Microsoft Leads Software Stocks In Tariff-Driven Market Volatility

Table of Contents

Microsoft's Resilience in the Face of Tariff Uncertainty

Unlike manufacturing-heavy sectors directly impacted by import tariffs on raw materials and finished goods, Microsoft enjoys a degree of immunity. This resilience stems from the nature of its business model and the diversification of its revenue streams. The company's dominance in cloud computing, enterprise software, and gaming provides a buffer against potential losses in other areas affected by trade disputes.

-

Strong Cloud Computing Growth (Azure): Microsoft's Azure cloud platform continues to experience substantial growth, mitigating potential negative effects from other business segments. This robust cloud segment lessens the reliance on physical goods and global supply chains, a key differentiator during times of tariff uncertainty.

-

Consistent Demand for Enterprise Software Solutions: The demand for Microsoft's enterprise software solutions, such as Microsoft 365 and Dynamics 365, remains consistently high. These products are crucial for businesses regardless of global trade fluctuations, offering stable revenue streams.

-

Reduced Reliance on Global Supply Chains: Compared to hardware manufacturers that heavily rely on global supply chains, Microsoft’s reliance is significantly lower. This lessens the direct impact of tariffs on production costs and delivery timelines.

-

Robust Financial Metrics: Microsoft's consistent revenue growth and strong earnings per share (EPS) further underscore its resilience. These positive financial indicators demonstrate the company's ability to navigate the current market volatility and maintain profitability.

Impact of Tariffs on Other Software Companies

While Microsoft displays remarkable resilience, the impact of tariffs on other software companies varies considerably. The effects depend heavily on their specific business models, geographical footprints, and supply chain dependencies.

-

Differing Degrees of Exposure: Companies heavily reliant on hardware components or with extensive manufacturing operations in tariff-affected regions experience greater vulnerability. Conversely, software companies with primarily cloud-based offerings or those with diversified manufacturing locations see less significant impacts.

-

Supply Chain Vulnerabilities: Companies with complex global supply chains face increased costs and potential delays due to tariffs. This can affect product pricing and time to market.

-

Mitigation Strategies: To mitigate tariff risks, software companies are employing various strategies including shifting production to regions with favorable trade agreements, adjusting product pricing to offset increased costs, and exploring alternative sourcing options.

Market Volatility and Investor Sentiment Toward Tech Stocks

The ongoing tariff-driven uncertainty has led to a "flight to safety" among investors. Many are seeking havens from volatility, and Microsoft is increasingly viewed as a safe haven investment within the tech sector.

-

Safe Haven Assets: Microsoft's consistent performance, strong fundamentals, and diversified revenue streams make it an attractive safe-haven asset. Investors perceive it as a less risky investment compared to companies more directly impacted by trade wars.

-

Shifting Investor Sentiment: While some tech stocks experience volatility, the overall investor sentiment towards the sector remains largely positive, with a focus on companies demonstrating resilience and growth potential, like Microsoft.

-

Long-term Implications: The current volatility might lead to consolidation within the tech sector, potentially benefiting larger, more established players like Microsoft with the resources to weather economic storms.

Long-term Outlook for Software Stocks in a Tariff-Affected Market

The long-term prospects for the software sector remain positive despite the current market turbulence. The continued growth of cloud computing, artificial intelligence, and other key software segments is expected to drive sustained growth.

-

Continued Growth Potential: The ongoing digital transformation across industries continues to fuel demand for software solutions, particularly in cloud computing. This underlying demand should support long-term growth.

-

Geopolitical Risks: Ongoing geopolitical uncertainty and potential escalation of tariff disputes remain risks. These factors could impact future growth trajectory and increase market volatility.

-

Market Trend Predictions: While short-term fluctuations are expected, the long-term trend suggests continued growth for the software sector, with companies demonstrating resilience and strong fundamentals likely to outperform.

Conclusion: Navigating the Tariff Landscape: Microsoft's Position and Your Investment Strategy

Microsoft's impressive performance in the face of tariff-driven market volatility underscores its strategic positioning and robust business model. Its diversification across cloud computing, enterprise software, and gaming, combined with reduced reliance on global supply chains, has proven to be a key factor in its resilience. While the impact of tariffs on other software stocks varies, understanding these diverse impacts is crucial for informed investment decisions. Therefore, we encourage you to conduct thorough research, analyze your investment strategy carefully, and consider the long-term implications of ongoing tariff issues when evaluating Microsoft and other software stocks. For further insights, refer to reputable financial resources like [link to a financial news source] and [link to another financial resource].

Featured Posts

-

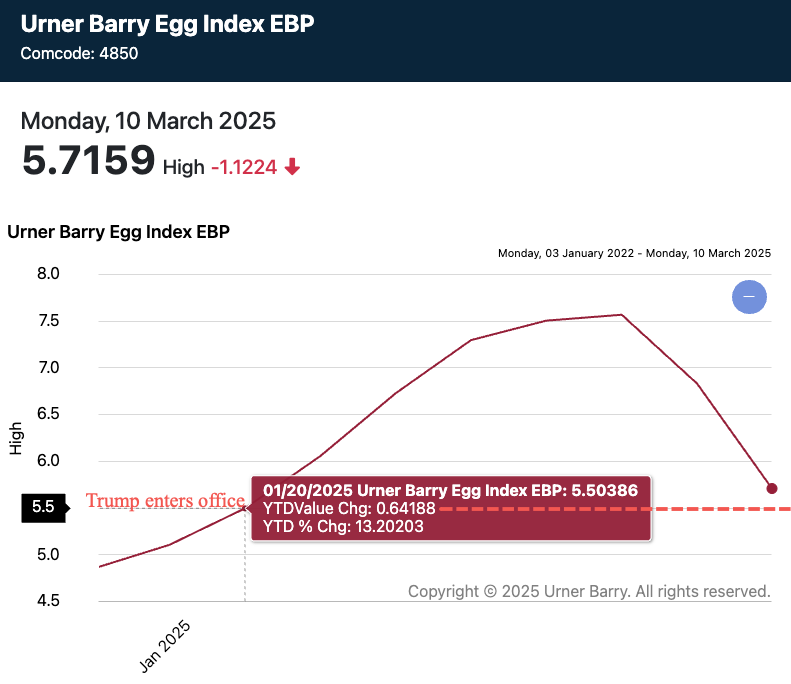

Egg Prices Plummet Dozen Now 5 After Record Highs

May 15, 2025

Egg Prices Plummet Dozen Now 5 After Record Highs

May 15, 2025 -

Shohei Ohtanis Walk Off Homer Dodgers 8 0 Loss Marks Historic Night

May 15, 2025

Shohei Ohtanis Walk Off Homer Dodgers 8 0 Loss Marks Historic Night

May 15, 2025 -

Watch Joe And Jill Bidens The View Interview Date Time And Streaming Info

May 15, 2025

Watch Joe And Jill Bidens The View Interview Date Time And Streaming Info

May 15, 2025 -

Anthony Edwards Faces 50 000 Fine From Nba For Fan Incident

May 15, 2025

Anthony Edwards Faces 50 000 Fine From Nba For Fan Incident

May 15, 2025 -

San Diego Padres Look To Maintain Home Winning Streak Vs Rockies

May 15, 2025

San Diego Padres Look To Maintain Home Winning Streak Vs Rockies

May 15, 2025