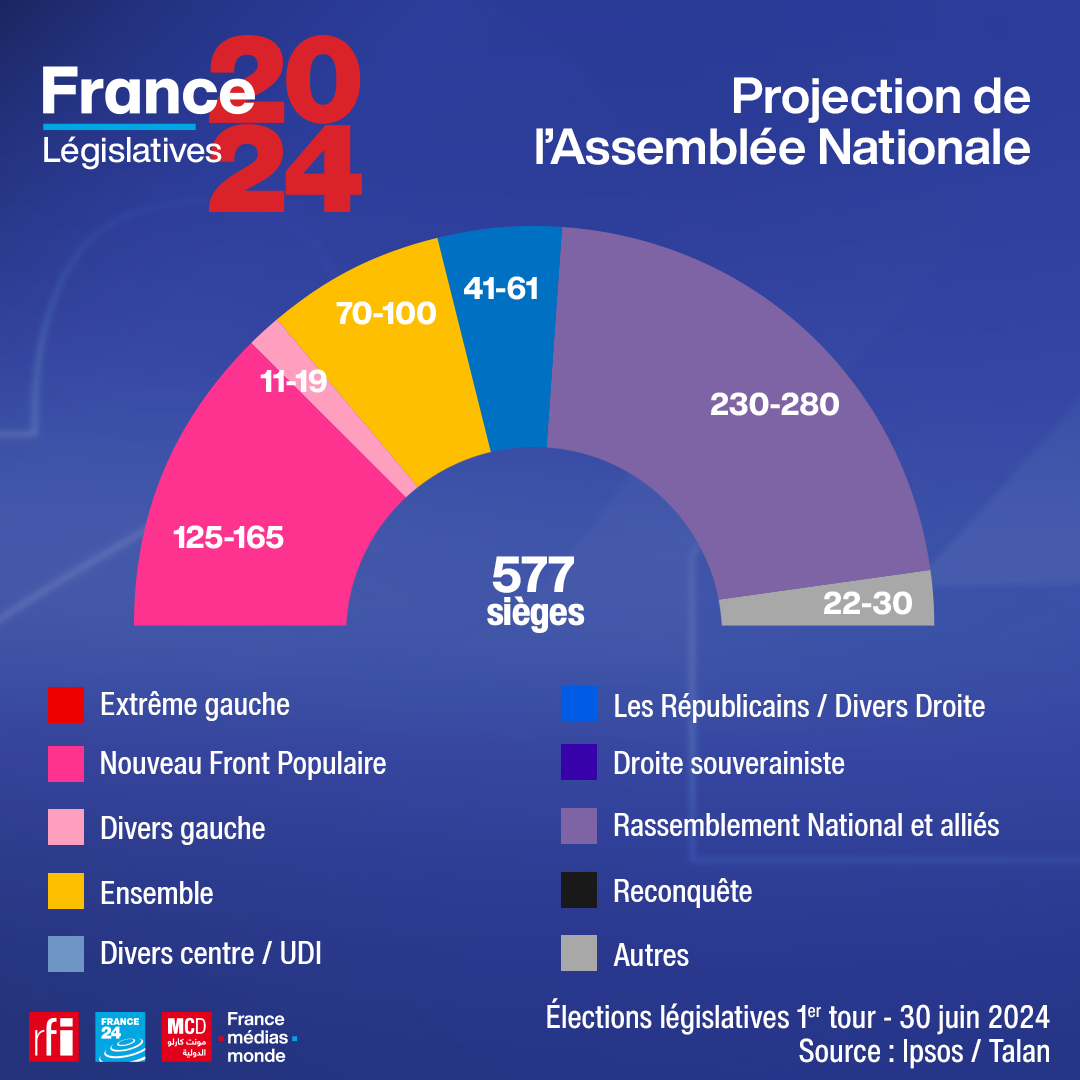

L Assemblee Nationale Analyse Du Positionnement Du Rn Face A Lfi

May 30, 2025

L Assemblee Nationale Analyse Du Positionnement Du Rn Face A Lfi

May 30, 2025 -

Wie Steffi Graf Und Andre Agassi Im Pickleball Erfolgreich Sind

May 30, 2025

Wie Steffi Graf Und Andre Agassi Im Pickleball Erfolgreich Sind

May 30, 2025 -

Honda Vs Yamaha At Le Mans An Unexpected Rivalry

May 30, 2025

Honda Vs Yamaha At Le Mans An Unexpected Rivalry

May 30, 2025 -

Kawasaki Disease Etiology Emerging Data Implicates A Unique Respiratory Virus

May 30, 2025

Kawasaki Disease Etiology Emerging Data Implicates A Unique Respiratory Virus

May 30, 2025