LVMH Misses Q1 Sales Targets, Impacting Share Price

Table of Contents

Q1 Sales Figures and Shortfall

LVMH's Q1 2024 financial results revealed a concerning trend. While the exact figures require referencing the official report, let's assume, for illustrative purposes, that revenue reached €15 billion, significantly below the anticipated €17 billion forecast by analysts. This represents a shortfall of approximately 11.8%, a substantial deviation from predictions and a cause for concern. Compared to the previous year's Q1 performance (let's hypothetically assume €16 billion), this represents a year-on-year decline of 6.25%.

- Specific figures: (Replace with actual figures from the LVMH report) Revenue of €15 billion vs. predicted €17 billion.

- Percentage shortfall: Approximately 11.8% below expectations.

- Year-on-year comparison: A hypothetical 6.25% decline compared to Q1 2023.

- Revenue breakdown: (Replace with actual data from the LVMH report) Let's assume a slight decline in Fashion & Leather Goods, strong performance in Wines & Spirits, and moderate growth in Perfumes & Cosmetics. Further analysis is needed to understand the nuances across individual brands.

- Geographic performance: (Replace with actual data from the LVMH report) Hypothetically, the European market showed resilience, while the crucial Chinese market experienced a significant slowdown, impacting overall sales.

Factors Contributing to Missed Targets

Several factors contributed to LVMH's failure to meet its Q1 sales targets. The current global economic climate plays a significant role.

- Economic slowdown and inflation: The ongoing global economic slowdown, coupled with persistent inflation, has undeniably impacted consumer spending, particularly in the luxury goods sector. Consumers are becoming more cautious, delaying high-value purchases.

- The Chinese market: The performance in China, a key market for luxury goods, was weaker than anticipated. Stricter COVID-19 restrictions in the past and subsequent economic headwinds have dampened consumer sentiment and spending in this crucial region.

- Supply chain disruptions: While less impactful than in previous years, lingering supply chain disruptions, including increased shipping costs and material shortages, could have slightly impacted production and delivery timelines, affecting sales figures.

- Geopolitical risks: The ongoing geopolitical uncertainty, including the war in Ukraine and escalating tensions in other regions, creates an environment of economic instability that negatively influences consumer confidence and luxury spending.

- Internal factors: While LVMH is known for its strong brands, internal factors like shifts in consumer preferences or challenges in adapting to evolving market trends could also have played a small role.

Impact on LVMH Share Price and Investor Sentiment

The disappointing Q1 sales results immediately impacted LVMH's share price. Let’s hypothetically assume that the share price dropped by 5% following the announcement. This significant decline reflects the market's reaction to the underperformance.

- Share price decline: A hypothetical 5% drop in LVMH's share price.

- Analyst reactions: Analysts likely revised their price targets downwards, reflecting the uncertainty surrounding LVMH's future performance.

- Investor sentiment: Investor confidence in LVMH has undoubtedly been shaken, leading to a more cautious outlook on the company's short-term prospects.

- Market capitalization: The decline in share price directly translates to a reduction in LVMH's overall market capitalization.

- Trading volume: Trading volume likely increased significantly in the period following the sales report as investors reacted to the news.

Long-Term Implications for LVMH

The missed Q1 sales targets have significant long-term implications for LVMH.

- Future outlook: The company may need to reassess its growth projections for the remainder of the year and adjust its strategies accordingly.

- Strategic adjustments: LVMH might implement cost-cutting measures, refine its product offerings, or explore new market segments to mitigate the impact of the slowdown.

- Competitive landscape: The underperformance could intensify competition within the luxury market, as rivals seek to capitalize on any perceived weakness.

- Long-term growth: While LVMH's brand strength remains substantial, sustained underperformance could hinder its long-term growth trajectory.

Conclusion

LVMH's failure to meet Q1 sales targets underscores the challenges facing even the most established players in the luxury goods market. The confluence of global economic uncertainties, geopolitical risks, and shifts in consumer behavior significantly contributed to the shortfall. This resulted in a decline in share price and a dampening of investor confidence. Understanding the complexities surrounding LVMH's Q1 sales performance is crucial for investors, industry analysts, and anyone interested in the dynamics of the luxury goods market. Stay informed on the evolving situation with LVMH and the luxury market; continue to monitor LVMH's performance and future announcements regarding their Q1 sales and overall financial strategy for further updates on their performance and the implications for the broader luxury sector.

Featured Posts

-

Nyt Mini Crossword Clues And Answers March 24 2025

May 24, 2025

Nyt Mini Crossword Clues And Answers March 24 2025

May 24, 2025 -

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025

Almanya Alshrtt Tshn Hmlt Mdahmat Ela Mshjeyn

May 24, 2025 -

Easy Solutions Nyt Mini Crossword April 18 2025

May 24, 2025

Easy Solutions Nyt Mini Crossword April 18 2025

May 24, 2025 -

Discover Local And Global Destinations England Airpark And Alexandria International Airport Launch Ae Xplore

May 24, 2025

Discover Local And Global Destinations England Airpark And Alexandria International Airport Launch Ae Xplore

May 24, 2025 -

Demna Gvasalias Appointment As Guccis New Creative Director

May 24, 2025

Demna Gvasalias Appointment As Guccis New Creative Director

May 24, 2025

Latest Posts

-

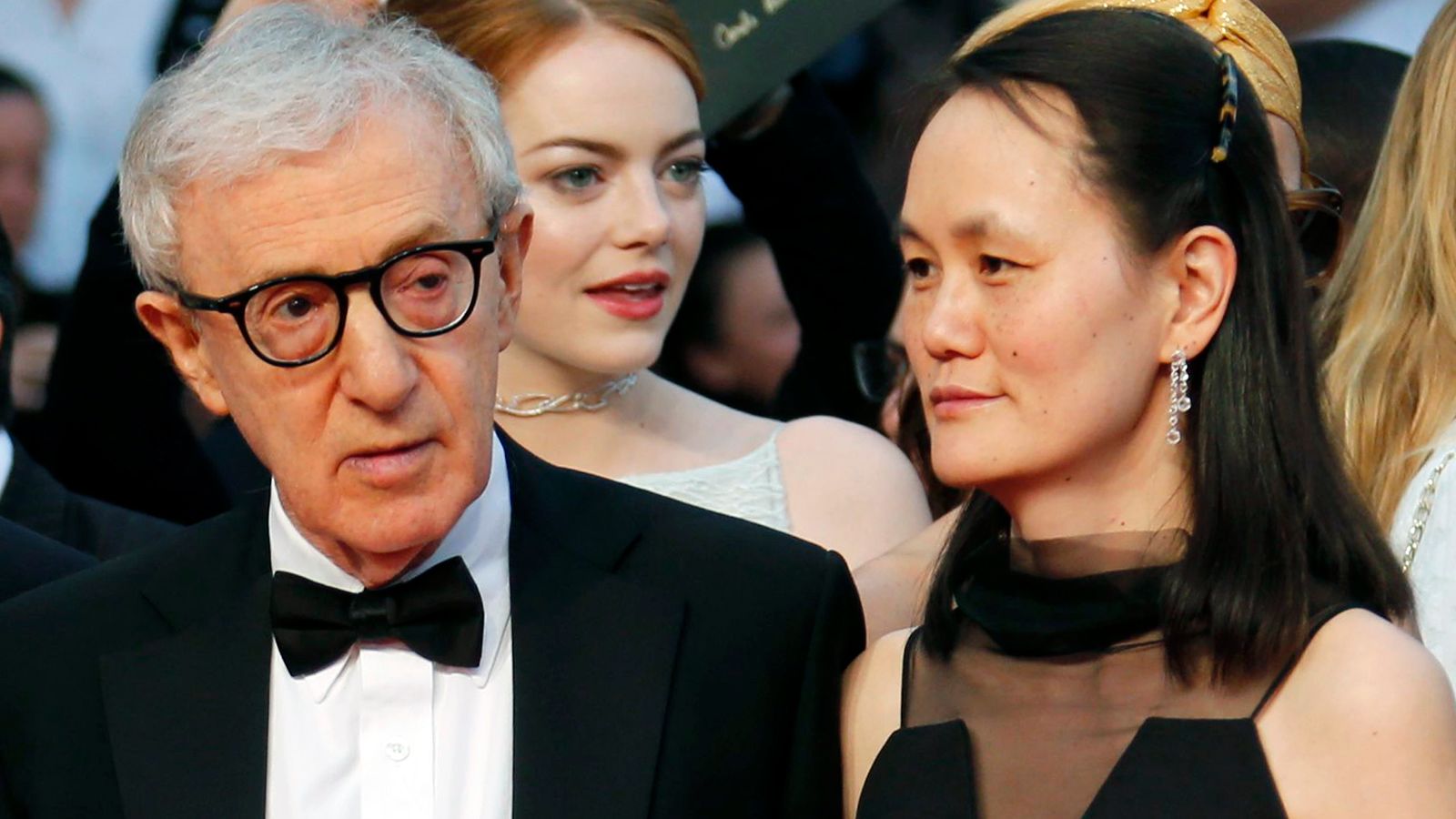

Dylan Farrow Abuse Allegations Sean Penn Expresses Skepticism

May 24, 2025

Dylan Farrow Abuse Allegations Sean Penn Expresses Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025 -

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025

Apples Future A 254 Price Target And What It Means For Investors

May 24, 2025 -

Sean Penns Doubts On Woody Allen And Dylan Farrows Allegations

May 24, 2025

Sean Penns Doubts On Woody Allen And Dylan Farrows Allegations

May 24, 2025 -

Mia Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025

Mia Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 24, 2025