Lowest Personal Loan Interest Rates: A Comprehensive Guide

Table of Contents

Factors Influencing Personal Loan Interest Rates

Lenders use a variety of factors to assess your creditworthiness and determine the interest rate they'll offer you. Understanding these factors is crucial in your quest for the lowest rates.

-

Credit Score: Your credit score is arguably the most significant factor. A high credit score (generally 700 or above) signals to lenders that you're a responsible borrower, significantly increasing your chances of securing lower interest rates. Improving your credit score involves paying bills on time, keeping credit utilization low, and maintaining a diverse credit history.

-

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your gross monthly income that goes towards debt payments. A lower DTI indicates you have more disposable income, making you a less risky borrower. For example, a DTI of 30% is generally considered good, while a DTI above 43% might result in higher interest rates or loan denial.

-

Loan Amount and Term: Larger loan amounts typically come with higher interest rates due to increased risk for the lender. Similarly, longer loan terms (e.g., 60 months) will generally result in higher total interest paid, though monthly payments will be lower. Shorter loan terms (e.g., 36 months) mean higher monthly payments but lower overall interest paid. You need to find a balance that suits your budget.

-

Loan Purpose: While many personal loans don't specify the purpose, some lenders might offer slightly better rates for loans used for specific purposes, such as debt consolidation or home improvement. Be upfront about your intended use.

-

Type of Lender: Different lenders have different lending criteria and interest rate structures. Banks often offer competitive rates but may have stricter eligibility requirements. Credit unions often provide lower rates to their members, while online lenders can offer convenience and potentially competitive rates but may lack the personal touch of traditional lenders.

How to Find the Lowest Personal Loan Interest Rates

Finding the best personal loan rates requires proactive steps and careful comparison.

-

Shop Around: Don't settle for the first offer you receive. Compare rates and terms from multiple lenders – at least three to five – to ensure you're getting the best deal.

-

Use Online Comparison Tools: Reputable websites allow you to compare loan offers from various lenders side-by-side, saving you time and effort. However, always verify the information on the comparison site with the lender directly.

-

Negotiate with Lenders: Don't be afraid to negotiate. If you find a lender offering a rate you think is too high, politely explain your situation and ask if they can offer a lower rate. Having pre-approval offers from other lenders strengthens your negotiating position.

-

Check for Pre-Approval Offers: Pre-approval checks your eligibility without impacting your credit score significantly. It gives you a clearer idea of the rates you're likely to qualify for before you formally apply, saving you time and potential hard inquiries on your credit report.

-

Consider Refinancing: If you already have a high-interest personal loan, refinancing with a lower-rate lender can save you significant money in the long run.

Understanding APR (Annual Percentage Rate)

The APR is the annual interest rate charged on a loan, including fees and other charges. It gives a more comprehensive picture of the loan's true cost than the interest rate alone.

-

Calculation of APR: APR calculation is complex, factoring in the interest rate, origination fees, closing costs, and other charges, expressed as an annual percentage.

-

Importance of Comparing APRs: Always compare the APRs of different loan offers, not just the stated interest rates. A lower interest rate with high fees can result in a higher APR than a slightly higher interest rate with lower fees.

Tips for Securing the Best Personal Loan Rates

Taking proactive steps before applying can significantly improve your chances of securing the lowest possible interest rates.

-

Improve Credit Score Before Applying: A higher credit score is your strongest asset. Work on improving it before you even start shopping for loans.

-

Maintain a Low Debt-to-Income Ratio: Reduce unnecessary debt to lower your DTI. This shows lenders you can manage your finances responsibly.

-

Choose a Shorter Loan Term: While monthly payments will be higher, a shorter loan term means you'll pay less interest overall.

-

Secure a Co-Signer: A co-signer with excellent credit can significantly improve your chances of approval and help you secure a lower interest rate.

Conclusion

Securing the lowest personal loan interest rates requires understanding the factors that influence rates, actively shopping around, and taking proactive steps to improve your creditworthiness. By following the tips outlined in this guide, you can significantly increase your chances of finding the best possible loan terms. Remember to compare APRs, negotiate rates, and consider all your options before making a decision. Find your perfect low-interest personal loan now! Start your search for the lowest personal loan interest rates today!

Featured Posts

-

Ipswich Town Update Mc Kennas Rise Tuanzebes Performance Phillips And Cajustes Setbacks

May 28, 2025

Ipswich Town Update Mc Kennas Rise Tuanzebes Performance Phillips And Cajustes Setbacks

May 28, 2025 -

Update Prakiraan Cuaca Bandung Dan Jawa Barat 23 4 Waspada Hujan Lebat

May 28, 2025

Update Prakiraan Cuaca Bandung Dan Jawa Barat 23 4 Waspada Hujan Lebat

May 28, 2025 -

Nintendos New Games A Focus On Proven Formulas

May 28, 2025

Nintendos New Games A Focus On Proven Formulas

May 28, 2025 -

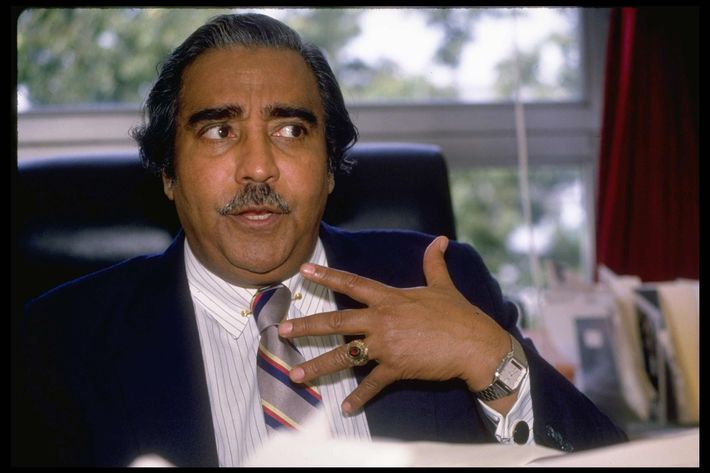

Congressman Charlie Rangel Tributes Pour In After His Passing

May 28, 2025

Congressman Charlie Rangel Tributes Pour In After His Passing

May 28, 2025 -

Truy Tim Kho Bau 13 Trieu Usd Cua Hai Tac Rau Den Chuyen That Hay Hu Cau

May 28, 2025

Truy Tim Kho Bau 13 Trieu Usd Cua Hai Tac Rau Den Chuyen That Hay Hu Cau

May 28, 2025

Latest Posts

-

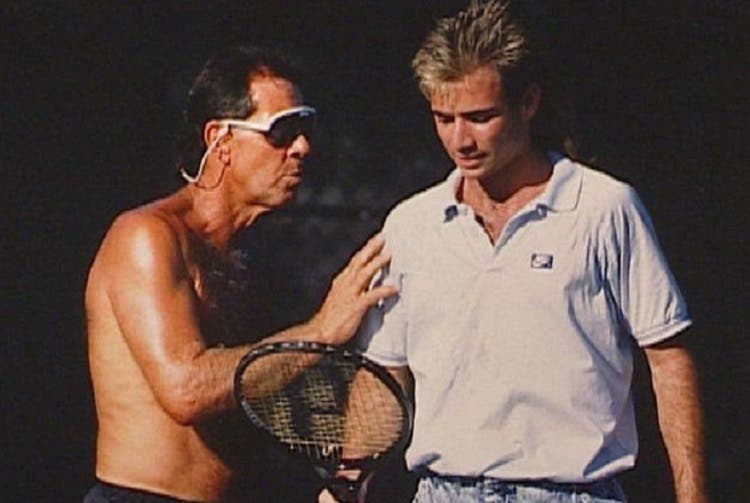

El Recuerdo De Agassi Rios Una Bestia En La Cancha

May 30, 2025

El Recuerdo De Agassi Rios Una Bestia En La Cancha

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

French Open 2025 Ruuds Knee Injury Costs Him Victory Against Borges

May 30, 2025

French Open 2025 Ruuds Knee Injury Costs Him Victory Against Borges

May 30, 2025 -

Agassi Rios Mi Gran Rival Sudamericano

May 30, 2025

Agassi Rios Mi Gran Rival Sudamericano

May 30, 2025 -

Agassi Schimba Raqueta De La Tenis La Pickleball

May 30, 2025

Agassi Schimba Raqueta De La Tenis La Pickleball

May 30, 2025