Live Stock Market Updates: Bond Sell-Off, Dow Futures Reaction, Bitcoin Rally

Table of Contents

The Bond Sell-Off: Understanding the Implications

The recent bond sell-off is a significant event impacting global financial markets. Rising interest rates are a primary driver. As central banks aim to curb inflation, higher yields on government bonds make existing bonds less attractive, leading investors to sell, driving prices down. This sell-off isn't isolated; geopolitical factors and persistent inflation concerns also play crucial roles.

The implications are far-reaching. Fixed-income investments, traditionally considered safe havens, are experiencing losses. This negatively impacts market sentiment, creating uncertainty across asset classes.

- Rising treasury yields and their effect on bond prices: Higher yields directly correlate with lower bond prices, creating losses for bondholders.

- Impact on pension funds and insurance companies: These institutions heavily rely on fixed-income investments. A bond sell-off significantly impacts their solvency and ability to meet future obligations.

- Potential for further sell-offs in the bond market: Depending on future economic data and central bank policy, further sell-offs remain a possibility.

- Strategies for mitigating bond market risk: Diversifying investments across asset classes and employing hedging strategies can help mitigate the impact of bond market volatility.

Dow Futures Reaction: Gauging the Market's Sentiment

The Dow Jones Industrial Average (Dow Futures) reflects the market's overall sentiment. The bond sell-off has created ripples, impacting investor confidence and causing uncertainty in the equity market. Dow futures have shown a mixed response, indicating a degree of decoupling from the bond market's sharp decline, yet still reflecting a degree of caution.

The implications for equity investors are complex. While some sectors might benefit from the current environment, others are likely to experience increased pressure. Careful analysis is crucial.

- Correlation between bond yields and Dow futures performance: While traditionally inversely correlated, the current situation showcases a more nuanced relationship, with Dow futures showing resilience despite the bond sell-off.

- Analysis of specific sectors most affected by the current market conditions: Sectors sensitive to interest rate changes, such as real estate and utilities, are likely to be disproportionately affected.

- Potential for a market correction or continued upward trend: The market's direction remains uncertain, depending on economic indicators and investor sentiment.

- Technical analysis of Dow futures charts: Studying chart patterns and technical indicators can offer insights into potential future price movements (though not a guarantee).

Bitcoin's Rally: Decoupling from Traditional Markets?

Bitcoin's recent rally stands in contrast to the turmoil in traditional markets. This surge is attributed to several factors, including increasing institutional adoption, regulatory developments in certain jurisdictions, and the ongoing macroeconomic uncertainty pushing investors toward alternative assets.

Interestingly, Bitcoin's performance shows a degree of decoupling from the Dow and bond markets, highlighting its status as a distinct asset class. However, global economic events still exert some influence.

- Bitcoin's price action compared to the Dow and bond markets: Bitcoin's price has shown less correlation with the downward trends in the bond and equity markets.

- Analysis of Bitcoin's market capitalization and trading volume: Increased trading volume often suggests increased investor interest and potential for further price movements.

- Discussion on the potential for further growth or a price correction: As with any volatile asset, predictions are difficult, and both growth and correction remain possibilities.

- Risks and opportunities associated with investing in Bitcoin: Bitcoin's high volatility presents significant risks but also potentially high rewards for long-term investors.

Conclusion: Staying Informed on Live Stock Market Updates

In summary, the current market landscape is characterized by a bond sell-off impacting fixed-income investments, a cautious reaction in Dow futures, and a surprising rally in Bitcoin. These interconnected events highlight the importance of staying informed on live stock market updates to navigate the complexities of investing. Understanding the dynamics of these different asset classes and their interplay is key to making sound investment decisions.

To stay ahead, regularly check reputable financial news sources for the latest live stock market updates, subscribe to newsletters providing in-depth market analysis, and consider consulting a qualified financial advisor before making any investment decisions. Remember that this analysis is for informational purposes only and shouldn't be considered financial advice. By staying informed on stock market news, financial market analysis, and utilizing effective investment strategies, you can better position yourself within this dynamic market.

Featured Posts

-

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Re Energizing Relations Bangladeshs Focus On Growth Through European Collaboration

May 24, 2025

Re Energizing Relations Bangladeshs Focus On Growth Through European Collaboration

May 24, 2025 -

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025 -

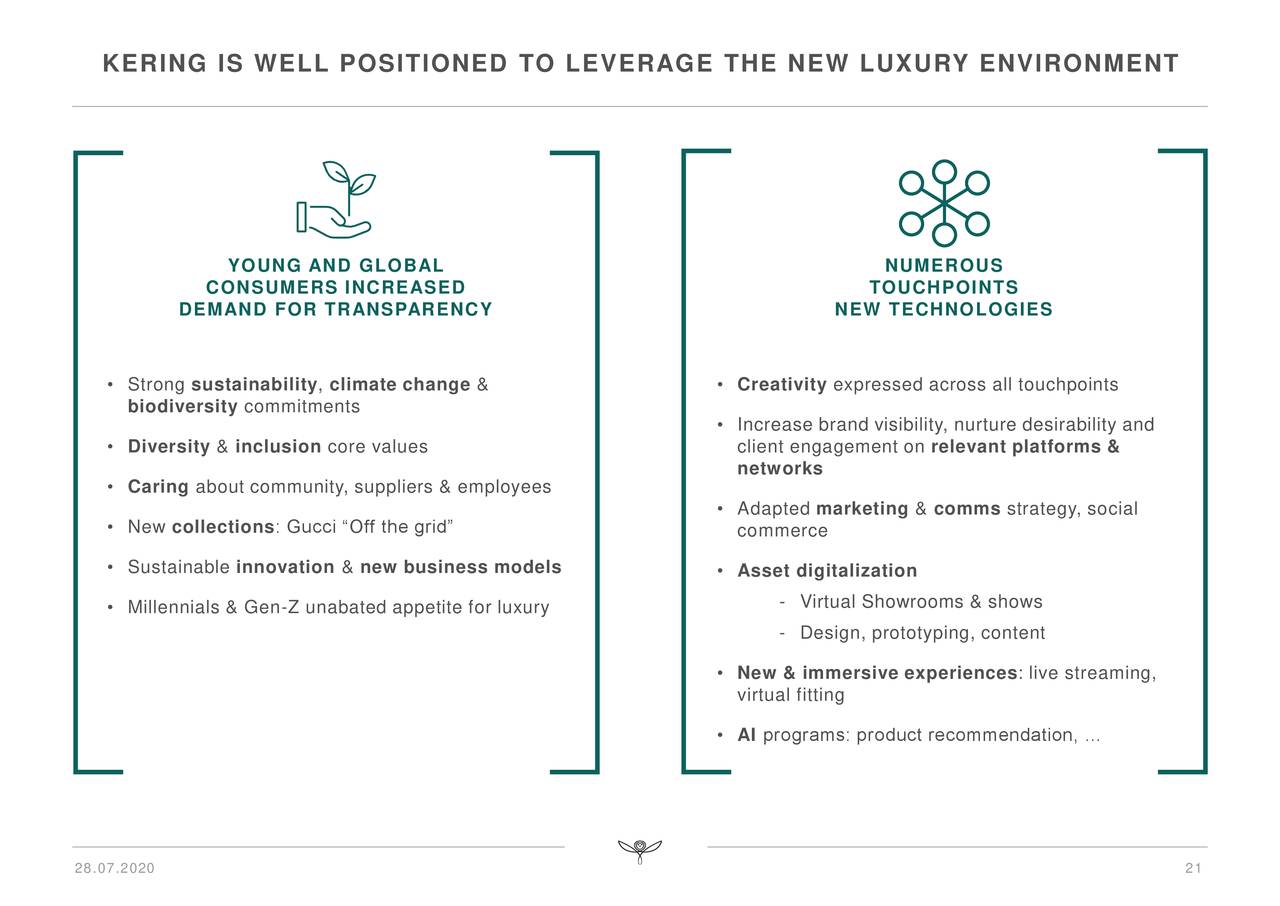

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Property

May 24, 2025

Your Escape To The Country Choosing The Right Rural Property

May 24, 2025

Latest Posts

-

Andreescu Defeats Rybakina Advances To Italian Open Fourth Round

May 24, 2025

Andreescu Defeats Rybakina Advances To Italian Open Fourth Round

May 24, 2025 -

Anchors Long Absence From Today Co Hosts Share Heartfelt Message

May 24, 2025

Anchors Long Absence From Today Co Hosts Share Heartfelt Message

May 24, 2025 -

Explanation For Anchors Prolonged Absence From Today Show

May 24, 2025

Explanation For Anchors Prolonged Absence From Today Show

May 24, 2025 -

Today Show Anchors Absence Explained Co Hosts Share Update

May 24, 2025

Today Show Anchors Absence Explained Co Hosts Share Update

May 24, 2025 -

Co Hosts Comment On Anchors Extended Absence We Were Praying For Her

May 24, 2025

Co Hosts Comment On Anchors Extended Absence We Were Praying For Her

May 24, 2025