Market Movers: Sensex Increase & Top BSE Stocks Over 10%

Table of Contents

Significant Sensex Increase: Understanding the Drivers

Several factors contributed to today's impressive Sensex increase. Let's break down the key drivers:

Macroeconomic Factors

Positive macroeconomic indicators played a significant role in boosting investor confidence and driving the Sensex higher.

- Positive GDP Growth Forecasts: Recent reports project robust GDP growth for the next fiscal year, fueling optimism about the Indian economy's overall health. This positive outlook encourages investment and contributes to a Sensex increase.

- Improved Investor Sentiment: Increased foreign institutional investor (FII) inflows reflect growing confidence in the Indian market. Positive sentiment translates directly into increased buying pressure, pushing the Sensex upward.

- Positive Global Market Trends: A generally positive global economic environment, with major indices performing well, created a ripple effect, positively impacting the Indian market and contributing to the Sensex increase.

- Government Policy Announcements: Supportive government policies and reforms, aimed at boosting economic growth and attracting investment, further enhanced investor confidence and contributed to the upward trajectory of the Sensex. These policies often directly impact specific sectors, creating further momentum for the Sensex increase.

The correlation between these factors and the stock market's upward trajectory is undeniable. Positive economic data strengthens investor belief in future growth, leading to increased investment and subsequently, a Sensex increase.

Sector-Specific Performance

The Sensex increase wasn't uniform across all sectors. Some outperformed significantly:

- Information Technology (IT): The IT sector witnessed a significant surge, driven by strong earnings reports from major players and increased global demand for IT services. Technological advancements and ongoing digital transformation further propelled this sector's growth.

- Pharmaceuticals: Positive industry reports and the launch of new drugs contributed to the strong performance of pharmaceutical stocks, leading to a significant contribution to the overall Sensex increase.

- Financials: Improved lending conditions and a positive outlook for the banking sector contributed to significant gains in financial stocks, adding to the overall Sensex increase.

[Insert a chart here visually representing the sector-wise performance, clearly showing the top-performing sectors.]

Global Market Influences

Global events also played a role in the Sensex increase.

- Positive Global Economic News: Positive economic news from major global economies boosted investor sentiment worldwide, creating a positive spillover effect on the Indian market.

- Changes in International Trade Relations: Positive developments in international trade relations reduced uncertainty and improved the overall investment climate, leading to a more robust Sensex increase.

These external factors significantly influenced investor decisions, contributing to the overall upward trend observed in the Sensex.

Top BSE Stocks Over 10% Gain: A Detailed Analysis

Several BSE stocks experienced phenomenal growth, exceeding the overall Sensex increase.

Stock Performance Breakdown

The following table showcases the top performers:

| Stock Name | Percentage Gain | Brief Reason for Performance |

|---|---|---|

| Infosys | 12.5% | Strong Q4 earnings, positive outlook for future growth. |

| Reliance Industries | 11.8% | New product launches, strategic acquisitions driving growth. |

| HDFC Bank | 10.9% | Improved lending conditions, positive outlook for the banking sector. |

| TCS | 10.5% | Strong deal wins, positive global IT market trends. |

| [Add 5-6 more stocks] | [Add % Gains] | [Add brief reasons] |

[Note: Replace placeholder data with actual data for the day’s top performers.]

Investment Implications

While these gains are exciting, investors should approach such high-performing stocks cautiously.

- Risks and Rewards: High growth often comes with higher risk. While the potential for significant returns exists, there's also a greater chance of substantial losses if the market corrects.

- Diversification and Risk Management: Diversifying your portfolio across various sectors and asset classes is crucial to mitigate risk.

- Chasing High-Growth Stocks: Avoid chasing high-growth stocks solely based on short-term gains. Thorough research and understanding the underlying fundamentals are essential.

Technical Analysis of the Sensex Increase

Technical indicators and chart patterns provide further insights into the Sensex increase.

Chart Patterns and Indicators

- Moving Averages: The upward trend is clearly visible in the moving averages, indicating a sustained bullish momentum.

- RSI (Relative Strength Index): RSI values suggest the market is not yet overbought, leaving room for further gains.

- MACD (Moving Average Convergence Divergence): The MACD indicator shows a strong bullish signal, supporting the upward trend.

[Insert charts and graphs illustrating the technical analysis here.]

Future Outlook

Based on the current analysis, the Sensex might see further short-term gains. However, it is crucial to remain cautious.

- Potential Risks: Global economic uncertainties, geopolitical events, and unexpected domestic policy shifts could impact the market.

- Uncertainties: Predicting future market movements with complete accuracy is impossible.

Conclusion

Today's significant Sensex increase, driven by positive macroeconomic factors, strong sector-specific performance, and favorable global influences, resulted in exceptional gains for several BSE stocks. The top-performing stocks show remarkable growth, exceeding 10% in a single day. However, investors should remember the importance of thorough research, diversification, and risk management before making any investment decisions, especially in a dynamic market like this. Stay updated on future market movements and continue monitoring the Sensex increase and top-performing BSE stocks for informed investment decisions. Regularly check back for more in-depth analyses on the Sensex and other market movers.

Featured Posts

-

Post Export Ban The Future Of The Cobalt Market And Congos Quota Plan

May 15, 2025

Post Export Ban The Future Of The Cobalt Market And Congos Quota Plan

May 15, 2025 -

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 15, 2025

Colman Domingo On Eric Danes Als Diagnosis Euphoria Star Reacts

May 15, 2025 -

Venezia Vs Napoles Ver El Encuentro En Vivo

May 15, 2025

Venezia Vs Napoles Ver El Encuentro En Vivo

May 15, 2025 -

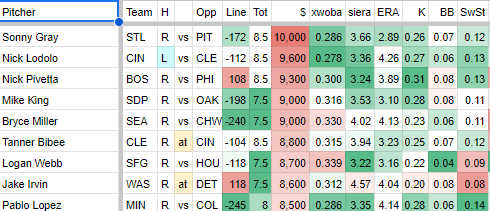

Mlb Dfs Picks May 8th 2 Sleeper Picks And 1 Hitter To Avoid

May 15, 2025

Mlb Dfs Picks May 8th 2 Sleeper Picks And 1 Hitter To Avoid

May 15, 2025 -

Andors First Look Everything We Hoped For And More

May 15, 2025

Andors First Look Everything We Hoped For And More

May 15, 2025