MNTN IPO: Ryan Reynolds' Company Poised For Stock Market Debut

Table of Contents

MNTN: A Deep Dive into the Advertising Technology Company

MNTN is a cutting-edge advertising technology company specializing in programmatic advertising and offering a self-serve platform designed for ease of use and maximum impact. Its unique approach is disrupting the digital advertising landscape, making it an attractive prospect for both investors and businesses.

-

Programmatic Advertising Revolution: MNTN utilizes advanced algorithms and machine learning to optimize advertising campaigns, delivering targeted video ads with greater efficiency than traditional methods. This programmatic approach ensures ads reach the right audience at the right time, maximizing return on investment (ROI) for clients.

-

Self-Serve Platform Accessibility: Unlike many competitors that cater exclusively to large enterprises, MNTN's self-serve platform empowers small and medium-sized businesses (SMBs) to access sophisticated advertising tools without needing a large in-house team. This democratization of access to advanced advertising technology is a key differentiator.

-

Video Advertising Focus: In a world increasingly dominated by video content, MNTN's focus on video advertising is strategically sound. The platform enables the creation and distribution of high-impact video ads across multiple platforms, leveraging the power of engaging visual content.

-

Technological Advantage: MNTN’s proprietary technology boasts features such as real-time bidding, advanced analytics, and sophisticated targeting capabilities, setting it apart in a competitive market. These technological advantages ensure superior campaign performance and better results for advertisers.

-

Strategic Partnerships and Acquisitions: While specifics may be limited before the IPO, MNTN's potential for future growth is enhanced by strategic partnerships and potential acquisitions that could further expand its reach and capabilities within the digital advertising sector.

Ryan Reynolds' Influence and Brand Recognition

Ryan Reynolds' involvement is arguably one of MNTN's greatest assets. His influence extends far beyond his acting career, impacting the company's brand recognition and investor appeal.

-

Celebrity Endorsement Power: Reynolds' celebrity status translates into significant brand awareness and credibility. His association with MNTN instantly elevates its profile, attracting both clients and investors.

-

Marketing Savvy and Appeal: Reynolds' reputation for creative and effective marketing campaigns, particularly through his Maximum Effort marketing company, adds significant value. His innovative approach resonates with a broad audience, aligning perfectly with MNTN's target demographic.

-

Celebrity-Backed IPO Benefits and Risks: While a celebrity endorsement can significantly boost an IPO's initial success, it also carries inherent risks. Investor perception might be overly influenced by Reynolds' fame rather than a comprehensive assessment of MNTN's business fundamentals. Over-reliance on this factor could negatively impact long-term success.

-

Maximum Effort's Contribution: Reynolds' Maximum Effort, known for its witty and unconventional marketing strategies, has played a key role in shaping MNTN's brand identity and marketing efforts, attracting significant attention and contributing to its rapid growth.

MNTN IPO Details and Investment Potential

The MNTN IPO details, including the precise date and share price, will be revealed closer to the launch. However, preliminary information and market analysis suggest a strong potential for growth.

-

IPO Pricing and Stock Valuation: The final IPO pricing will depend on various factors, including market conditions, investor demand, and the company's financial projections. Experts will closely analyze these details to assess its valuation relative to similar publicly traded advertising technology companies.

-

Potential Returns and Associated Risks: Investing in any IPO, especially a relatively new company, entails inherent risks. While the potential for substantial returns exists, investors must carefully weigh these against the potential downsides of market volatility and unforeseen business challenges.

-

Financial Performance and Growth Trajectory: MNTN's financial performance leading up to the IPO will be scrutinized by investors and analysts. A strong track record of revenue growth and profitability will significantly influence the success of the IPO.

-

Comparison to Similar Companies: Analyzing the performance and valuation of similar publicly traded companies in the advertising technology sector provides crucial context for evaluating MNTN's potential. This comparative analysis helps determine if the MNTN stock is fairly priced.

-

Expert Opinions on Success: Financial analysts and industry experts will offer diverse opinions on the MNTN IPO's likely success. Carefully reviewing these perspectives and understanding their underlying assumptions is crucial for informed decision-making.

Assessing the Risks and Rewards of Investing in the MNTN IPO

Investing in the MNTN IPO offers considerable potential but demands careful consideration of the risks involved.

-

Market Volatility and Risk: Market conditions at the time of the IPO significantly impact its performance. Economic downturns, changes in investor sentiment, and general market volatility can affect the stock price, regardless of the company's underlying strength.

-

IPO-Specific Risks: IPOs inherently carry more risk than investing in established companies. The company's relatively short operating history increases uncertainty about its future performance and ability to sustain growth.

-

Due Diligence Importance: Before investing in the MNTN IPO, thorough due diligence is paramount. This includes carefully reviewing the company's financial statements, understanding its business model, and assessing the overall competitive landscape.

-

Balancing Rewards and Risks: The potential for significant returns in the MNTN IPO must be carefully weighed against the inherent risks. A balanced assessment of both factors is crucial to make an informed investment decision.

Conclusion

The MNTN IPO presents a potentially lucrative investment opportunity, combining the appeal of a celebrity-backed company with a promising technology in the rapidly growing advertising technology sector. While inherent risks associated with all IPOs, particularly in a volatile market, must be considered, the potential for substantial returns makes it an attractive prospect for investors with a higher risk tolerance.

Call to Action: Stay informed about the upcoming MNTN IPO and consider adding this innovative advertising technology company to your investment portfolio. Learn more about the MNTN stock and its potential for growth before the official MNTN IPO date. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions relating to the MNTN IPO. Understanding the nuances of the MNTN IPO is key to making an informed investment choice.

Featured Posts

-

Chto Delali Boris I Kerri Dzhonson V Tekhase Novye Foto

May 11, 2025

Chto Delali Boris I Kerri Dzhonson V Tekhase Novye Foto

May 11, 2025 -

Laicidad Uruguaya El Cambio De Nombre De Semana Santa A Semana De Turismo Y Sus Implicaciones

May 11, 2025

Laicidad Uruguaya El Cambio De Nombre De Semana Santa A Semana De Turismo Y Sus Implicaciones

May 11, 2025 -

Szokujace Opowiesci Masazystki Ksiaze Andrzej Rozebrany Na Zabiegu

May 11, 2025

Szokujace Opowiesci Masazystki Ksiaze Andrzej Rozebrany Na Zabiegu

May 11, 2025 -

Seattles Smart Business Move Accepting Canadian Dollars To Attract Sports Fans

May 11, 2025

Seattles Smart Business Move Accepting Canadian Dollars To Attract Sports Fans

May 11, 2025 -

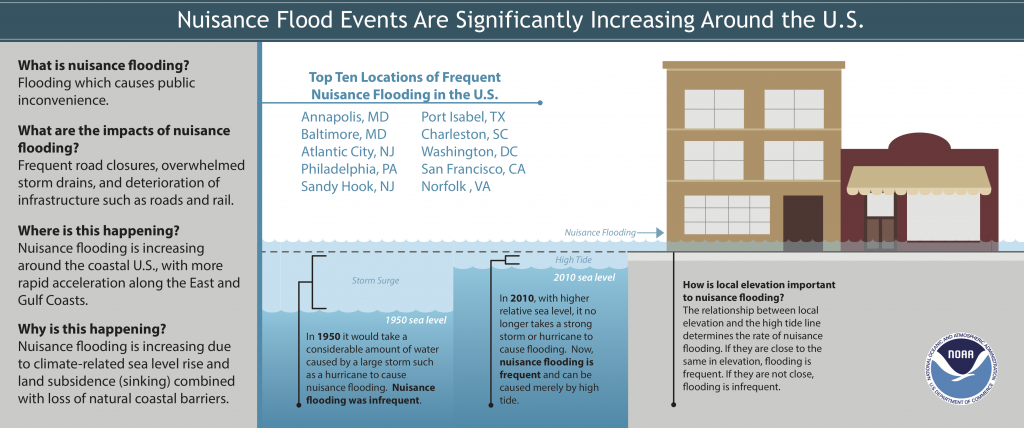

The Growing Threat Of Rising Sea Levels Impacts And Mitigation Strategies

May 11, 2025

The Growing Threat Of Rising Sea Levels Impacts And Mitigation Strategies

May 11, 2025