Market Analysis: Why D-Wave Quantum (QBTS) Stock Fell On Thursday

Table of Contents

Negative Earnings Report & Revenue Miss

D-Wave's Q[insert quarter, e.g., 3] earnings report significantly impacted the stock price, triggering a sell-off. The report revealed a substantial miss on revenue expectations, fueling negative investor sentiment.

- Revenue shortfall: The company reported [insert specific revenue figure], falling significantly short of the anticipated [insert expected revenue figure]. This represents a [insert percentage]% decrease compared to the previous quarter/year.

- Reasons for shortfall: The revenue shortfall can be attributed to several factors. Slower-than-anticipated adoption of D-Wave's quantum computing solutions by businesses could be a key element. Increased competition from other players in the burgeoning quantum computing market also played a role. Furthermore, potential delays in securing larger contracts might have also contributed to the disappointing numbers.

- Decreased guidance: The company's lowered guidance for future earnings further dampened investor enthusiasm. This projection of reduced revenue in the coming quarters suggests that the current challenges are not likely to be resolved in the short term.

- Negative investor sentiment: The earnings report triggered a wave of negative sentiment among investors, leading to a significant sell-off and contributing to the QBTS stock decline. Analyst commentary following the report underscored this negative sentiment.

Overall Market Downturn & Tech Sector Weakness

The drop in QBTS stock price didn't occur in isolation. It coincided with a broader macroeconomic downturn and a general weakening of the tech sector, especially within the computer technology and software sub-sectors.

- Market trends: Thursday witnessed a general negative trend in the stock market, impacting various sectors. Major indices experienced declines, contributing to a risk-averse environment for investors.

- Tech stock performance: Many tech stocks, particularly those in the computing and software sectors, experienced declines on Thursday. This general tech sector weakness amplified the negative impact on QBTS.

- External factors impacting tech: Negative news related to [mention specific events, e.g., interest rate hikes, geopolitical tensions, regulatory changes] further exacerbated the overall tech sector weakness and contributed to the fall in QBTS stock.

- Investor risk aversion: In times of market uncertainty, investors often move away from higher-risk growth stocks like QBTS, opting for safer investments. This risk aversion contributed to the sell-off.

Competition and Market Saturation Concerns

The quantum computing field is becoming increasingly competitive. This burgeoning sector is witnessing the entry of new players and the advancement of existing competitors. This heightened competition poses a challenge to D-Wave's market position and future growth.

- Key competitors: Companies like [mention key competitors, e.g., IBM, Google, Rigetti] are aggressively developing their quantum computing technologies, increasing the competitive pressure on D-Wave. These companies' recent breakthroughs and announcements added to the perceived competitive threat.

- Market saturation potential: Concerns about potential market saturation in the near future might have also contributed to the negative investor sentiment. The fear that the market may not be large enough to support multiple major players simultaneously contributed to the QBTS stock fall.

- Impact on D-Wave: The intensified competition is placing downward pressure on D-Wave’s market share and hindering its ability to secure new contracts and partnerships.

Lack of Major Breakthrough Announcements

The absence of significant announcements regarding major technological breakthroughs or significant partnerships also played a role in the QBTS stock decline.

- Importance of breakthroughs: For a growth stock like QBTS, which is heavily reliant on future potential, groundbreaking news is essential to maintain investor confidence. Positive announcements typically boost investor optimism and drive up stock prices.

- Missed expectations: Investors may have been anticipating significant announcements, such as a breakthrough in [mention specific technology or application], which did not materialize. This unmet expectation contributed to the negative sentiment.

- Investor expectations and volatility: High expectations, especially in a rapidly evolving sector like quantum computing, can lead to substantial stock price volatility. When expectations are not met, a significant stock price drop may result.

Analyst Ratings and Price Target Revisions

Several analyst firms revised their ratings and price targets for QBTS following the earnings report, further exacerbating the stock's decline.

- Analyst revisions: [Mention specific analyst firms and their actions, e.g., "Morgan Stanley downgraded QBTS from 'buy' to 'hold,' while Goldman Sachs lowered its price target from $X to $Y."]

- Influence on investor sentiment: Analyst opinions significantly influence investor sentiment and trading activity. Negative revisions often lead to increased selling pressure.

- Impact on price: These downward revisions further contributed to the already negative sentiment surrounding QBTS, driving the stock price even lower.

Conclusion

The D-Wave Quantum (QBTS) stock decline on Thursday was likely a confluence of factors, including a disappointing earnings report, broader market weakness, competitive pressures, and a lack of significant positive news. Understanding these interwoven influences is crucial for investors assessing the future of QBTS and the quantum computing sector. Continued monitoring of D-Wave’s progress, industry trends, and analyst sentiment is essential for making informed decisions about investing in D-Wave Quantum (QBTS) stock. Conduct thorough research and consult with a financial advisor before making any investment choices related to QBTS or other quantum computing stocks.

Featured Posts

-

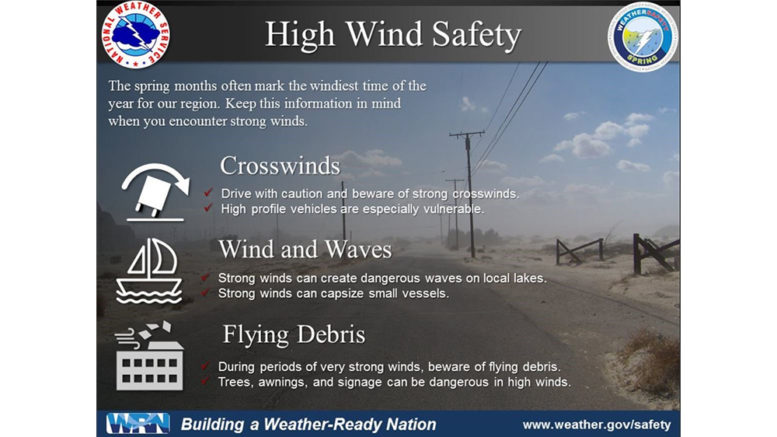

Staying Safe During Fast Moving Storms With High Winds

May 21, 2025

Staying Safe During Fast Moving Storms With High Winds

May 21, 2025 -

The Goldbergs A Comprehensive Guide To Every Season

May 21, 2025

The Goldbergs A Comprehensive Guide To Every Season

May 21, 2025 -

The Impact Of Trumps Tariffs And Statehood Comments On Wayne Gretzkys Legacy

May 21, 2025

The Impact Of Trumps Tariffs And Statehood Comments On Wayne Gretzkys Legacy

May 21, 2025 -

Bangladeshinfo Com A Reliable Source For Information About Bangladesh

May 21, 2025

Bangladeshinfo Com A Reliable Source For Information About Bangladesh

May 21, 2025 -

Family Struck By Train Two Dead Childrens Fate Uncertain

May 21, 2025

Family Struck By Train Two Dead Childrens Fate Uncertain

May 21, 2025

Latest Posts

-

Switzerland Condemns Pahalgam Terror Attack Official Statement From Foreign Minister Cassis

May 22, 2025

Switzerland Condemns Pahalgam Terror Attack Official Statement From Foreign Minister Cassis

May 22, 2025 -

Combate Las Enfermedades Cronicas Este Superalimento Es Tu Mejor Aliado Para Un Envejecimiento Saludable

May 22, 2025

Combate Las Enfermedades Cronicas Este Superalimento Es Tu Mejor Aliado Para Un Envejecimiento Saludable

May 22, 2025 -

Mas Alla Del Arandano El Superalimento Clave Para Prevenir Enfermedades Cronicas

May 22, 2025

Mas Alla Del Arandano El Superalimento Clave Para Prevenir Enfermedades Cronicas

May 22, 2025 -

Superalimentos Para La Salud Por Que Este Supera Al Arandano En La Prevencion De Enfermedades

May 22, 2025

Superalimentos Para La Salud Por Que Este Supera Al Arandano En La Prevencion De Enfermedades

May 22, 2025 -

El Superalimento Que Supera Al Arandano Beneficios Para La Salud Y La Longevidad

May 22, 2025

El Superalimento Que Supera Al Arandano Beneficios Para La Salud Y La Longevidad

May 22, 2025