Lower UK Inflation Eases BOE Rate Cut Pressure: Pound Value Increases

Table of Contents

Falling UK Inflation: A Detailed Look at the Figures

The recent decline in UK inflation is a significant development with far-reaching consequences. Let's examine the specifics:

CPI Data and its Implications

The latest Consumer Price Index (CPI) data reported a decrease in inflation to [insert latest CPI percentage]%, down from [insert previous month's CPI percentage]%. This represents a [insert percentage change] decrease and is significantly lower than many economists' forecasts of [insert forecasted percentage]%. This substantial drop is primarily attributed to several factors:

- Falling energy prices: The easing of the energy crisis has significantly reduced household energy bills, contributing to lower overall inflation.

- Easing supply chain issues: Global supply chain disruptions have begun to ease, leading to lower prices for imported goods.

- Government interventions: Specific government policies aimed at mitigating the cost of living crisis have had a demonstrable impact on inflation.

Impact on Inflation Expectations

The fall in inflation is not merely a one-off event; it's also influencing market expectations for future inflation. Surveys like the [mention relevant survey, e.g., Bank of England's Inflation Expectations Survey] indicate a significant downward revision in inflation forecasts for the coming year. This reduced expectation of future price increases is crucial because it lessens the pressure on the BOE to act aggressively to curb inflation. Lower inflation expectations allow for a more measured approach to monetary policy.

Reduced BOE Rate Cut Pressure: Implications for Monetary Policy

The decreased inflation rate significantly alters the landscape of BOE monetary policy.

The BOE's Mandate and Current Stance

The BOE's primary mandate is to maintain price stability, typically targeting an inflation rate of 2%. The recent fall in inflation brings the UK closer to this target, reducing the urgency for further interest rate cuts. The current interest rate stands at [insert current interest rate]%, and while further rate increases are unlikely in the near term, the BOE will continue to monitor the situation closely. External factors, such as global economic slowdown or geopolitical instability, could, however, influence future decisions.

Market Reactions to Lower Inflation

Financial markets have responded positively to the lower inflation figures. Government bond yields have [increased/decreased – choose the correct option] reflecting a shift in investor sentiment. The yield curve, which plots the yields of government bonds across different maturities, is now [describe the shape of the yield curve and its significance]. This suggests a change in investor expectations regarding future interest rates and economic growth.

Pound Sterling Strengthens: Currency Value and Exchange Rates

The positive economic news has directly translated into a strengthening of the Pound.

Correlation Between Lower Inflation and Pound Value

Lower inflation is generally seen as positive for a currency. Reduced inflation signals a more stable economic environment, boosting investor confidence and attracting foreign capital. This increased demand for the Pound pushes its value upwards against other currencies.

GBP Exchange Rate Performance

The GBP/USD exchange rate has recently shown [describe the movement, e.g., an upward trend], reaching [insert latest exchange rate]. Similarly, the GBP/EUR exchange rate has [describe the movement, e.g., strengthened] to [insert latest exchange rate]. [Insert chart or graph illustrating exchange rate fluctuations]. Forecasts for the Pound's future value vary, but many analysts predict continued strengthening, provided that inflation remains low and the UK economy continues its positive trajectory.

Conclusion: Lower UK Inflation and the Future Outlook for the Pound

In conclusion, the recent decline in UK inflation has significantly eased the pressure on the BOE to cut interest rates further, and consequently, the Pound Sterling has strengthened. This positive economic shift is a welcome development, although careful monitoring of inflation figures and BOE policy announcements remains crucial. Stay updated on UK inflation to understand its continuing impact on the economy and the Pound Sterling's value. Monitor BOE interest rate decisions and track the economic outlook for a complete picture of the situation. Understanding these factors is key to navigating the evolving economic landscape.

Featured Posts

-

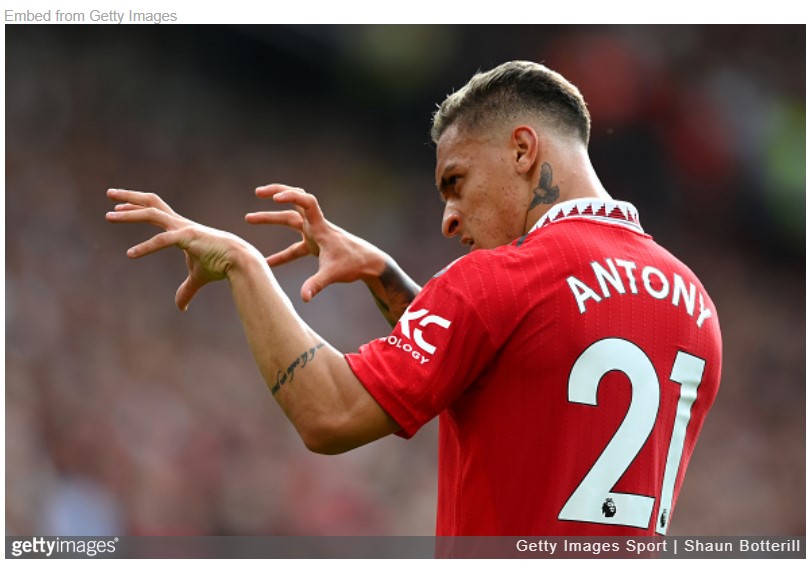

Antony On Almost Joining Manchester Uniteds Arch Rivals

May 23, 2025

Antony On Almost Joining Manchester Uniteds Arch Rivals

May 23, 2025 -

The Jonas Brothers Joe Jonas Addresses Fan Fight

May 23, 2025

The Jonas Brothers Joe Jonas Addresses Fan Fight

May 23, 2025 -

Jonathan Groff Could He Win A Tony Award For Just In Time

May 23, 2025

Jonathan Groff Could He Win A Tony Award For Just In Time

May 23, 2025 -

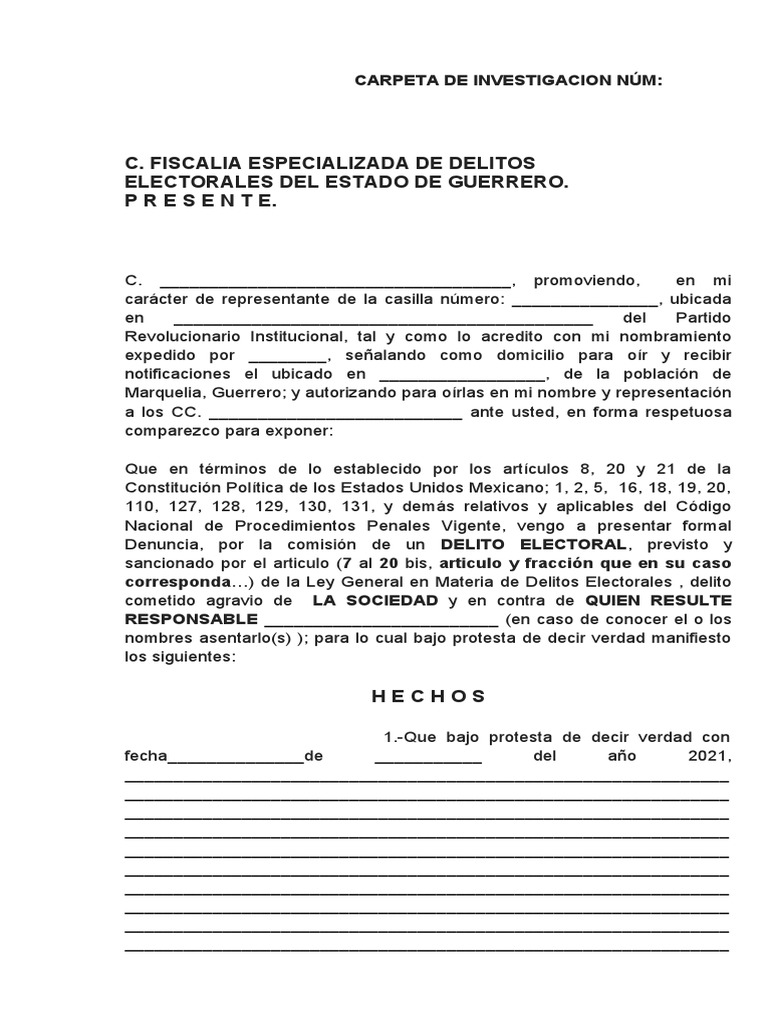

La Libertad Elias Rodriguez Y La Polemica Denuncia Por Venganza Politica De App

May 23, 2025

La Libertad Elias Rodriguez Y La Polemica Denuncia Por Venganza Politica De App

May 23, 2025 -

Nisan 2024 Zengin Olmaya Hazirlanan Burclar

May 23, 2025

Nisan 2024 Zengin Olmaya Hazirlanan Burclar

May 23, 2025

Latest Posts

-

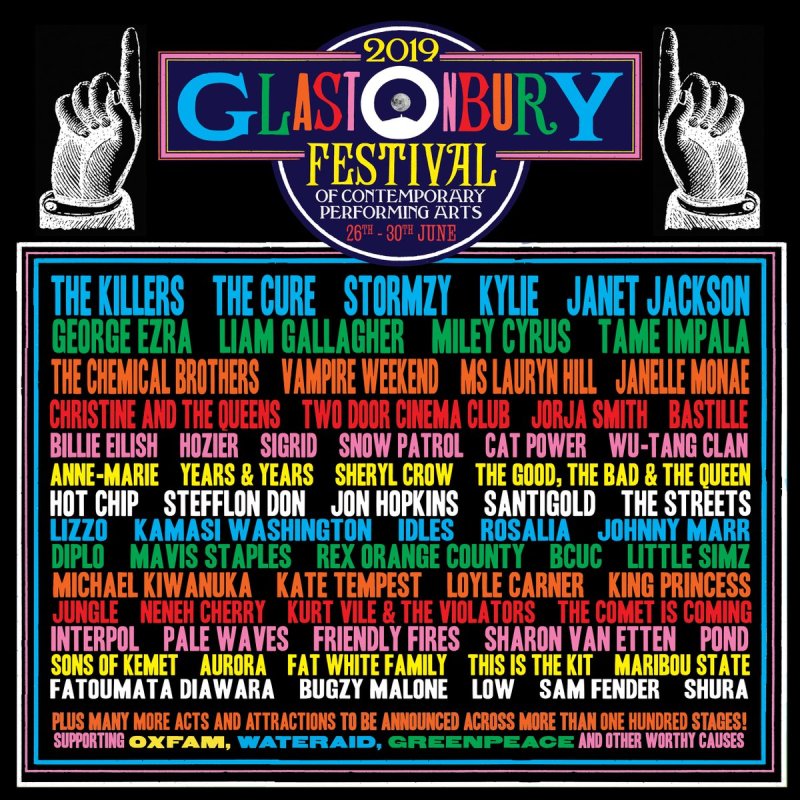

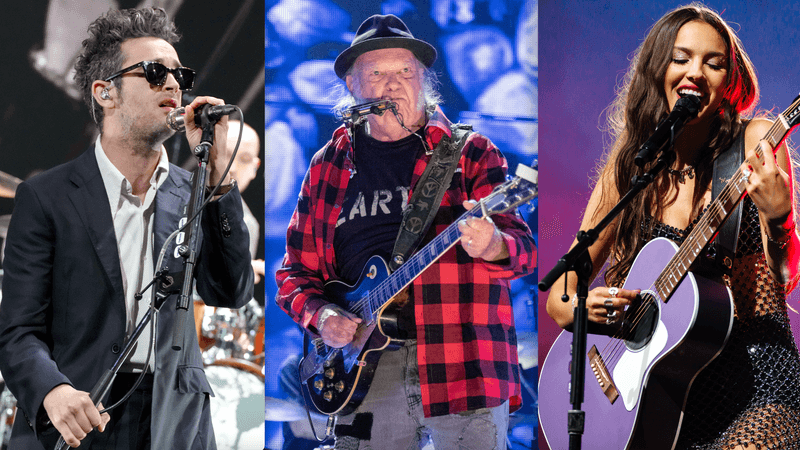

Confirmed Olivia Rodrigo And The 1975 To Play Glastonbury 2025

May 24, 2025

Confirmed Olivia Rodrigo And The 1975 To Play Glastonbury 2025

May 24, 2025 -

Leak Reveals Glastonbury 2025 Lineup Confirmed Acts And Ticket Details

May 24, 2025

Leak Reveals Glastonbury 2025 Lineup Confirmed Acts And Ticket Details

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025