MicroStrategy Stock Vs Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business revolves around enterprise analytics and software. They provide business intelligence, mobile software, and cloud-based services, primarily through software licenses and subscription revenue. However, what truly sets MicroStrategy apart is its aggressive and highly publicized Bitcoin investment strategy.

MicroStrategy's Core Business

MicroStrategy's traditional business model is relatively stable, generating consistent (though not spectacular) revenue through its software offerings. However, its growth potential is arguably limited compared to the potentially explosive growth of the cryptocurrency market. Their clients are mainly large corporations requiring sophisticated data analysis tools. This market segment is relatively predictable, offering a degree of stability to the company’s overall financial picture.

Bitcoin as a Corporate Strategy

MicroStrategy's bold move to acquire a significant amount of Bitcoin has transformed the company's profile. This strategy, spearheaded by CEO Michael Saylor, represents a massive bet on Bitcoin's long-term future. The company has steadily accumulated Bitcoin over several years, making it one of the largest corporate holders of the cryptocurrency. This strategy, while potentially lucrative, also introduces significant risk.

- Risks: The primary risk is the inherent volatility of Bitcoin. A sharp decline in Bitcoin's price could severely impact MicroStrategy's balance sheet and stock price. This makes MicroStrategy stock more susceptible to the ups and downs of the cryptocurrency market, unlike most traditional tech companies.

- Benefits: The potential upside is equally significant. If Bitcoin's price appreciates as anticipated by many cryptocurrency enthusiasts, MicroStrategy could see enormous gains, boosting its stock price and solidifying its position as a forward-thinking tech innovator. The strategy has also boosted MicroStrategy's brand image, attracting attention from investors interested in cryptocurrency exposure.

- Correlation: While there is a correlation between MicroStrategy's stock price and Bitcoin's price, it's not a perfect one-to-one relationship. Other factors, such as MicroStrategy's software business performance and overall market sentiment, also influence its stock price.

Bitcoin's Market Position and Future Projections

Bitcoin, the world's first and most well-known cryptocurrency, operates on a decentralized blockchain technology. This makes it resistant to censorship and control by any single entity.

Bitcoin's Technological Foundation

Bitcoin's decentralized nature is a key factor driving its appeal. No single institution controls the network, enhancing its security and resilience. Its transparent, public ledger ensures accountability and allows for verifiable transactions.

Market Adoption and Institutional Investment

Institutional investment in Bitcoin has significantly increased in recent years. Major corporations and investment firms are increasingly recognizing Bitcoin as a potential asset class, driving up demand and potentially influencing its price. This growing adoption suggests a maturing market, though the level of adoption is still relatively small compared to traditional markets.

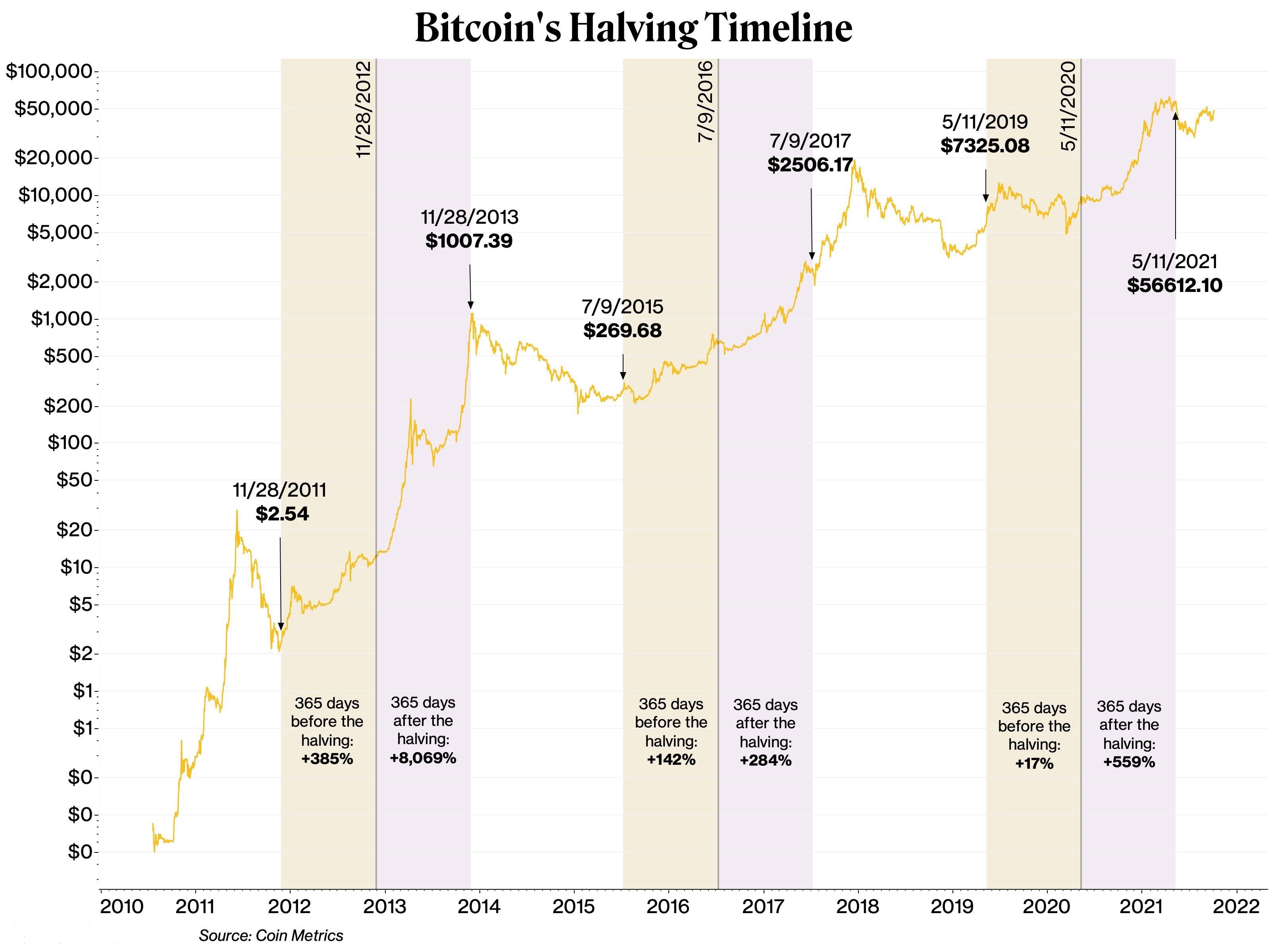

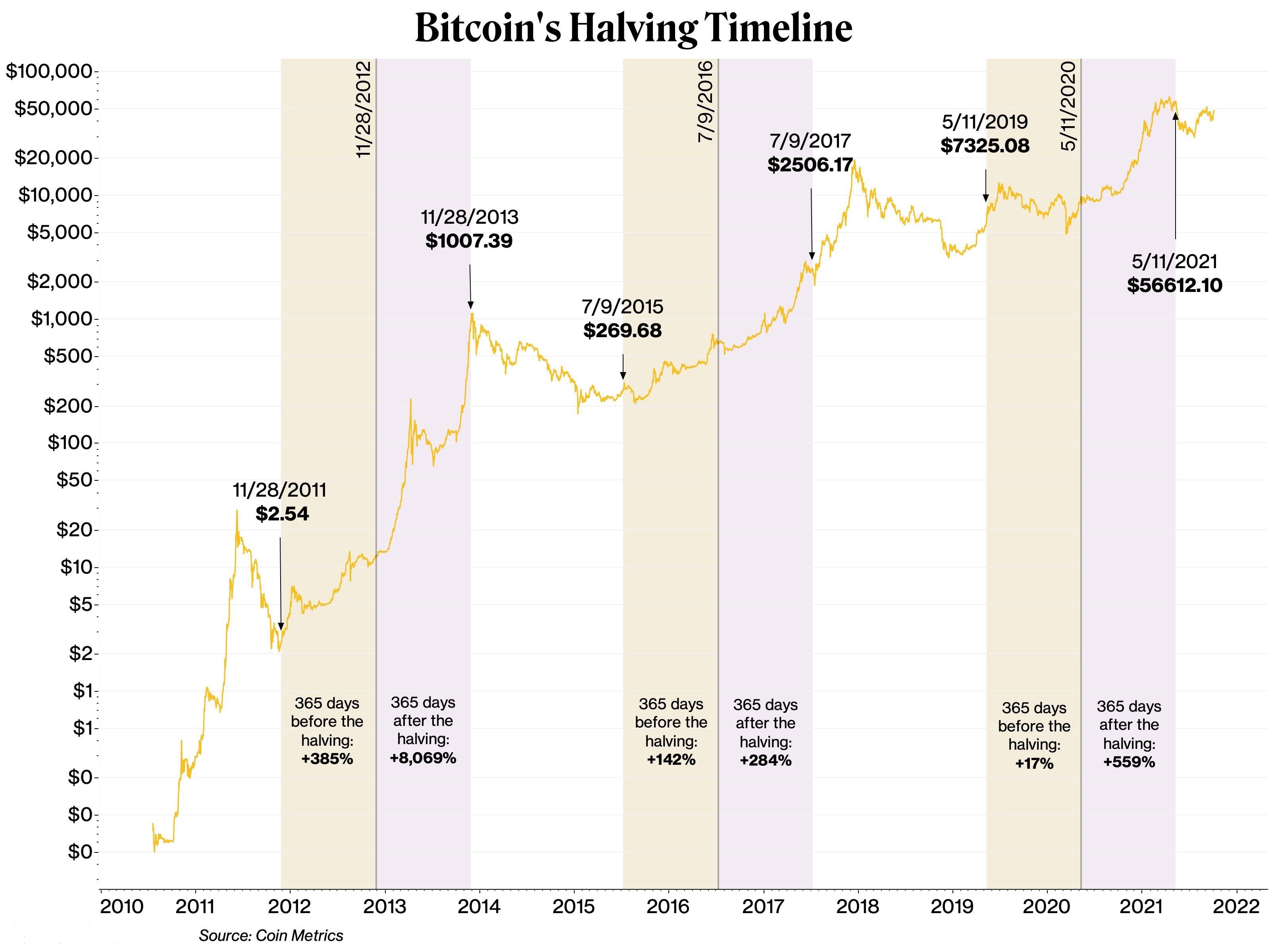

Predicting Bitcoin's Price in 2025

Predicting Bitcoin's price in 2025 is inherently challenging due to its volatility. However, we can consider various scenarios:

- Bullish Scenario: Continued institutional adoption, increasing regulatory clarity (or lack of harsh regulations), and further technological advancements could push Bitcoin's price significantly higher.

- Bearish Scenario: Increased regulatory scrutiny, security breaches, or a broader market downturn could lead to a price decline.

Factors influencing Bitcoin's price include:

- Regulatory changes (both positive and negative).

- Technological advancements (e.g., the Lightning Network's improvement of transaction speed and scalability).

- Market sentiment (driven by news, social media, and overall economic conditions).

Direct Comparison: MicroStrategy Stock vs. Bitcoin Investment in 2025

Choosing between MicroStrategy stock and Bitcoin requires considering your risk tolerance, investment goals, and time horizon.

Risk Tolerance

Bitcoin carries significantly higher volatility than MicroStrategy stock. While MicroStrategy's stock price is influenced by Bitcoin, it's also impacted by the performance of its software business, offering a degree of diversification within the investment itself.

Investment Goals and Time Horizon

For long-term investors with a high-risk tolerance, Bitcoin might be a more appealing option due to its potential for exponential growth. Investors seeking a less volatile investment with a blend of traditional tech exposure and cryptocurrency exposure might prefer MicroStrategy. Short-term investors should approach both with extreme caution due to their inherent volatility.

Diversification Strategies

Both MicroStrategy stock and Bitcoin can play a role in a diversified portfolio, but their inclusion should be strategic. Holding both might amplify risk or offer a hedge depending on the investor's overall asset allocation strategy.

| Feature | MicroStrategy Stock | Bitcoin |

|---|---|---|

| Volatility | Moderate to High | Very High |

| Liquidity | High | High |

| Potential Return | Moderate to High (dependent on BTC) | Very High (but highly volatile) |

| Accessibility | Relatively easy to trade | Relatively easy to trade |

Alternative Investment Options: Exploring Other Digital Assets

Investing in Bitcoin isn't the only way to gain exposure to the cryptocurrency market. Other cryptocurrencies (altcoins) exist, each with its own potential and risks. However, thorough research is crucial before investing in any altcoin. Furthermore, traditional assets like stocks and bonds provide significantly lower risk with potentially lower returns. Comparing these different options is crucial for a well-rounded investment strategy.

- Examples of alternative digital assets include Ethereum, Solana, and Cardano, each with its own unique characteristics and associated risks.

Conclusion: MicroStrategy Stock vs Bitcoin: Making the Right Choice for 2025

The choice between MicroStrategy stock and Bitcoin depends entirely on your individual risk tolerance, investment goals, and time horizon. MicroStrategy offers a unique blend of traditional tech investment and cryptocurrency exposure, while Bitcoin presents a more volatile, potentially higher-reward, higher-risk opportunity. Both options require thorough research and a clear understanding of the inherent risks involved. Remember to conduct due diligence and consider consulting a financial advisor before making any investment decisions related to MicroStrategy Stock vs Bitcoin.

Featured Posts

-

Expo 2025 Sufian Applauds Gcci Presidents Organizational Achievements

May 08, 2025

Expo 2025 Sufian Applauds Gcci Presidents Organizational Achievements

May 08, 2025 -

Neymar De Vuelta En Brasil Convocatoria Para El Partido Contra Argentina En El Monumental

May 08, 2025

Neymar De Vuelta En Brasil Convocatoria Para El Partido Contra Argentina En El Monumental

May 08, 2025 -

Daily Lotto Tuesday 15th April 2025 Results

May 08, 2025

Daily Lotto Tuesday 15th April 2025 Results

May 08, 2025 -

Lahwr Myn 5 Ahtsab Edaltyn Khtm Ewam Pr Kya Athr Pre Ga

May 08, 2025

Lahwr Myn 5 Ahtsab Edaltyn Khtm Ewam Pr Kya Athr Pre Ga

May 08, 2025 -

2025 Bitcoin Conference Seouls Hub For Global Leaders

May 08, 2025

2025 Bitcoin Conference Seouls Hub For Global Leaders

May 08, 2025