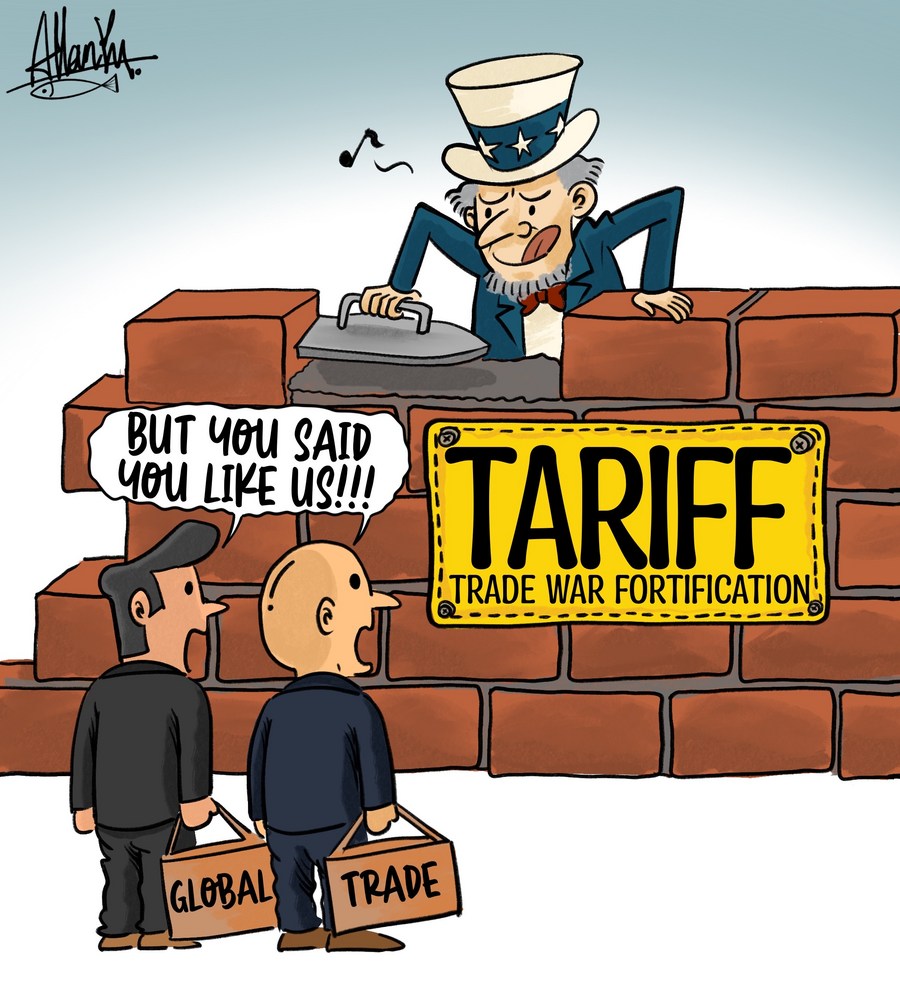

Live Stock Market Coverage: Trump's China Tariffs And UK Trade Implications

Table of Contents

Trump's China Tariffs: A Retrospective and Ongoing Impact

Initial Impact of Tariffs on Global Markets

The initial imposition of Trump's China tariffs sent shockwaves through global markets. The trade war, characterized by escalating tariffs on billions of dollars worth of goods, immediately impacted various sectors.

- Technology: Companies heavily reliant on Chinese manufacturing, particularly in the tech sector, experienced significant stock price drops as supply chains were disrupted and costs increased.

- Agriculture: American farmers, facing retaliatory tariffs on agricultural exports to China, suffered substantial losses, leading to decreased farm incomes and impacting related businesses.

- Manufacturing: Many manufacturing companies faced increased production costs, forcing them to either absorb these costs or pass them on to consumers, impacting both profitability and sales.

Keywords: China tariffs, trade war, global market volatility, stock market impact

Long-Term Consequences of the Trade War

The long-term consequences of the US-China trade war extend far beyond initial market reactions. The disruption to established supply chains forced many companies to reassess their global manufacturing strategies.

- Supply Chain Disruption: Businesses scrambled to diversify their supply chains, moving production away from China and incurring significant costs in the process. This led to increased production times and higher prices for consumers.

- Changes in Investment Strategies: Investors became more cautious, reassessing their investment strategies to account for increased geopolitical risks and trade uncertainty. This led to a decrease in overall investment in certain sectors.

- Shifts in Consumer Behavior: Consumers faced higher prices for many goods, leading to altered purchasing habits and a decline in demand for some products.

Keywords: supply chain disruption, long-term market effects, investment strategies, trade agreements

UK Trade Implications: Brexit and the China-US Trade Dispute

Navigating Brexit's Economic Challenges

Brexit significantly compounded the negative effects of the US-China trade war on the UK economy. The already strained situation was further complicated by new trade barriers and reduced access to the EU market.

- Increased Trade Barriers: Brexit introduced new tariffs and customs procedures, adding to the existing challenges posed by the US-China trade war. This increased the cost of importing and exporting goods.

- Reduced Access to EU Markets: The UK's departure from the EU severely impacted its access to the single market, limiting its trade opportunities and increasing economic vulnerability.

- Vulnerability of UK Businesses: Many UK businesses, already facing challenges from the China tariffs, found themselves further exposed to economic instability due to Brexit's complexities.

Keywords: Brexit, UK economy, trade barriers, EU market access

The Search for New Trade Partners

Facing these challenges, the UK has actively pursued new trade partnerships post-Brexit, attempting to diversify its trading relationships amidst the ongoing US-China trade conflict.

- New Trade Deals: The UK has negotiated several new trade agreements with countries outside the EU, aiming to secure access to new markets and reduce reliance on the EU.

- Strengthening Ties with Non-EU Countries: Efforts have been made to strengthen existing trade relationships and forge new ones with countries outside the EU, seeking to mitigate the economic fallout from Brexit and the US-China trade disputes.

- Impact on Specific Industries: Certain industries, particularly those heavily reliant on exports to the EU, have been disproportionately affected by Brexit and the global trade dynamics, necessitating adaptation and diversification.

Keywords: trade diversification, post-Brexit trade, new trade partners, global trade relationships

Live Stock Market Coverage and Investment Strategies

Analyzing Market Trends

Utilizing live stock market coverage is crucial for making informed investment decisions amidst the uncertainty created by global trade disputes. Real-time data provides investors with the crucial information needed to adapt to rapidly changing market conditions.

- Importance of Real-Time Data: Real-time updates are essential for understanding immediate market reactions to trade news and policy announcements.

- Risk Management Strategies: Effective risk management strategies, including diversification and hedging, are critical for mitigating losses during times of heightened market volatility.

- Diversification of Investment Portfolios: Spreading investments across various asset classes and geographic regions is a key aspect of mitigating risk associated with global trade uncertainties.

Keywords: investment strategies, risk management, portfolio diversification, market analysis, real-time data

Tools and Resources for Live Stock Market Monitoring

Staying informed about market movements and global trade news requires access to reliable sources. Several tools and resources can help investors stay ahead of the curve.

- Financial News Outlets: Reputable financial news websites and publications provide valuable insights and analysis.

- Market Data Providers: Specialized data providers offer comprehensive real-time data and analytical tools for market monitoring.

- Stock Market Analysis Tools: Software and platforms offer advanced charting, technical analysis, and screening capabilities to identify investment opportunities and assess risk.

Keywords: financial news, market data, stock market analysis tools, live market updates

Conclusion: Understanding Live Stock Market Coverage in a Globalized World

Trump's China tariffs have had a profound and lasting impact on global markets, significantly impacting the UK economy, particularly in conjunction with Brexit. The interconnectedness of global markets highlights the importance of understanding and adapting to rapidly changing trade dynamics. The key takeaway is the critical role of consistent and comprehensive live stock market coverage in navigating these complexities.

Stay informed with consistent live stock market coverage to effectively manage your investments in the face of ever-changing global trade dynamics.

Featured Posts

-

Sydney Mc Laughlin Levrones World Leading 400m Hurdle Run In Miami

May 11, 2025

Sydney Mc Laughlin Levrones World Leading 400m Hurdle Run In Miami

May 11, 2025 -

Crazy Rich Asians Tv Series In Development Henry Golding Shares Reunion Details

May 11, 2025

Crazy Rich Asians Tv Series In Development Henry Golding Shares Reunion Details

May 11, 2025 -

Szokujace Opowiesci Masazystki Ksiaze Andrzej Rozebrany Na Zabiegu

May 11, 2025

Szokujace Opowiesci Masazystki Ksiaze Andrzej Rozebrany Na Zabiegu

May 11, 2025 -

Change In Policy Faber Cancels All Outings For Refugees

May 11, 2025

Change In Policy Faber Cancels All Outings For Refugees

May 11, 2025 -

Bundesliga 2023 24 Relegation Confirmed For Bochum And Holstein Kiel Leipzig Out Of Champions League

May 11, 2025

Bundesliga 2023 24 Relegation Confirmed For Bochum And Holstein Kiel Leipzig Out Of Champions League

May 11, 2025