Live Nation Entertainment (LYV): Investor Strategies And Stock Outlook

Table of Contents

Live Nation Entertainment (LYV) is a global behemoth in the live entertainment industry, holding a dominant position in the concert and ticketing markets. For investors, understanding the nuances of its business model and market standing is paramount to successfully navigating this dynamic sector. This comprehensive analysis delves into effective investor strategies for Live Nation Entertainment stock and provides a detailed outlook on its future performance.

Understanding Live Nation Entertainment's Business Model

Dominance in Live Music

Live Nation's influence on the live music landscape is undeniable. It boasts a significant market share, controlling various aspects of the concert business, creating a powerful vertically integrated model. This control extends from owning and operating numerous venues worldwide to its dominant ticketing platform, Ticketmaster, and even artist management services.

- Market Share Statistics: While precise figures fluctuate, Live Nation commands a substantial portion of the global concert promotion market, solidifying its position as the industry leader. Precise numbers require referencing their financial reports and industry analysis.

- Revenue Breakdown by Segment: Live Nation's revenue is diversified across its segments: venues, ticketing, and artist management. This diversification mitigates risk and allows for stable growth across various economic conditions. Analyzing the revenue breakdown from their quarterly reports offers valuable insights.

- Competitive Advantages: Live Nation benefits from significant scale, strong brand recognition, and strategic relationships with major artists and venues, creating barriers to entry for competitors. This gives them a clear advantage in the market.

Ticketmaster's Role and Impact

Ticketmaster, a subsidiary of Live Nation Entertainment, plays a pivotal role in the company's overall success. Its dominance in ticketing generates substantial revenue and provides valuable data on consumer preferences, artist popularity, and market trends.

- Ticketmaster Revenue: Ticketmaster contributes significantly to Live Nation's total revenue, highlighting the strategic importance of this segment. Regular review of Live Nation's financial reports will give current figures.

- Technological Innovations: Ticketmaster's continuous investment in technological advancements, such as mobile ticketing and dynamic pricing, enhances efficiency and improves the customer experience, leading to increased revenue and customer satisfaction.

- Potential Antitrust Concerns: Ticketmaster's market dominance has drawn antitrust scrutiny in the past. Understanding potential regulatory risks and their impact on the LYV stock price is crucial for investors.

Artist Relationships and Booking Power

Live Nation's success hinges on its strong relationships with leading artists. Its extensive network and booking power allow it to secure top talent for its venues and festivals, directly impacting attendance and revenue.

- Examples of Key Artist Partnerships: Analyzing successful partnerships with major artists reveals Live Nation’s ability to secure high-profile acts and events, impacting attendance and profitability.

- Booking Strategies: Live Nation employs sophisticated booking strategies that leverage data analysis and market trends to maximize revenue and minimize risk.

- Impact on Concert Attendance and Revenue: The quality of artists secured directly influences concert attendance and ultimately, the financial performance of the company.

Analyzing LYV Stock Performance and Valuation

Historical Stock Performance

Live Nation Entertainment's stock performance has mirrored the overall health of the entertainment industry and broader economic conditions. Analyzing its historical performance offers valuable insights for potential investors.

- Key Historical Milestones: Identifying key events – such as acquisitions, economic downturns, or technological disruptions – and correlating them with the stock's price reveals patterns and potential future impacts.

- Stock Price Charts and Trends: Reviewing historical stock charts provides a visual representation of LYV's past performance, highlighting trends and volatility.

- Analysis of Past Performance Indicators: Analyzing key metrics like Earnings Per Share (EPS) and revenue growth helps predict future performance and valuation.

Current Valuation and Future Projections

Evaluating LYV's current valuation is critical for determining if the stock is undervalued or overvalued. This requires comparing current metrics with future projections.

- Key Valuation Metrics: Metrics like Price-to-Earnings (P/E) ratio, market capitalization, and revenue multiples provide a snapshot of the company's valuation relative to its peers and historical data.

- Analysts' Price Targets: Consolidating and comparing analysts' price targets offers a range of potential future share price values.

- Projected Revenue Growth: Analyzing future revenue projections, considering industry trends and Live Nation's growth strategies, helps to estimate future stock performance.

- Potential Risks and Opportunities: Identifying potential risks (e.g., economic downturns, competition) and opportunities (e.g., market expansion, new technologies) is crucial for informed investment decisions.

Dividends and Share Buybacks

Live Nation's dividend policy (or lack thereof) and any share buyback programs influence investor returns. Understanding this is vital for assessing potential income generation and long-term growth.

- Dividend History: Reviewing the company's dividend history provides insights into their payout policy and consistency.

- Dividend Yield (if applicable): The dividend yield, if applicable, shows the return on investment from dividends relative to the stock price.

- Share Buyback Program Details: Details on share buyback programs reveal the company's commitment to increasing shareholder value.

- Impact on Shareholder Value: Assessing the overall impact of dividends and buybacks on shareholder value over time is crucial for evaluating investment potential.

Investor Strategies for Live Nation Entertainment (LYV)

Long-Term Investment Approach

A long-term investment strategy for LYV stock offers significant potential, given the anticipated growth of the live music industry.

- Reasons for Long-Term Investment: The long-term growth potential of the live entertainment industry, coupled with Live Nation’s market leadership, provides a compelling case for long-term investment.

- Risk Tolerance: Long-term investing requires accepting a higher risk tolerance for potential higher rewards.

- Potential for Capital Appreciation: The long-term growth trajectory of the company presents significant potential for capital appreciation.

Short-Term Trading Strategies

Short-term trading strategies in LYV stock may be considered but require careful analysis and higher risk tolerance.

- Technical Indicators: Technical indicators such as moving averages, relative strength index (RSI), and volume analysis can aid in short-term trading decisions.

- News Events to Watch: Major news events, such as artist tours, festival announcements, or financial reports, can significantly impact LYV's short-term stock price.

- Potential Risks of Short-Term Trading: Short-term trading is highly volatile and carries increased risk compared to long-term investing.

Diversification and Portfolio Allocation

Diversification is crucial for minimizing risk within any investment portfolio.

- Importance of Diversification: Diversifying across different asset classes and sectors reduces the impact of any single investment performing poorly.

- Optimal Allocation Strategies: The optimal allocation of LYV stock within an investment portfolio depends on individual risk tolerance and investment goals.

Conclusion

Live Nation Entertainment (LYV) presents a compelling investment opportunity within the dynamic live entertainment sector. By thoroughly analyzing its business model, understanding its historical and projected stock performance, and implementing well-defined investment strategies, investors can potentially reap the benefits of the company's continued growth. Remember to conduct thorough due diligence and carefully consider your risk tolerance before investing in LYV stock or any other security. Learn more about optimizing your Live Nation Entertainment (LYV) investment strategy and maximize your potential returns.

Featured Posts

-

The Nature And Reach Of Eric Damaseaus Anti Lgbt You Tube Videos

May 29, 2025

The Nature And Reach Of Eric Damaseaus Anti Lgbt You Tube Videos

May 29, 2025 -

Tate Mc Raes Morgan Wallen Collaboration A Political Controversy

May 29, 2025

Tate Mc Raes Morgan Wallen Collaboration A Political Controversy

May 29, 2025 -

Best Office Chairs Of 2025 Tried And Tested

May 29, 2025

Best Office Chairs Of 2025 Tried And Tested

May 29, 2025 -

O Captain America Xairetaei Ton Tramp Stratiotikos Xairetismos Prokalei Sygxysi

May 29, 2025

O Captain America Xairetaei Ton Tramp Stratiotikos Xairetismos Prokalei Sygxysi

May 29, 2025 -

Guia Para Entender Los Arcanos Menores En El Tarot

May 29, 2025

Guia Para Entender Los Arcanos Menores En El Tarot

May 29, 2025

Latest Posts

-

Improve Your Severe Weather Awareness Tom Atkins Skywarn Class

May 31, 2025

Improve Your Severe Weather Awareness Tom Atkins Skywarn Class

May 31, 2025 -

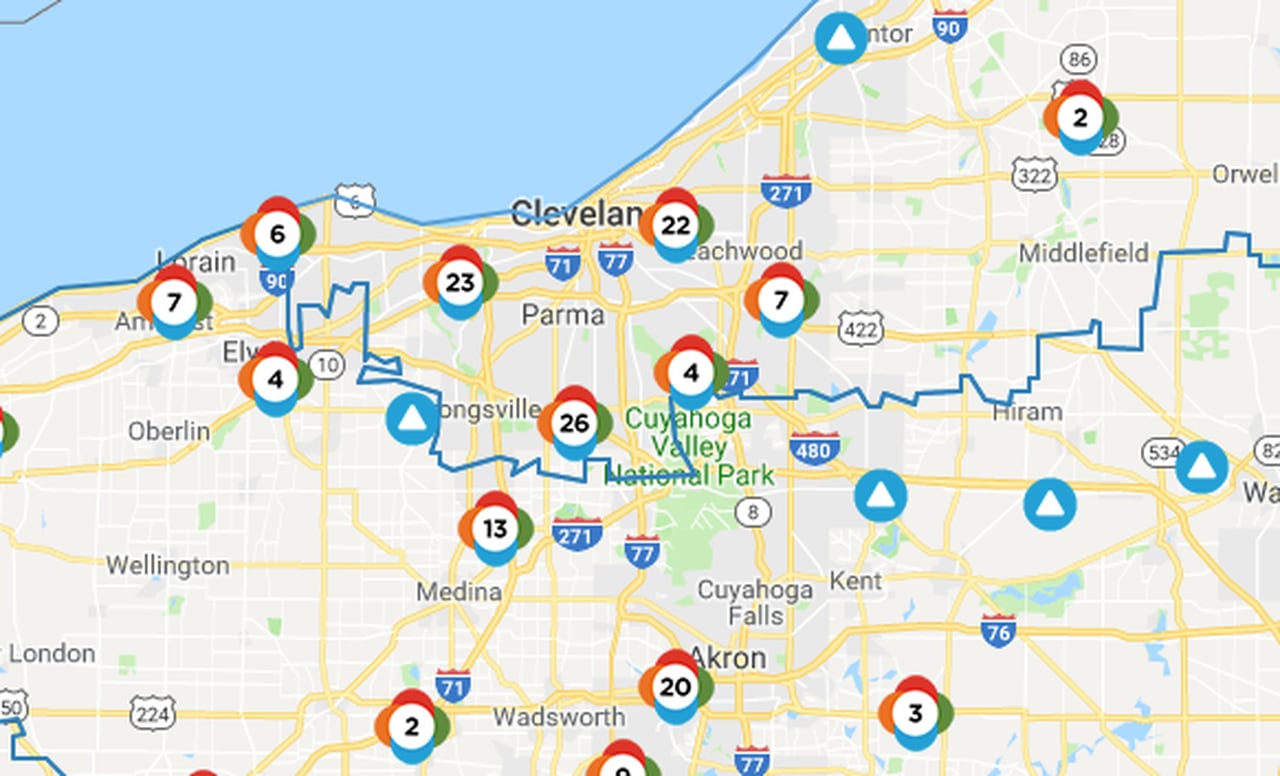

Northeast Ohio Power Outages Latest Statistics And Restoration Efforts

May 31, 2025

Northeast Ohio Power Outages Latest Statistics And Restoration Efforts

May 31, 2025 -

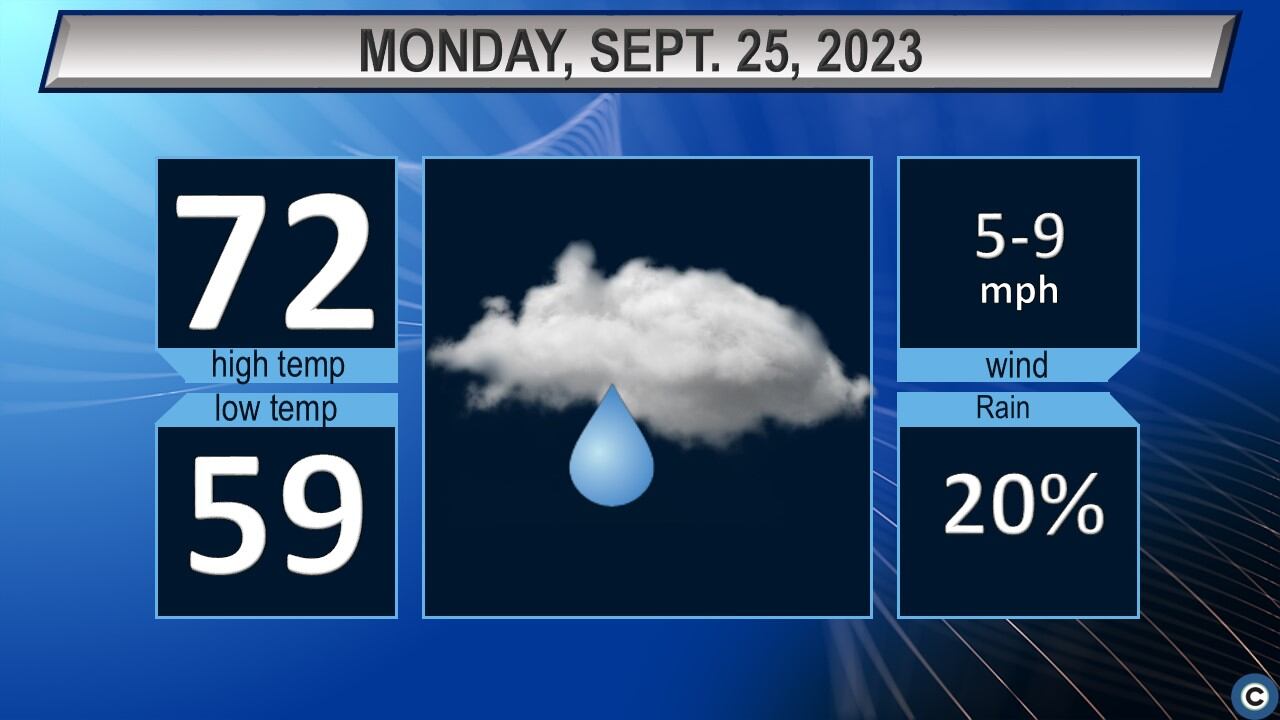

Northeast Ohio Thunderstorms Weather Alerts And Power Outages

May 31, 2025

Northeast Ohio Thunderstorms Weather Alerts And Power Outages

May 31, 2025 -

Election Day Weather Forecast Northeast Ohio Faces Potential Showers

May 31, 2025

Election Day Weather Forecast Northeast Ohio Faces Potential Showers

May 31, 2025 -

Power Outages In Northeast Ohio Current Numbers And Updates

May 31, 2025

Power Outages In Northeast Ohio Current Numbers And Updates

May 31, 2025