Market Reaction To UK Inflation: Pound Rises, BOE Cuts Less Likely

Table of Contents

Pound Strengthens Amidst High UK Inflation – Why?

While high UK inflation typically weakens a currency, the recent strengthening of Sterling presents a fascinating anomaly. Several factors contribute to this unexpected market behavior.

Positive Economic Indicators Beyond Inflation:

Beyond the headline inflation figures, other positive economic indicators have boosted investor confidence in the UK economy and the GBP exchange rate.

- Robust Employment Figures: The UK has maintained relatively strong employment numbers, indicating a resilient labor market. This reduces fears of a significant economic slowdown, bolstering the pound.

- Resilient Retail Sales: Despite the cost-of-living crisis, retail sales have shown surprising resilience, suggesting consumer spending remains relatively strong. This positive data point counters expectations of a sharp economic contraction.

- Economic Growth Forecasts: While growth is slower than in previous years, some forecasts predict a less severe downturn than initially anticipated, supporting a more optimistic outlook for the UK economy and strengthening the Sterling.

Global Market Factors:

Global economic conditions also play a crucial role in influencing investor sentiment towards the UK pound.

- Global Currency Movements: The relative strength of the pound compared to other major currencies, particularly the Euro and the US dollar, has contributed to its rise. This is often influenced by factors such as shifts in global risk appetite.

- Risk-Off Sentiment: Interestingly, periods of global uncertainty can sometimes lead investors to seek safe haven assets, which may include the UK pound, depending on the perceived stability of the UK economy.

- Geopolitical Events: International events, while unpredictable, can significantly impact global currency markets. Favorable geopolitical developments can positively influence investor confidence in the pound.

Speculation on BOE Policy:

Market participants are actively speculating about the Bank of England's future monetary policy decisions. This speculation significantly influences the pound’s strength.

- Less Aggressive Rate Cuts Priced In: Despite high inflation, the market seems to be anticipating less aggressive interest rate cuts from the BOE than previously expected. This is likely due to the resilience shown by other economic indicators.

- Forward Guidance: The BOE's communication regarding its future policy approach plays a crucial role in shaping market expectations. Clear and consistent messaging can help stabilize the currency.

- Data Dependency: The market is keenly watching the incoming economic data, and the BOE’s reaction to this data will be pivotal in determining future interest rate decisions.

Reduced Probability of BOE Interest Rate Cuts

The recent market reaction suggests a diminished likelihood of the Bank of England cutting interest rates, despite the persistent inflationary pressures.

Inflation Data Analysis:

While UK inflation remains stubbornly high, the latest figures may not be as alarming as initially feared by some market participants.

- CPI and RPI Figures: Analyzing the Consumer Price Index (CPI) and Retail Price Index (RPI) provides a clearer picture of inflation's trajectory. Any deviation from market expectations significantly impacts the pound.

- Core Inflation: Focusing on core inflation (excluding volatile components like energy and food) can offer a better understanding of underlying inflationary pressures. A moderation in core inflation could support the BOE's less hawkish stance.

- Inflation Expectations: Market expectations for future inflation are crucial. If these expectations start to moderate, it can reduce pressure on the BOE to act aggressively.

BOE's Stance and Forward Guidance:

The Bank of England’s recent communications and actions regarding interest rates are key to understanding the market’s response.

- Monetary Policy Committee Statements: The statements released by the Monetary Policy Committee (MPC) offer valuable insights into their thinking and future intentions.

- Quantitative Easing (QE): The BOE's approach to quantitative easing or other unconventional monetary policy tools influences market sentiment significantly.

- Interest Rate Hikes vs. Cuts: The balance between the risks of inflation and recession will ultimately guide the BOE's decisions on whether to hike or cut rates.

Market Consensus on Future Rate Changes:

Market analysts and economists offer diverse forecasts regarding future interest rate movements.

- Interest Rate Forecasts: Different financial institutions provide their interest rate forecasts, offering a range of possible scenarios. These forecasts reflect varying interpretations of economic data and market sentiment.

- Economic Outlook: The overall economic outlook, incorporating factors like growth forecasts and unemployment projections, plays a crucial role in shaping interest rate predictions.

- Shifting Market Sentiment: Market sentiment can shift rapidly based on new data releases and changing geopolitical circumstances. This volatility necessitates constant monitoring of the situation.

Conclusion: Understanding the Market Reaction to UK Inflation

The recent strengthening of the pound amidst high UK inflation reflects a complex interplay of factors. Positive economic indicators beyond inflation, global market dynamics, and speculation regarding the Bank of England's less-hawkish stance have all contributed to this surprising market response. The reduced probability of BOE interest rate cuts highlights the nuances of economic analysis and the importance of considering factors beyond just headline inflation figures. Stay updated on UK inflation trends by following our analysis of UK inflation and monitoring the market reaction to UK inflation. Subscribe to our newsletter for in-depth insights and stay informed on crucial economic developments impacting the UK and global markets.

Featured Posts

-

Le Boom Des Tours Nantaises Et L Essor De L Activite Des Cordistes

May 22, 2025

Le Boom Des Tours Nantaises Et L Essor De L Activite Des Cordistes

May 22, 2025 -

Ancelotti Den Klopp A Real Madrid Icin Dogru Secim Mi

May 22, 2025

Ancelotti Den Klopp A Real Madrid Icin Dogru Secim Mi

May 22, 2025 -

Manhattans Forgotten Foods Festival Showcases Unique Culinary Heritage

May 22, 2025

Manhattans Forgotten Foods Festival Showcases Unique Culinary Heritage

May 22, 2025 -

Is Dexter Resurrections Villain A New Fan Favorite

May 22, 2025

Is Dexter Resurrections Villain A New Fan Favorite

May 22, 2025 -

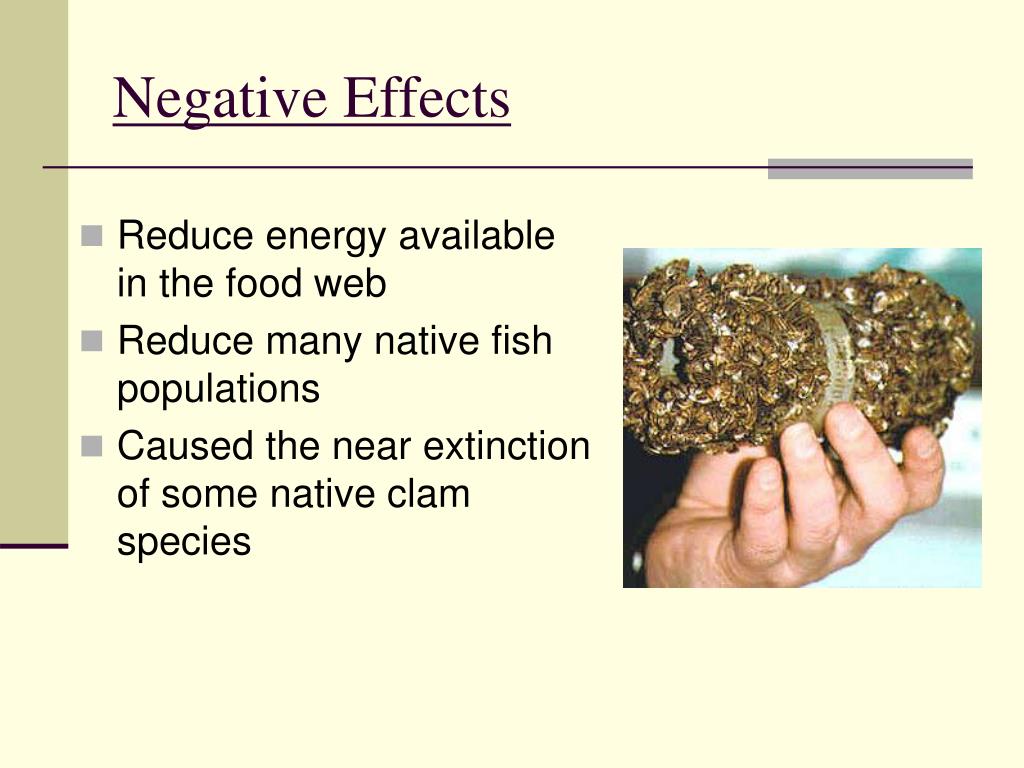

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025

Latest Posts

-

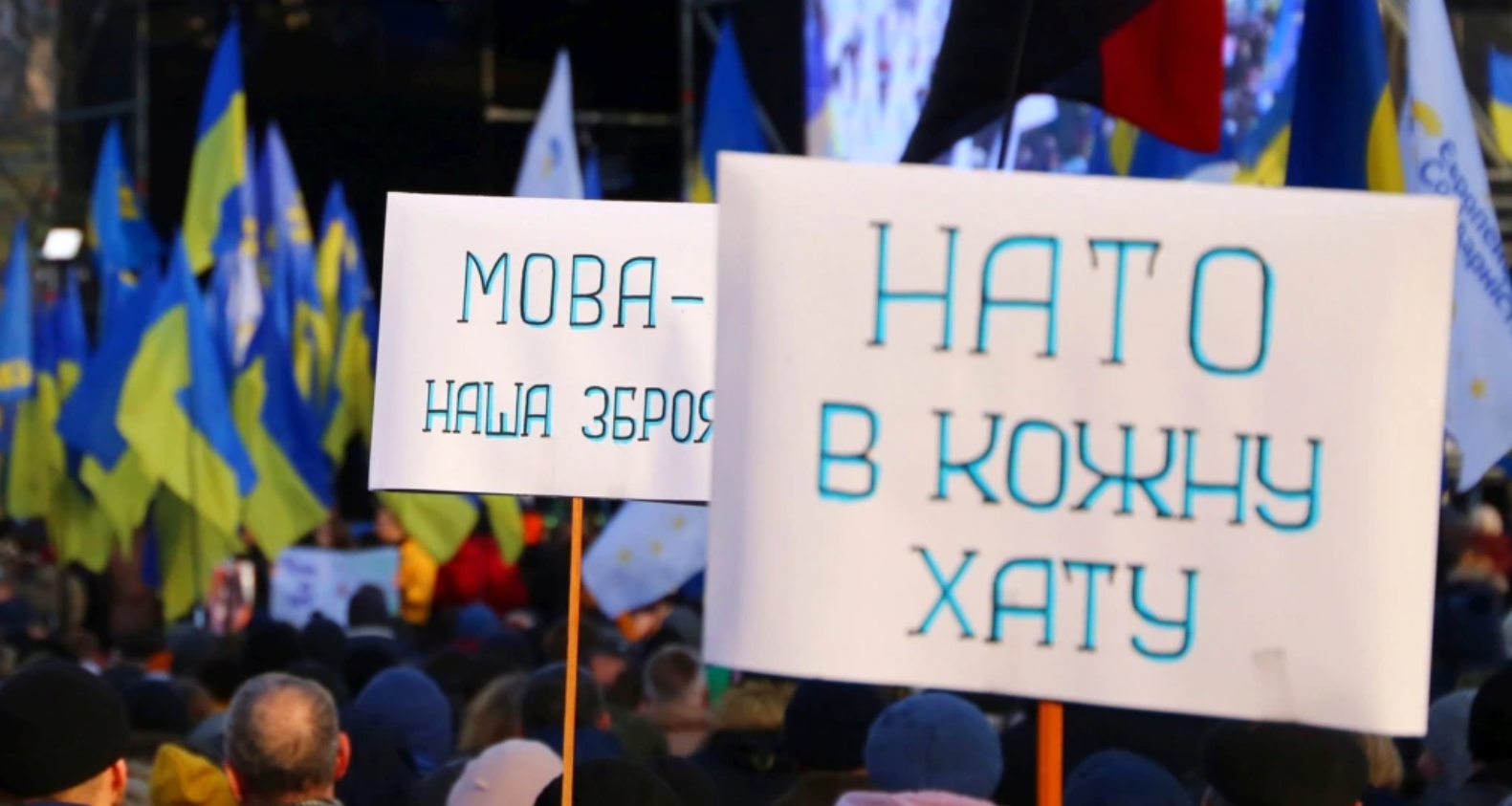

Vstup Ukrayini Do Nato Otsinka Golovnikh Viklikiv Ta Nebezpek

May 22, 2025

Vstup Ukrayini Do Nato Otsinka Golovnikh Viklikiv Ta Nebezpek

May 22, 2025 -

Shlyakh Ukrayini Do Nato Poperedzhennya Pro Potentsiyni Zagrozi

May 22, 2025

Shlyakh Ukrayini Do Nato Poperedzhennya Pro Potentsiyni Zagrozi

May 22, 2025 -

Ukrayina Ta Nato Analiz Golovnikh Rizikiv Chlenstva

May 22, 2025

Ukrayina Ta Nato Analiz Golovnikh Rizikiv Chlenstva

May 22, 2025 -

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025

Yevrokomisar Pro Golovnu Pereshkodu Dlya Vstupu Ukrayini Do Nato

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025