Long-Term Vision: BBVA's Investment Banking Push

Table of Contents

BBVA's Strategic Objectives in Investment Banking

BBVA's overarching goals in the investment banking sector are multifaceted. The institution seeks to not only increase its profitability but also strengthen its global standing and diversify its revenue streams beyond traditional banking services. This strategic ambition is underpinned by a series of ambitious targets:

- Increase revenue from investment banking activities by 25% within 5 years. This ambitious target necessitates significant growth across various service lines.

- Expand into key geographic regions including Asia-Pacific and North America. BBVA aims to leverage its existing network and build new partnerships to penetrate these lucrative markets.

- Develop expertise in high-growth areas of investment banking, specifically focusing on M&A advisory, equity capital markets, and sustainable finance. This strategic focus allows BBVA to capitalize on market trends and cater to evolving client needs.

- Enhance client relationships and build a stronger brand reputation as a leading provider of comprehensive financial solutions. Strengthening existing relationships and attracting new high-value clients are crucial to achieving these objectives.

Key Initiatives Driving BBVA's Investment Banking Growth

To achieve its ambitious goals, BBVA is implementing a series of key initiatives:

- Significant recruitment of experienced investment bankers. BBVA is actively seeking top talent globally to strengthen its teams and bolster its expertise across various service lines. This includes recruiting experienced professionals in M&A, equity capital markets, and debt financing.

- Investment in cutting-edge technology and data analytics platforms. By embracing technological advancements, BBVA aims to enhance its efficiency, improve decision-making, and offer more sophisticated services to its clients. This includes investing in AI-driven solutions and advanced data analytics capabilities.

- Strategic partnerships with fintech companies and other financial institutions. Collaborations and joint ventures are viewed as key to expanding reach, accessing new technologies, and offering comprehensive client solutions.

- Development of specialized industry expertise, particularly in renewable energy and technology sectors. This targeted approach allows BBVA to become a trusted advisor for companies in high-growth and strategically important sectors.

- Enhanced digital client onboarding and service. Streamlining client interactions through digital channels improves efficiency and enhances the overall client experience.

BBVA's Competitive Advantages and Challenges in the Investment Banking Market

BBVA operates in a highly competitive market, dominated by global giants like Goldman Sachs, JPMorgan Chase, and Bank of America Merrill Lynch. However, BBVA possesses several key competitive advantages:

- Strong global network and presence: Its established footprint across Europe and Latin America provides a solid foundation for expansion.

- Deep understanding of Latin American markets: This regional expertise provides a distinct competitive edge in a rapidly growing region.

- Established client base: A loyal client base provides a strong foundation for revenue generation and future growth.

Despite these advantages, BBVA faces challenges:

- Competition from larger investment banks: The sheer scale and resources of major players present significant hurdles.

- Regulatory hurdles: Navigating complex and evolving regulations across multiple jurisdictions is a constant challenge.

- Economic uncertainty: Global economic fluctuations can significantly impact investment banking activity.

Geographic Focus: Expansion Strategies

BBVA's geographic expansion strategy is central to its investment banking ambitions. The bank is focusing on:

- Focus on growth in Asia-Pacific and North America. These regions represent significant opportunities for expansion and diversification.

- Localized strategies to cater to the specific needs of each market. This involves adapting services and products to meet the unique requirements of each region.

- Development of local partnerships and alliances. Building relationships with local firms and institutions helps navigate market complexities and access new client segments.

Long-Term Outlook and Potential Impact of BBVA's Investment Banking Push

BBVA's ambitious investment banking strategy has the potential to significantly impact both the company and the broader financial market.

- Increased profitability and shareholder value for BBVA: Successful execution of this strategy could lead to substantial revenue growth and increased profitability.

- Enhanced competition and innovation in the investment banking sector: BBVA's aggressive expansion will likely spur greater competition and innovation within the industry.

- Potential for greater access to capital for businesses in target markets: BBVA's expanded investment banking capabilities could facilitate greater access to capital for businesses in its target regions.

Conclusion

BBVA's ambitious push into investment banking represents a significant strategic shift with the potential to reshape its long-term growth trajectory. Through targeted initiatives, strategic partnerships, and a focus on key markets, BBVA is actively positioning itself for success in this highly competitive arena. The success of this long-term vision will depend on effectively navigating the challenges and capitalizing on emerging opportunities. Stay informed on the progress of BBVA Investment Banking and its related services to witness the unfolding of this significant strategic undertaking. Follow BBVA's progress to see how their investment banking strategy unfolds and impacts the global financial landscape.

Featured Posts

-

Jan 6th Hearing Cassidy Hutchinson To Publish Memoir This Fall

Apr 25, 2025

Jan 6th Hearing Cassidy Hutchinson To Publish Memoir This Fall

Apr 25, 2025 -

Heartthrobs Unexpected Accent Revealed In New Netflix Hit

Apr 25, 2025

Heartthrobs Unexpected Accent Revealed In New Netflix Hit

Apr 25, 2025 -

Spider Man 4 And The Jean Grey Question Sadie Sinks Possible Mcu Future

Apr 25, 2025

Spider Man 4 And The Jean Grey Question Sadie Sinks Possible Mcu Future

Apr 25, 2025 -

Bnp Paribas Equity Trading Record High Despite Rising Costs

Apr 25, 2025

Bnp Paribas Equity Trading Record High Despite Rising Costs

Apr 25, 2025 -

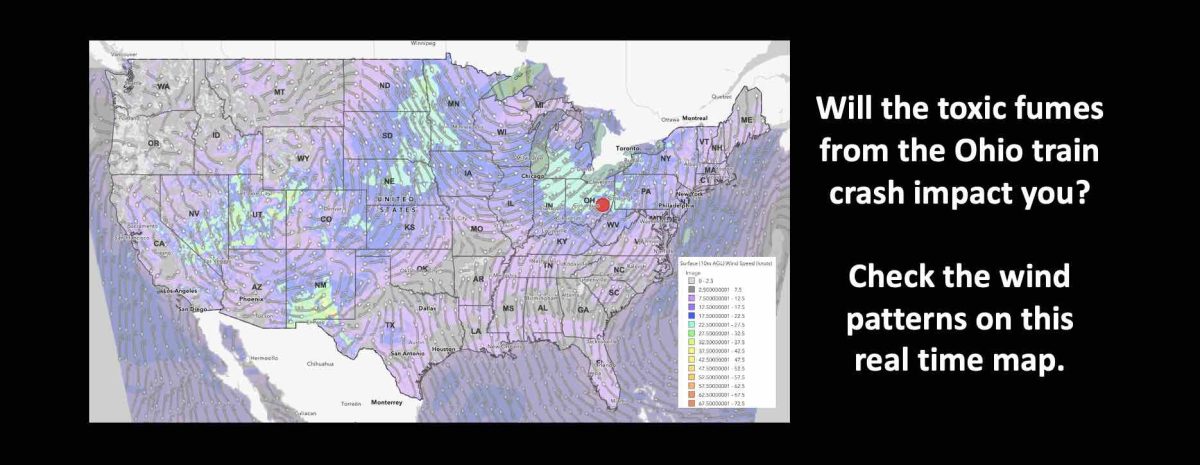

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 25, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 25, 2025

Latest Posts

-

Journalist Reveals Arsenals Pursuit Of Two Bundesliga Players

Apr 25, 2025

Journalist Reveals Arsenals Pursuit Of Two Bundesliga Players

Apr 25, 2025 -

Arsenal Transfer News Journalists Update On Bundesliga Targets

Apr 25, 2025

Arsenal Transfer News Journalists Update On Bundesliga Targets

Apr 25, 2025 -

St Pauli Vs Bayern Munich Sanes Impact Decides Close Match

Apr 25, 2025

St Pauli Vs Bayern Munich Sanes Impact Decides Close Match

Apr 25, 2025 -

Five Goal Thriller Bayern Munich Edge Past St Pauli Thanks To Sanes Performance

Apr 25, 2025

Five Goal Thriller Bayern Munich Edge Past St Pauli Thanks To Sanes Performance

Apr 25, 2025 -

Sane Inspires Bayern Munich To Hard Fought Win Against St Pauli

Apr 25, 2025

Sane Inspires Bayern Munich To Hard Fought Win Against St Pauli

Apr 25, 2025