Low Personal Loan Interest Rates: Get The Best Deal Today

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into securing low personal loan interest rates, it's crucial to understand what determines them. Several factors play a significant role in the interest rate you'll receive.

Factors Affecting Interest Rates

Several factors influence the interest rate you'll be offered on a personal loan. Understanding these is crucial for securing the best deal.

- Credit Score: This is arguably the most important factor. A higher credit score (700 or above is generally considered excellent) significantly increases your chances of qualifying for low personal loan interest rates. Lenders view a high score as an indicator of your creditworthiness and responsible borrowing habits.

- Loan Amount: Generally, larger loan amounts tend to come with slightly higher interest rates. Lenders assess more risk with larger loans.

- Loan Term: The length of your loan term also affects the interest rate. Longer loan terms typically result in lower monthly payments but higher overall interest paid. Shorter terms mean higher monthly payments but less interest paid over the life of the loan.

- Lender Type: Different lenders have different lending criteria and interest rate structures. Banks, credit unions, and online lenders often offer varying rates. Credit unions frequently offer more competitive rates to their members.

- Income: Your income demonstrates your ability to repay the loan. A stable and substantial income increases your chances of securing a lower interest rate.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI indicates lower financial risk to the lender and can lead to lower interest rates.

Types of Personal Loans and Their Rates

Personal loans come in various forms, each with its own interest rate implications.

- Secured vs. Unsecured Loans: Secured loans, which require collateral (like a car or savings account), typically have lower interest rates than unsecured loans, which don't. If you default on a secured loan, the lender can seize your collateral.

- Fixed vs. Variable Interest Rates: Fixed-rate loans offer consistent monthly payments throughout the loan term, providing predictability. Variable-rate loans have interest rates that fluctuate based on market conditions, potentially leading to unpredictable monthly payments. Fixed-rate loans generally offer more stability, though variable-rate loans may sometimes offer initially lower rates. The average interest rate will vary significantly depending on the lender and your creditworthiness.

How to Find Low Personal Loan Interest Rates

Finding low personal loan interest rates requires proactive effort and smart strategies.

Shop Around and Compare Offers

Never settle for the first offer you receive. Compare rates from multiple lenders – banks, credit unions, and online lenders. Use online comparison tools and calculators to streamline the process.

- Comparison Websites: Numerous websites allow you to compare loan offers from various lenders side-by-side.

- Online Calculators: Use loan calculators to estimate your monthly payments and total interest paid under different interest rate scenarios.

Improve Your Credit Score

A higher credit score is your best weapon in securing low personal loan interest rates. Even a small improvement can lead to substantial savings.

- Pay Bills on Time: This is the single most important factor in your credit score.

- Reduce Credit Utilization: Keep your credit card balances low (ideally below 30% of your total credit limit).

- Monitor Your Credit Report: Regularly check your credit report for errors and take steps to correct them.

Negotiate with Lenders

Don't be afraid to negotiate. If you have a strong credit score and multiple offers from competing lenders, you may be able to negotiate a lower interest rate.

- Demonstrate Financial Stability: Highlight your stable income and low debt-to-income ratio.

- Compare Offers: Let the lender know you have received competitive offers from other institutions.

Avoiding Hidden Fees and Charges

Be aware of potential hidden fees that can significantly impact your overall loan cost.

Common Hidden Fees

Several fees can add to your overall loan cost. Be sure to ask about these upfront.

- Origination Fees: These are fees charged by the lender to process your loan application.

- Prepayment Penalties: These penalties are charged if you pay off your loan early.

- Late Payment Fees: These fees are charged if you miss a payment.

Reading the Fine Print

Always carefully read the loan agreement before signing. Understand all terms and conditions.

- APR (Annual Percentage Rate): This represents the total cost of the loan, including interest and fees.

- Payment Schedule: Clearly understand your payment schedule and the total amount you will repay.

- Default Clause: Understand the implications of defaulting on the loan.

Securing the Best Deal: Tips and Strategies

To maximize your chances of securing the best deal, consider these additional strategies.

Pre-qualification vs. Application

Pre-qualification allows you to check your eligibility for a loan without impacting your credit score. It gives you a better understanding of the rates you may qualify for before applying formally.

Utilizing Online Tools

Utilize online loan calculators and comparison websites to simplify your search and compare different offers effectively.

Considering Your Financial Situation

Borrow responsibly. Only borrow what you can comfortably repay, factoring in your monthly expenses and income.

Conclusion

Securing low personal loan interest rates requires careful planning and a strategic approach. By understanding the factors that influence interest rates, shopping around for the best offers, improving your credit score, and avoiding hidden fees, you can significantly reduce the overall cost of your loan. Don't delay your financial dreams! Start comparing low personal loan interest rates today and find the perfect loan to meet your needs. Use our resources to secure the best deal!

Featured Posts

-

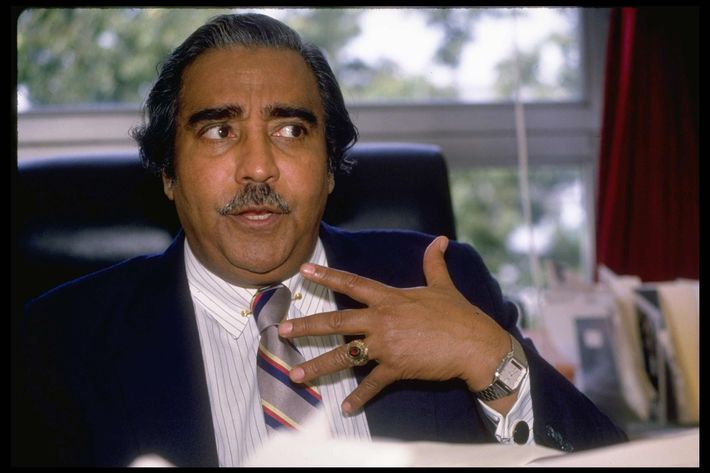

Congressman Charlie Rangel Tributes Pour In After His Passing

May 28, 2025

Congressman Charlie Rangel Tributes Pour In After His Passing

May 28, 2025 -

Hailee Steinfeld And Josh Allens Wedding Plans Intimate Ceremony Four Months Post Engagement

May 28, 2025

Hailee Steinfeld And Josh Allens Wedding Plans Intimate Ceremony Four Months Post Engagement

May 28, 2025 -

Angels Defeat Dodgers In Thrilling Freeway Series Matchup

May 28, 2025

Angels Defeat Dodgers In Thrilling Freeway Series Matchup

May 28, 2025 -

Kerja Sama Kodam Udayana Untuk Mewujudkan Bali Bersih Sampah

May 28, 2025

Kerja Sama Kodam Udayana Untuk Mewujudkan Bali Bersih Sampah

May 28, 2025 -

Plummeting European Car Sales Reflect Economic Downturn

May 28, 2025

Plummeting European Car Sales Reflect Economic Downturn

May 28, 2025

Latest Posts

-

5 Ans D Ineligibilite Le Jugement De Marine Le Pen Suscite La Controverse

May 30, 2025

5 Ans D Ineligibilite Le Jugement De Marine Le Pen Suscite La Controverse

May 30, 2025 -

Grand Est Subvention Pour Medine Provoque La Colere Du Rassemblement National

May 30, 2025

Grand Est Subvention Pour Medine Provoque La Colere Du Rassemblement National

May 30, 2025 -

Ineligibilite De Marine Le Pen Impact Sur La Politique Francaise

May 30, 2025

Ineligibilite De Marine Le Pen Impact Sur La Politique Francaise

May 30, 2025 -

Concert De Medine Subventionne En Grand Est La Reaction Outree Du Rn

May 30, 2025

Concert De Medine Subventionne En Grand Est La Reaction Outree Du Rn

May 30, 2025 -

Marine Le Pen Condamnee Analyse De La Decision De 5 Ans D Ineligibilite

May 30, 2025

Marine Le Pen Condamnee Analyse De La Decision De 5 Ans D Ineligibilite

May 30, 2025