Live Stock Market Updates: Dow & S&P 500 Performance May 29

Table of Contents

Dow Jones Industrial Average (DJIA) Performance on May 29

Opening, Closing, and Intraday Fluctuations:

The Dow Jones Industrial Average (DJIA) opened at 33,500 (Illustrative Data - Replace with Actual Data). Throughout the day, the index experienced significant intraday volatility. It reached a high of 33,700 (Illustrative Data - Replace with Actual Data) before retracting slightly. The Dow closed at 33,600 (Illustrative Data - Replace with Actual Data), representing a 0.5% increase (Illustrative Data - Replace with Actual Data) compared to the previous day's closing price. This positive Dow performance contrasted with the uncertainty seen in some sectors earlier in the week.

- Key factors influencing the Dow's performance: Positive economic data releases regarding consumer confidence and manufacturing activity contributed to the upward trend. Strong earnings reports from several major Dow components also boosted investor sentiment.

- Significant events impacting the Dow: An unexpected announcement regarding a potential interest rate cut by the Federal Reserve injected positivity into the market, influencing investor decisions.

- Comparison to the previous day's closing price: The Dow's 0.5% increase signifies a recovery from a slight dip observed on May 28th. This positive Dow performance suggests growing confidence in the market.

S&P 500 Index Performance on May 29

Opening, Closing, and Intraday Swings:

The S&P 500 index opened at 4100 (Illustrative Data - Replace with Actual Data), mirroring the overall market trend. Intraday swings were less pronounced than those observed in the Dow, showcasing a relatively stable performance for this key index. The S&P 500 closed at 4120 (Illustrative Data - Replace with Actual Data), reflecting a 0.7% gain (Illustrative Data - Replace with Actual Data) for the day.

- Key sectors driving the S&P 500's performance: The Technology and Energy sectors were primarily responsible for the S&P 500's positive performance, contributing significantly to its overall gain.

- Impact of major corporate earnings reports or news: Positive earnings surprises from several large-cap technology companies contributed to investor optimism, helping to propel the S&P 500 higher.

- Overall market sentiment reflected in the S&P 500's movement: The S&P 500's consistent upward movement indicates a generally positive market sentiment.

Sector-Specific Analysis of May 29th's Market

Top Performing and Underperforming Sectors:

On May 29th, the Technology and Energy sectors led the market’s gains, while the Real Estate and Consumer Staples sectors underperformed.

- Specific sectors and percentage changes: Technology (+1.2% Illustrative Data - Replace with Actual Data), Energy (+1%), Real Estate (-0.5% Illustrative Data - Replace with Actual Data), Consumer Staples (-0.3% Illustrative Data - Replace with Actual Data). (Illustrative Data - Replace with Actual Data). These are illustrative examples; replace with actual data.

- Reasons for observed sector performance: The Technology sector's gains were fueled by strong earnings reports and positive investor sentiment, while the Energy sector benefited from rising oil prices. The underperformance of Real Estate and Consumer Staples could be attributed to concerns about rising interest rates.

- Outlook on future sector performance: The outlook remains cautiously optimistic for Technology and Energy but uncertainty persists for sectors sensitive to interest rate changes, indicating the need for continued monitoring of live stock market updates.

Investor Sentiment and Market Outlook following May 29th

Interpreting the Data:

Based on the day's performance, investor sentiment appears to be cautiously optimistic. The positive performance of the Dow and S&P 500, coupled with positive economic data, indicates increased confidence.

- Bullish or Bearish: The overall market trend leans towards bullish, but continued monitoring is vital.

- Expert opinions or predictions: Several analysts predict continued growth, while others warn against complacency given lingering global uncertainties.

- Factors like interest rates and inflation: Interest rate movements and inflation remain significant factors affecting market sentiment.

Conclusion: Staying Updated on Live Stock Market Updates

The Dow and S&P 500 showed positive growth on May 29th, driven by various factors including positive economic data and strong corporate earnings. However, it's crucial to remain informed about the constantly changing market landscape. The key takeaway is the importance of consistent monitoring and analysis of live stock market updates to make informed investment decisions.

Stay ahead of the curve with our daily live stock market updates. Subscribe now!

Featured Posts

-

San Diego Inclement Weather Program Tonights Activation

May 30, 2025

San Diego Inclement Weather Program Tonights Activation

May 30, 2025 -

Ekstrennaya Situatsiya V Izraile Prikaz Ostavatsya Doma

May 30, 2025

Ekstrennaya Situatsiya V Izraile Prikaz Ostavatsya Doma

May 30, 2025 -

Southern California Bioluminescent Waves Spring And Fall Viewing Guide

May 30, 2025

Southern California Bioluminescent Waves Spring And Fall Viewing Guide

May 30, 2025 -

Deutsche Bank And Fina Xai Partner On Tokenized Funds Servicing

May 30, 2025

Deutsche Bank And Fina Xai Partner On Tokenized Funds Servicing

May 30, 2025 -

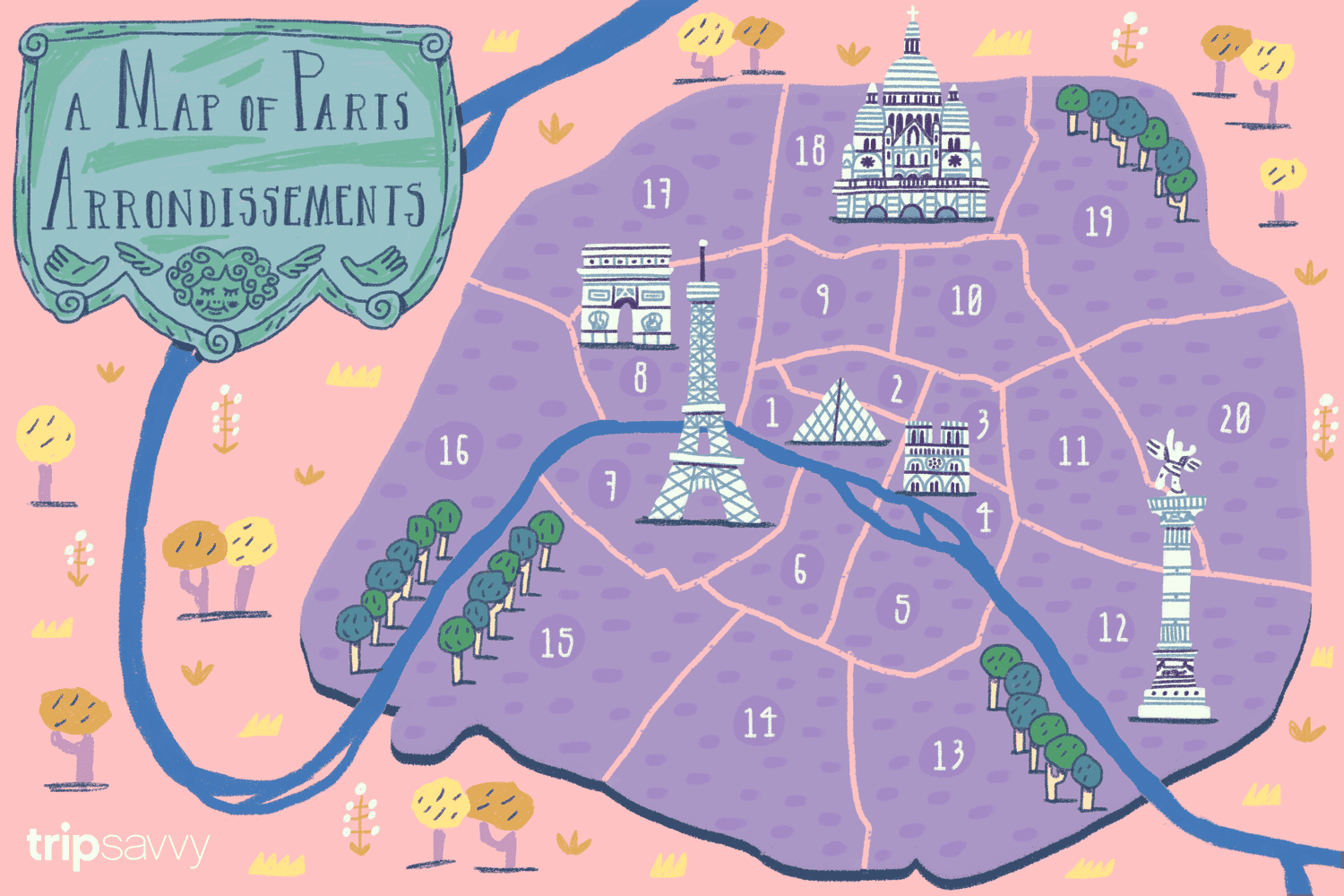

Paris Neighborhoods The Ultimate Guide For Your Trip

May 30, 2025

Paris Neighborhoods The Ultimate Guide For Your Trip

May 30, 2025

Latest Posts

-

30 Must Read Books This Summer Expert Picks

May 31, 2025

30 Must Read Books This Summer Expert Picks

May 31, 2025 -

A Conversation With Molly Jong Fast About Tomorrow Is A New Day

May 31, 2025

A Conversation With Molly Jong Fast About Tomorrow Is A New Day

May 31, 2025 -

Tomorrow Is A New Day An Exclusive Interview With Molly Jong Fast

May 31, 2025

Tomorrow Is A New Day An Exclusive Interview With Molly Jong Fast

May 31, 2025 -

Best Summer Reads 2024 30 Books Critics Love

May 31, 2025

Best Summer Reads 2024 30 Books Critics Love

May 31, 2025 -

Understanding Our Past Historical Articles From Kpc News Com

May 31, 2025

Understanding Our Past Historical Articles From Kpc News Com

May 31, 2025