MicroStrategy Stock Vs Bitcoin: Predicting Investment Performance In 2025

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

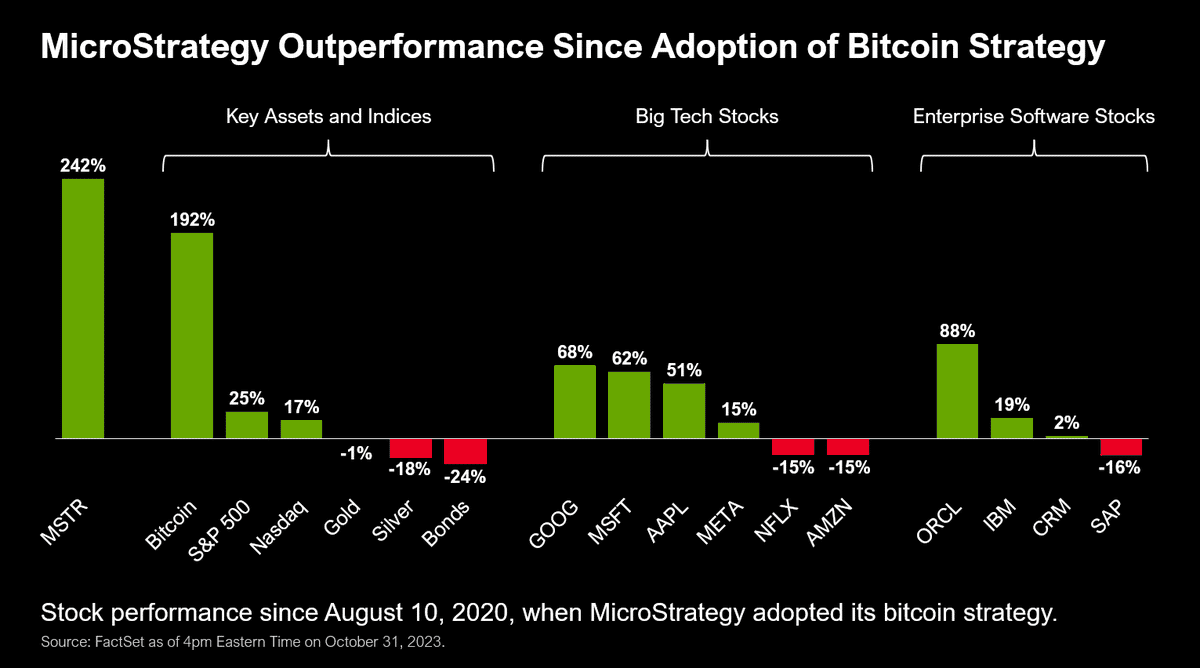

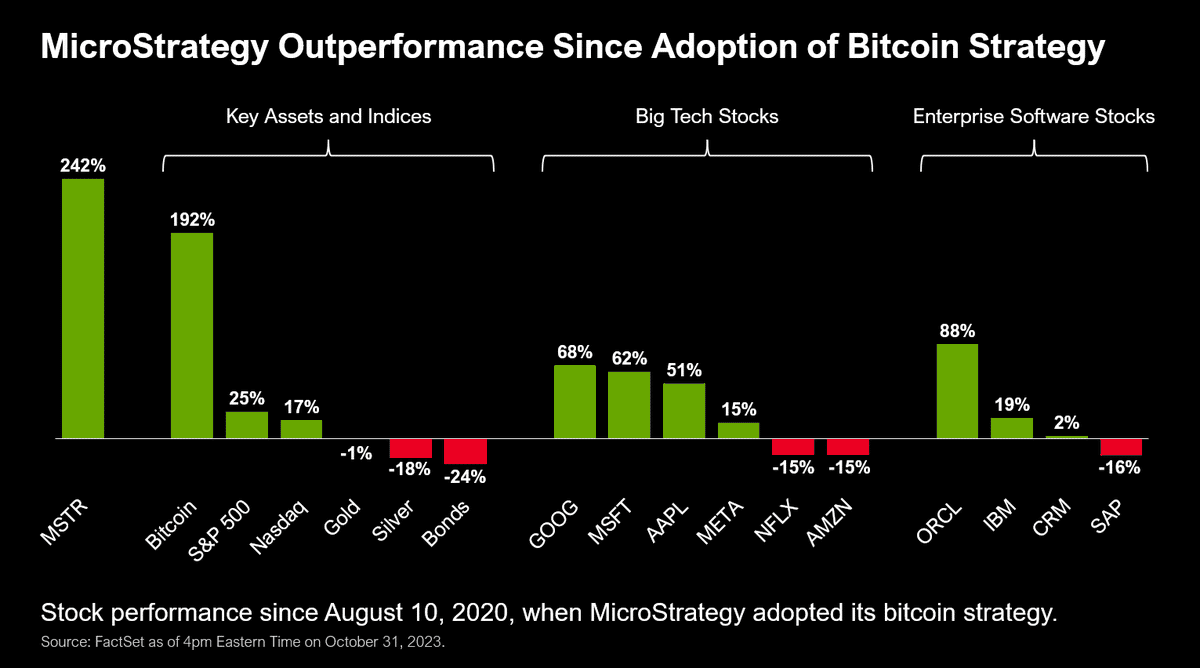

MicroStrategy's aggressive Bitcoin acquisition strategy has become a defining characteristic of the company. This section delves into the intricacies of this strategy and its impact on the company's stock performance.

MicroStrategy's Bitcoin Holdings and Their Impact on Stock Price

MicroStrategy's massive Bitcoin holdings, accumulated through strategic purchases over several years, have directly correlated its stock price with the price of Bitcoin. This creates significant volatility.

- Correlation: A surge in Bitcoin's price often leads to a rise in MicroStrategy's stock price, and vice versa. This high correlation presents both opportunities and significant risks.

- Volatility: Investing in MicroStrategy stock exposes investors to the inherent volatility of the cryptocurrency market. Sudden price swings in Bitcoin can translate into dramatic changes in MicroStrategy's stock valuation.

- Risk: This strategy inherently carries considerable risk. A prolonged bear market in Bitcoin could severely impact MicroStrategy's stock price, potentially resulting in substantial losses for investors.

- Michael Saylor's Influence: The leadership of Michael Saylor, a fervent Bitcoin advocate, has heavily influenced MicroStrategy's Bitcoin strategy. His bullish outlook on Bitcoin's long-term potential significantly shapes the company's investment decisions.

Analyzing MicroStrategy's Fundamentals Beyond Bitcoin

While Bitcoin forms a substantial part of MicroStrategy's narrative, it's crucial to assess the company's core business performance and financial health independently.

- Revenue Streams: MicroStrategy's core business involves providing enterprise analytics, mobility, cloud, and other related software and services. The performance of this segment is vital to understanding the overall financial health of the company.

- Profitability and Debt: Analyzing MicroStrategy's profitability margins, debt levels, and cash flow provides a clearer picture of its financial stability beyond its Bitcoin holdings.

- Long-Term Viability: Assessing the long-term viability of MicroStrategy's core business model, irrespective of Bitcoin's price, is crucial for a comprehensive investment evaluation.

- Regulatory Impacts: Changes in regulations surrounding cryptocurrency and business software can significantly influence MicroStrategy's future performance.

Predicting Bitcoin's Price in 2025

Predicting the price of Bitcoin in 2025 is inherently challenging, given its volatile nature. However, considering several influential factors allows for a more informed outlook.

Factors Influencing Bitcoin's Future Price

Numerous factors could significantly affect Bitcoin's price trajectory by 2025:

- Technological Advancements: The development and adoption of technologies like the Lightning Network could enhance Bitcoin's scalability and transaction speed, potentially driving demand.

- Regulatory Developments: Government regulations, including adoption or bans, will significantly impact Bitcoin's price and overall market acceptance. Increased regulatory clarity could potentially boost confidence.

- Macroeconomic Factors: Global macroeconomic conditions, such as inflation and recessionary pressures, can greatly affect investor sentiment toward Bitcoin, influencing its price.

- Market Adoption: Increased institutional and individual adoption of Bitcoin will be a key driver of its price growth. Wider acceptance among mainstream investors could fuel substantial price increases.

Different Price Prediction Models and Their Limitations

Various methods are used to predict Bitcoin's price, each with its limitations:

- Technical Analysis: This method uses historical price and volume data to predict future price movements. However, it's susceptible to manipulation and doesn't account for fundamental factors.

- Fundamental Analysis: This focuses on evaluating underlying factors, such as adoption rates and technological advancements, but is highly subjective.

- Uncertainty: It is important to recognize the inherent uncertainty in cryptocurrency price forecasting. Predictions are not guarantees and should be treated with caution.

- Market Sentiment: Market sentiment and speculation play a dominant role in determining Bitcoin's price. These are difficult, if not impossible, to accurately predict.

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis for 2025

Choosing between MicroStrategy stock and Bitcoin depends heavily on individual risk tolerance and investment goals.

Risk Tolerance and Investment Goals

- Risk Profiles: Both MicroStrategy stock and Bitcoin are high-risk investments. However, their risk profiles differ. MicroStrategy's stock also incorporates the risk of its core business performance.

- High Rewards, High Losses: Both investments offer the potential for substantial returns but also carry the possibility of significant losses.

- Investment Horizons: Long-term investors might be more comfortable with the volatility of both assets, whereas short-term investors should proceed with extreme caution.

Diversification and Portfolio Allocation

Diversification is critical to mitigating risk:

- Benefits of Diversification: Diversifying across asset classes, including but not limited to MicroStrategy stock and Bitcoin, reduces overall portfolio risk.

- Portfolio Allocation: The optimal allocation between MicroStrategy stock, Bitcoin, and other assets will depend on individual risk tolerance and financial goals.

- Due Diligence: Thorough due diligence, including research and consultation with financial advisors, is essential before making investment decisions.

Conclusion

Predicting the performance of MicroStrategy stock and Bitcoin in 2025 is complex and fraught with uncertainty. Both assets present significant opportunities but also carry considerable risk. Understanding the correlation between Bitcoin's price and MicroStrategy's stock, along with the fundamental factors affecting each, is critical for informed investment decisions. The interplay of technological advancements, regulatory changes, and macroeconomic conditions will significantly shape the future of both assets.

Call to Action: Before making any investment in MicroStrategy stock or Bitcoin, conduct thorough research and carefully assess your own risk tolerance. Consider consulting a financial advisor for personalized guidance on incorporating MicroStrategy stock and/or Bitcoin into your diversified investment portfolio. Remember, investing in MicroStrategy stock and Bitcoin involves substantial risk.

Featured Posts

-

Inters 2026 Contract Situation Which Four Players Are Leaving

May 08, 2025

Inters 2026 Contract Situation Which Four Players Are Leaving

May 08, 2025 -

Deciphering Mondays Fall What Happened To Scholar Rock Stock

May 08, 2025

Deciphering Mondays Fall What Happened To Scholar Rock Stock

May 08, 2025 -

Mick Jagger No Oscar Brasileiros Temem Pe Frio

May 08, 2025

Mick Jagger No Oscar Brasileiros Temem Pe Frio

May 08, 2025 -

Cinema Con 2024 Stephen Kings The Long Walk Gets A Release Date

May 08, 2025

Cinema Con 2024 Stephen Kings The Long Walk Gets A Release Date

May 08, 2025 -

Counting Crows Slip Into The Rain A Deep Dive Into The Meaning And Impact

May 08, 2025

Counting Crows Slip Into The Rain A Deep Dive Into The Meaning And Impact

May 08, 2025