Minority Government: Implications For The Canadian Dollar's Value

Table of Contents

Political Instability and Currency Fluctuations

Minority governments, by their very nature, introduce an element of inherent instability. Their reliance on support from other parties to pass legislation creates a riskier environment for investors compared to majority governments. This uncertainty directly impacts investor confidence and consequently, the Canadian dollar's value.

- Increased likelihood of snap elections: The fragility of a minority government means there's a higher chance of unexpected elections, creating further uncertainty in the market. This unpredictability can lead to capital flight as investors seek safer havens for their investments.

- Difficulty in passing legislation, potentially impacting economic policies: The need for consensus among multiple parties can significantly slow down the legislative process. This delay can hinder the implementation of crucial economic policies, impacting business confidence and investment decisions, ultimately affecting the CAD exchange rate.

- Higher risk perception amongst investors, leading to capital flight: Investors are inherently risk-averse. The perceived instability of a minority government can lead them to withdraw investments from Canada, reducing demand for the CAD and potentially weakening its value.

- Potential for policy gridlock, hindering economic growth and impacting CAD value: Disagreements among coalition partners can lead to policy gridlock, preventing the government from effectively addressing economic challenges and fostering sustainable growth. This economic stagnation can negatively influence the Canadian dollar's value.

Impact on Fiscal Policy and the CAD

A minority government's reliance on coalition building significantly impacts its fiscal policy decisions. The necessity for compromise often leads to diluted or less ambitious budgetary measures.

- Potential for compromise on budgetary measures: To secure the support of coalition partners, a minority government might need to compromise on its initial fiscal plans, resulting in less effective or targeted economic policies.

- Increased difficulty in implementing significant fiscal reforms: Ambitious fiscal reforms often require broad political consensus, which can be challenging to achieve in a minority government setting. This difficulty can hinder long-term economic planning and stability.

- Impact on government spending and deficits: The need for compromise can influence government spending levels and potentially lead to larger or smaller deficits depending on the priorities of the coalition partners. This directly affects interest rates and ultimately the CAD trading value.

- The potential for increased or decreased government borrowing which can affect interest rates and currency value: To finance deficits, the government might increase borrowing, which can impact interest rates. Higher interest rates can attract foreign investment, strengthening the CAD, while lower rates might weaken it.

Economic Growth and the Canadian Dollar

The ability of a minority government to foster strong and sustainable economic growth is directly linked to the performance of the Canadian dollar. Political instability and policy gridlock can significantly hinder growth.

- Potential for slower economic growth due to political gridlock: A prolonged period of political uncertainty can discourage investment, reducing economic activity and slowing GDP growth.

- Impact of economic uncertainty on foreign investment: Foreign investors are hesitant to commit capital to countries facing political instability. This reduced foreign investment can negatively impact economic growth and weaken the CAD appreciation.

- The correlation between GDP growth and currency value: Generally, strong GDP growth is correlated with a stronger currency. Conversely, slower growth often leads to currency depreciation.

- The effect of potential economic stimulus packages or their lack thereof on the CAD: Government stimulus packages aimed at boosting economic growth can positively affect the CAD, whereas a lack of such measures can have the opposite effect.

Global Economic Factors and the CAD

It's crucial to remember that the impact of a minority government on the CAD is not isolated. Global economic conditions significantly influence the Canadian dollar's value.

- Influence of global commodity prices (especially oil) on the CAD: Canada is a major commodity exporter, and fluctuations in global commodity prices, particularly oil, significantly impact the CAD.

- Impact of international trade agreements and relations on the CAD: Canada's trading relationships and participation in international trade agreements directly affect its economy and the CAD's value.

- The role of the US dollar and other major currencies in affecting the CAD: The CAD's value is often influenced by the performance of other major currencies, particularly the US dollar.

- Effects of global economic uncertainty on the Canadian dollar: Global economic downturns or uncertainties can negatively impact the Canadian economy and weaken the CAD outlook.

Conclusion

A minority government in Canada presents both challenges and opportunities for the Canadian dollar. While potential political instability may lead to Canadian dollar volatility and decreased investor confidence, the ability to forge compromises and implement effective economic policies can contribute to stability and growth. The overall impact will depend on various factors, including the government's ability to navigate political complexities and the prevailing global economic climate.

Understanding the implications of a minority government on the Canadian dollar is crucial for investors and businesses alike. Stay informed about the evolving political and economic landscape to make informed decisions regarding your investments and strategies related to the Canadian dollar. Further research into the current economic climate and the specifics of the minority government’s policies is recommended for a comprehensive understanding of the potential impact on the Minority Government and the Canadian Dollar's Value.

Featured Posts

-

Shbab Bn Jryr Alqdae Yhkm Ela Ryys Alnady

Apr 30, 2025

Shbab Bn Jryr Alqdae Yhkm Ela Ryys Alnady

Apr 30, 2025 -

More Young People Diagnosed With Adhd At Aiims Opd Investigating The Contributing Factors

Apr 30, 2025

More Young People Diagnosed With Adhd At Aiims Opd Investigating The Contributing Factors

Apr 30, 2025 -

Canadian Election And Us Relations The Trump Factor

Apr 30, 2025

Canadian Election And Us Relations The Trump Factor

Apr 30, 2025 -

Canadian Dollar Risks A Strategists Warning On Minority Government

Apr 30, 2025

Canadian Dollar Risks A Strategists Warning On Minority Government

Apr 30, 2025 -

Channing Tatum And Inka Williams A Look At Their Pre Oscars Party Appearance

Apr 30, 2025

Channing Tatum And Inka Williams A Look At Their Pre Oscars Party Appearance

Apr 30, 2025

Latest Posts

-

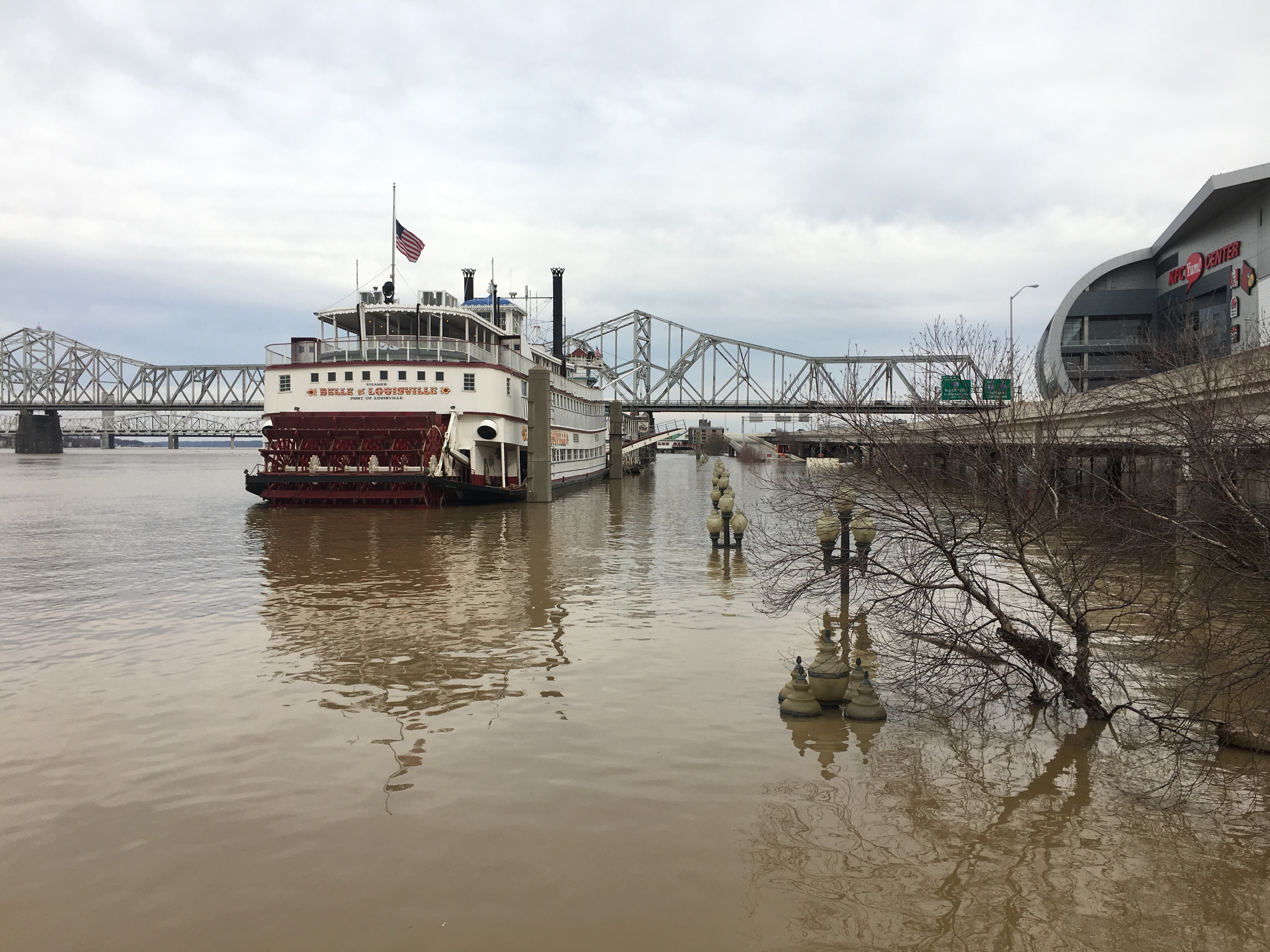

Severe Weather Cleanup Louisville Launches Debris Pickup Program

Apr 30, 2025

Severe Weather Cleanup Louisville Launches Debris Pickup Program

Apr 30, 2025 -

How River Road Construction Affects Louisvilles Food Businesses

Apr 30, 2025

How River Road Construction Affects Louisvilles Food Businesses

Apr 30, 2025 -

The Impact Of River Road Construction On Louisville Restaurants

Apr 30, 2025

The Impact Of River Road Construction On Louisville Restaurants

Apr 30, 2025 -

Kamala Harris Political Plans A Timeline

Apr 30, 2025

Kamala Harris Political Plans A Timeline

Apr 30, 2025 -

Louisville Opens Storm Debris Pickup Request System After Severe Weather

Apr 30, 2025

Louisville Opens Storm Debris Pickup Request System After Severe Weather

Apr 30, 2025