Live Music Stock Slide: Friday's Expected Dip

Table of Contents

Underlying Factors Contributing to the Live Music Stock Slide

Several interconnected factors contribute to the anticipated live music stock slide. These factors create a perfect storm impacting profitability and investor confidence.

Inflation and Increased Operational Costs

Rising inflation significantly impacts the live music industry. Increased costs across the board are squeezing profit margins and affecting consumer behavior.

- Increased production costs squeezing profit margins: Venue rentals, artist fees, equipment costs, staffing wages – all are rising, directly impacting the bottom line for promoters and venues. This reduces profitability and makes it harder to justify current stock valuations.

- Higher ticket prices potentially deterring some attendees: To offset increased costs, many live music events are forced to raise ticket prices. This can lead to decreased attendance, especially among budget-conscious consumers. The elasticity of demand in the live music sector becomes a critical factor.

- Analysis of the impact of inflation on major live music companies: Major players in the industry are reporting reduced profit margins and increased operating expenses. This is reflected in their financial reports and analyst predictions, contributing to the negative outlook for Friday's market performance. This decreased profitability directly translates to lower stock valuations.

Post-Pandemic Market Saturation and Competition

The post-pandemic resurgence of live music has led to a surge in events and increased competition. This intense competition is putting pressure on profitability and pricing.

- Increased number of concerts leading to diluted audience reach: With more events vying for the same audience pool, it's harder for individual concerts to sell out and maximize revenue. This leads to underperforming events and impacts overall revenue for companies involved.

- Competition for talent driving up artist fees: High demand for popular artists leads to bidding wars, driving up their fees and putting further pressure on promoters’ budgets. Securing top talent becomes increasingly expensive, impacting profitability.

- Discussion of market saturation and its effect on stock prices: The market is simply oversaturated in some areas. This oversupply directly translates to reduced prices and lower returns, thereby impacting investor confidence and stock valuations negatively.

Economic Uncertainty and Consumer Sentiment

Concerns about a potential recession are impacting consumer spending, a critical factor for the live music industry which relies heavily on discretionary income.

- Decreased discretionary spending impacting ticket purchases: As consumers tighten their belts, live music events – often seen as a luxury – are among the first things to be cut from budgets. This directly reduces ticket sales and revenue.

- Analysis of consumer confidence indices and their correlation to live music attendance: A correlation exists between consumer confidence and attendance at live events. Lower confidence indicators directly translate to reduced attendance and negatively impact live music stock.

- Impact of economic uncertainty on investor confidence in the sector: Economic uncertainty naturally leads to investors seeking safer, more stable investments. The perceived risk in the live music sector increases, driving down demand for related stocks.

Specific Stocks Expected to be Affected

Several major publicly traded companies in the live music industry are expected to experience a decline on Friday. This includes:

- Live Nation Entertainment (LYV): The world's leading live entertainment company is highly susceptible to economic downturns and market saturation. [Link to relevant financial news source]

- Ticketmaster (part of Live Nation): As the dominant ticketing platform, Ticketmaster is directly impacted by reduced ticket sales. [Link to relevant financial news source]

- AEG Presents: A major concert promoter, AEG Presents faces similar challenges to Live Nation, including increased costs and competition. [Link to relevant financial news source]

- Super Group (SGHC): While not solely focused on live music, their significant investment in entertainment ventures makes them vulnerable to the predicted downturn. [Link to relevant financial news source]

The predicted decline for these companies stems from their exposure to various market segments and their dependence on consumer spending. Their financial performance reflects the challenges discussed above.

Strategies for Investors During the Live Music Stock Slide

Navigating this potential live music stock slide requires strategic planning and risk management.

- Recommendation for diversification of investment portfolios: Diversification is key. Reducing exposure to the live music sector by spreading investments across different asset classes can mitigate potential losses.

- Suggestions for risk management strategies in the face of the expected downturn: Implementing stop-loss orders to limit potential losses and considering hedging strategies can help manage risk.

- Discussion of long-term investment opportunities within the live music industry: While the short-term outlook might be negative, the long-term prospects of the live music industry remain strong. Investing in resilient companies with strong fundamentals might present long-term growth opportunities.

Conclusion

This article analyzed the anticipated "Live Music Stock Slide" on Friday, examining the confluence of factors contributing to the predicted downturn. From increased operational costs and market saturation to broader economic uncertainties, several challenges are impacting the live music industry’s stock performance. The interconnectedness of inflation, competition, and consumer sentiment creates a complex scenario for investors.

Call to Action: Understanding the potential for a live music stock slide is crucial for informed investment decisions. Stay informed about market trends and consult with a financial advisor before making any investment choices relating to the live music sector. Learn more about mitigating risks associated with a live music stock slide by researching further into the companies mentioned and their financial performance. Careful consideration and proactive risk management are vital for navigating this challenging market.

Featured Posts

-

Kawasaki Ninja 500 Dan 500 Se 2025 Harga Rp100 Juta Lebih

May 30, 2025

Kawasaki Ninja 500 Dan 500 Se 2025 Harga Rp100 Juta Lebih

May 30, 2025 -

Des Moines Public Schools Temporarily Suspends Central Campus Agriscience Program

May 30, 2025

Des Moines Public Schools Temporarily Suspends Central Campus Agriscience Program

May 30, 2025 -

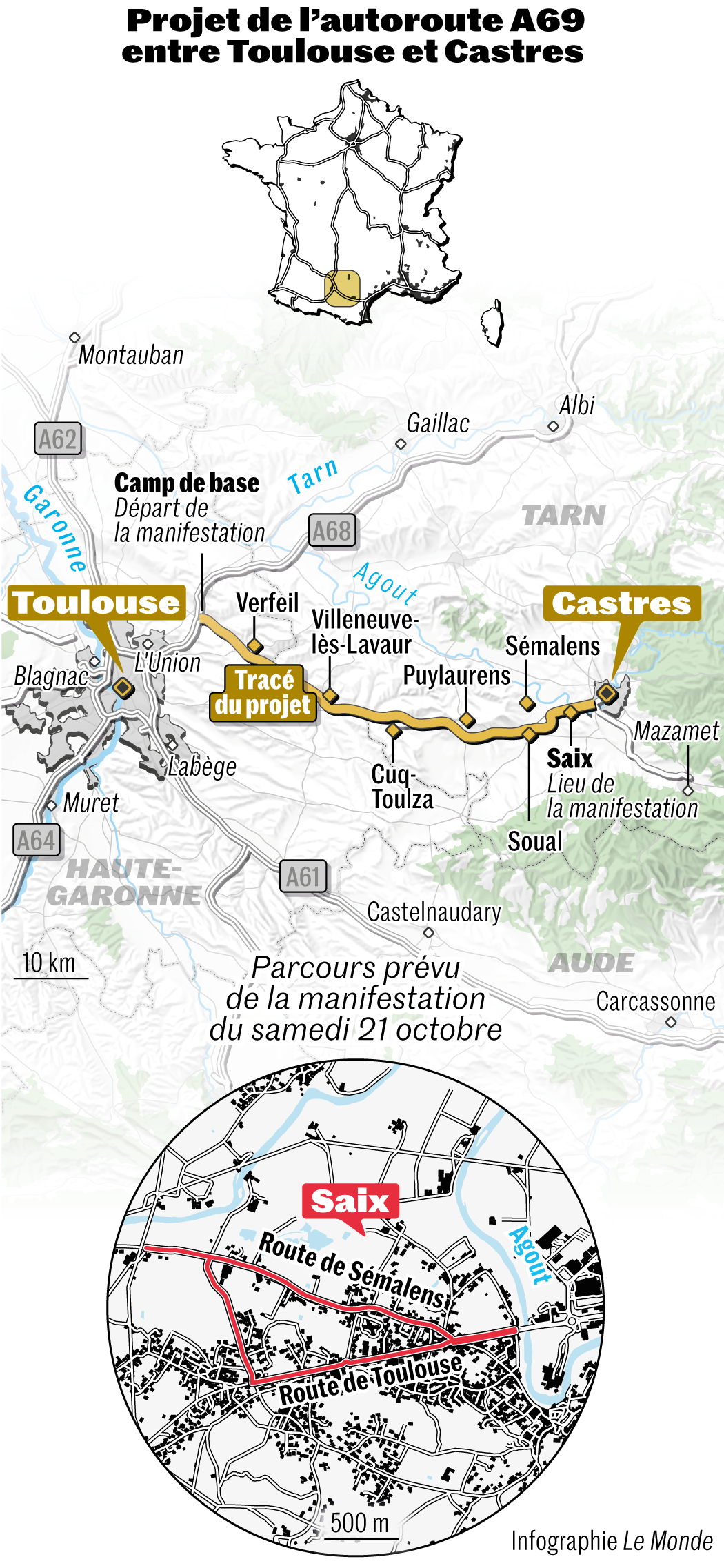

Recours De L Etat Le Projet A69 Sud Ouest Reprend Il Vie

May 30, 2025

Recours De L Etat Le Projet A69 Sud Ouest Reprend Il Vie

May 30, 2025 -

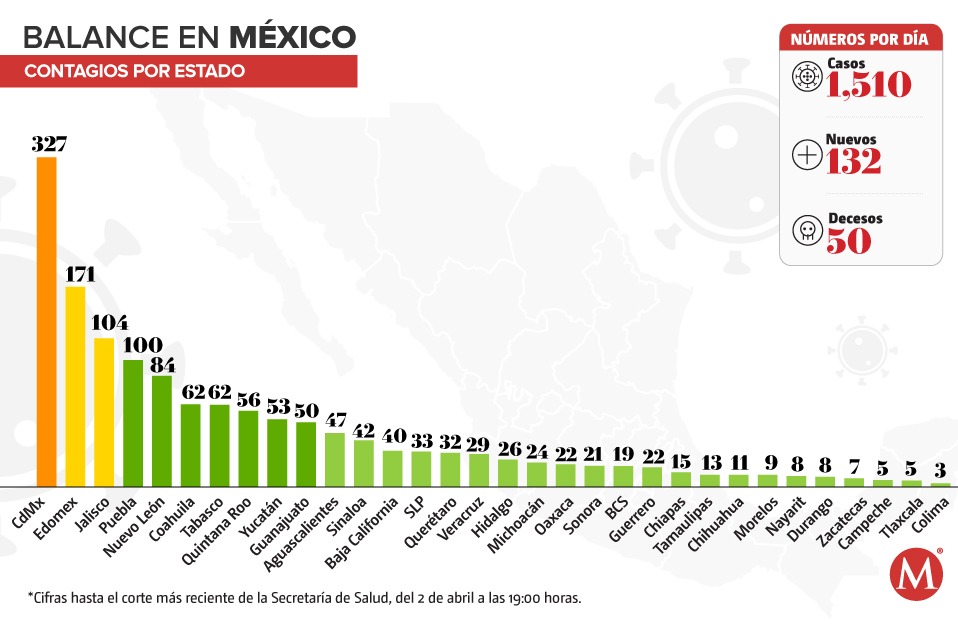

Reporte Caida De Ticketmaster El 8 De Abril Grupo Milenio

May 30, 2025

Reporte Caida De Ticketmaster El 8 De Abril Grupo Milenio

May 30, 2025 -

Southeast Asian Solar Imports Face Massive Us Tariffs 3 521 Duty Increase

May 30, 2025

Southeast Asian Solar Imports Face Massive Us Tariffs 3 521 Duty Increase

May 30, 2025