Market Volatility And The Freeze On IPOs: The Impact Of Tariffs

Table of Contents

Increased Market Uncertainty Due to Tariffs

Tariffs introduce a significant element of unpredictability into market conditions, making it challenging for businesses to plan and investors to make informed decisions. This uncertainty directly impacts the impact of tariffs on IPOs.

-

Uncertainty about future costs and profitability for businesses: Fluctuating tariff rates make it difficult for companies to accurately forecast their future costs and profit margins. This uncertainty extends to supply chains, as businesses grapple with increased import costs and potential disruptions. The inability to provide reliable financial projections is a major deterrent for potential IPO candidates.

-

Fluctuations in currency exchange rates: Tariffs can trigger significant fluctuations in currency exchange rates, adding another layer of complexity to financial planning. Companies with international operations are particularly vulnerable, as their earnings can be significantly impacted by unpredictable currency movements.

-

Reduced consumer spending due to increased prices: Tariffs often lead to higher prices for consumers, impacting consumer spending and overall economic growth. This reduced demand can negatively impact the revenue projections of companies considering an IPO, making them less attractive to investors.

-

Investor hesitancy in a volatile market: The increased uncertainty created by tariffs leads to investor hesitancy. Investors are less likely to take risks in volatile markets, preferring to invest in established, less volatile companies. This decreased appetite for risk significantly impacts the IPO market. Economic indicators like the VIX (volatility index) often reflect this increased market anxiety.

This overall uncertainty erodes investor confidence and significantly reduces the willingness to invest in new ventures, especially those facing the added complexities introduced by tariffs.

The Direct Impact of Tariffs on IPO Valuation

Tariffs directly impact a company's projected revenue and profitability, making accurate valuation incredibly challenging, which heavily influences the impact of tariffs on IPOs.

-

Increased input costs impacting profit margins: Tariffs increase the cost of imported goods and raw materials, squeezing profit margins for many businesses. This directly affects the company's bottom line and makes it harder to justify a high IPO valuation.

-

Difficulty forecasting future earnings due to tariff-related disruptions: The unpredictable nature of tariffs makes it difficult to forecast future earnings with any degree of accuracy. This lack of clarity significantly increases the risk associated with investing in a company's IPO.

-

Lower investor appetite for companies exposed to tariff risks: Investors are less likely to invest in companies heavily exposed to tariff risks, leading to a lower demand for shares during the IPO process and potentially lower valuations.

-

Examples of companies postponing or canceling IPOs due to valuation concerns: Numerous companies have postponed or even canceled their IPOs in recent years due to the uncertainties surrounding tariffs and their impact on valuation. This demonstrates the very real effects of tariffs on the IPO market.

The perceived risk associated with tariffs, therefore, directly leads to lower IPO valuations or outright cancellations, severely impacting the success of the IPO market.

Regulatory Scrutiny and Increased Due Diligence

Increased regulatory scrutiny related to trade disputes and tariffs adds another layer of complexity to the already intricate IPO process. This added scrutiny significantly contributes to the impact of tariffs on IPOs.

-

More stringent requirements for financial disclosure related to tariff exposure: Regulators are demanding more detailed financial disclosures from companies regarding their exposure to tariffs and the potential impact on their business. This increases the burden on companies preparing for an IPO.

-

Increased legal and compliance costs for companies going public: The added regulatory requirements translate into higher legal and compliance costs for companies preparing for an IPO, further adding to the financial strain.

-

Lengthier timelines for IPO approvals due to heightened scrutiny: The increased scrutiny by regulators leads to longer review periods, delaying the IPO process and potentially impacting the overall success of the offering.

-

Examples of regulatory changes impacting IPO procedures: Recent regulatory changes in several countries reflect a tightening of requirements related to transparency regarding tariff exposure, contributing to the delays and cancellations of IPOs.

This increased scrutiny and the associated burdens contribute significantly to the delay or cancellation of IPOs, creating a bottleneck in the IPO market.

Geopolitical Risks and Investor Sentiment

The broader geopolitical climate influenced by trade tensions significantly impacts investor sentiment and risk appetite, adding another dimension to the impact of tariffs on IPOs.

-

Negative investor sentiment stemming from trade disputes: Trade disputes and uncertainty create a negative overall investor sentiment, impacting the attractiveness of riskier investments such as IPOs.

-

Flight to safety in more stable asset classes: Investors tend to shift their investments towards safer assets, such as government bonds, during times of geopolitical uncertainty, reducing the capital available for IPOs.

-

Reduced appetite for riskier investments, including IPOs: The increased risk aversion in volatile markets leads to a reduced appetite for riskier investments, such as those in the early stages of growth represented by IPOs.

-

Impact of global macroeconomic indicators on IPO markets: Global macroeconomic indicators, influenced by trade tensions and tariffs, significantly impact the health and activity of IPO markets worldwide. Major indices like the S&P 500 and Dow Jones Industrial Average often reflect this overall market sentiment.

The negative sentiment created by global trade tensions, therefore, significantly dampens the attractiveness of IPOs to investors.

Conclusion

In summary, tariffs create market volatility, impacting IPO valuations and increasing regulatory scrutiny, leading to a freeze in IPO activity. The uncertainty surrounding tariffs significantly dampens investor confidence, delaying or preventing companies from entering the public market. Understanding the impact of tariffs on IPOs is crucial for investors and businesses alike. The challenges related to predicting future earnings and navigating increased regulatory hurdles are significant obstacles.

Call to Action: Understanding the impact of tariffs on IPOs is crucial for investors and businesses alike. Stay informed about trade developments and their potential effects on your investment strategy and business planning. Learn more about mitigating the risks associated with tariff-related market volatility and navigating the complexities of the IPO market in a volatile global economy.

Featured Posts

-

When To Stream Captain America Brave New World On Disney

May 14, 2025

When To Stream Captain America Brave New World On Disney

May 14, 2025 -

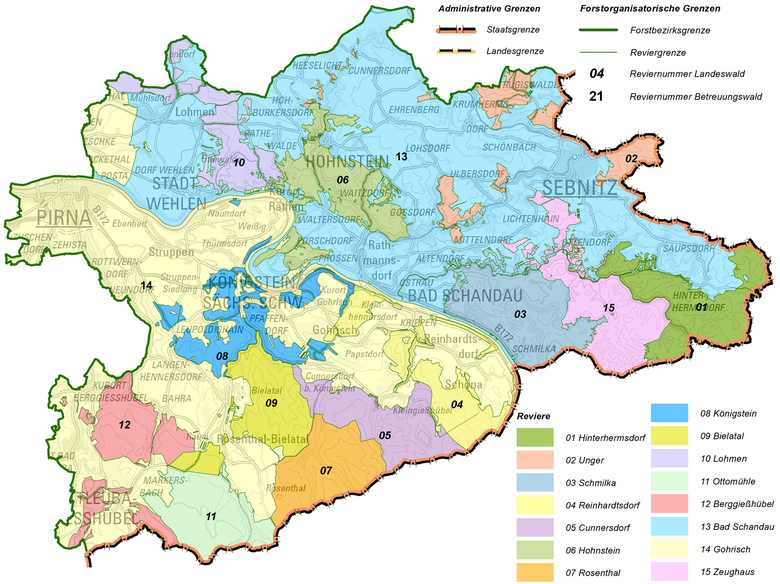

Saechsische Schweiz Sachsenforst Setzt Auf Innovative Sensortechnologie Zur Waldbrandfrueherkennung

May 14, 2025

Saechsische Schweiz Sachsenforst Setzt Auf Innovative Sensortechnologie Zur Waldbrandfrueherkennung

May 14, 2025 -

Bianca Censoris Film Debut Kanye Wests Unconventional Marketing Tactic

May 14, 2025

Bianca Censoris Film Debut Kanye Wests Unconventional Marketing Tactic

May 14, 2025 -

Will England Stars Brother Make An Immediate Impact At Man Utd

May 14, 2025

Will England Stars Brother Make An Immediate Impact At Man Utd

May 14, 2025 -

Oqtf A Cannes Attaque Au Cutter Dans Un Bus Mere Et Fils Menaces

May 14, 2025

Oqtf A Cannes Attaque Au Cutter Dans Un Bus Mere Et Fils Menaces

May 14, 2025