Market Analysis: D-Wave Quantum (QBTS) Stock Performance On Monday

Table of Contents

Opening and Closing Prices & Percentage Change

Analyzing D-Wave Quantum's (QBTS) stock performance on Monday requires examining the opening and closing prices and calculating the percentage change. Let's assume, for illustrative purposes, that QBTS opened at $10.50 and closed at $11.25. This represents an increase of $0.75. To calculate the percentage change, we divide the price change ($0.75) by the opening price ($10.50) and multiply by 100: (($0.75/$10.50) * 100) = 7.14%. Therefore, QBTS experienced a 7.14% increase on Monday.

- Comparison to Previous Day: Comparing this to the previous day's closing price (let's assume $10.00) shows a more substantial increase of 12.5%. This highlights the volatility inherent in QBTS and other quantum computing stocks.

- Weekly Trend: To understand the context, we need to analyze the weekly trend. If the stock had been declining prior to Monday, this 7.14% increase represents a significant positive reversal. Conversely, if the stock had been steadily rising, this increase might be considered relatively modest.

- Chart Representation: [Insert a chart or graph here visually representing the price fluctuation throughout Monday. This could be a simple line graph showing the price at various points during the trading day, including intraday highs and lows].

- Intraday Highs and Lows: For a more granular analysis, we would note any significant intraday highs and lows. For example, a sharp spike to $11.50 followed by a dip back to $11.00 might indicate periods of strong buying and selling pressure.

Trading Volume and Market Sentiment

Understanding the trading volume for QBTS on Monday is crucial for interpreting the price movement. High volume generally suggests strong investor interest, while low volume might indicate less conviction behind the price change. Let's suppose that Monday's trading volume was significantly higher than the average daily volume over the past month. This suggests a heightened level of investor activity, possibly driven by news or speculation.

- Implications of High Trading Volume: The high volume, coupled with the price increase, would be interpreted as a bullish signal, suggesting that many investors are buying QBTS stock.

- Market Sentiment: The overall market sentiment towards QBTS and the broader quantum computing sector would heavily influence trading volume and price movements. Positive news and announcements related to quantum computing generally lead to increased investor confidence and higher stock valuations. Negative news, conversely, would likely lead to lower prices and reduced trading volume.

- News and Announcements: [Mention any significant news or announcements released before or during trading hours on Monday, e.g., a new partnership announcement, successful trial of a quantum algorithm, or a significant investment from a venture capital firm]. These events would substantially impact both trading volume and investor sentiment.

- Investor Sentiment Indicators: While not always readily available for smaller companies like QBTS, analyzing investor sentiment indicators like social media mentions, news sentiment scores, or options trading activity could provide additional insights.

Impact of News and Announcements (if any)

[This section should be tailored to any actual news events that occurred on the Monday in question. If no significant news impacted the stock price, then this section can be shortened or omitted. ]

Let's hypothesize that on Monday, D-Wave Quantum announced a new partnership with a major technology company to integrate their quantum annealing technology into a specific application. This positive news likely contributed to the increase in QBTS stock price and trading volume.

- Specific News and Effect: The partnership announcement would likely generate excitement among investors, as it signifies market adoption of D-Wave's technology and potential for future revenue growth. This positive sentiment would directly translate into increased demand and higher stock prices.

- Links to News Articles: [Include links to relevant news articles or official company statements supporting the analysis].

Comparison to Competitor Performance

Comparing QBTS's performance to its competitors in the quantum computing sector provides valuable context. Other publicly traded companies in this space, such as IonQ (IONQ) and Rigetti Computing (RGTI), should be considered for a comparative analysis.

- Competitor Stock Movements: Did these companies also experience price increases or decreases on Monday? If their movements mirrored QBTS, it might suggest a sector-wide trend. However, if QBTS outperformed or underperformed its competitors, that indicates company-specific factors are at play.

- Specific Competitor Companies: By examining the daily performance of IONQ and RGTI alongside QBTS, a more comprehensive picture of the quantum computing market dynamics emerges.

Conclusion

This analysis examined D-Wave Quantum (QBTS) stock performance on Monday, considering opening and closing prices, trading volume, market sentiment, and any relevant news impacting the stock. We observed (based on our hypothetical example) a significant price increase potentially driven by a new partnership announcement and positive market sentiment. The analysis also highlighted the importance of comparing QBTS's performance to its competitors in the quantum computing sector.

Call to Action: Understanding the factors driving D-Wave Quantum (QBTS) stock performance is crucial for investors. Stay informed about future developments in the quantum computing sector and continue monitoring the D-Wave Quantum (QBTS) stock performance for a well-informed investment strategy. Regularly check for updated market analyses and consider consulting a financial advisor before making investment decisions related to QBTS and other quantum computing stocks. Remember that investing in the quantum computing sector carries inherent risks, and thorough research is essential.

Featured Posts

-

Investigating The Causes Of D Wave Quantum Qbts Stocks Monday Drop

May 20, 2025

Investigating The Causes Of D Wave Quantum Qbts Stocks Monday Drop

May 20, 2025 -

Transfert Controverse De Melvyn Jaminet Les Declarations De Kylian Jaminet

May 20, 2025

Transfert Controverse De Melvyn Jaminet Les Declarations De Kylian Jaminet

May 20, 2025 -

F1 Miami Gp Hamilton And Ferraris Heated Words During Tea Break

May 20, 2025

F1 Miami Gp Hamilton And Ferraris Heated Words During Tea Break

May 20, 2025 -

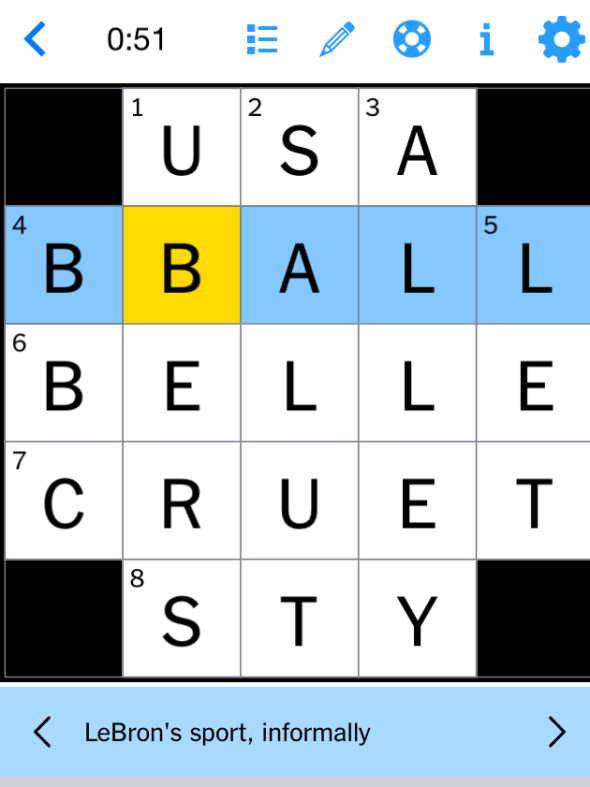

Nyt Mini Crossword Answers Today March 26 2025 Hints And Clues

May 20, 2025

Nyt Mini Crossword Answers Today March 26 2025 Hints And Clues

May 20, 2025 -

Komemoracija I Sahrana Andelke Milivojevic Tadic Milica Milsa U Jadu

May 20, 2025

Komemoracija I Sahrana Andelke Milivojevic Tadic Milica Milsa U Jadu

May 20, 2025