Market Rally: S&P 500 Up Over 3% Following Trade Truce

Table of Contents

The Trade Truce and its Impact

The announcement of a temporary trade truce between major economic powers significantly eased concerns about escalating trade tensions. This positive development calmed market volatility and boosted investor confidence. The reduction in uncertainty surrounding future tariffs had a ripple effect across global markets.

- Reduced uncertainty regarding future tariffs: The threat of further tariffs had been a major dampener on economic growth and investor sentiment. The truce removed this immediate threat, allowing businesses to plan with more certainty.

- Improved outlook for global economic growth: Easing trade tensions improves the outlook for global trade and economic growth. This positive expectation is a key driver of the stock market rally.

- Increased investor appetite for riskier assets: With reduced uncertainty, investors are more willing to invest in riskier assets, such as stocks, leading to increased demand and higher prices.

- Positive impact on supply chains and international trade: The truce reduces disruptions to global supply chains, benefiting businesses and consumers alike. This contributes to a more positive overall economic climate, supporting the market surge.

Sector-Specific Performance During the Rally

The market rally didn't affect all sectors equally. Some sectors experienced more pronounced gains than others, reflecting varied responses to the news. Analyzing sector performance provides crucial insights into the market's dynamics.

- Technology stocks saw significant gains: Technology companies, often heavily impacted by trade disputes, benefited significantly from the reduced uncertainty. This is reflected in their strong performance during the stock market gains.

- Consumer discretionary stocks also performed well: Increased consumer confidence, partly fueled by the positive trade news, boosted the performance of consumer discretionary stocks.

- Some more sensitive sectors might have seen less dramatic increases or even minor corrections: Sectors highly sensitive to global trade fluctuations might have shown more muted responses or even experienced temporary corrections. This highlights the importance of conducting thorough sector analysis before making investment decisions. Careful index performance tracking is essential in such situations.

Analyzing Investor Sentiment and Market Volatility

The market rally was accompanied by a noticeable shift in investor sentiment, moving from fear and uncertainty towards optimism and renewed confidence. Analyzing market indicators helps understand the depth and sustainability of this rally.

- Significant decrease in the VIX (Volatility Index): The VIX, a measure of market fear, dropped significantly, reflecting reduced anxiety among investors. This decrease is a strong indicator of increased confidence.

- Increased trading volume: Higher trading volume indicates heightened investor activity, suggesting a broader participation in the market surge.

- Positive shifts in other key market indicators: Other market indicators, such as increased bond yields and improving economic data, further support the positive shift in investor sentiment and contribute to the overall market rally.

Opportunities and Risks for Investors

While the market rally presents opportunities, investors need to adopt a balanced approach, considering both potential gains and inherent risks. Developing a robust investment strategy is key during periods of market fluctuation.

- Potential for further gains in the short-term, but also the possibility of corrections: While the short-term outlook might seem positive, investors should be aware of the possibility of corrections or periods of consolidation.

- Importance of diversifying portfolios to mitigate risks: Diversification remains a crucial element of risk management, helping investors to weather potential market downturns.

- Long-term investment strategies remain crucial, despite short-term market fluctuations: Focusing on long-term investment goals helps to mitigate the impact of short-term market volatility.

- Careful risk management is essential to protect against unforeseen market downturns: Implementing appropriate risk management strategies is essential to protect investments during any potential market corrections.

Conclusion

The S&P 500's impressive market rally, fueled by a trade truce, signifies a shift in investor sentiment and presents both opportunities and challenges. Understanding the underlying factors driving this surge is crucial for making informed investment decisions. While the short-term outlook seems positive, a long-term perspective and diversified investment strategy remain essential. To stay informed on future market movements and capitalize on potential market rallies, continue to monitor economic indicators and news related to trade negotiations. Don't miss out on the next market rally – stay informed and adapt your investment strategy accordingly.

Featured Posts

-

Adrien Brody Post Oscar Win A Case For His Mcu Magneto Casting

May 13, 2025

Adrien Brody Post Oscar Win A Case For His Mcu Magneto Casting

May 13, 2025 -

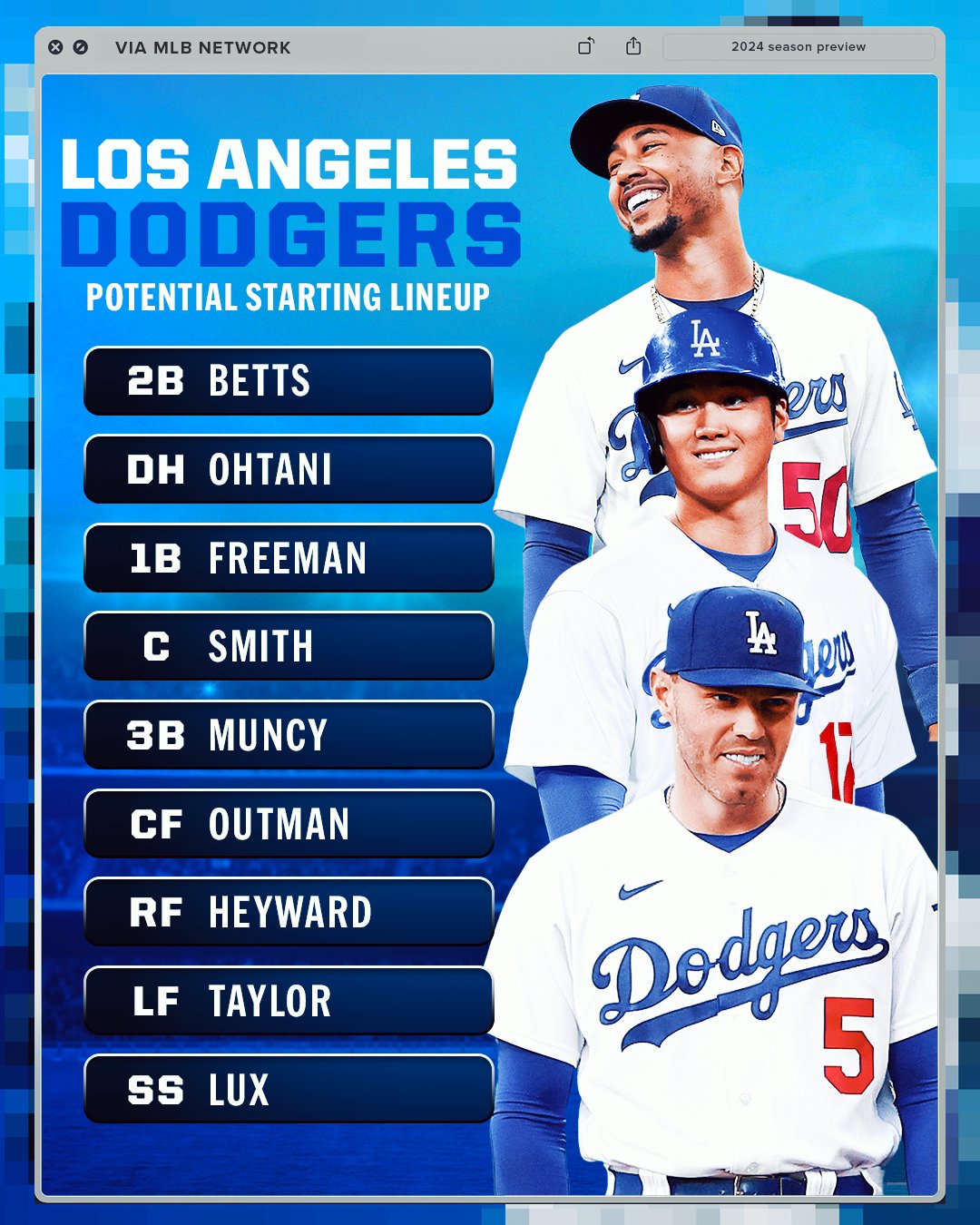

Cubs Vs Dodgers Game Day Lineups Tv Info And Live Game Thread 2 05 Ct

May 13, 2025

Cubs Vs Dodgers Game Day Lineups Tv Info And Live Game Thread 2 05 Ct

May 13, 2025 -

Family Business Drama Elsbeths Predicament In S02 E14

May 13, 2025

Family Business Drama Elsbeths Predicament In S02 E14

May 13, 2025 -

Limited Edition Doom Dark Ages Xbox Controller Amazon Price Drop

May 13, 2025

Limited Edition Doom Dark Ages Xbox Controller Amazon Price Drop

May 13, 2025 -

Der Braunschweiger Schoduvel Ein Umfassender Ueberblick Zum Karnevalsumzug

May 13, 2025

Der Braunschweiger Schoduvel Ein Umfassender Ueberblick Zum Karnevalsumzug

May 13, 2025