Market Reaction: House Tax Bill Passage And Its Effects On Stocks, Bonds, And Bitcoin

Table of Contents

Impact on the Stock Market

The House Tax Bill's impact on the stock market is multifaceted, varying significantly across sectors and individual companies. The immediate aftermath saw increased volatility, reflecting investor uncertainty about the long-term implications of the new tax code.

Sector-Specific Effects

The House Tax Bill’s impact varies significantly across different sectors. Some companies will benefit, while others might face challenges.

- Companies with high tax burdens: These companies might see increased profitability and subsequent stock price increases as their tax liabilities decrease. This could lead to a re-evaluation of their intrinsic value and potential for future growth.

- Sectors heavily reliant on tax deductions: Sectors like real estate investment trusts (REITs), which heavily rely on tax deductions, may experience negative short-term consequences due to changes in allowable deductions. This could lead to decreased investment and potentially lower stock prices.

- Analysis of specific sectors: The real estate sector, for instance, is likely to see significant changes due to modifications in depreciation rules and mortgage interest deductions. Technology companies, with their often high R&D expenditure, may also experience adjustments, depending on the specifics of the bill’s impact on research and development tax credits. Energy companies, already facing fluctuating energy prices, may experience further pressure depending on the bill's influence on energy tax incentives.

Investor Sentiment and Volatility

The passage of the bill introduced considerable uncertainty, influencing investor sentiment and market volatility.

- Increased trading volume: Following the announcement, a surge in trading volume was observed across major exchanges, indicating heightened investor activity and attempts to reposition portfolios.

- Market indices: The Dow Jones Industrial Average and S&P 500 experienced significant fluctuations in the days following the bill's passage, reflecting the market's attempt to price in the potential long-term implications. Careful monitoring of these indices is crucial for understanding the overall market reaction.

- Investor confidence indicators: Measures of investor confidence, such as consumer confidence indices and surveys of professional investors, are likely to reflect the uncertainty and volatility introduced by the House Tax Bill. These indicators should be closely observed to gauge the overall impact on investor psychology.

Effects on the Bond Market

The House Tax Bill's impact extends to the bond market, primarily through its effects on interest rates and investor sentiment.

Interest Rate Fluctuations

The bill's impact on government borrowing and inflation expectations significantly influences bond yields.

- Inverse relationship: Remember the inverse relationship between bond prices and interest rates. Increased government borrowing could potentially push interest rates higher, leading to a decline in bond prices.

- Treasury yields and corporate bond spreads: Careful monitoring of Treasury yields (the return on government bonds) and corporate bond spreads (the difference between corporate and government bond yields) provides insight into investor risk appetite and expectations for future inflation.

- Inflationary pressures: The bill's provisions could contribute to inflationary pressures, either through increased government spending or changes in tax policies affecting businesses. This would negatively affect the value of fixed-income investments.

Flight to Safety

Economic uncertainty often leads investors to seek safer assets, a phenomenon known as "flight to safety."

- Capital flows: Capital flows are expected to increase into government bonds, perceived as less risky than corporate bonds or equities, as investors seek to preserve capital amidst uncertainty.

- Demand for high-quality bonds: Demand for high-quality, low-risk bonds, such as U.S. Treasury securities, is likely to increase, potentially pushing their prices up and yields down.

- Bond market liquidity: While increased demand can stabilize the market, it could also lead to increased competition among investors and potential impacts on bond market liquidity.

Bitcoin and the House Tax Bill: An Unexpected Correlation?

While seemingly unrelated, the House Tax Bill's passage may have indirect consequences for Bitcoin and the broader cryptocurrency market.

Tax Implications for Cryptocurrency

The bill might have indirect consequences for cryptocurrency taxation and regulation.

- Future tax policies: The bill could set a precedent for future tax policies concerning digital assets, potentially influencing how cryptocurrency transactions are taxed and regulated.

- Regulatory uncertainty: Regulatory uncertainty surrounding cryptocurrencies can significantly impact Bitcoin's price, as investors react to unclear rules and potential risks.

- Previous legislative impact: Analyzing how previous legislative actions have affected Bitcoin's price can offer insights into potential future responses.

Safe Haven Asset Perception

Bitcoin is often considered a "safe haven" asset by some investors, although this classification is debated.

- Price movements: Analyzing Bitcoin's price movements following the bill's passage provides evidence of whether it acted as a safe haven or experienced correlation with other asset classes.

- Comparison with gold: Comparing Bitcoin's price reaction with that of gold (a traditional safe haven asset) reveals if it behaved similarly during periods of increased market uncertainty.

- Investor behavior: Understanding investor behavior during periods of uncertainty provides insights into whether investors sought Bitcoin as a refuge from the volatility in traditional markets.

Conclusion

The passage of the House Tax Bill has created a dynamic shift in the financial markets, with varying impacts on stocks, bonds, and even Bitcoin. Understanding these effects is vital for investors to make informed decisions and adjust their portfolios accordingly. While the stock market showed immediate reactions based on sector-specific vulnerabilities and opportunities, the bond market experienced fluctuations influenced by interest rate expectations and investor sentiment. Unexpectedly, the bill's passage also impacted Bitcoin, highlighting its complex interplay with broader economic trends and regulatory uncertainties. Stay informed about the unfolding consequences of the House Tax Bill and its continuing effects on your investments. Continuously monitor the market reaction to the House Tax Bill and consult with financial advisors for personalized guidance. Understanding the nuances of the House Tax Bill's impact is key to navigating the evolving financial landscape and making strategic investment decisions.

Featured Posts

-

Hulu Movie Departures Full List For This Month

May 23, 2025

Hulu Movie Departures Full List For This Month

May 23, 2025 -

Witkoffs Claim Duped By Hamas An Emissarys Account

May 23, 2025

Witkoffs Claim Duped By Hamas An Emissarys Account

May 23, 2025 -

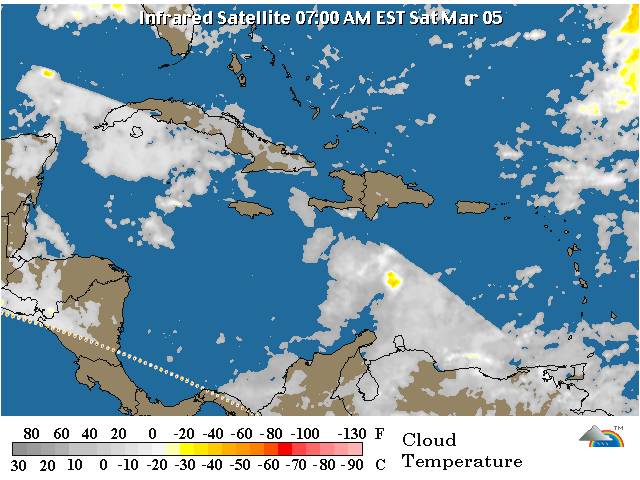

Lluvias Este Sabado Vaguada Y Sistema Frontal

May 23, 2025

Lluvias Este Sabado Vaguada Y Sistema Frontal

May 23, 2025 -

University Of Maryland Selects Kermit The Frog For 2025 Commencement

May 23, 2025

University Of Maryland Selects Kermit The Frog For 2025 Commencement

May 23, 2025 -

Will Itv Survive Another Countdown After Holly Willoughbys Shock Departure

May 23, 2025

Will Itv Survive Another Countdown After Holly Willoughbys Shock Departure

May 23, 2025

Latest Posts

-

Dallas Hosts Usa Film Festival Free Movie Screenings And Celebrity Encounters

May 23, 2025

Dallas Hosts Usa Film Festival Free Movie Screenings And Celebrity Encounters

May 23, 2025 -

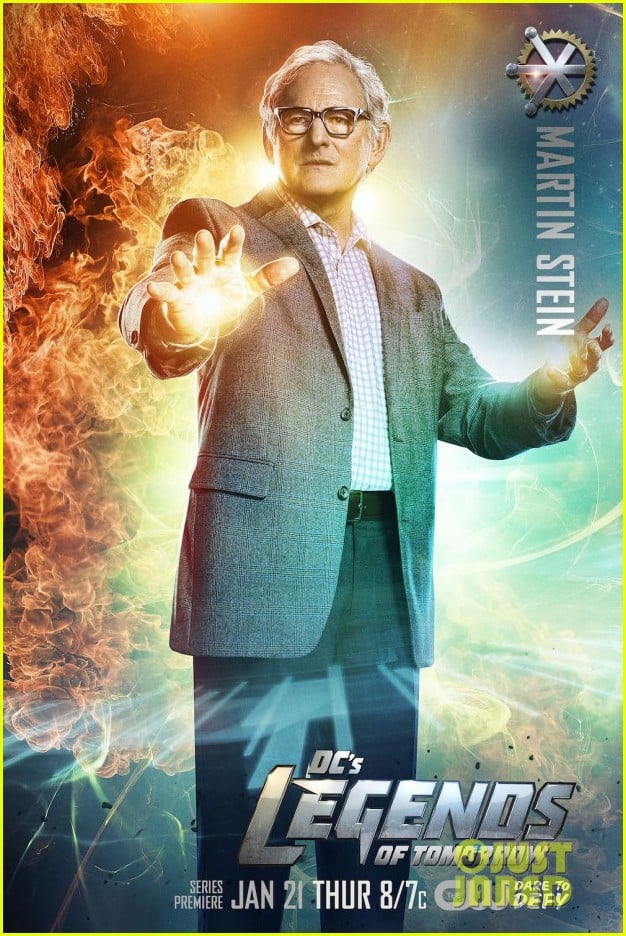

A Deep Dive Into Dc Legends Of Tomorrow Exploring The Shows Themes And Legacy

May 23, 2025

A Deep Dive Into Dc Legends Of Tomorrow Exploring The Shows Themes And Legacy

May 23, 2025 -

Experience The Usa Film Festival Free Movies In Dallas

May 23, 2025

Experience The Usa Film Festival Free Movies In Dallas

May 23, 2025 -

Exploring The Dc Legends Of Tomorrow Universe History Characters And Episodes

May 23, 2025

Exploring The Dc Legends Of Tomorrow Universe History Characters And Episodes

May 23, 2025 -

Dc Legends Of Tomorrow Character Guide And Team Building Strategies

May 23, 2025

Dc Legends Of Tomorrow Character Guide And Team Building Strategies

May 23, 2025