Live Now, Pay Later: Your Guide To Smart Spending

Table of Contents

Understanding Live Now, Pay Later (LNPL) Schemes

How LNPL Works

Live now, pay later services allow you to purchase goods and services and pay for them in installments over a set period. The application process is typically quick and straightforward, often requiring minimal credit checks or none at all. Payment schedules are usually structured with interest-free periods, often lasting a few weeks, followed by interest-bearing repayments if the full balance isn't settled within that timeframe. The interest rates and fees can vary significantly depending on the provider.

- Examples of popular LNPL providers: Afterpay, Klarna, Affirm, PayPal Pay in 4.

- Typical repayment periods: 4-6 weeks for interest-free periods; longer periods with interest charges.

- Typical APRs (Annual Percentage Rates): These vary greatly but can range from 0% during the interest-free period to upwards of 20% or more if payments are missed or not paid in full within the grace period.

- Interest-free periods: These are crucial to understand. Missing payments during the interest-free period can instantly result in significant interest charges being applied retroactively.

Types of LNPL Services

The live now, pay later landscape encompasses several different service types:

- Point-of-sale financing: Offered directly by retailers at the checkout, allowing you to finance your purchase directly through the store.

- Buy now, pay later (BNPL) apps: Standalone apps like Afterpay or Klarna, which allow you to use their services across various participating retailers.

- Other variations: Some credit cards offer similar installment plans, although typically with a more rigorous credit check.

Responsible Use of Live Now, Pay Later

Budgeting and Financial Planning

Before using any LNPL service, creating a realistic budget is paramount. Only use LNPL for essential purchases or planned expenses you can comfortably afford to repay within the given timeframe. Avoid impulsive buys!

- Tips for creating a budget: Track your income and expenses, categorize spending, identify areas to cut back.

- Tracking spending: Utilize budgeting apps or spreadsheets to monitor your spending and ensure you stay within your limits.

- Understanding your debt-to-income ratio: This crucial metric reveals the percentage of your income going towards debt repayment. A high ratio indicates a potential financial strain.

Avoiding Debt Traps

Over-reliance on multiple LNPL services can quickly lead to a debt spiral. Missed payments accumulate interest and fees, making it difficult to manage your finances effectively.

- Setting spending limits: Determine a maximum amount you'll spend using LNPL each month, and stick to it.

- Sticking to repayment schedules: Set reminders to ensure on-time payments and avoid late fees.

- Avoid relying solely on LNPL: It's a supplementary payment method, not a primary financial solution.

Credit Score Impact

While LNPL providers may not always perform traditional credit checks, missed payments can still negatively impact your credit score. These services often report payment history to credit bureaus.

- How late payments affect credit scores: Late or missed payments can significantly lower your credit score, impacting your ability to secure loans or credit in the future.

- Importance of on-time repayments: Consistent and timely payments demonstrate responsible financial behavior.

- Maintaining a good credit history: Responsible LNPL use is one factor that can contribute to building good credit.

Alternatives to Live Now, Pay Later

Traditional Credit Cards

Credit cards offer flexibility but come with higher interest rates and fees than some LNPL options. Rewards programs can be beneficial, but responsible usage is crucial.

- Interest rates: Credit card interest rates are generally higher than those offered by some LNPL providers (though not all).

- Rewards programs: Some credit cards offer cashback or points on purchases.

- Credit limits: Credit cards offer pre-approved spending limits, providing a clearer financial boundary.

Saving and Budgeting

The most responsible approach to purchases is saving up beforehand. This avoids debt and encourages mindful spending.

- Strategies for saving money: Create a savings plan, automate transfers, cut unnecessary expenses.

- Setting financial goals: Define your savings objectives and track your progress.

Negotiated Payment Plans

For large purchases, explore negotiated payment plans directly with retailers. This can provide a more manageable repayment schedule.

- How to approach retailers: Politely inquire about payment plans, outlining your financial situation.

- Potential benefits and drawbacks: Negotiated plans may offer more flexibility, but be aware of potential interest or fees.

Conclusion

Live now, pay later services offer convenience, but responsible usage is paramount. By understanding the mechanics of live now, pay later and employing responsible financial strategies, you can leverage this convenient payment method without falling into debt traps. Creating a budget, tracking spending, and avoiding over-reliance on LNPL are crucial steps. Explore alternatives like saving, using credit cards responsibly, or negotiating payment plans with retailers. Make smart choices and live within your means! Use live now, pay later wisely, and prioritize responsible financial management.

Featured Posts

-

Hhs Letter Sparks Outrage Providers Questioned On Transgender Care Protocols

May 30, 2025

Hhs Letter Sparks Outrage Providers Questioned On Transgender Care Protocols

May 30, 2025 -

Bruno Fernandes Al Hilal Negocia Com O Agente Do Jogador

May 30, 2025

Bruno Fernandes Al Hilal Negocia Com O Agente Do Jogador

May 30, 2025 -

Public Outcry 100 000 Sign Petition To Remove Jon Jones Title

May 30, 2025

Public Outcry 100 000 Sign Petition To Remove Jon Jones Title

May 30, 2025 -

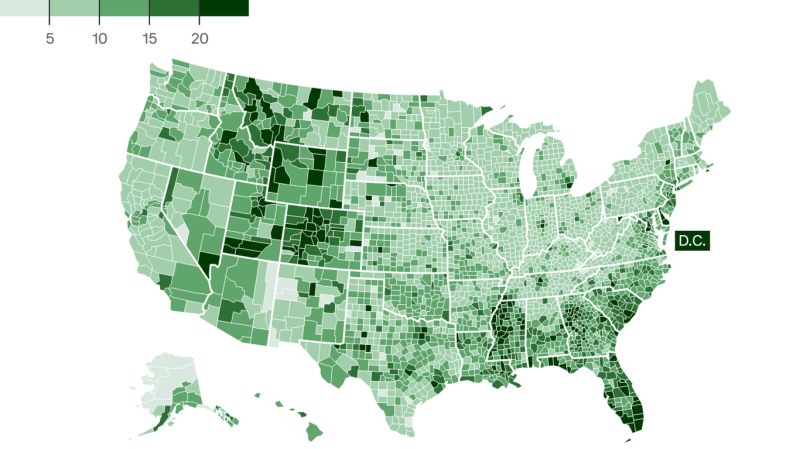

Investment Opportunities New Business Hot Spots In Country Name

May 30, 2025

Investment Opportunities New Business Hot Spots In Country Name

May 30, 2025 -

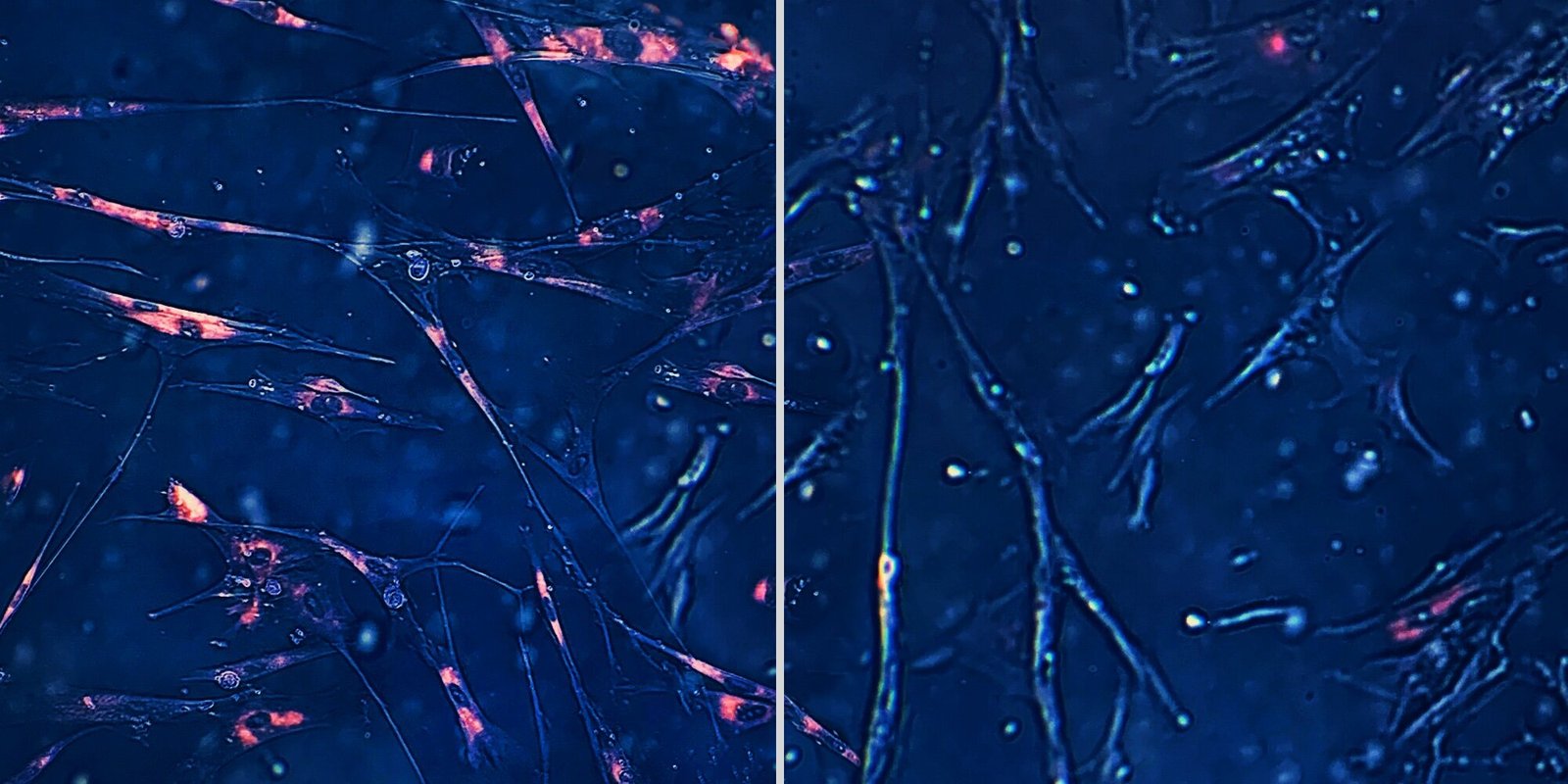

Crisprs Potential Efficient Whole Gene Insertion In Human Dna

May 30, 2025

Crisprs Potential Efficient Whole Gene Insertion In Human Dna

May 30, 2025

Latest Posts

-

Perspectives Boursieres De Sanofi L Analyse De Loeil Du Loup

May 31, 2025

Perspectives Boursieres De Sanofi L Analyse De Loeil Du Loup

May 31, 2025 -

Dren Bio Et Sanofi Collaboration Strategique Pour Le Traitement Des Maladies Immunologiques

May 31, 2025

Dren Bio Et Sanofi Collaboration Strategique Pour Le Traitement Des Maladies Immunologiques

May 31, 2025 -

Sanofi Quel Potentiel Boursier Reste T Il L Avis De Loeil Du Loup De Zurich

May 31, 2025

Sanofi Quel Potentiel Boursier Reste T Il L Avis De Loeil Du Loup De Zurich

May 31, 2025 -

Acquisition Majeure De Sanofi Un Nouvel Anticorps Bispecifique Ciblant Les Cellules Myeloides

May 31, 2025

Acquisition Majeure De Sanofi Un Nouvel Anticorps Bispecifique Ciblant Les Cellules Myeloides

May 31, 2025 -

Sanofi Croissance Continue Et Potentiel Boursier Analyse De Loeil Du Loup

May 31, 2025

Sanofi Croissance Continue Et Potentiel Boursier Analyse De Loeil Du Loup

May 31, 2025