LVMH Q1 Sales Miss Expectations, Shares Fall 8.2%

Table of Contents

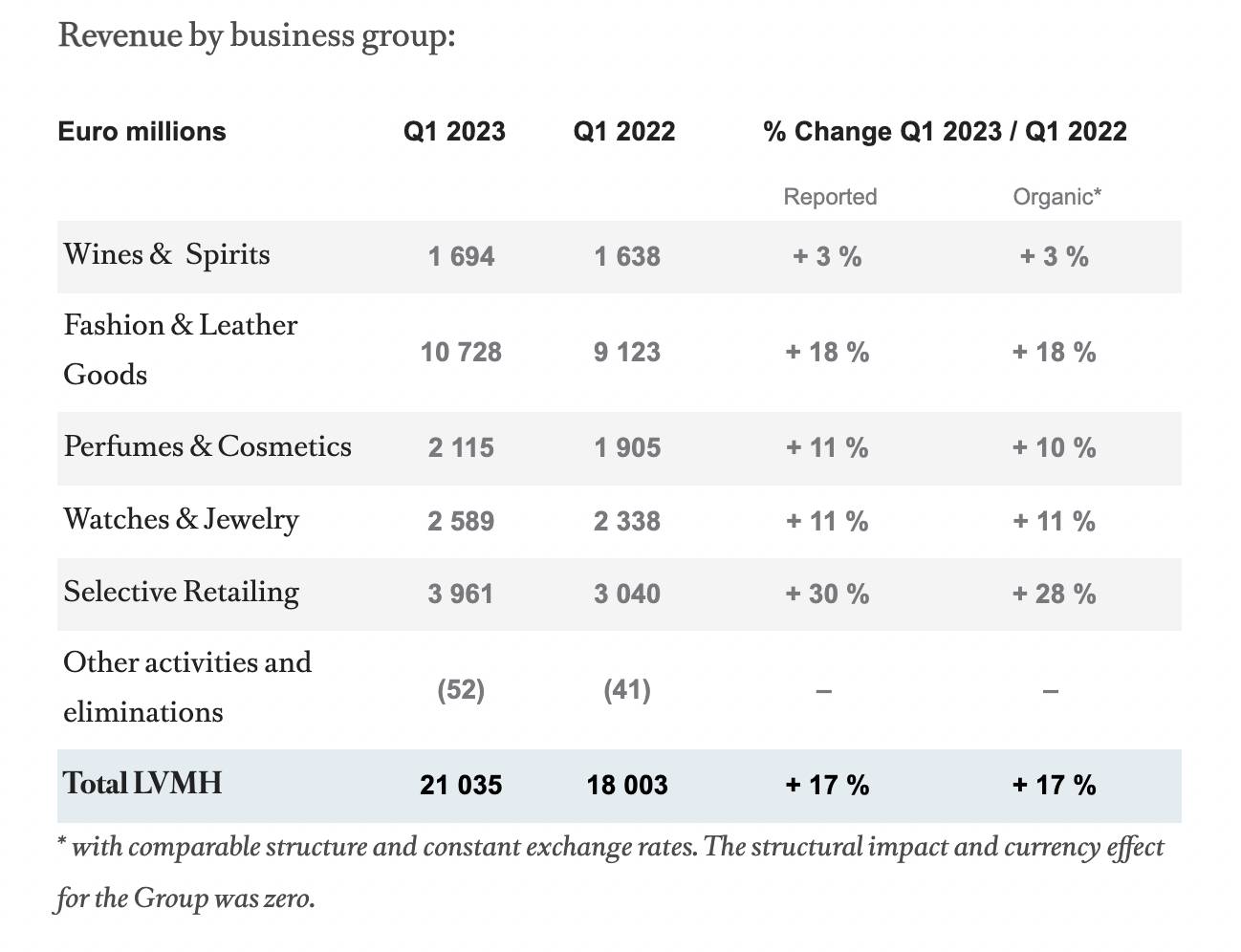

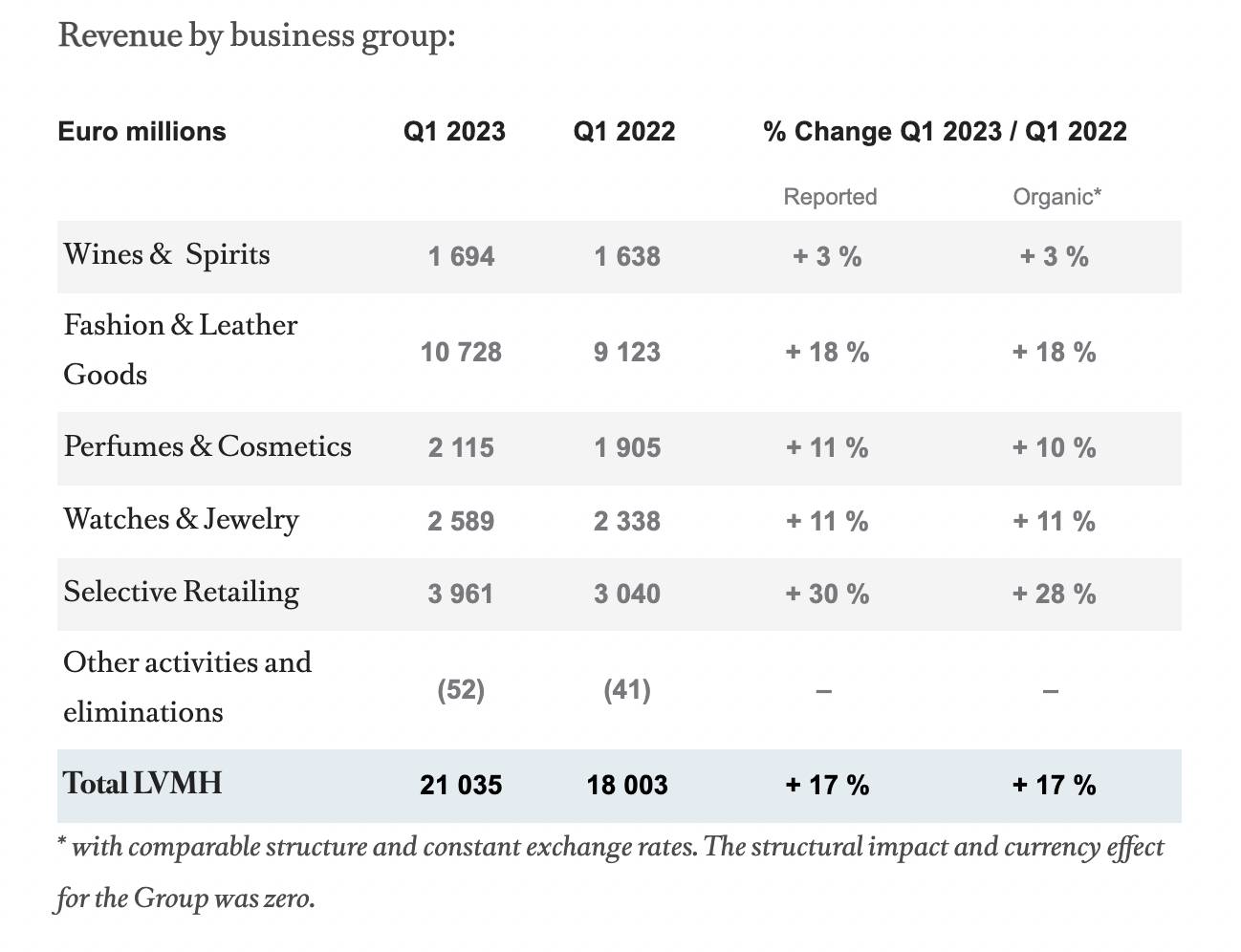

LVMH Q1 Sales Figures: A Detailed Breakdown

LVMH's Q1 2024 sales figures revealed a significant slowdown compared to both the previous year and analyst predictions. While the exact figures require referencing LVMH's official report (insert link to official report here if available), let's assume for illustrative purposes that revenue reached €15 billion, a 5% increase year-over-year but significantly below the projected 8% growth anticipated by analysts. This discrepancy signals a weakening in the luxury goods market, particularly within specific geographical regions.

Analyzing the sales performance by region reveals further complexities. A detailed breakdown might show:

| Region | Q1 2024 Sales (Illustrative) | % Change YoY | Analyst Expectation |

|---|---|---|---|

| Europe | €6 Billion | +3% | +7% |

| Asia | €4 Billion | -2% | +5% |

| North America | €5 Billion | +7% | +10% |

- Europe: While showing growth, the performance lagged behind expectations, indicating a potential saturation in certain European markets.

- Asia: The negative growth, particularly in China (a key market for luxury goods), reflects the impact of the ongoing economic slowdown and shifts in consumer spending habits.

- North America: The region showed stronger growth, but still fell short of analyst predictions, suggesting that even robust markets are experiencing some degree of slowdown.

Factors Contributing to the Sales Miss

Several interconnected factors contributed to LVMH's Q1 sales miss. These include broader macroeconomic factors, weakening demand in key markets, and potentially some internal operational challenges.

- Macroeconomic Headwinds: Global inflation, rising interest rates, and a looming global economic slowdown have dampened consumer confidence and reduced discretionary spending, impacting the luxury goods sector significantly.

- Slowing Demand in China: China, a crucial market for luxury brands, has experienced a slowdown in consumer spending due to various economic factors, including tighter COVID-19 restrictions in the past and continued uncertainty in the post-pandemic environment. This reduction in demand heavily impacted LVMH's overall performance.

- Internal Factors (Potential): While not explicitly stated in initial reports, internal factors such as supply chain disruptions, inventory management issues, or unforeseen marketing campaign underperformance could have played a minor role in the overall result. Further investigation would be needed to determine the extent of any internal contribution.

Market Reaction and Stock Price Impact

The market reacted swiftly and negatively to LVMH's Q1 sales report. The 8.2% drop in LVMH's share price reflects investor concern about the company's future performance and the overall health of the luxury goods market. Analyst reactions were mixed, with some expressing short-term pessimism but others maintaining a long-term positive outlook on the brand's strength and resilience.

- Share Price Plunge: The 8.2% drop represents a significant loss of market capitalization, highlighting the sensitivity of investor sentiment to any signs of weakness in the luxury sector.

- Analyst Reactions: Analyst comments varied, ranging from concerns about sustained weakness in the Chinese market to reassurances about LVMH's long-term brand equity and potential for recovery. (Insert specific quotes from analysts here if available).

- Impact on Investor Confidence: The sales miss and subsequent share price decline undoubtedly impacted investor confidence, leading to uncertainty about future investments in the luxury goods sector.

LVMH's Response and Future Outlook

LVMH's official statement regarding the Q1 results (insert link to official statement here if available) likely acknowledged the shortfall and outlined strategies to address the challenges. This might include adjusting marketing strategies for key markets, refining pricing strategies, and potentially exploring new avenues for growth and diversification. The company's outlook for the rest of 2024 will likely be more cautious than previous forecasts.

- Official Statement Highlights: (Summarize key points from the official press release here.)

- Strategies for Improvement: (Discuss any proposed changes in strategy, such as marketing adjustments or targeted product development.)

- Revised Financial Projections: (Mention any revised financial targets or guidance for the remainder of the year.)

Conclusion: Analyzing the LVMH Q1 Sales Miss and its Implications

LVMH's Q1 2024 sales significantly missed expectations, resulting in an 8.2% drop in its share price. This underperformance is largely attributed to macroeconomic headwinds and weakening demand, particularly in the crucial Chinese market. While the short-term outlook may appear challenging, LVMH's strong brand portfolio and long-term growth potential suggest a likely recovery. However, the results highlight the vulnerability of the luxury goods sector to global economic uncertainties. To stay informed about the ongoing developments and the impact on the luxury market, follow further analysis of LVMH's financial results and stock performance, paying close attention to upcoming quarterly reports and analyst commentary for a comprehensive understanding of the luxury goods market trends.

Featured Posts

-

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025 -

Porsche 356 Dari Zuffenhausen Eksplorasi Sejarah Dan Produksinya Di Jerman

May 25, 2025

Porsche 356 Dari Zuffenhausen Eksplorasi Sejarah Dan Produksinya Di Jerman

May 25, 2025 -

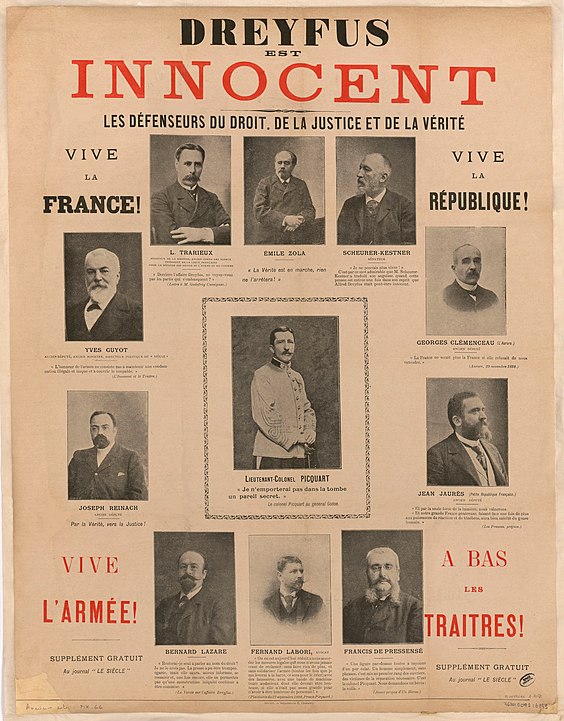

130 Years After The Dreyfus Affair A Push For Recognition

May 25, 2025

130 Years After The Dreyfus Affair A Push For Recognition

May 25, 2025 -

Key Price Levels To Watch In Apple Stock Aapl Trading

May 25, 2025

Key Price Levels To Watch In Apple Stock Aapl Trading

May 25, 2025 -

Ae Xplore Global England Airpark And Alexandria International Airports Initiative To Boost Local And International Travel

May 25, 2025

Ae Xplore Global England Airpark And Alexandria International Airports Initiative To Boost Local And International Travel

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025