Live Nation (LYV): A Deep Dive Into Current Market Sentiment

Table of Contents

Live Nation Entertainment, Inc. (LYV) is a leading global live entertainment company, boasting a business model encompassing ticket sales, venue operations, artist management, and sponsorship. Its reach extends across numerous key markets worldwide, solidifying its position as a significant player in the global economy. This analysis aims to provide a comprehensive understanding of the current investor outlook for LYV stock.

Live Nation's Recent Financial Performance and Future Outlook

Live Nation's recent financial performance provides a crucial insight into current market sentiment. Analyzing quarterly and annual reports reveals key trends. The company's revenue growth is largely driven by strong ticket sales, fueled by a return to live events after pandemic restrictions eased. However, inflation and increased operating costs are factors to consider.

- Revenue Figures: Reviewing LYV's recent filings shows significant year-over-year revenue growth, exceeding pre-pandemic levels. Specific figures will need to be updated based on the most recent financial reports.

- Key Revenue Drivers: Ticket sales remain the cornerstone of Live Nation's revenue, supplemented by substantial income from sponsorships and other ancillary revenue streams. The success of their diverse revenue model mitigates risk compared to companies relying solely on ticket sales.

- Profitability Analysis: Profit margins are influenced by various factors, including venue operating costs, artist fees, and marketing expenses. A detailed analysis of the profit margin trends helps assess the company's financial health and long-term prospects.

- Debt Levels and Financial Health: Assessing Live Nation's debt-to-equity ratio and overall financial leverage is essential for evaluating its long-term sustainability and its ability to weather economic downturns. A healthy balance sheet indicates resilience to potential market fluctuations. Acquisitions and expansion plans also impact financial health.

Analysis of Analyst Ratings and Price Targets for LYV Stock

Analyst ratings and price targets offer valuable insights into market sentiment towards LYV stock. A consensus of ratings from major financial analysts paints a broader picture of investor confidence.

- Consensus Rating: A summary of buy, hold, and sell ratings from prominent financial institutions offers a weighted average sentiment towards Live Nation. The ratio of buy to sell ratings helps gauge the overall bullishness or bearishness of the analyst community.

- Price Targets: The range of price targets offered by analysts reflects varying expectations for LYV's future performance. A wide range indicates uncertainty among analysts, while a narrow range suggests stronger consensus regarding future valuation.

- Factors Influencing Ratings: Analyst opinions are shaped by various factors, including Live Nation's financial performance, macroeconomic conditions, competitive landscape, and potential risks and opportunities. Understanding these influences helps contextualize the ratings.

Impact of Macroeconomic Factors on Live Nation (LYV)

Macroeconomic conditions significantly impact the live entertainment industry. Inflation, recessionary fears, and geopolitical events all influence consumer spending and concert attendance.

- Inflation and Consumer Spending: Rising inflation can impact consumer discretionary spending, potentially affecting ticket sales. Analyzing consumer trends regarding entertainment spending is critical.

- Interest Rates and Financing Costs: Higher interest rates increase Live Nation's borrowing costs, impacting profitability. Assessing the company's ability to manage debt in a rising-rate environment is important.

- Geopolitical Events and Operational Risks: Geopolitical instability can disrupt concert tours, affect travel patterns, and present operational challenges. Analyzing potential risks from these events is key to understanding future performance.

Competitive Landscape and Market Share

Live Nation operates in a competitive landscape. Understanding its market share and competitive advantages is essential for assessing its future performance.

- Major Competitors: Identifying key competitors, such as AEG Presents, and analyzing their market share helps gauge Live Nation's dominance within the industry.

- Market Share Comparison: Evaluating Live Nation's market share relative to competitors highlights its competitive position and potential for future growth.

- Competitive Strategies: Analyzing Live Nation's competitive strategies, such as acquisitions, technological innovation, and diversification, illuminates its capacity to maintain market leadership.

Conclusion: Summarizing Market Sentiment on Live Nation (LYV)

In summary, the current market sentiment toward Live Nation (LYV) is largely positive, driven by strong financial performance and a resurgence in live events. However, macroeconomic uncertainties and competitive pressures present potential risks. Analyst ratings are generally favorable, but price targets vary reflecting differing perspectives on future growth.

While this deep dive into Live Nation (LYV) provides valuable insights into current market sentiment, remember to always conduct your own comprehensive research and consider consulting a financial advisor before making any investment decisions related to LYV stock or other live entertainment investments. Understanding the nuances of the Live Nation business model and the factors influencing its performance is crucial for informed decision-making in this dynamic sector.

Featured Posts

-

Impact Of Winners Speech Brisbane Council Ends Queensland Music Awards Funding

May 29, 2025

Impact Of Winners Speech Brisbane Council Ends Queensland Music Awards Funding

May 29, 2025 -

All Air Jordans Dropping In June 2025 Release Dates And Details

May 29, 2025

All Air Jordans Dropping In June 2025 Release Dates And Details

May 29, 2025 -

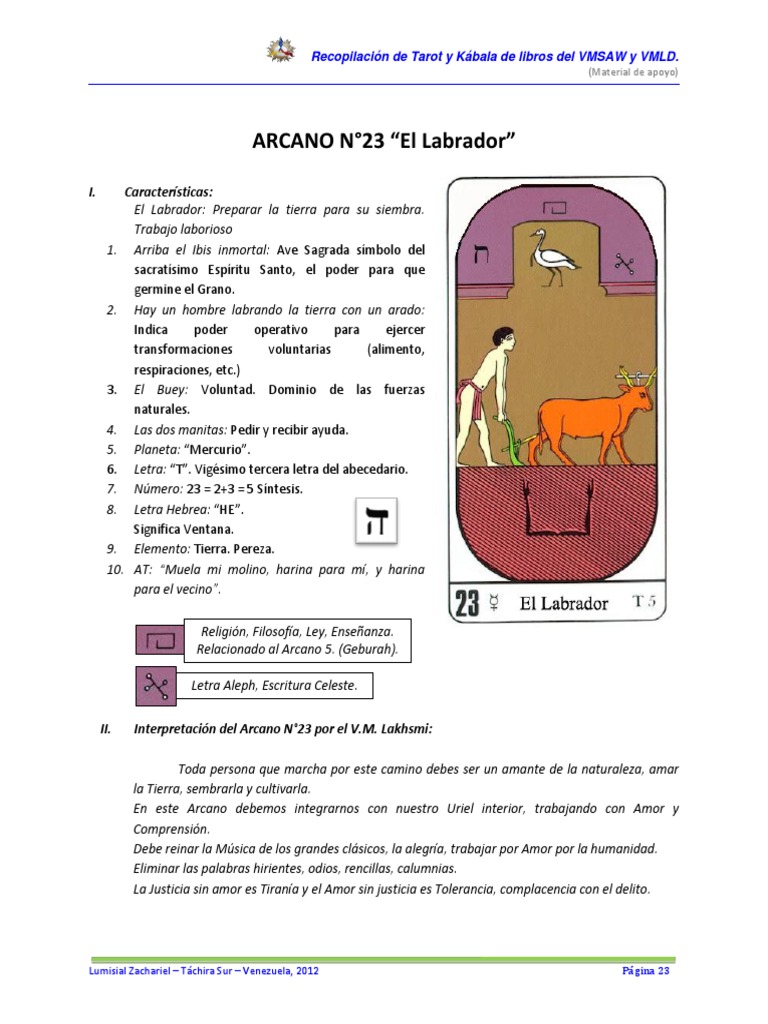

Guia Para Entender Los Arcanos Menores En El Tarot

May 29, 2025

Guia Para Entender Los Arcanos Menores En El Tarot

May 29, 2025 -

A Look At The Nickname Morgan Wallens Grandma Uses

May 29, 2025

A Look At The Nickname Morgan Wallens Grandma Uses

May 29, 2025 -

Pacers Decision Mathurins Latest Message Demands Action

May 29, 2025

Pacers Decision Mathurins Latest Message Demands Action

May 29, 2025