MicroStrategy Vs Bitcoin In 2025: Which Is The Better Investment?

Table of Contents

MicroStrategy's Business Model and Bitcoin Holdings (Keyword: MicroStrategy Bitcoin Investment)

MicroStrategy's core business lies in providing business intelligence, analytics, and mobile software solutions to enterprise clients. However, its most significant recent development is its massive accumulation of Bitcoin. This bold strategy, spearheaded by CEO Michael Saylor, positions the company as a major player in the Bitcoin space. MicroStrategy's Bitcoin investment is a crucial element of its overall strategy, aiming to diversify its assets and capitalize on the long-term growth potential of Bitcoin.

This approach presents both risks and rewards:

- Rewards: Potential for significant capital appreciation if Bitcoin's price increases. Furthermore, MicroStrategy might generate additional revenue through Bitcoin-related services or ventures.

- Risks: The stock market's volatility can impact MicroStrategy's share price independently of Bitcoin's value. Heavy reliance on Bitcoin's performance means the company’s valuation is directly tied to its price fluctuations.

Bitcoin's Market Position and Future Projections (Keyword: Bitcoin Investment 2025)

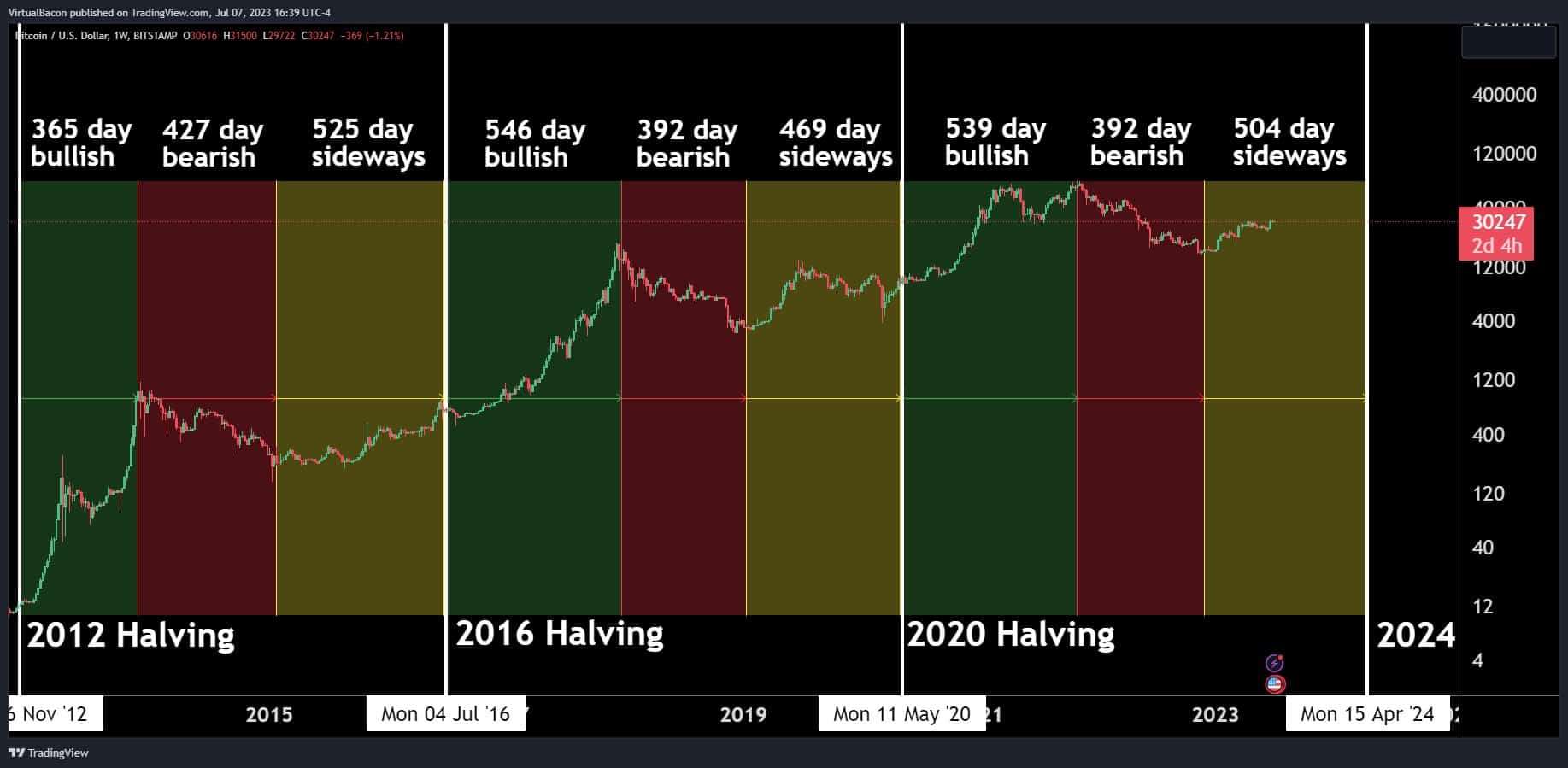

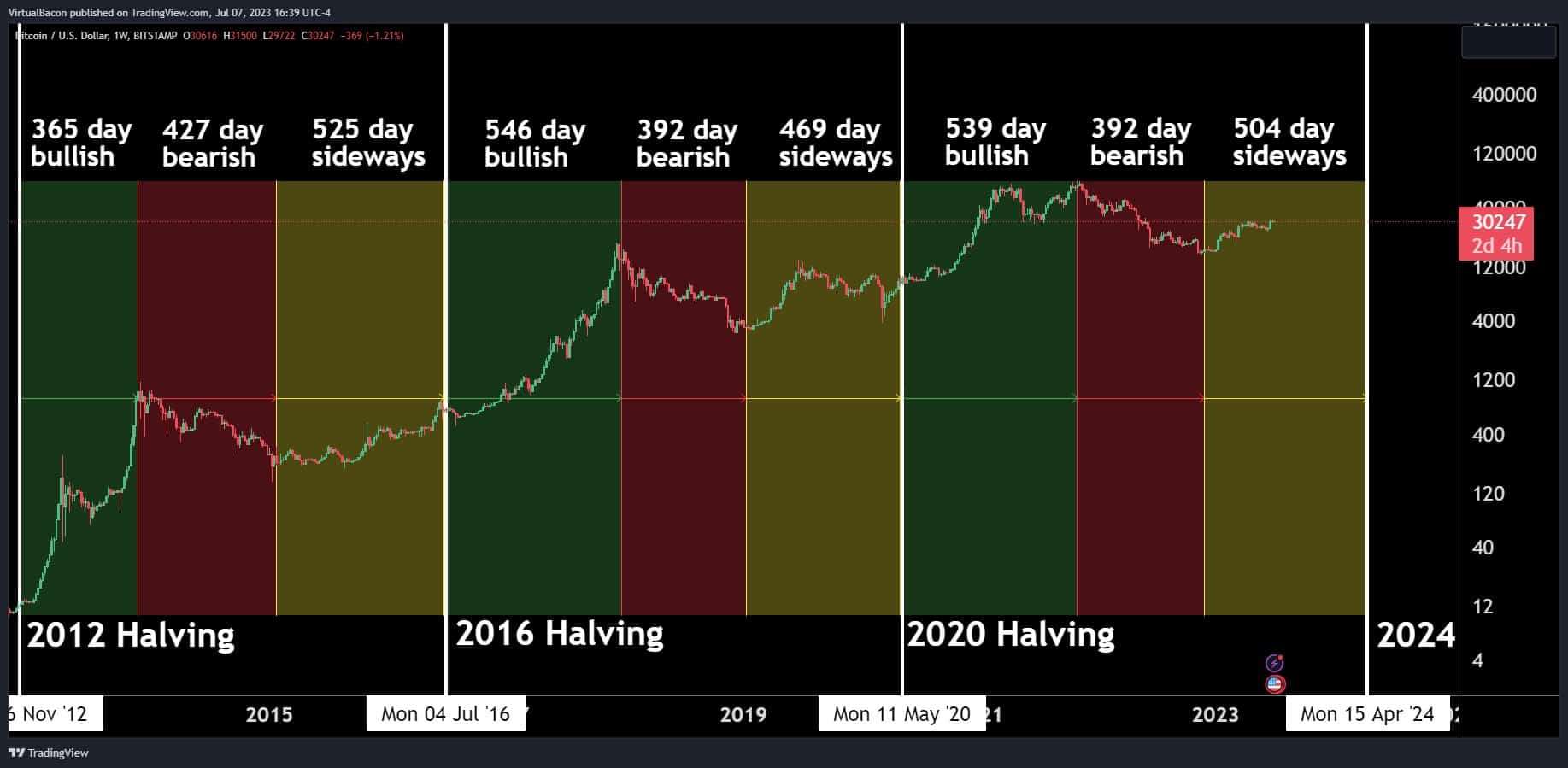

Bitcoin's position as the leading cryptocurrency is undeniable. Its decentralized nature, limited supply (21 million coins), and growing acceptance as a store of value continue to drive investor interest. Predicting Bitcoin's price in 2025 is inherently speculative, but several factors could influence its trajectory:

- Increased Institutional Adoption: Continued inflow of investments from institutional investors and large corporations could push the price upward.

- Regulatory Developments: Government regulations concerning cryptocurrencies will significantly impact market sentiment and price stability. Clearer regulatory frameworks could lead to increased adoption.

- Technological Advancements: Improvements like the Lightning Network, which enhances transaction speed and scalability, could broaden Bitcoin's usability and appeal.

- Global Economic Conditions: Macroeconomic factors, such as inflation and recessionary periods, often correlate with Bitcoin's price.

Comparative Investment Analysis: MicroStrategy Stock vs Bitcoin (Keyword: MicroStrategy vs Bitcoin Investment)

Directly comparing a MicroStrategy stock investment against holding Bitcoin involves assessing potential returns and risks:

- Correlation: MicroStrategy's stock price is highly correlated with Bitcoin's price, meaning movements in one often mirror the other. This reduces diversification benefits compared to holding Bitcoin directly.

- Transaction Costs: Buying and selling MicroStrategy stock involves brokerage fees, while Bitcoin transactions have network fees (though these are relatively low).

- Tax Implications: Capital gains taxes apply to both investments, but the specific tax treatment can vary based on jurisdiction and holding period.

- Diversification: Investing in MicroStrategy adds exposure to its core business alongside Bitcoin exposure. Direct Bitcoin ownership offers less diversification but more direct exposure to Bitcoin's price movements.

Risk Assessment: MicroStrategy vs Direct Bitcoin Ownership (Keyword: Bitcoin Risk vs MicroStrategy Risk)

Both Bitcoin and MicroStrategy stock are volatile investments. However, their risk profiles differ:

- Bitcoin Price Crashes: A sharp decline in Bitcoin's price directly impacts both direct Bitcoin holders and MicroStrategy's valuation.

- MicroStrategy's Business Performance: MicroStrategy's stock price can also be affected by factors unrelated to Bitcoin, such as its success in its core business segments.

- Regulatory Uncertainty: Changes in cryptocurrency regulations globally could negatively affect both investments.

Conclusion: Making the Right Investment Choice in 2025: MicroStrategy or Bitcoin?

Investing in either MicroStrategy or Bitcoin involves significant risk and potential reward. MicroStrategy offers indirect exposure to Bitcoin alongside its core business, potentially mitigating risk but reducing pure Bitcoin exposure. Direct Bitcoin ownership offers more direct exposure to Bitcoin's price but lacks the diversification provided by MicroStrategy’s broader business activities.

The optimal choice depends heavily on your risk tolerance and investment goals. Conservative investors might favor MicroStrategy for its diversification, while those with a higher risk tolerance and a belief in Bitcoin's long-term potential might prefer direct Bitcoin ownership. Remember, thorough research and consultation with a qualified financial advisor are crucial before investing in either MicroStrategy vs Bitcoin.

Featured Posts

-

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 08, 2025

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 08, 2025 -

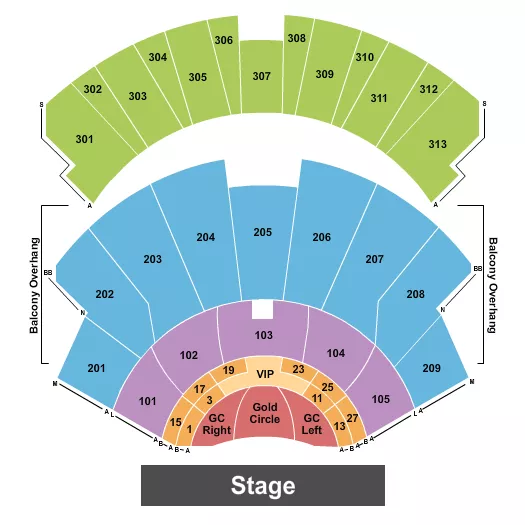

Counting Crows Las Vegas Concert Dates Tickets And Venue

May 08, 2025

Counting Crows Las Vegas Concert Dates Tickets And Venue

May 08, 2025 -

Sag Aftra Joins Wga Complete Hollywood Production Halt

May 08, 2025

Sag Aftra Joins Wga Complete Hollywood Production Halt

May 08, 2025 -

Dojs Google Antitrust Action Will It Undermine User Trust

May 08, 2025

Dojs Google Antitrust Action Will It Undermine User Trust

May 08, 2025 -

Presenca De Mick Jagger No Oscar Gera Preocupacao No Brasil

May 08, 2025

Presenca De Mick Jagger No Oscar Gera Preocupacao No Brasil

May 08, 2025